Global Multiple Element Gas Container (MEGC) Market – Industry Trends and Forecast to 2030

Report ID: MS-2550 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Multiple Element Gas Container (MEGC) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

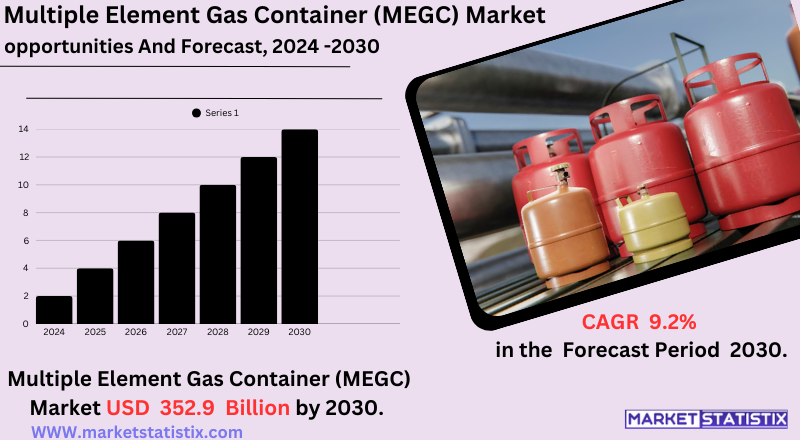

| Growth Rate | CAGR of 9.2% |

| Forecast Value (2030) | USD 352.9 billion |

| By Product Type | 20 Ft, 40 Ft and Above |

| Key Market Players |

|

| By Region |

|

Multiple Element Gas Container (MEGC) Market Trends

Some of the major developments in the global MEGC market include increased usage of MEGCs in transporting and storing alternative fuels such as natural gas (CNG, LNG) and hydrogen, due in large part to a worldwide acceptance for cleaner energy and stricter emission regulation. This has created demand for larger-volume and higher-pressure MEGCs, along with supporting infrastructure for their use in diverse transportation, energy, and industrial applications across India and other parts of the globe. In addition, advancements in valve technology are supporting safer gas handling, which presents MEGCs as an even more viable logistics solution for bulk gas with a better global acceptance.Multiple Element Gas Container (MEGC) Market Leading Players

The key players profiled in the report are Worthington Enterprises, Inc., McPhy Energy, FIBA Technologies, Inc., Quantum Fuel Systems LLC., Luxfer Gas Cylinders, Faber Industrie SPA, Koyuncu Gas and Gas Equipment, Gaznet OÜ, Hexagon Composites ASA, Beijing Tianhai Industry Co., Ltd., Linde plcGrowth Accelerators

The global MEGC market has been fuelled mainly by the increasing need for efficient and safe transport and storage of various industrial gases, including natural gas, hydrogen, and speciality gases. The advantages of MEGCs allow the safe transportation of comparatively larger volumes of gas than they would be able to with single cylinders. High safety features rendered against high-pressure containment make them a preferred choice in many industries, including manufacturing, healthcare, and energy. The growth of sectors where these gases find application directly paves the way for a strong demand for robust and scalable MEGCs. At the same time, the growing thrust towards cleaner energy production is also an important force in the MEGC market, with the development of hydrogen economies and the increased use of natural gas as a transition fuel. MEGCs are also vital to realise the concept of a virtual pipeline in areas with little heavy fixed infrastructure, facilitating the delivery of these gases to end users.Multiple Element Gas Container (MEGC) Market Segmentation analysis

The Global Multiple Element Gas Container (MEGC) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed 20 Ft, 40 Ft and Above . The Application segment categorizes the market based on its usage such as Natural Gas, Hydrogen, Industrial Gases. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global MEGC, or Multiple Element Gas Container, market showcases an astoundingly competitive environment, having both large, well-established international companies and small, specialised manufacturers. Some of the key global companies include Worthington Industries, CIMC Enric, Luxfer Gas Cylinders, and Hexagon Composites, which hold a significant share in such markets owing to their wide range of products, technological advances in materials such as lightweight composites, and strong global distribution networks. These bigger companies often treat competition through product innovation, safety features, customisation capabilities, and adherence to strict international regulations. In addition, above all these giants, a few other regional and niche players keep the competition heated up. Most usually these companies are focused on specific applications – could be by gases like hydrogen or natural gas or may be for the regional clear demands. The trend is namely towards safe and efficient transport for more gases at present, such as the burgeoning hydrogen economy with growing demand for industrial gases – with many end-user applications – from healthcare and manufacturing in India and globally.Challenges In Multiple Element Gas Container (MEGC) Market

The global MEGC market has been facing multiple challenges with a significant impact on growth and adoption. Very high costs of production on the one hand and very high costs of rigorous testing on the other are great deterrents for new entrants and commercial players wishing to expand in the business. The costly uses of advanced materials such as carbon fibre composites and automated welding are the causes of this. On top of that, there are no universal safety standards, and these varying standards place another hurdle for new market entrants trying to sell their products, breaking this rule all over the globe. Furthermore, there are operational challenges such as the need for specific infrastructure and skilled personnel for the safe handling and maintenance of MEGCs given their complex design as well as high pressures. This market would also be affected by raw material prices, which make their profitability depend heavily on whims. Further, areas having a short supply of qualified personnel will continue to lower the rate of adoption of MEGCs, and risks associated with gas storage and transportation will remain a matter of concern.Risks & Prospects in Multiple Element Gas Container (MEGC) Market

