Global Mobile Weight Loss Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-935 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The mobile weight loss market refers to the segment of the broader weight loss industry that leverages mobile technology, primarily through smartphone applications (apps) and wearable devices, to help individuals manage their weight and improve their health. These platforms offer a range of features such as calorie tracking, exercise logging, personalised meal plans, progress monitoring, virtual coaching, and integration with fitness wearables. This market is driven by the widespread adoption of smartphones, increasing health consciousness, and the desire for convenient, accessible, and often more affordable alternatives to traditional weight loss programmes.

This market provides users with digital tools to self-monitor their diet and physical activity, set goals, and receive feedback to support behavioural changes. Many apps utilise algorithms and increasingly artificial intelligence to offer tailored recommendations and motivational content. The appeal of the mobile weight loss market lies in its flexibility, allowing users to manage their weight loss journey anytime and anywhere. It also fosters a sense of accountability through tracking features and can often connect users with online communities or professional coaches, further enhancing engagement and adherence to their weight loss goals.

Mobile Weight Loss Report Highlights

| Report Metrics | Details |

|---|---|

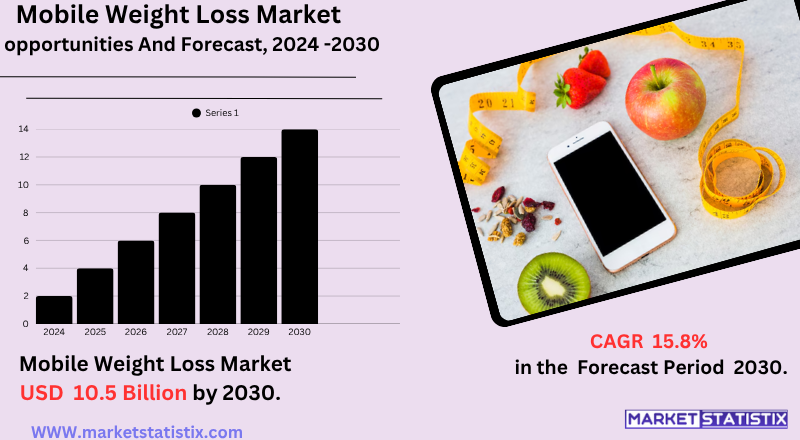

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 15.8% |

| Forecast Value (2030) | USD 10.5 Billion |

| Key Market Players |

|

| By Region |

|

Mobile Weight Loss Market Trends

The mobile weight loss market is currently experiencing strong growth, which is mainly inspired by increasing public awareness about the growing global obesity rates and health and well-being. A major trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) to provide a major individual and adaptive weight loss plan. These AI-driven features analyse user data from dietary tracking, exercise logs, and even connected wearable equipment (such as smartwatches and fitness bands) from biometric information, offering potential laps and recommendations predicted in real-time response. This level of adaptation, which is beyond general advice, is proving highly effective in increasing the user's busyness and following weight loss goals.

Another important tendency is increasing emphasis on overall welfare and convenience. Mobile weight loss solutions are extended beyond the counting of calories and exercise tracking, including facilities such as mental health assistance, sleep pattern analysis, and virtual coaching from nutritionists and fitness professionals through telehealth platforms. The "freemium" model, which offers basic features for free with premium membership for advanced functionalities, remains popular, making these solutions accessible to broader audiences.

Mobile Weight Loss Market Leading Players

The key players profiled in the report are OurPath, Dario Health, Lifesum, BetterMe, MyFitnessPal, Noom, Lark Health, WW International, Omada Health, Under Armour, Livongo Health, Verv, Oviva, YAZIOGrowth Accelerators

The mobile weight loss market is experiencing significant growth, which is mainly inspired by obesity and the global proliferation of related health conditions such as diabetes and heart disease. With the motionless lifestyle and unhealthy diet patterns being more normal, there is a strong demand for accessible and convenient weight management solutions. The wide adoption of smartphones and the growing penetration of the Internet in all demographics make mobile applications a highly accessible platform for individuals to manage their weight. In addition, the desire for health consciousness and individual welfare approaches also promotes consumer interest in these digital devices.

Another major driver is constant advancement in mobile technology and wearable equipment, which increases the functionality and accuracy of the weight loss app. Physical activity and calorie intake, integration with smartwatches and fitness trackers, and inclusion of Artificial Intelligence (AI) for personal coaching and food schemes make these apps highly effective and attractive. Recent distance from global health events to distance fitness and self-care solutions to also strengthen the status of the mobile weight loss market as an important component of the broader digital health ecosystem, which provides a flexible and often more inexpensive alternative to traditional weight loss programmes.

