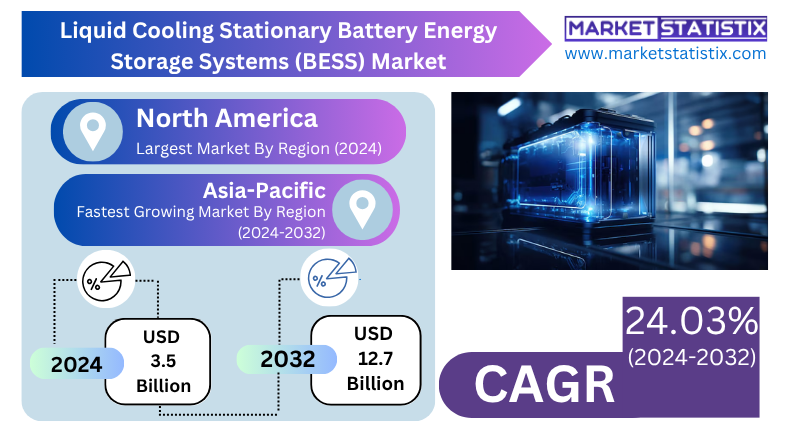

Global Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-2597 | Manufacturing and Construction | Last updated: May, 2025 | Formats*:

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market targets the technologies and solutions applied to manage the temperature of battery packs and modules in large-scale energy storage facilities. The systems are vital in ensuring the optimal operating temperatures, which have a direct effect on the performance, lifespan, and safety of the batteries. Efficient thermal management, achieved through liquid cooling, prevents overheating, thermal runaway, and degradation, hence optimising the BESS efficiency and reliability.

Stationary battery liquid cooling systems normally consist of pumping a coolant fluid (e.g., water-glycol blends or dielectric fluids) through cooling plates or channels in contact with the battery cells or modules. This approach provides better heat transfer performance than air cooling, allowing BESS to run at higher power densities and over a broader ambient condition range. The market includes different components such as cooling plates, pumps, heat exchangers, chillers, control systems, and dedicated coolants, all designed for the unique thermal management needs of different battery chemistries and BESS configurations applied in grid-scale energy storage, commercial and industrial use, and microgrids.

Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 24.03% |

| Forecast Value (2032) | USD 12.7 Billion |

| By Product Type | Flow Batteries, Lead-acid Batteries, Lithium-ion Batteries, Sodium-ion Batteries, Solid-State Batteries |

| Key Market Players |

|

| By Region |

|

Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market Trends

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market is in a state of vigorous growth at present, propelled by the proliferation of grid-related energy storage systems and escalating global demand for integrating renewable energy. One of the most important trends is the growing demand for active liquid cooling systems because they better handle the high thermal loads found in large battery installations, promoting improved temperature uniformity and avoidance of hot spots that can deteriorate battery performance and life. Water-based coolants are also becoming the most popular choice owing to their high thermal efficiency, cost-effectiveness, and safety for the environment.

One other major trend is the increasing use of liquid cooling for medium-scale energy storage systems (1 MW to 10 MW), which are vital in commercial and industrial applications, delivering grid stability and peak shaving functionalities. In addition, the Asia-Pacific region, including India, is expected to dominate the market because of widespread renewable energy adoption and aggressive energy storage targets. Recent advancements involve firms introducing high-efficiency battery systems with sophisticated liquid cooling to enable grid-scale applications, reflecting a keen interest in improving the reliability and performance of BESS through efficient thermal management solutions.

Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market Leading Players

The key players profiled in the report are NEC ES, Toshiba, Fluence, Huawei, Eaton, Wärtsilä Energy, Samsung SDI, Mitsubishi Electric, Saft, VARTA AG, Siemens, Sungrow, Hitachi Energy, Tesla, Panasonic, ABB, BYD, LG Energy Solution, Kokam, Delta Electronics, CATL, LeclanchéGrowth Accelerators

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market is driven mainly by the rising need for effective thermal management systems with the growth in large-scale battery storage installations around the world. The need to ensure proper operating temperatures for improved battery performance, extended lifespan, and enhanced safety in applications related to grid-scale and commercial/industrial energy storage drives the market.

Yet another major driver is the persistent technological advancements in battery technology, which result in greater energy densities and faster charging/discharging rates and consequently produce more heat. Liquid cooling is a much better heat-dissipation solution than conventional air-cooling systems and is therefore an essential solution for coping with the thermal issues involved in these next-generation batteries. Moreover, increasing consciousness of safety norms and necessity to avoid thermal runaway in large battery installations are also driving the implementation of liquid cooling systems as a vital safety factor. Government regulations and incentives towards energy storage solutions also play an important role in the market growth.

Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market Segmentation analysis

The Global Liquid Cooling Stationary Battery Energy Storage Systems (BESS) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Flow Batteries, Lead-acid Batteries, Lithium-ion Batteries, Sodium-ion Batteries, Solid-State Batteries . The Application segment categorizes the market based on its usage such as Utility-scale Energy Storage, Microgrids, Commercial & Industrial, Data Centers, Renewable Energy Integration. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market is a competitive one with a combination of existing thermal management solutions providers and those focused on energy storage components. Leading players in the cooling technologies, such as Boyd Corporation, and those highly present in the BESS industry, such as Sungrow and VE Energy Co., Ltd., are among the key players. Such businesses tend to fight on the effectiveness of their cooling solutions, whether they can configure systems for unique BESS geometries, and their history in maintaining the dependability and integrity of large installations of energy storage.

Growing demand for high-performance BESS to enable renewable energy integration and grid stability is drawing new companies and driving innovation in the liquid cooling sector. Competition is mounting around the creation of next-generation cooling methods, including immersion cooling and two-phase cooling, and smart monitoring and control systems integration.

Challenges In Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) industry is confronted with a number of major challenges despite technological superiority and the fast-growing nature of the market. Upfront costs are high, as systems need sophisticated designs with pumps, heat exchangers, and bespoke equipment; hence, initial expenditures are high, particularly for smaller players or in retrofitting existing facilities. Maintenance sophistication is another significant problem: the movable parts in liquid cooling systems, including pumps and fluid flow mechanisms, have a tendency to fail, and the possibility of coolant contamination or degradation adds to the necessity of periodic, qualified maintenance. These issues have the potential to raise operating expenses and cause possible downtime if not addressed.

Moreover, system reliability and implementation ease are continuing concerns. Adding liquid cooling to large-scale or legacy BESS installations can be expensive and logistically complex, while achieving uniform temperature control across extensive battery arrays necessitates careful engineering. As battery technology improves and energy density grows, maintaining optimal operating temperatures within tight safety margins (usually 15°C–35°C) becomes increasingly important, further making system design and operation more challenging. In spite of these challenges, continuing technological advancement and increasing demand for effective, large-scale renewable energy storage are likely to stimulate sustained investment and advances in liquid cooling solutions.

Risks & Prospects in Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market

Principal market opportunities arise from the ramping up of renewable energy deployment, which requires efficient, high-capacity energy storage solutions for grid stability and reliability. Liquid cooling provides better heat dissipation and temperature control than air cooling and is thus a requirement for utility-scale applications and high-density battery installations. With safety, battery life, and system performance becoming increasingly important, continued innovation in cooling technology and integration with smart grid infrastructure will continue to drive adoption and innovation in this market.

Regionally, Asia-Pacific is becoming the leading force, driven by high growth in renewable energy, huge government investments in grid modernisation, and aggressive clean energy targets in China and India. China alone will contribute almost 60% of global renewable capacity additions by 2030, supporting the region's need for sophisticated thermal management. North America also accounts for a large portion, led by big wind and solar schemes as well as a robust emphasis on system reliability. High upfront expenses as well as complexity are still impediments, although the market vision is strong with innovation, sustainability, and efficiency being the core drivers of growth in the future, especially among regions focusing on energy transition as well as the modernisation of grids.

Key Target Audience

,

The target group of the liquid cooling market in BESS is the utility-scale energy providers, the commercial and industrial (C&I) industries, and the microgrid operators. Utility-scale applications are going to be predominant, with capacity reaching 86 GWh in 2030, led by the demand for grid stability as well as integrating renewable energy. C&I applications and industries, especially the medium-scale ESS (1–10 MW), are switching more and more towards liquid cooling and solutions to meet thermal loads effectively while providing battery lifespan and operational reliability. And microgrid operators also form a major target segment, leveraging liquid-cooled BESS for stable power supply in off-grid or far-flung areas.

,, Secondary stakeholders include technology vendors, system integrators, and regulatory agencies. Technology vendors offering specialised advanced cooling technologies are creating active liquid cooling systems to satisfy high thermal management requirements of large-scale BESS installations. System integrators ensure that these offerings find applications across a range of applications with smooth integration into existing infrastructure. Regulatory agencies drive market forces by establishing standards and policies facilitating the adoption of efficient and sustainable energy storage solutions.Merger and acquisition

The Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market has seen high merger and acquisition (M&A) activity as the need for effective thermal management solutions in the energy storage industry continues to increase. Schneider Electric's purchase of a 75% stake in Motivair Corp for $850 million strengthens its liquid cooling technology expertise in high-performance computing and energy storage. Equally, Vertiv's purchase of CoolTera Ltd and select assets of BiXin Energy enhances its thermal management offerings, addressing the growing demand for sophisticated cooling solutions in energy storage systems.

