Global Low Voltage Energy Storage System Market Trends and Forecast to 2030

Report ID: MS-709 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Low Voltage Energy Storage System Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

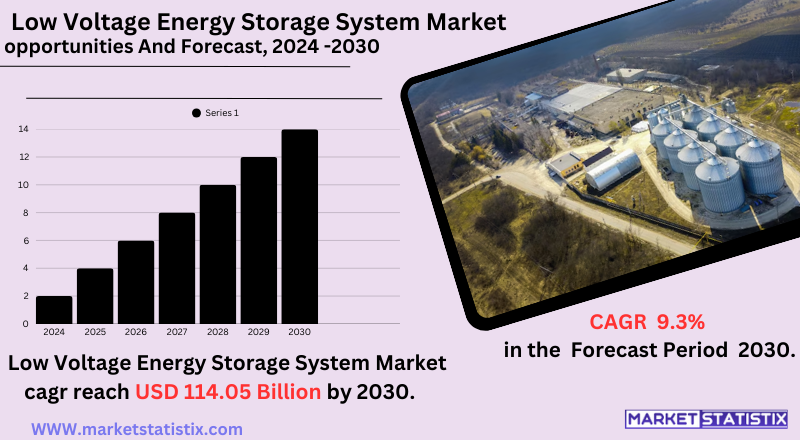

| Growth Rate | CAGR of 9.3% |

| Forecast Value (2030) | USD 114.05 Billion |

| By Product Type | Flow Battery, Lead Acid Battery, Lithium-ion Battery, Others |

| Key Market Players |

|

| By Region |

|

Low Voltage Energy Storage System Market Trends

Energy self-consumption is progressively emerging as an important trend in which homeowners and businesses have connected their solar systems to low-voltage energy storage systems (LV ESS) that allow them to store excess energy generated during the daytime hours for night or low-solar-output times. The falling cost of batteries adds to this already considerable trend, making low-voltage energy storage solutions economically more attractive and widely available to more consumers. Another factor driving change is the increasing need for battery-supported power backups as some regions increasingly suffer from grid instability and, at the same time, a rise in independence for energy. Improvements in battery lifetimes, higher energy densities, and advanced safety features render the LV ESS alternative experimentally reliable and more appealing. Besides that, intelligent home energy management systems are recently getting popular – coupled with LV ESS – allowing users to optimise how they use energy and control it remotely, while future benefits could be in terms of demand participation in grid services programmes, improving the valuations of these systems.Low Voltage Energy Storage System Market Leading Players

The key players profiled in the report are ABB (Switzerland), EVE Energy Co., Ltd. (China), Narada (China), GE (U.S.), Siemens Energy (Germany), Kokam (South Korea), LG Energy Solution (South Korea), Samsung SDI (South Korea), Total (France), VRB Energy (Canada), Fluence (U.S.), Hitachi Chemical Co., Ltd. (Japan), Black & Veatch (U.S.)Growth Accelerators

It is indeed growing at a fast rate with the increase in installing solar PV systems in homes and businesses. More people and companies tend to pay for green energy as savings on electric bills go higher; hence, the need for LV ESS-acquired power from excess solar energy for later use is a must. Battery prices from such effects are much cheaper than those for lithium-ion, which is a big factor driving suitability for these systems for more consumers. Another major driving factor of the market is the increasing need for reliable backup power solutions. LV ESS serves as a primary source of energy independence and security against power outages, particularly in regions characterised by an unstable grid or high susceptibility to natural disasters. In addition, regarding energy self-consumption and peak shaving (i.e., using stored energy during periods of higher tariffs), awareness of potential savings in these areas has made LV ESS more appealing to homeowners and small businesses alike. Its contribution to local grid stability and facilitation of distributed energy resource integration further reinforces its market growth.Low Voltage Energy Storage System Market Segmentation analysis

The Global Low Voltage Energy Storage System is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Flow Battery, Lead Acid Battery, Lithium-ion Battery, Others . The Application segment categorizes the market based on its usage such as Non-Residential, Residential, Utility. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

A recent merger and acquisition trend in the low-voltage energy storage system market indicates a consolidation of strategies by the companies to improve their capabilities and market positions. For example, in March 2025, Scania struck an agreement to acquire Northvolt's heavy industry battery business, Northvolt Systems Industrial, in order to reinforce its battery system offerings for industrial applications. Further, Castleton Commodities International acquired a majority equity stake in Lower 48 Energy BESS Ltd, a UK-based developer of large-scale energy storage systems, marking CCI's foray into the energy storage sector in December 2024. These transactions illustrate the increasing importance of battery energy storage systems (BESS) in fostering the global energy transition. With record investment levels in BESS, 2023 saw the announcement of 227 battery storage M&A deals, which represents a 15.8% increase over last year and amounted to $24.1 billion—almost three times the value in 2022. This trend exemplifies the sector's critical importance in the attainment of net-zero and sustainable energy objectives.Challenges In Low Voltage Energy Storage System Market