Mobile Weight Loss Market Segmentation analysis

The Global Mobile Weight Loss is segmented by and Region. . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The mobile weight loss market is intensifying competition, which ranges from fitness and wellness brands to innovative tech startups with various types of players. Major contestants include famous names such as MyFitnessPal, Los IT!, and Noom, who have created large user bases through comprehensive tracking features, personal coaching, and behavioural psychology approaches. Traditional weight-loss companies like WW International (Wetwors) have also successfully invested in the mobile space, took advantage of their brand recognition and expanded their digital offerings to remain relevant. The competition is terrible due to the relatively low barrier to admission for app development, causing a continuous arrival of new applications.

The major competitive differentiation in this market includes the accuracy and ease of data tracking (e.g., calorie counting, exercise logging), refinement of individual algorithms, integration and effectiveness of community support and coaching facilities with integration and other health platforms. There is a growing trend towards the inclusion of artificial intelligence and machine learning for more sewn recommendations and insight. Companies are focusing on specific sales proposals such as gamification, virtual reality workouts, and specialised demographics or special programmes for health conditions, all aiming to increase user engagement and long-term adherence in a crowded and digital health landscape.

Challenges In Mobile Weight Loss Market

The mobile weight loss market faces important challenges despite rapid growth and technological progress. One of the main issues is the difference between increasing consumer expectations and the stability of weight loss consequences for quick results. Many users are prepared for extreme measures promoted through FAD diets or digital platforms, which lead to short-term success, but over time these solutions lead to high relapse rates and loss of trust. This makes it difficult for companies to offer products and services that provide permanent, healthy results, eventually affecting customer retention and the reliability of the market.

Additionally, the market is highly fragmented, with thousands of apps, programmes and supplements that create confusion for consumers, who struggle to identify safe and effective options. The spread of irregular or potentially unsafe products, especially in the complementary region, reduces further confidence and increases the risk of consumer loss. Other challenges include data safety and privacy concerns, integration complications with other health systems, and rapid transfer of consumer preferences, all of which require strategic risk mitigation and transparent, evidence-based prasad to ensure long-term development and user trust.

Risks & Prospects in Mobile Weight Loss Market

The mobile weight loss market is experiencing development opportunities inspired by global health consciousness, rising obesity rates and smartphones and digital health solutions. The dissemination of integration with AI-operated fitness apps, personal coaching and wearable equipment is creating new avenues for user engagement and retention. Additionally, the demand for individual weight management programmes and the facility provided by mobile platforms is attracting both consumers and investors, designed for strong expansion as part of the wider weight management industry with the market.

Regionally, North America leads the market due to the prevalence of high obesity and early adoption of digital health technologies, while Europe follows closely with strong regulatory support and a growing wellness culture. The Asia-Pacific region is expected to see rapid urbanisation, smartphone penetration and the fastest growth from rising disposable income. Latin America and other areas, including the Middle East and Africa, are also showing potential as awareness about digital health solutions increases. Overall, the market is fragmented by the region and the country; the unique trends and development drivers have been performed in each region, making regional analysis important to identify targeted opportunities in the mobile weight loss area.

Key Target Audience

,,

,

,

Additionally, healthcare providers, wellness coaches, insurers and corporate wellness programmes are important stakeholders. These organizations often partner with or recommend mobile weight loss apps to support patient health, reduce the cost of health care and improve employee welfare. The increasing prevalence of obesity and lifestyle-related conditions has increased the demand for scalable, user-friendly digital health equipment, making this market especially attractive to both direct consumers and institutional users.

,,,, ,, ,

The major target audiences for the mobile weight loss market include a health-conscious person looking for technology-powered solutions to manage their weight. The group expands various demographics, including busy professionals, millennials and tech-service consumers who prefer app-based guidance, personal food schemes, fitness tracking and virtual coaching. Many users are inspired by the goals related to fitness, appearance or prevention of chronic disease, and they give importance to flexibility and real-time support that mobile platforms provide.

,

Merger and acquisition

The mobile weight loss market has experienced significant merger and acquisition (M&A) activity reflecting a change towards digital health solutions and drug integration. In March 2024, Wetwachrs acquired the telehealth platform Sequence for about 100 million pounds, which aims to include GLP-1 weight-loss drugs in its offerings. Despite this strategic move, the Vetwatchers filed Chapter 11 for bankruptcy in May 2025, citing challenges from the emergence of dietary drugs and social media effects on consumer preferences. Similarly, HIMS and Hurs acquired a compounding pharmacy for about 25 million pounds in August 2024, increasing the ability to produce weight loss drugs and strengthen its position in the direct-to-consumer healthcare market.

