Global Modular Room System Market Trends and Forecast to 2030

Report ID: MS-411 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

The Modular Room System market consists of companies that design, fabricate, and install prefabricated room systems. These systems are built in a controlled off-site environment and then transported to the location for assembly. The construction of modular room systems has several advantages, such as reduced time of construction, lower cost, better quality control, and more flexibility in design and customisation. Modular room systems find various applications for cleanrooms, laboratories, healthcare settings, data centers, and commercial spaces. The increasing demand for construction solutions that are efficient and cost-effective, the rising need for adaptable spaces, and the growing prevalence of prefabricated construction methods are some of the key drivers acting on the Modular Room System Market. Depending on the type, material, end user, and region, the market segments.

Modular Room System Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

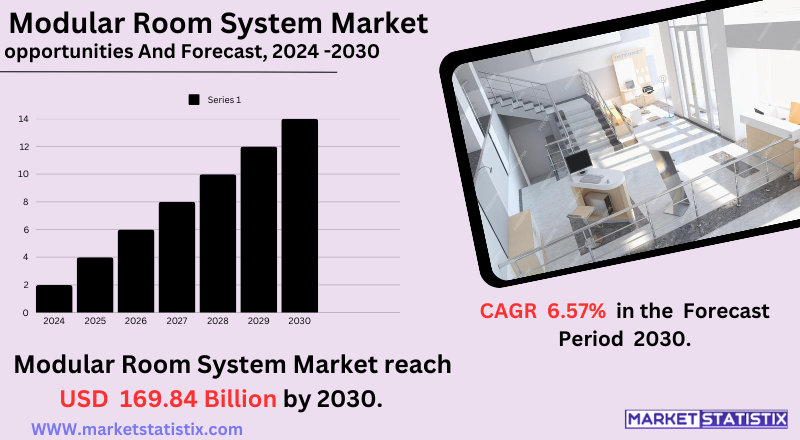

| Growth Rate | CAGR of 6.57% |

| Forecast Value (2030) | USD 169.84 Billion |

| By Product Type | Fixed Type, Removable Type |

| Key Market Players |

|

| By Region |

|

Modular Room System Market Trends

Several macro trends characterise the surging popularity of the Modular Room System Market: One of the foremost trends is the widespread acceptance of Building Information Modelling (BIM) in the design and construction of modular rooms. BIM assists in visualisation, clash detection, and coordination of various building elements, enhancing efficiency and reducing mistakes. The significant trend is the growing demand for customisation and flexibility in modular room systems. End-users are demanding systems that can be customised to their sizes, layouts, or functionalities. Manufacturers are responding with myriad options and features that allow customers to create personalized spaces.

Modular Room System Market Leading Players

The key players profiled in the report are Lindab Group (Sweden), Royal Boon Edam Group (Netherlands), Armstrong World Industries (United States), Saint-Gobain (France), Nippon Steel Corporation (Japan), Etex Group (Belgium), Getinge Group (Sweden), Tata Steel Limited (India), Agfa-Gevaert Group (Belgium), Kingspan Group plc (Ireland), Knauf AG (Germany), Rockwool International A/S (Denmark), USG Corporation (United States), Marley Eternit Group (France), Hunter Douglas GrouGrowth Accelerators

The main thrust propelling the Modular Room System Market is the need for efficient construction methods with low cost, especially at a time when traditional methods of construction have not been immune to problems of overrun of time and cost. Modular construction does its off-site manufacturing and quick assembly while using advanced techniques. Thus, it merits this alternative, as it abbreviates project completion periods and more savings. Besides, the part where flexible and adaptable spaces go, for example, into healthcare settings, data centers, or offices, further contributes to the market; modular systems are wholly modified and reconfigured to suit the upgrading needs, which is their major advantage compared to conventional construction. On the other hand, increasing acceptance of prefabricated methods of construction is one of the factors that has made a significant contribution to the market. Prefabricated construction offers several advantages, such as improved quality control, less waste, greater safety, and many more. Now, industries have been recognizing these advantages, and the demand for modular room systems still goes up.

Modular Room System Market Segmentation analysis

The Global Modular Room System is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fixed Type, Removable Type . The Application segment categorizes the market based on its usage such as Office, Hospital, Airport, School, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment of the modular room system market is characterised by its key competitors engaged in prefabricated and customizable room solutions for different sectors, like healthcare, hospitality, residential, commercial, and so on. Top companies such as DIRTT Environmental Solutions, Panel Built Inc., and PortaFab Corporation compete on factors such as innovation, product quality, sustainability, and cost efficiency. The market demand is driven by increased demand for quick construction, low labour cost, and environmentally friendly building alternatives. Businesses are advancing their product offerings to satisfy changing customer demands through the adoption of state-of-the-art manufacturing technologies—including automation and AI-driven design.

Challenges In Modular Room System Market

There are several challenges hounding the modular room systems market, the major ones being high initial investment costs and complex regulatory requirements. However, what must be borne in mind is that although the initial costs are high because they include costs for materials, technology, and skilled labour, savings will accrue over time, and this potentially becomes a barrier for market entry. Beyond that, building codes and regulations differ from region to region and create further delays in project approvals and increase compliance costs, thus rendering the adoption difficult in some areas. Another hurdle is the fact that modular construction is not accepted in the traditional sense. A lot of people within the construction realm don't believe in the durability and customisation of the rooms, as well as in their beauty, and that proves a barrier to acceptance of the approach. Additionally, there have also been problems in supply chains and a nonavailability of materials, especially steel and prefabricated components, which result in delays and extra cost incidences affecting the growth of the market.