Among energy storage projects, some of the major transactions are Copenhagen Infrastructure Partners (CIP) disposing of a 50% interest in the Coalburn battery energy storage project in Scotland to AXA's alternative investment division. The 500 MW lithium-ion battery system, which is set to be Europe's largest, reflects the strategic investments in large-scale energy storage facilities. Moreover, CATL's deal with FlexGen to provide 10 GWh of containerised liquid-cooling battery systems within three years reflects the focus on liquid cooling technologies in large-scale energy storage deployments.

>Analyst Comment

The market for liquid cooling stationary battery energy storage systems (BESS)is growing at a breakneck pace, with the size of the market going up from around $4.2 billion in 2024 to between $24.5 billion and $30.2 billion by 2033–2034, with a staggering CAGR. This expansion is driven by the expanding deployment of grid-associated energy storage systems and mounting integration of renewable energy sources, which need higher thermal management techniques to provide safety, longevity, and performance to batteries. Liquid cooling systems with better heat rejection and temperature regulation than air-based cooling is fast becoming essential in high-power applications like grid stability, renewable energy storage, and uninterruptible power supplies.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Liquid Cooling Stationary Battery Energy Storage Systems (BESS)- Snapshot

- 2.2 Liquid Cooling Stationary Battery Energy Storage Systems (BESS)- Segment Snapshot

- 2.3 Liquid Cooling Stationary Battery Energy Storage Systems (BESS)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Lithium-ion Batteries

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Flow Batteries

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Lead-acid Batteries

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Sodium-ion Batteries

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Solid-State Batteries

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Utility-scale Energy Storage

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial & Industrial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Data Centers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Microgrids

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Renewable Energy Integration

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market by Cooling Fluid

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Water-Based Coolants

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Glycol-Based Coolants

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Oil-Based Coolants

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Synthetic Fluids

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market by Cooling Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Active Liquid Cooling

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Passive Liquid Cooling

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Hybrid Liquid Cooling Systems

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Panasonic

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Samsung SDI

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 LG Energy Solution

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 NEC ES

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Saft

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 CATL

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Sungrow

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Eaton

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Fluence

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Delta Electronics

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 VARTA AG

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Toshiba

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Hitachi Energy

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Kokam

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 Tesla

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

- 10.16 Siemens

- 10.16.1 Company Overview

- 10.16.2 Key Executives

- 10.16.3 Company snapshot

- 10.16.4 Active Business Divisions

- 10.16.5 Product portfolio

- 10.16.6 Business performance

- 10.16.7 Major Strategic Initiatives and Developments

- 10.17 BYD

- 10.17.1 Company Overview

- 10.17.2 Key Executives

- 10.17.3 Company snapshot

- 10.17.4 Active Business Divisions

- 10.17.5 Product portfolio

- 10.17.6 Business performance

- 10.17.7 Major Strategic Initiatives and Developments

- 10.18 ABB

- 10.18.1 Company Overview

- 10.18.2 Key Executives

- 10.18.3 Company snapshot

- 10.18.4 Active Business Divisions

- 10.18.5 Product portfolio

- 10.18.6 Business performance

- 10.18.7 Major Strategic Initiatives and Developments

- 10.19 Huawei

- 10.19.1 Company Overview

- 10.19.2 Key Executives

- 10.19.3 Company snapshot

- 10.19.4 Active Business Divisions

- 10.19.5 Product portfolio

- 10.19.6 Business performance

- 10.19.7 Major Strategic Initiatives and Developments

- 10.20 Wärtsilä Energy

- 10.20.1 Company Overview

- 10.20.2 Key Executives

- 10.20.3 Company snapshot

- 10.20.4 Active Business Divisions

- 10.20.5 Product portfolio

- 10.20.6 Business performance

- 10.20.7 Major Strategic Initiatives and Developments

- 10.21 Mitsubishi Electric

- 10.21.1 Company Overview

- 10.21.2 Key Executives

- 10.21.3 Company snapshot

- 10.21.4 Active Business Divisions

- 10.21.5 Product portfolio

- 10.21.6 Business performance

- 10.21.7 Major Strategic Initiatives and Developments

- 10.22 Leclanché

- 10.22.1 Company Overview

- 10.22.2 Key Executives

- 10.22.3 Company snapshot

- 10.22.4 Active Business Divisions

- 10.22.5 Product portfolio

- 10.22.6 Business performance

- 10.22.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Cooling Fluid |

|

By Cooling Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Liquid Cooling Stationary Battery Energy Storage Systems (BESS) in 2032?

+

-

Which application type is expected to remain the largest segment in the Global Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market?

+

-

How big is the Global Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market?

+

-

How do regulatory policies impact the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market?

+

-

What major players in Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market?

+

-

What applications are categorized in the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market study?

+

-

Which product types are examined in the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) Market Study?

+

-

Which regions are expected to show the fastest growth in the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market?

+

-

Which application holds the second-highest market share in the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market?

+

-

Which region is the fastest growing in the Liquid Cooling Stationary Battery Energy Storage Systems (BESS) market?

+

-