Digital health companies have also been active in expanding their services through M&A. A telehealth company, RO, has made several acquisitions, including WorkPaths and kits, to broaden the clinical and treatment capabilities of its home. In 2024, the RO participated with Eli Lilly to offer the weight loss drug JEPBONDS through its platform, integrating its telehealth services into pharmaceutical offerings. Another digital health company, Nom, launched a mixed GLP-1 drug in 2024 as part of its weight management programme, showing the tendency of digital platforms to include drug solutions. These growths indicate a convergence of digital health platforms and pharmaceutical companies, aimed at providing a comprehensive weight management solution.

Analyst Comment

The mobile weight loss market is increasing rapidly, fuelled at the rate of widely adopting smartphones, increasing health consciousness and globally increasing obesity. By 2025, mobile weight loss solutions are expected to exceed US $3 billion in revenue, with 1.5 billion weighing smartphones worldwide in the market of users with major providers such as NOOM and WW International capitalising on a large addressable market. The Covid-19 epidemic has accelerated the adoption of digital weight loss tools, with advanced markets such as America already looking at the rates of adoption among overweight smartphone owners. While North America leads in use, there are important opportunities in Asia and Europe, where the adoption rate is increasing, but still the U.S.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Mobile Weight Loss- Snapshot

- 2.2 Mobile Weight Loss- Segment Snapshot

- 2.3 Mobile Weight Loss- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Mobile Weight Loss Market by Region

- 4.1 Overview

- 4.1.1 Market size and forecast By Region

- 4.2 North America

- 4.2.1 Key trends and opportunities

- 4.2.2 Market size and forecast, by Type

- 4.2.3 Market size and forecast, by Application

- 4.2.4 Market size and forecast, by country

- 4.2.4.1 United States

- 4.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.1.2 Market size and forecast, by Type

- 4.2.4.1.3 Market size and forecast, by Application

- 4.2.4.2 Canada

- 4.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.2.2 Market size and forecast, by Type

- 4.2.4.2.3 Market size and forecast, by Application

- 4.2.4.3 Mexico

- 4.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.3.2 Market size and forecast, by Type

- 4.2.4.3.3 Market size and forecast, by Application

- 4.2.4.1 United States

- 4.3 South America

- 4.3.1 Key trends and opportunities

- 4.3.2 Market size and forecast, by Type

- 4.3.3 Market size and forecast, by Application

- 4.3.4 Market size and forecast, by country

- 4.3.4.1 Brazil

- 4.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.1.2 Market size and forecast, by Type

- 4.3.4.1.3 Market size and forecast, by Application

- 4.3.4.2 Argentina

- 4.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.2.2 Market size and forecast, by Type

- 4.3.4.2.3 Market size and forecast, by Application

- 4.3.4.3 Chile

- 4.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.3.2 Market size and forecast, by Type

- 4.3.4.3.3 Market size and forecast, by Application

- 4.3.4.4 Rest of South America

- 4.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.4.2 Market size and forecast, by Type

- 4.3.4.4.3 Market size and forecast, by Application

- 4.3.4.1 Brazil

- 4.4 Europe

- 4.4.1 Key trends and opportunities

- 4.4.2 Market size and forecast, by Type

- 4.4.3 Market size and forecast, by Application

- 4.4.4 Market size and forecast, by country

- 4.4.4.1 Germany

- 4.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.1.2 Market size and forecast, by Type

- 4.4.4.1.3 Market size and forecast, by Application

- 4.4.4.2 France

- 4.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.2.2 Market size and forecast, by Type

- 4.4.4.2.3 Market size and forecast, by Application

- 4.4.4.3 Italy

- 4.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.3.2 Market size and forecast, by Type

- 4.4.4.3.3 Market size and forecast, by Application

- 4.4.4.4 United Kingdom

- 4.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.4.2 Market size and forecast, by Type

- 4.4.4.4.3 Market size and forecast, by Application

- 4.4.4.5 Benelux

- 4.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.5.2 Market size and forecast, by Type

- 4.4.4.5.3 Market size and forecast, by Application

- 4.4.4.6 Nordics

- 4.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.6.2 Market size and forecast, by Type

- 4.4.4.6.3 Market size and forecast, by Application

- 4.4.4.7 Rest of Europe

- 4.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.7.2 Market size and forecast, by Type

