Global Industrial Engines Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-740 | Service Industry | Last updated: Apr, 2025 | Formats*:

Industrial Engines Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

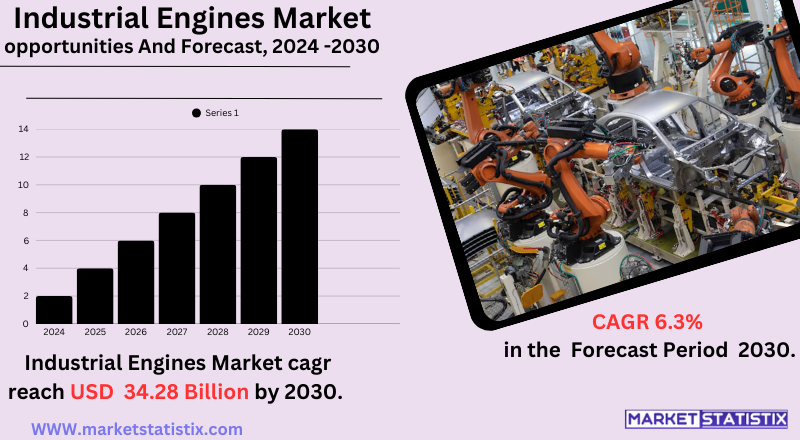

| Growth Rate | CAGR of 6.3% |

| Forecast Value (2030) | USD 34.28 Billion |

| By Product Type | Diesel Engines, Gasoline Engines |

| Key Market Players |

|

| By Region |

Industrial Engines Market Trends

With the current stringency of emission regulations around the globe, stringent investments are poised for research and development to manufacture cleaner fuels and engines. The equipment has been run on advanced combustion technologies and exhaust after-treatment systems and has continued developing alternative fuels such as natural gas, biogas and hydrogen over the long term. Engine customisation also gets more into focus, developing engines that deliver facilities-specific power requirements and meet operational challenges of different industrial applications, helping optimise performance and efficiency. The other important trend is the integration of digital technologies and connectivity into industrial engines. It means that the industrial engine will be connected to sensors, data analytics, and the Internet of Things for the real-time monitoring of engine performance, predictive maintenance, and remote diagnostics. These smart engine solutions enable better asset management, reduced downtime, and optimised operational efficiency for end-users.Industrial Engines Market Leading Players

The key players profiled in the report are Cummins (United States), Yanmar (Japan), Kohler Power (United States), Kubota (Japan), Isuzu (Japan), DEUTZ (Germany), John Deere (United States), Weichai (China), FTP Industrial (Italy), Caterpillar (United States), Yuchai (Singapore)Growth Accelerators

The Industrial Engines Market would thrive primarily from the continuous growth of several end-user industries such as construction, agriculture, mining, and power generation. Factors like rapid industrialisation and urbanisation in developing economies would require continuous increased deployment of heavy machines and assured power sources, thus driving the need for robust industrial engines. Further, a substantial investment is experienced in infrastructure development projects like transportation networks, buildings, and utilities, which will equate to the greater demand for industrial engines powering that needed equipment and machinery. Alongside this, interested fuel economies that are reducing operational costs, along with digitisation technologies for better monitoring and maintenance of industrial engines, also add to the factors promoting growth.Industrial Engines Market Segmentation analysis

The Global Industrial Engines is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Diesel Engines, Gasoline Engines . The Application segment categorizes the market based on its usage such as Oil & Gas, Power Generation, Mining Industry, Agriculture, Construction, Rail & Transportation. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the industrial engines market comprises both global manufacturers and regional players sharing the cake across various industrial applications. These global players are characterised by an extensive product portfolio, strong R&D capabilities for meeting stringent emission standards, and a widely dispersed distribution network. The basis for competition includes engine performance, fuel efficiency, durability, after-sales service, and, increasingly, the ability to offer engines compatible with alternative fuels or integrated with digital monitoring systems. Additionally, the growing economies and infrastructure development projects provide ample opportunities and, at the same time, challenges for both global and local players in the industrial engines market.Challenges In Industrial Engines Market

The industrial engines market is beset with problems. Topping the list are tough environmental regulations, along with high costs of adopting advanced technologies. Governments in various countries are enforcing stricter emission norms, such as the U.S. EPA Tier 4 and EU Stage V regulations, which require significantly reduced emissions from conventional diesel and gasoline engines. Thus, R&D costs have to be heavily invested in to comply with regulations, raising the general cost of production and influencing the market for older engine models. This affects smaller manufacturers and SMEs mainly, as they tend to struggle between pricing and environmental compliance. Yet the hefty price tag of these advanced industrial engines featuring modern technologies, such as IoT-based monitoring systems and AI for predictive maintenance, acts as a deterrent to entering the market. For SMEs, replacing or retrofitting existing equipment to fit with these engines is a major financial burden. Besides this, fluctuating fossil fuel costs and global reforms toward cleaner energy alternatives further complicate the market landscape. These factors will, as a result, stifle market growth, providing an enabling environment for innovation in hybrid and electric engine technology.Risks & Prospects in Industrial Engines Market

