Global LNG Bunkering Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-708 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

LNG Bunkering Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

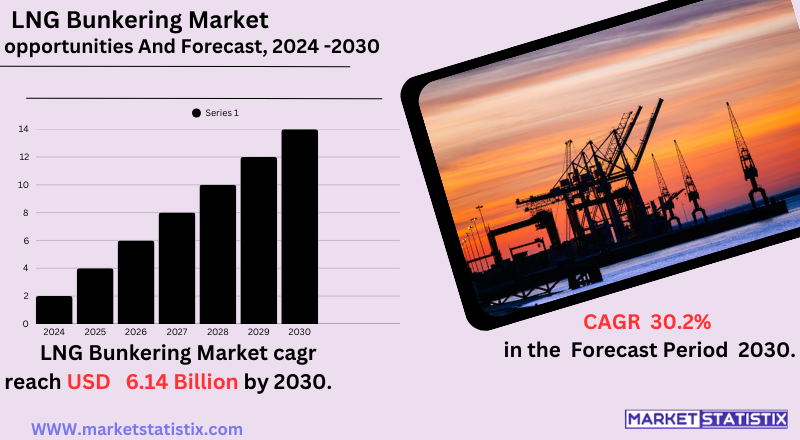

| Growth Rate | CAGR of 30.2% |

| Forecast Value (2030) | USD 6.14 billion |

| By Product Type | Bulk and General Cargo Vessel, Tankers, Container Ships, Ferries and Offshore Support Vessel |

| Key Market Players |

|

| By Region |

|

LNG Bunkering Market Trends

Key trends include the swift maturation of ship-to-ship LNG bunkering operations, the development of green LNG bunkering vessels, and the application of artificial intelligence for improving operational efficiency. Strategic partnerships and product innovations also drive the market, with larger companies focusing on enhancing LNG supply chains and related infrastructure. The increase in the container fleet, plus stricter emissions regulations, creates further demand for LNG bunkering solutions, and the market is forecasted to grow significantly at a CAGR over the next ten years. Investment in LNG bunkering infrastructure is yet another prominent trend. The ports and energy companies now share a long-term vision for LNG as a marine fuel and are developing or extending their bunkering facilities, including both onshore terminals and dedicated bunker vessels.LNG Bunkering Market Leading Players

The key players profiled in the report are Royal Dutch Shell plc., Engie, ENN Energy Holdings Limited, EVOL LNG, Gasnor AS, Eagle LNG, Harvey Gulf International Marine LLC, Gasum Ltd., Korea Gas Corporation, Bomin Linde LNG GmbH & Co. KG, Polskie LNG S.A., Fjord LineGrowth Accelerators

The increasing rigorous environmental regulations in the maritime sector which are greatly impacting growth in the LNG bunkering market include those directed by the International Maritime Organisation, or IMO; these are focused on reducing the sulphur oxides (SOₓ), nitrogen oxides (NOₓ), and greenhouse gas (GHG) emissions from ships. LNG provides very clean alternatives for traditional heavy fuel oil without high emissions of these pollutants. Among the key growth market factors are LNG's cost advantages and wider availability. Although LNG fuel vessels will mean increased capital costs up front, they become cost-effective as fewer dollars are spent on operational costs over the life of the vessel due to less fuel consumption, lower maintenance needs, and possibly longer engine life. Thus, both increasing global natural gas production and the increasingly efficient LNG supply chains have further increased accessibility and lowered costs for use in marine LNG, which in time would accelerate the growth of the LNG bunkering market.LNG Bunkering Market Segmentation analysis

The Global LNG Bunkering is segmented by Type, and Region. By Type, the market is divided into Distributed Bulk and General Cargo Vessel, Tankers, Container Ships, Ferries and Offshore Support Vessel . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The LNG bunkering market is characterised by the presence of a moderately fragmented competitive landscape where several major global energy corporations exist alongside specialised bunkering service providers and port authorities, making it a controlled market. Several major players, such as Shell, TotalEnergies, and Petronas, have a significant impact on the supply of bunkers, owing to their global states of infrastructural establishment and supply chain capabilities in liquefied natural gas. Other regional examples include Gasum in the Nordic region and Korea Gas Corporation in Asia, which hold strong competitive positions in their respective markets. The major part has been played by the availability and strategic location of bunkering infrastructure, the efficiency of operations and safety during bunkering, and competitive pricing and supply reliability.Challenges In LNG Bunkering Market

The LNG bunkering market has shown an increasing trend in recent merger activities and acquisitions, which indicates the opportunity for consolidation and capability expansions in this fast-developing domain. One recent occurrence is Shell's settlement for the acquisition of Pavilion Energy from Temasek in June 2024. Through acquiring Pavilion Energy's LNG trading, shipping, and bunkering operations in Asia and Europe, including access to regasification capacity in strategically located hubs and a fleet of LNG vessels, Shell intends to consolidate its global LNG portfolio significantly. Besides outright acquisitions, the market has been experiencing recent strategic partnerships and collaborations for developing geographic reach and service offerings. One more recent example is Stolt-Nielsen increasing its stake in Avenir LNG to 94.37% in February 2025, signalling consolidation within the small-scale LNG supply sector to expand their bunkering and supply services to a greater range of customers. Similarly, previous partnerships, such as the LNG supply agreement between Shell and CMA CGM in Singapore in 2023, demonstrate the role of collaboration in establishing a reliable and expansive LNG bunkering network across key shipping hubs.Risks & Prospects in LNG Bunkering Market