Risks & Prospects in Modular Room System Market

The Modular Room System Market is poised to grow dramatically because of rising demand for flexible, cost-wise, and time-efficient construction options. The healthcare, hospitality, commercial office, and residential sectors have been using modular room systems for fast installation, sustainability, and adaptability. As urbanisation rises, further recreational places and structures are needed on-site; advancements in prefabrication technology will also act as a boost. Regionally, North America and Europe take a fair share of the market owing to stringent building regulations, adoption of smart infrastructures, and imperialist investments in modular construction. Asia-Pacific, meanwhile, is expected to see the highest growth rate, spurred by increasing urbanisation, government initiatives promoting affordable housing, and the growth of commercial infrastructure, in particular in China and India. On the other hand, the Middle East and Africa are gaining recognition as regional markets spurred by ramping construction projects covering the hospitality, health, and industrial sectors.

Key Target Audience

The main target audience for the modular room system market consists of the commercial sector: healthcare, hospitality, offices, and educational institutions, which demand flexibility and cost-effective space solutions. Preference for modular rooms in hospitals and medical facilities lies in their quick installation, improved hygiene, and easy scalability, while hotels and office spaces benefit from versatile layouts that ultimately boost efficiency. Farther down, educational institutions adopt a modular system for temporary classrooms or expansions, thus significantly shortening the construction time and disruptions. Another equally important segment includes the end consumers and developers of residential buildings searching for sustainable and flexible living solutions. As urbanisation and housing shortages increase, the option of modular room systems provides an accessible and quick alternative to conventional construction. Government and military sectors are other contributors to the market demand for modular units used in emergencies with housing provisions, disaster relief, and temporary workspace.

Merger and acquisition

The modular room system market is characterised by major merger and acquisition activities due to the dynamics of rapid growth and increasing demand for fast construction solutions. Eco Modular, a front runner in the sustainable modular building manufacturing industry, announced that it is merging with Zalatoris II Acquisition Corp. in December 2023. This merger, which puts Eco Modular at an enterprise value of $600 million, is meant to augment the growth potential and operational efficiency of the company in light of the current trend in the industry toward sustainable and offsite construction applications. The market further consolidated in November 2024, when the Tesya Group, parent company of Cat Rental Store CGTE, completed the acquisition of Strutture Srl, a modular building specialist. This acquisition is in line with the Tesya acquisition strategy of establishing a strong presence in the modular construction industry and utilising Strutture's expertise to supply turn-key modular solutions across a variety of sectors.

>Analyst Comment

With the increasing demand for efficient, rapid construction alternatives, the Modular Room System in the construction market has experienced unprecedented growth. Urbanisation, rising infrastructure spending, and the need for adaptable and flexible spaces are also propelling this market growth. There has been a general shift toward prefabricated construction methods, which include advantages such as faster construction, better quality control, and lower costs.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Modular Room System- Snapshot

- 2.2 Modular Room System- Segment Snapshot

- 2.3 Modular Room System- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Modular Room System Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fixed Type

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Removable Type

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Modular Room System Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Office

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 School

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Hospital

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Airport

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Modular Room System Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Saint-Gobain (France)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Rockwool International A/S (Denmark)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Knauf AG (Germany)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 USG Corporation (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Etex Group (Belgium)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Kingspan Group plc (Ireland)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Armstrong World Industries (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Lindab Group (Sweden)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Marley Eternit Group (France)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Tata Steel Limited (India)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Nippon Steel Corporation (Japan)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Royal Boon Edam Group (Netherlands)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Getinge Group (Sweden)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Agfa-Gevaert Group (Belgium)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Hunter Douglas Grou

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Modular Room System in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Modular Room System market?

+

-

How big is the Global Modular Room System market?

+

-

How do regulatory policies impact the Modular Room System Market?

+

-

What major players in Modular Room System Market?

+

-

What applications are categorized in the Modular Room System market study?

+

-

Which product types are examined in the Modular Room System Market Study?

+

-

Which regions are expected to show the fastest growth in the Modular Room System market?

+

-

Which application holds the second-highest market share in the Modular Room System market?

+

-

What are the major growth drivers in the Modular Room System market?

+

-

The main thrust propelling the Modular Room System Market is the need for efficient construction methods with low cost, especially at a time when traditional methods of construction have not been immune to problems of overrun of time and cost. Modular construction does its off-site manufacturing and quick assembly while using advanced techniques. Thus, it merits this alternative, as it abbreviates project completion periods and more savings. Besides, the part where flexible and adaptable spaces go, for example, into healthcare settings, data centers, or offices, further contributes to the market; modular systems are wholly modified and reconfigured to suit the upgrading needs, which is their major advantage compared to conventional construction. On the other hand, increasing acceptance of prefabricated methods of construction is one of the factors that has made a significant contribution to the market. Prefabricated construction offers several advantages, such as improved quality control, less waste, greater safety, and many more. Now, industries have been recognizing these advantages, and the demand for modular room systems still goes up.