Global Microbial Fermentation Service Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-934 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Microbial Fermentation Service Market refers to a cluster of industries offering specialised services for the application of microorganisms (such as bacteria, yeasts, or fungi) to manufacture various compounds via controlled fermentation. The service is crucial for a host of industries, including pharmaceutical, biotech, food and beverage, agriculture, and biofuels. Companies in this market provide technical inputs on strain development and optimisation, process development and scale-up, and large-scale manufacturing of antibiotics, therapeutic proteins, enzymes, vaccines, probiotics, and other biochemicals.

The rising demand for bio-based products, the incidence of chronic diseases requiring new drug lines, and increasing interest in sustainable and eco-friendly production methods propel this market. CROs, as well as CDMOs, are major constituents of this market, providing their special facilities, technical knowledge, and regulatory guidance to their clients, who may not necessarily have this availability for the microbial fermentation process.

Microbial Fermentation Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

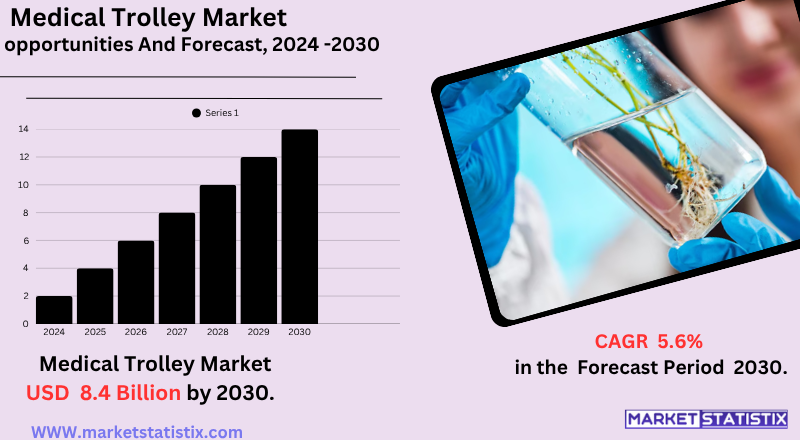

| Growth Rate | CAGR of 5.6% |

| Forecast Value (2030) | USD 8.4 Billion |

| By Product Type | Microbial Cultures, Fermentation Equipment, Fermentation Broth |

| Key Market Players |

|

| By Region |

|

Microbial Fermentation Service Market Trends

The Microbial Fermentation Service Market is on a remarkable upswing, largely fuelled by the growing demand for biopharmaceuticals and bio-based products across a range of industries. As chronic diseases, including various infections and cancers, become more common, there's a heightened need for innovative therapeutic proteins, vaccines, and cutting-edge treatments like cell and gene therapies—all of which depend heavily on microbial fermentation for their production.

Another significant factor driving this growth is the increasing trend of outsourcing among pharmaceutical and biotechnology companies to Contract Development and Manufacturing Organizations (CDMOs). Many smaller, innovative firms often find themselves lacking the in-house capabilities, specialised knowledge, and hefty capital investment needed for large-scale microbial fermentation. As a result, they are turning to CDMOs for their state-of-the-art facilities, technical expertise, and support with regulatory compliance, which helps them get their high-quality bioproducts to market more quickly and efficiently.

Microbial Fermentation Service Market Leading Players

The key players profiled in the report are FUJIFILM Diosynth Biotechnologies, Laurus Bio, EUROAPI, AbbVie Contract Manufacturing, Lonza, AGC Biologics, NordmarkGrowth Accelerators

The Microbial Fermentation Service Market is on a remarkable upswing, largely fuelled by the growing demand for biopharmaceuticals and bio-based products across a range of industries. As chronic diseases, including various infections and cancers, become more common, there's a heightened need for innovative therapeutic proteins, vaccines, and cutting-edge treatments like cell and gene therapies—all of which depend heavily on microbial fermentation for their production.