- 4.4.4.7.3 Market size and forecast, by Application

- 4.4.4.1 Germany

- 4.5 Asia Pacific

- 4.5.1 Key trends and opportunities

- 4.5.2 Market size and forecast, by Type

- 4.5.3 Market size and forecast, by Application

- 4.5.4 Market size and forecast, by country

- 4.5.4.1 China

- 4.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.1.2 Market size and forecast, by Type

- 4.5.4.1.3 Market size and forecast, by Application

- 4.5.4.2 Japan

- 4.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.2.2 Market size and forecast, by Type

- 4.5.4.2.3 Market size and forecast, by Application

- 4.5.4.3 India

- 4.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.3.2 Market size and forecast, by Type

- 4.5.4.3.3 Market size and forecast, by Application

- 4.5.4.4 South Korea

- 4.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.4.2 Market size and forecast, by Type

- 4.5.4.4.3 Market size and forecast, by Application

- 4.5.4.5 Australia

- 4.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.5.2 Market size and forecast, by Type

- 4.5.4.5.3 Market size and forecast, by Application

- 4.5.4.6 Southeast Asia

- 4.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.6.2 Market size and forecast, by Type

- 4.5.4.6.3 Market size and forecast, by Application

- 4.5.4.7 Rest of Asia-Pacific

- 4.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.7.2 Market size and forecast, by Type

- 4.5.4.7.3 Market size and forecast, by Application

- 4.5.4.1 China

- 4.6 MEA

- 4.6.1 Key trends and opportunities

- 4.6.2 Market size and forecast, by Type

- 4.6.3 Market size and forecast, by Application

- 4.6.4 Market size and forecast, by country

- 4.6.4.1 Middle East

- 4.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.6.4.1.2 Market size and forecast, by Type

- 4.6.4.1.3 Market size and forecast, by Application

- 4.6.4.2 Africa

- 4.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.6.4.2.2 Market size and forecast, by Type

- 4.6.4.2.3 Market size and forecast, by Application

- 4.6.4.1 Middle East

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 BetterMe

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Dario Health

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Lark Health

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Lifesum

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Livongo Health

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 MyFitnessPal

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Noom

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Omada Health

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 OurPath

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Oviva

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 Under Armour

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 Verv

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

- 6.13 WW International

- 6.13.1 Company Overview

- 6.13.2 Key Executives

- 6.13.3 Company snapshot

- 6.13.4 Active Business Divisions

- 6.13.5 Product portfolio

- 6.13.6 Business performance

- 6.13.7 Major Strategic Initiatives and Developments

- 6.14 YAZIO

- 6.14.1 Company Overview

- 6.14.2 Key Executives

- 6.14.3 Company snapshot

- 6.14.4 Active Business Divisions

- 6.14.5 Product portfolio

- 6.14.6 Business performance

- 6.14.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

| Aspects | Details |

|---|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Mobile Weight Loss in 2030?

+

-

How big is the Global Mobile Weight Loss market?

+

-

How do regulatory policies impact the Mobile Weight Loss Market?

+

-

What major players in Mobile Weight Loss Market?

+

-

What applications are categorized in the Mobile Weight Loss market study?

+

-

Which product types are examined in the Mobile Weight Loss Market Study?

+

-

Which regions are expected to show the fastest growth in the Mobile Weight Loss market?

+

-

What are the major growth drivers in the Mobile Weight Loss market?

+

-

The mobile weight loss market is experiencing significant growth, which is mainly inspired by obesity and the global proliferation of related health conditions such as diabetes and heart disease. With the motionless lifestyle and unhealthy diet patterns being more normal, there is a strong demand for accessible and convenient weight management solutions. The wide adoption of smartphones and the growing penetration of the Internet in all demographics make mobile applications a highly accessible platform for individuals to manage their weight. In addition, the desire for health consciousness and individual welfare approaches also promotes consumer interest in these digital devices.

Another major driver is constant advancement in mobile technology and wearable equipment, which increases the functionality and accuracy of the weight loss app. Physical activity and calorie intake, integration with smartwatches and fitness trackers, and inclusion of Artificial Intelligence (AI) for personal coaching and food schemes make these apps highly effective and attractive. Recent distance from global health events to distance fitness and self-care solutions to also strengthen the status of the mobile weight loss market as an important component of the broader digital health ecosystem, which provides a flexible and often more inexpensive alternative to traditional weight loss programmes.

Is the study period of the Mobile Weight Loss flexible or fixed?

+

-

How do economic factors influence the Mobile Weight Loss market?

+

-