Global Livestock Electronic Tags Market – Industry Trends and Forecast to 2030

Report ID: MS-636 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Livestock Electronic Tags Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

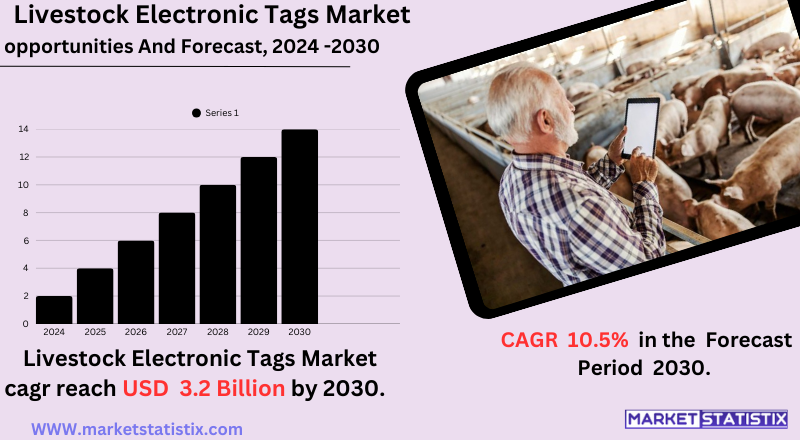

| Growth Rate | CAGR of 10.5% |

| Forecast Value (2030) | USD 3.2 Billion |

| By Product Type | RFID (Radio Frequency Identification), GPS (Global Positioning System), Bluetooth, Other Wireless Technologies |

| Key Market Players |

|

| By Region |

Livestock Electronic Tags Market Trends

As a result of technological advancements as well as the higher needs for improved livestock management, the Livestock Electronic Tags Market has been experiencing remarkable developments. Two of the important trends that define this market are the rising adoption of RFID technology that is oriented toward accurate animal identity and tracking and IoT device incorporation, which allows real-time monitoring of data. Such data can allow farmers to optimize herd health and improve breeding programs, as well as enhance traceability throughout the food supply chain. There will also be a greater user emphasis in livestock management toward smart livestock management, mostly on GPS and sensor technologies. This allows the farmer to remotely monitor animal movements, activity levels, and important signs, hence helping improve animal welfare while reducing operational costs. Regulatory pressures related to animal identification and disease control will also continue to affect the market since countries all over the world are in the process of adopting electronic tagging systems.Livestock Electronic Tags Market Leading Players

The key players profiled in the report are CattleTrace, Global Animal ID, UHF Livestock, EIDAP Inc., TagTech Innovations, FarmID Innovations, DataLivestock, VirtualHerd Technologies, Datamars, SmartTag Systems, Shearwell Data Limited, AgriTech Solutions, BioTrack, Ranchers Choice Tech, Avid Identification Systems, Inc., Merck Animal Health, LivestockID Solutions, WISE Livestock SystemsGrowth Accelerators

Livestock electronic tags market drivers include traceability of livestock in food safety. Governments worldwide have made stricter regulations, monitoring animal health to prevent disease outbreaks, to push the electronic tagging systems. The growing awareness of consumers with respect to food origin and food safety standards further drives demand since traceability is vital for transparency in the supply chain. Moreover, the precision livestock farming technique, which tracks and measures information in real-time to manage for optimization, offers further impetus for market growth as it finds increasing adoption. The various efficacies required for cattle management in the large-scale sector are another aspect driving the demand for electronic tagging systems. Labor costs are lowered through the automation of data collection and analysis by electronic tags, thus improving profitability. This is complemented by the actions of IoT and cloud technologies pushing forward the market by providing solutions for remote monitoring, real-time alerts, and enriched analytics that aid farmers in making decisions, thus improving farm efficiency.Livestock Electronic Tags Market Segmentation analysis

The Global Livestock Electronic Tags is segmented by Type, Application, and Region. By Type, the market is divided into Distributed RFID (Radio Frequency Identification), GPS (Global Positioning System), Bluetooth, Other Wireless Technologies . The Application segment categorizes the market based on its usage such as Wildlife Monitoring, Livestock Management, Pet Tracking, Research and Conservation Efforts. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape in the Livestock Electronic Tags Market is characterized by both established players and emerging technology providers vying for each segment of the market. The competitive factors are key in the areas of product innovation, technological advancement, and the provision of total solutions, including hardware, software, and data analytics. Major players are focusing on developing robust and reliable tags that can withstand environmental conditions along with improved data transmission capabilities and battery life. Strategic partnerships and collaborations with livestock management software providers are key in delivering integrated solutions to meet changing demands from farmers.Challenges In Livestock Electronic Tags Market