Key opportunities are generated from increasing demand for efficient, high-pressure storage and transport of gases across the industrial, healthcare, chemicals, and energy areas. Major drivers for these industries are the switch to alternative energy sources such as hydrogen and the need for speciality gases for manufacturing and medical applications. Technology development toward increased real-time monitoring and better valve technology are increasing safety and efficiency and driving market penetration. From a regional aspect, the North American market is expected to be the largest, recommended by advanced materials science, strong industrial demand, and the burgeoning hydrogen economy. The Asia Pacific area is also witnessing massive growth, propelled by the cleaner energy transition and rapid industrialisation of developing countries. Infrastructure development and emission reduction efforts are being supported in both regions through investments.Key Target Audience

The Multiple-Element Gas Container market is the primary target market for several industries that need cost-effective gas storage and transport systems under high pressures. Some of the relevant sectors include energy, especially natural gas and hydrogen; manufacturing; healthcare; and food and beverage. In the energy sector, MEGCs are used to trade natural gas or hydrogen for areas that do not have pipelines so that decentralised power generation can support the transition to cleaner fuels. Industries use MEGCs for welding and metal fabrication, while the healthcare sector uses them for safe storage and delivery of medical gases.,, Geographically, the Asia-Pacific region, including countries like China and India, is experiencing significant growth in MEGC adoption due to rapid industrialisation and a push for sustainable energy solutions. In Europe, environment-orientated initiatives, including investments in hydrogen and biogas technologies, are driving MEGC demand. North America is also part of the developing markets for MEGCs, especially as it boasts an amazing solid energy sector, particularly in the case of the U.S.Merger and acquisition

The worldwide MEGC market witnessed mergers and acquisitions in the recent past, indicative of the dynamic character of this industry and the new-age efficiencies taking centre stage in demand for gas transport solutions. Hexagon Agility, part of the Hexagon Composites group, acquired the assets of Speciality Fleet Services, a leading provider of natural gas mobile servicing and inspection in the United States and Canada, in November 2024. This strategic move was meant to set Hexagon in an enhanced service capability for the compressed natural gas, liquefied natural gas, and renewable natural gas sectors. Moreover, Luxfer Gas Cylinders and FIBA Technologies have also established partnerships to expand their presence in the market. For instance, in July 2022, Luxfer signed an agreement worth multimillion with Octopus Hydrogen for 40-foot MEGCs for transporting green hydrogen across the United Kingdom. In January 2023, FIBA Technologies won a contract from Arkema to supply 16 MEGCs for the transport of boron trifluoride across Europe. These partnerships have stressed the industry's inclination toward innovation and strategic partnerships to meet the challenges of gas transportation changing with time. >Analyst Comment

The global Multiple Element Gas Container (MEGC) market is in very good health, and it is estimated to grow from around $162.5-169 million in 2023-2024 to about $303.6-361.9 million by 2031-2033. The growth is driven by the increasing demand for efficient and high-capacity gas storage and transportation mechanisms in the energy, healthcare, chemicals, and manufacturing sectors. MEGCs allow interconnected cylinders to be stored and transported inside a solid frame, thus presenting a significant advantage in safety and operation over conventional single-cylinder systems, enabling bulk transport of gases such as hydrogen, oxygen, nitrogen, and speciality gases. The natural gas segment commands most of the applications in the market, particularly in regions having decentralised power needs with non-existent grid infrastructure, while the performance and safety of MEGCs are further enhanced by the adoption of advanced materials and real-time monitoring technology.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Multiple Element Gas Container (MEGC)- Snapshot

- 2.2 Multiple Element Gas Container (MEGC)- Segment Snapshot

- 2.3 Multiple Element Gas Container (MEGC)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Multiple Element Gas Container (MEGC) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 20 Ft

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 40 Ft and Above

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Multiple Element Gas Container (MEGC) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Natural Gas

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Hydrogen

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial Gases

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Multiple Element Gas Container (MEGC) Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Hexagon Composites ASA

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Worthington Enterprises

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inc.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 FIBA Technologies

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Luxfer Gas Cylinders

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Koyuncu Gas and Gas Equipment

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Gaznet OÜ

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Quantum Fuel Systems LLC.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Faber Industrie SPA

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Beijing Tianhai Industry Co.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Ltd.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 McPhy Energy

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Linde plc

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Multiple Element Gas Container (MEGC) in 2030?

+

-

Which type of Multiple Element Gas Container (MEGC) is widely popular?

+

-

What is the growth rate of Multiple Element Gas Container (MEGC) Market?

+

-

What are the latest trends influencing the Multiple Element Gas Container (MEGC) Market?

+

-

Who are the key players in the Multiple Element Gas Container (MEGC) Market?

+

-

How is the Multiple Element Gas Container (MEGC) } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Multiple Element Gas Container (MEGC) Market Study?

+

-

What geographic breakdown is available in Global Multiple Element Gas Container (MEGC) Market Study?

+

-

Which region holds the second position by market share in the Multiple Element Gas Container (MEGC) market?

+

-

How are the key players in the Multiple Element Gas Container (MEGC) market targeting growth in the future?

+

-