Various challenges exist which will limit the growth of the LNG bunkering market even as it plays an important role in maritime decarbonisation. One of the most important challenges is the high upfront investment requirement for the infrastructure pertaining to LNG, including such things as high-pressure storage and supply vessels, which poses a financial hurdle to many interested stakeholders; another challenge is the limited global footprint of LNG bunkering facilities, only a few of the ports being able to facilitate ship-to-ship LNG bunkering, which makes infrastructure gaps between regions and slows the acceptance of LNG as the marine fuel of choice. Furthermore, standing in the path of marketing expansion are emissions reduction competitions from other alternative products, like scrubbers. Another hurdle is the economic attractiveness of LNG against traditional fuels. With worldwide oil prices dipping to record lows, the cost-effectiveness with which LNG may be adopted into fleets for replacement and transition diminishes further for shipowners. Additionally, the adaptation of commercial agreements for different price indices and flexible supply is complex and impedes widespread adoption. Joint action will address all these challenges in accelerating infrastructure development, easing regulations and attracting investments into cleaner technologies.Key Target Audience

, The shipping firms and vessel operators who own or operate LNG-fuelled vessels are the principal target audience for LNG bunkering. Shipping, in conjunction with conventional maritime transport activities, encompasses a plethora of offerings, segmentation-wise going from container shipping lines, tanker operators (be it crude oil, chemicals, or LNG in itself), bulk carriers, cruise lines, and ferry services. The very motivation comes from adhering to increasingly stringent environmental regulations, reducing fuel costs for the long run, and enhancing their sustainability image., Other major target audiences include port authorities and terminal operators, which are essential to the design and provision of infrastructures for LNG bunkering, such as the provision of dedicated berths, storage, and transfer equipment. Their interest in the attraction of LNG-fuelled vessels to their ports and the corresponding increased traffic and revenue is to create environmentally friendly centres. Their decisions via strategic means about the respective supply chain effects, pricing elements, and therefore the locations of bunkering have a considerable impact directly on the growth and availability of the LNG bunkering market.Merger and acquisition

The shipping firms and vessel operators who own or operate LNG-fuelled vessels are the principal target audience for LNG bunkering. Shipping, in conjunction with conventional maritime transport activities, encompasses a plethora of offerings, segmentation-wise going from container shipping lines, tanker operators (be it crude oil, chemicals, or LNG in itself), bulk carriers, cruise lines, and ferry services. The very motivation comes from adhering to increasingly stringent environmental regulations, reducing fuel costs for the long run, and enhancing their sustainability image. Other major target audiences include port authorities and terminal operators, which are essential to the design and provision of infrastructures for LNG bunkering, such as the provision of dedicated berths, storage, and transfer equipment. Their interest in the attraction of LNG-fuelled vessels to their ports and the corresponding increased traffic and revenue is to create environmentally friendly centres. Their decisions via strategic means about the respective supply chain effects, pricing elements, and therefore the locations of bunkering have a considerable impact directly on the growth and availability of the LNG bunkering market. >Analyst Comment

LNG bunkering is witnessing increasing rapidity in growth due to rising global demand for liquefied natural gas (LNG) as a marine fuel having cleaner and more sustainable credentials. The LNG bunkering market size is projected to be around $2.34 billion in 2025, growing at a magnificent compound annual growth rate and further projected to expand to $10.86 billion by 2029. The market is being boosted by the growing market trade activities, stringent environmental regulations such as IMO's sulphur cap, and increased installation of LNG vessels to curb emissions. Key trends include developments in ship-to-ship and shore-to-ship LNG bunkering technologies, cooperative agreements, and the design of sustainable LNG bunkering vessels.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 LNG Bunkering- Snapshot

- 2.2 LNG Bunkering- Segment Snapshot

- 2.3 LNG Bunkering- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: LNG Bunkering Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Container Ships

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Tankers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Bulk and General Cargo Vessel

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Ferries and Offshore Support Vessel

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: LNG Bunkering Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Royal Dutch Shell plc.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Engie

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Bomin Linde LNG GmbH & Co. KG

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Gasum Ltd.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Gasnor AS

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Korea Gas Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Harvey Gulf International Marine LLC

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Polskie LNG S.A.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Eagle LNG

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 ENN Energy Holdings Limited

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 EVOL LNG

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Fjord Line

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of LNG Bunkering in 2030?

+

-

Which type of LNG Bunkering is widely popular?

+

-

What is the growth rate of LNG Bunkering Market?

+

-

What are the latest trends influencing the LNG Bunkering Market?

+

-

Who are the key players in the LNG Bunkering Market?

+

-

How is the LNG Bunkering } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the LNG Bunkering Market Study?

+

-

What geographic breakdown is available in Global LNG Bunkering Market Study?

+

-

Which region holds the second position by market share in the LNG Bunkering market?

+

-

How are the key players in the LNG Bunkering market targeting growth in the future?

+

-