There are limitations to the low-voltage energy storage system market. A major problem is the architecture of the system; involving integration includes batteries, inverters, and other components and makes systems so difficult to install or maintain, given their distributed nature, in which wiring and connections must be individually implemented on-site. Putting up such systems consumes time and resources on one hand and inhibits scaling up for private or small-end use. Also, battery efficacy is not inefficient in which capacity differences stem from parallel resistance internal differences among battery modules, thus resulting in partial capacity losses as time passes and then decreases performance and system reliability. The regular maintenance, such as SOC calibration and manual recharging, is a burden, as it requires skilled personnel to keep the functioning of the system intact, thus driving the cost of using up by end users high. The safety of systems because of battery performances and fire risks makes it more complex in its adoption. Solutions to all these could be found through developing technologies in the areas of system integration, improving battery management systems, and having streamlined regulatory frameworks.Risks & Prospects in Low Voltage Energy Storage System Market

The decline in lithium-ion battery prices, along with their lightweight and efficient nature, is increasing the demand for them, especially in solar rooftops and home inverters. Emerging markets within the Asia-Pacific region are likely to achieve rapid growth considering increasing energy consumption and supportive government rules to promote decentralised energy solutions. Further advancements in batteries, especially solid-state and redox flow batteries, will take the performance and sustainability in this segment another level up in their viability. North America and Europe are pretty much leading in the market owing to strong policymaking, matured renewable energy sectors, and increasing consciousness about energy sustainability. The Asia-Pacific region, particularly China, Japan, and South Korea, offers vast growth potential due to urbanisation, increasing energy demand, and rapid government initiatives for promoting clean energy technology. Promising opportunities are also arising across emerging markets in Latin America and Africa as they seek to modernise their grids and expand electricity accessibility using the cheapest low-voltage storage solutions.Key Target Audience

The major target customer segments for Low Voltage Energy Storage Systems (LV ESSs) are firstly the residential segment and secondly the small commercial and industrial segment. Households are adopting LV ESSs paired with rooftop solar installations to increase self-consumption, reduce bills, and ensure backup during outages. This group of people includes those who are concerned about the environment and energy independence and those who reside in high electricity-cost regions or where power disruption is fairly common.,, This also extends into a small commercial and light industrial audience. Companies are deploying LV ESS solutions to cut charges for peak demand, integrate on-site renewable energy, gain business continuity from backup power, and meet sustainability targets. Small offices, retail stores, restaurants, workshops, and a variety of agricultural operations all fall under this category. These users, therefore, have significantly understandable economic benefits realised through savings in energy consumption plus the resilience that energy storage brings with it.Merger and acquisition

A recent merger and acquisition trend in the low-voltage energy storage system market indicates a consolidation of strategies by the companies to improve their capabilities and market positions. For example, in March 2025, Scania struck an agreement to acquire Northvolt's heavy industry battery business, Northvolt Systems Industrial, in order to reinforce its battery system offerings for industrial applications. Further, Castleton Commodities International acquired a majority equity stake in Lower 48 Energy BESS Ltd, a UK-based developer of large-scale energy storage systems, marking CCI's foray into the energy storage sector in December 2024. These transactions illustrate the increasing importance of battery energy storage systems (BESS) in fostering the global energy transition. With record investment levels in BESS, 2023 saw the announcement of 227 battery storage M&A deals, which represents a 15.8% increase over last year and amounted to $24.1 billion—almost three times the value in 2022. This trend exemplifies the sector's critical importance in the attainment of net-zero and sustainable energy objectives. >Analyst Comment

The LV ESS market is experiencing a rapid expansion phase largely on the back of accelerated adoption of solar PV panels across residential and small commercial sectors in India and elsewhere. Assembling more investments into solar as panel prices decline and awareness about the benefits of clean energy grows. This ultimately drives the need for the LV ESS market to store excess solar energy produced during the daytime for later evening or during power outages for autonomous energy consumption while affording maximum relief from the grid. Governmental policies and incentives favouring solar and energy storage apposite to their adoption in India, meanwhile, are also adding to the aforementioned growth.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Low Voltage Energy Storage System- Snapshot

- 2.2 Low Voltage Energy Storage System- Segment Snapshot

- 2.3 Low Voltage Energy Storage System- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Low Voltage Energy Storage System Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Lithium-ion Battery

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lead Acid Battery

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Flow Battery

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Low Voltage Energy Storage System Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Non-Residential

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Utility

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Low Voltage Energy Storage System Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 GE (U.S.)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 ABB (Switzerland)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Samsung SDI (South Korea)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Hitachi Chemical Co.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Ltd. (Japan)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Siemens Energy (Germany)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Total (France)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 LG Energy Solution (South Korea)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Fluence (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Narada (China)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 VRB Energy (Canada)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Kokam (South Korea)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 EVE Energy Co.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Ltd. (China)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Black & Veatch (U.S.)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Low Voltage Energy Storage System in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Low Voltage Energy Storage System market?

+

-

How big is the Global Low Voltage Energy Storage System market?

+

-

How do regulatory policies impact the Low Voltage Energy Storage System Market?

+

-

What major players in Low Voltage Energy Storage System Market?

+

-

What applications are categorized in the Low Voltage Energy Storage System market study?

+

-

Which product types are examined in the Low Voltage Energy Storage System Market Study?

+

-

Which regions are expected to show the fastest growth in the Low Voltage Energy Storage System market?

+

-

Which application holds the second-highest market share in the Low Voltage Energy Storage System market?

+

-

What are the major growth drivers in the Low Voltage Energy Storage System market?

+

-