Various challenges in the livestock electronic tag markets could hinder their growth and adoption. One major challenge is the high initial costs of electronic tags that deter small-time farmers and livestock owners from adopting them in developing parts of the world. In addition, the implementation of such systems requires supporting systems such as reliable internet connectivity and data storage, which are unlikely to be found in rural or remote areas. Another challenge is the durability and reliability of electronic tags in cruel environmental conditions. The tags must be able to withstand extreme weather, rough handling, and prolonged usage and maintain their performance in an accurate manner. Limited battery life of certain devices further raises farmers' maintenance costs as it hinders their free and widespread adoption. Additionally, farmers' concerns about data privacy and security are still an important issue, posing a challenge to implementing electronic tagging systems, as they are reluctant to divulge sensitive information regarding their livestock for fear of possible misuse or attacks from cyberspace. Innovative solutions, cost-effective designs, and an enhanced understanding of the advantages of adopting electronic tagging systems by farmers would do well to address these challenges.Risks & Prospects in Livestock Electronic Tags Market

The major opportunities involve an upsurge in the introduction of advanced technologies like Global Positioning Systems (GPS) and the Internet of Things (IoT) in electronic tags that allow real-time monitoring of the health and movement activities of an animal. Additionally, the government regulations that promote livestock traceability and food safety fuel this market growth. Region-based, North America and Europe are the number one leading market because of their advances in farming practices along with strict regulations. In contrast, the Asia Pacific is a midnight market that promises to become quite lucrative with the modernization and commercialization advancement in livestock farming practices and people's awareness of animal welfare and rising incomes. Countries such as China, India, and Australia are anticipated to witness a massive surge in the commercialization of electronic livestock tags. The Middle East and Africa are in the same way promising countries, if not through all, especially those concentrating efforts on better management systems for livestock in view of enhancing food security and export opportunities.Key Target Audience

, The core market for the Livestock Electronic Tags includes commercial livestock farmers and ranchers who maintain a large herd and want to increase efficiency and traceability. To achieve this, they need strong solutions for animal identification, health monitoring, and data management., Moreover, these tags are significant for veterinary professionals and livestock management consultants because they use electronic tag data in their advisory and service-provision activities with farmers. Research institutions and breeding organizations are thus also a prime audience, as they use these technologies for genetic tracking and protein improvement of livestock breeding programs. Essentially, all targets who play significant roles in large-scale animal husbandry, regulation, or research are missions in this segment.Merger and acquisition

The last few years have seen interesting mergers and acquisitions in the market for livestock electronic tagging systems, indicating somewhat consolidation and technological advancement trends. Specifically, Datamars, a major player in animal identification, severely improved its market position by acquiring Z Tags and Tru-Test, thus expanding its product portfolio and solidifying its standing in world markets. Such acquisitions allow businesses to integrate solutions through visual and electronic identification systems whereby the livestock management market requirements are met. Apart from mergers and acquisitions, strategic partnerships were developed, which aided in shaping the competitive arena. For instance, Allflex—a principal in animal identification and traceability solutions—announced a strategic partnership with Kezzler in 2023 to boost the traceability and transparency of livestock supply chains with blockchain technology. These alliances prove how the industry is increasingly desirous to employ advanced technology for livestock management and assurance of food safety. >Analyst Comment

The Livestock Electronic Tags Market is undergoing rapid growth owing mainly to the growing need for efficient livestock management and enhanced traceability in the food supply chain. Geminization of the market is due to rising animal health concerns, compliance with increasingly stringent regulations, and growing acceptance of precision livestock farming. With technological advancements combining RFID, GPS, and IoT technologies, farmers can now track animal location, health, and behaviour in real-time, leading to increased productivity and reduced operational costs.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Livestock Electronic Tags- Snapshot

- 2.2 Livestock Electronic Tags- Segment Snapshot

- 2.3 Livestock Electronic Tags- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Livestock Electronic Tags Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 RFID (Radio Frequency Identification)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 GPS (Global Positioning System)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Bluetooth

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Other Wireless Technologies

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Livestock Electronic Tags Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Livestock Management

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pet Tracking

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Wildlife Monitoring

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Research and Conservation Efforts

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 AgriTech Solutions

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Avid Identification Systems

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 BioTrack

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 CattleTrace

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 DataLivestock

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Datamars

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 EIDAP Inc.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 FarmID Innovations

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Global Animal ID

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 LivestockID Solutions

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Merck Animal Health

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ranchers Choice Tech

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Shearwell Data Limited

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 SmartTag Systems

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 TagTech Innovations

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 UHF Livestock

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 VirtualHerd Technologies

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 WISE Livestock Systems

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Livestock Electronic Tags in 2030?

+

-

Which type of Livestock Electronic Tags is widely popular?

+

-

What is the growth rate of Livestock Electronic Tags Market?

+

-

What are the latest trends influencing the Livestock Electronic Tags Market?

+

-

Who are the key players in the Livestock Electronic Tags Market?

+

-

How is the Livestock Electronic Tags } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Livestock Electronic Tags Market Study?

+

-

What geographic breakdown is available in Global Livestock Electronic Tags Market Study?

+

-

Which region holds the second position by market share in the Livestock Electronic Tags market?

+

-

Which region holds the highest growth rate in the Livestock Electronic Tags market?

+

-