Another significant factor driving this growth is the increasing trend of outsourcing among pharmaceutical and biotechnology companies to Contract Development and Manufacturing Organizations (CDMOs). Many smaller, innovative firms often find themselves lacking the in-house capabilities, specialised knowledge, and hefty capital investment needed for large-scale microbial fermentation. As a result, they are turning to CDMOs for their state-of-the-art facilities, technical expertise, and support with regulatory compliance, which helps them get their high-quality bioproducts to market more quickly and efficiently.

Microbial Fermentation Service Market Segmentation analysis

The Global Microbial Fermentation Service is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Microbial Cultures, Fermentation Equipment, Fermentation Broth . The Application segment categorizes the market based on its usage such as Food & Beverages, Agriculture, Pharmaceuticals, Biofuels, Cosmetics & Personal Care. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the microbial fermentation service market is mainly shaped by a mixture of development and manufacturing organizations (CDMOs) and special biotechnology firms. Prominent players such as Lonza, Fujifilm Diootechnology, AGC Biologics, and Evonik Industries take advantage of their widespread experiences, global manufacturing footprints and advanced technical abilities, including specialisation in synthetic biology and process adaptation. These companies often provide end-to-end services for catering to various industries, such as strain development and process development, to large-scale CGMP manufacturing, pharmaceuticals, food and drinks and industrial enzymes.

Beyond these large CDMOs, there are many small, special companies and educational institutions in the market that focus on top applications, innovative stress engineering or specific product classes. The competition is powered by factors such as high yield and product purity, cost-effectiveness, scalability of procedures and strict regulatory standards (especially in pharmaceuticals). The growing demand for biosimilars, biosics and durable bio-based products is accelerating competition, causing strategic support to meet the ongoing investment, capacity expansion and growing market needs in R&D.

Challenges In Microbial Fermentation Service Market

Numerous existing impediments may hinder growth and operational effectiveness of the microbial fermentation service market. Obstacles such as high capital investment tend to take a toll – setting up and operating modern fermentation plants demands high spending for equipment, a skilled workforce, and continuous operations. Furthermore, stringent regulatory compliance for biopharmaceuticals entails additional costs that limit manufacturing budgets, intensifying compliance bottlenecks on product development.

Market dynamics hit a bump due to operational constraints. While the scale of the problem is clear, construction of an industrial facility around lab-scale equipment often unlocks surprising technical or logistical problems. Handing production over from upstream to downstream processing escalates both the possibility of human error and contamination. Additionally, the need for automation widens the gap from upstream to downstream personnel and cross-functional CDMO partnerships. With a chronic workforce solution, robust reliance on skilled CNC operators increases project complexity. Enhancements in automation, single-use systems, and process streamlining offer solutions, even if the headwinds remain prominent.

Risks & Prospects in Microbial Fermentation Service Market

Biotech breakthroughs, synthetic biology's growing use, and AI and machine learning's addition to fermentation have an influence on key growth chances. The market's potential expands due to the rising demand for plant-based and alternative proteins, biosimilars, and mRNA vaccines. Companies that focus on novel fermentation methods for high-value products and use new bioprocessing tech are in a good spot to seize emerging opportunities as governments and industries look for greener options to traditional manufacturing.

In terms of regions, Europe now has the biggest share of the global microbial fermentation service market, making up about 46.9% of market opportunities, and it's likely to stay ahead in the years to come. But the Asia-Pacific area is set to grow the fastest because of more money going into research and development, growing pharmaceutical and food industries, and the use of industrial biotech for value-added products. North America remains an important market driven by top-notch healthcare systems and a strong focus on biomanufacturing innovation. As the market changes, local industry needs, rules and regulations, and how fast new tech is adopted will shape regional trends.

Key Target Audience

In addition, contract development and manufacturing organizations (CDMOs), neutrality companies and agricultural biotech firms create an important section of the audience. These groups seek special fermentation capabilities for probiotics, amino acids, biofertilizers and other microbial-trans course products. The growing interest in permanent and bio-based options in various industries leads to demand from the environment and industrial biotechnology, leading to highly diverse and innovation-operating markets.