Main opportunities include the increasing implementation of renewable energy applications, the shift to electric-powered industrial equipment, and high demand from emerging economies like India and China. Advancements in technology with hybrid engines, IoT-enabled monitoring systems, and AI-driven predictive maintenance are changing the landscape toward efficiency and sustainability. Regionally, Asia-Pacific has become the leader in the engine market, underpinned by rapid urbanisation and industrial proliferation, while technological innovation and advanced research have brought North America into prominence as the fastest-growing region. Emerging economies are investing substantially in energy infrastructure and agricultural mechanisation, thereby augmenting the demand for heavy-duty engines. However, challenges such as the adherence to stringent emission regulations and high initial costs may act as barriers to growth. Notwithstanding these challenges, the opportunities for applications such as power generation, marine, and mining keep the market actively upbeat.Key Target Audience

, The chief market target for industrial engines includes industries such as manufacturing, construction, agriculture, marine transportation, and mining. These industries require high-performance engines for machinery and vehicles so that productivity and operational efficiency can be optimised. In these industries, the manufacturers and end-users prefer engines with the following characteristics: fuel efficiency, durability, low emissions, and reliability to suit their various operational needs. Added to this, government and infrastructure developers also make for a significant audience, as large-scale projects are under their aegis, thus ensuring compliance with environmental regulations., Another very important section comprises consumers looking for advanced technologies in industrial engines, such as IoT-enabled predictive maintenance systems and hybrid or electric engine solutions. This audience values eco-friendly design, low noise level, and ease of operation, highlighting the movement toward sustainability. Emerging economies with rapid industrialisation and urbanisation also form key markets, where enterprises demand engines capable of supporting automation and mechanisation in production processes.Merger and acquisition

Recent activities in the industrial engines market have witnessed significant mergers and acquisitions, symptomizing the large strategic turn towards consolidation and technological enhancement. In December 2023, DEUTZ AG entered into the agreement to acquire sales and service operations for selected off-highway engines from Rolls-Royce Power Systems, including mtu Classic series engines and engine series 1000-1500. The acquisition is expected to yield an additional €300 million in annual revenue and is in line with the DEUTZ Dual+ strategy aimed at improving its position among larger independent drive manufacturers. In India, by June 2024, Mahindra & Mahindra completed the merger of Mahindra Heavy Engines Limited, Mahindra Two-Wheelers Limited, and Trringo.com Limited into its central operations. The operational logic of this consolidation is to bring down corporate structure, regulatory compliance, and operational costs, thereby enhancing Mahindra's presence in the industrial engine sector. >Analyst Comment

The industrial engine market is likely to register opportunities for a considerable boost owing to emerging demands from one sector or another, including construction, agriculture, manufacturing, and power generation. In 2024, the market is estimated at USD 125.1 billion, which is expected to skyrocket to USD 135 billion towards the end of the forecast period in 2030. Several factors are being catered for growth in the market, like advances in the engine, which include better fuel economy and reduced emissions, and growing industrialisation as well as needs for energy worldwide. While diesel engines occupy the market due to strong construction and thermal efficiency, gas engines gain recognition owing to their environmental benevolence. Emerging advancements such as IoT-based engines and AI-based predictive maintenance give a competitive edge for improved operational reliability and efficiency.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Industrial Engines- Snapshot

- 2.2 Industrial Engines- Segment Snapshot

- 2.3 Industrial Engines- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Industrial Engines Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Diesel Engines

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Gasoline Engines

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Industrial Engines Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Agriculture

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Construction

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Power Generation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Mining Industry

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Oil & Gas

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Rail & Transportation

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Caterpillar (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Cummins (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 DEUTZ (Germany)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 FTP Industrial (Italy)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Isuzu (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 John Deere (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Kohler Power (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Kubota (Japan)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Weichai (China)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Yanmar (Japan)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Yuchai (Singapore)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Industrial Engines in 2030?

+

-

Which type of Industrial Engines is widely popular?

+

-

What is the growth rate of Industrial Engines Market?

+

-

What are the latest trends influencing the Industrial Engines Market?

+

-

Who are the key players in the Industrial Engines Market?

+

-

How is the Industrial Engines } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Industrial Engines Market Study?

+

-

What geographic breakdown is available in Global Industrial Engines Market Study?

+

-

Which region holds the second position by market share in the Industrial Engines market?

+

-

How are the key players in the Industrial Engines market targeting growth in the future?

+

-