,,,

The major target audiences for the microbial fermentation service market include drug and biotechnology companies that use fermentation for the production of drugs, vaccines, enzymes and biology. These companies rely on microbial fermentation to develop high yields for complex molecules and cost-effective manufacturing processes. Startups and research institutes are engaged in developing novel therapeutics or scaling bio-based products, which also represent an important part of the market demand.

,, ,

Merger and acquisition

The microbial fermentation service market has recently experienced remarkable merger and acquisition (M&A) activities, which focuses a strategic focus on the expansion of abilities and focuses a strategic focus on pursuing biotechnology innovations. For example, in May 2023, Danone Manifesto Ventures invested in Imagindairy, an Israeli startup that specialises in accurate fermentation for animal-free dairy products, leading to a minority stake. Similarly, in September 2022, a French biotechnology company, lesfrey, acquired Recombia biochenes to increase its yeast development and microbial fermentation innovation.

Additionally, companies like Lonza have made significant investments to increase their microbial manufacturing capabilities. In November 2021, Lonza announced a plan to invest more than $1 billion to expand its microbial manufacturing facility in VISP, Switzerland, which aims to meet the growing demand for microbially derived biology. These strategic tricks underline the industry's commitment to scoring the operation and to integrating advanced technologies to fulfil the increasing demand for durable and efficient bioproded methods.

>Analyst Comment

The global microbial fermentation service market is seen to have strong and continuous growth, with a price of about 36–41 billion USD in 2025 and by 2029–2034 to reach 57–62 billion USD. This expansion is inspired by increasing demand for biopharmaceuticals, vaccines, biosimilars, fermented foods and industrial enzymes, as well as an increase in investment in research and development. The Asia-Pacific region, in particular, is emerging as a major force due to growing drugs and biotechnology, while North America and Europe maintain important market stocks due to their advanced healthcare infrastructure and high adoption of innovative fermentation technologies.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Microbial Fermentation Service- Snapshot

- 2.2 Microbial Fermentation Service- Segment Snapshot

- 2.3 Microbial Fermentation Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Microbial Fermentation Service Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Microbial Cultures

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Fermentation Equipment

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Fermentation Broth

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Microbial Fermentation Service Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food & Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceuticals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Biofuels

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Agriculture

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Cosmetics & Personal Care

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Microbial Fermentation Service Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Lonza

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 AbbVie Contract Manufacturing

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 EUROAPI

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 FUJIFILM Diosynth Biotechnologies

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Laurus Bio

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 AGC Biologics

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Nordmark

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Microbial Fermentation Service in 2030?

+

-

Which type of Microbial Fermentation Service is widely popular?

+

-

What is the growth rate of Microbial Fermentation Service Market?

+

-

What are the latest trends influencing the Microbial Fermentation Service Market?

+

-

Who are the key players in the Microbial Fermentation Service Market?

+

-

How is the Microbial Fermentation Service } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Microbial Fermentation Service Market Study?

+

-

What geographic breakdown is available in Global Microbial Fermentation Service Market Study?

+

-

Which region holds the second position by market share in the Microbial Fermentation Service market?

+

-

How are the key players in the Microbial Fermentation Service market targeting growth in the future?

+

-

Another significant factor driving this growth is the increasing trend of outsourcing among pharmaceutical and biotechnology companies to Contract Development and Manufacturing Organizations (CDMOs). Many smaller, innovative firms often find themselves lacking the in-house capabilities, specialised knowledge, and hefty capital investment needed for large-scale microbial fermentation. As a result, they are turning to CDMOs for their state-of-the-art facilities, technical expertise, and support with regulatory compliance, which helps them get their high-quality bioproducts to market more quickly and efficiently.

,The Microbial Fermentation Service Market is on a remarkable upswing, largely fuelled by the growing demand for biopharmaceuticals and bio-based products across a range of industries. As chronic diseases, including various infections and cancers, become more common, there's a heightened need for innovative therapeutic proteins, vaccines, and cutting-edge treatments like cell and gene therapies—all of which depend heavily on microbial fermentation for their production.

,