Global Ice Cream Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-780 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Ice Cream Report Highlights

| Report Metrics | Details |

|---|---|

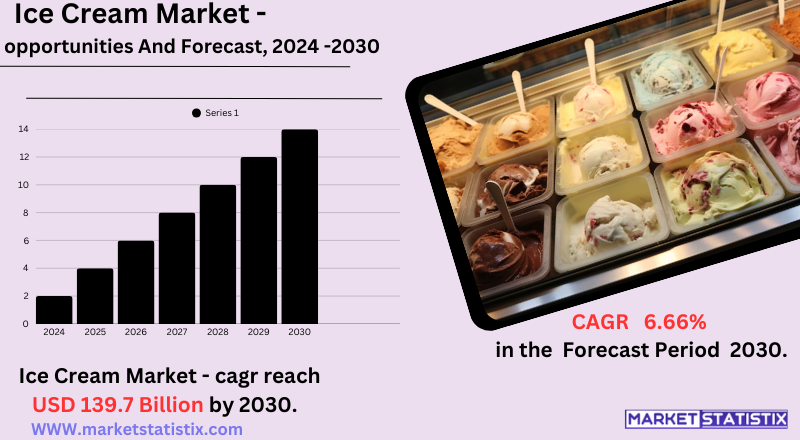

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 6.66% |

| Forecast Value (2030) | USD 139.7 Billion |

| By Product Type | Dairy & Water-based, Vegan |

| Key Market Players |

|

| By Region |

|

Ice Cream Market Trends

The ice cream market has some major trends caused by the change in customer needs and technological advancement. The first trend is the increasing demand for healthier and more nutritious choices, including plant-based low-sugar ice creams, low-fat ice cream, and dairy-free varieties. The need for indulgent desserts that also fit into their health objectives has been responsible for driving functional premium ice cream varieties with added health benefits like prebiotics and organic components. Furthermore, there has been an increase in the number of new and exotic flavours in addition to customisability options. Ice cream makers are trying out new tastes that bring together various ethnic food products from around the world while at the same time offering personalised options for each individual customers taste preferences. Also, online delivery as well as subscription services have changed the way one accesses ice cream, hence making it easier and more straightforward than ever before.Ice Cream Market Leading Players

The key players profiled in the report are General Mills, Inc., Nestlé SA, Cold Stone Creamery, Blue Bell Creameries, Unilever PLC, Inspire Brands, Inc. (Baskin Robbins), American Dairy Queen Corporation, Wells Enterprises, Danone S.A., NadaMooGrowth Accelerators

Several factors characterise the ice cream market; hence, food comforts and indulgence experienced and strong consumer demand are the forces behind its growth as well as increased incomes. Generally, it serves several age groups as it can be taken in different formats, such as cone, cup, and bar forms, among others. In addition, new flavours and textures apart from low-fat or even non-dairy kinds have emerged to satisfy dieting habits and consumer preferences. Moreover, expansion of distribution networks like supermarkets, convenience stores, and e-commerce is another significant driver since it increases access and ease for customers. Besides, seasonal promotions, marketing campaigns, and the current trend towards premium and artisanal ice creams are some other factors contributing to this industry's growth.Ice Cream Market Segmentation analysis

The Global Ice Cream is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Dairy & Water-based, Vegan . The Application segment categorizes the market based on its usage such as Foodservice, Retail. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the ice cream market is characterised by a variety of players, such as multinational corporations, regional brands, and artisanal producers. The market is dominated by major global companies like Unilever, Nestlé, and General Mills, who have wide product portfolios, extensive distribution networks, and strong brand recognition. These large players usually jostle for consumer attention through factors like product innovation, flavour variety, and marketing strategies; hence, they invest heavily in research and development for new flavours or low-calorie options such as ice cream that is low in fat or does not contain any dairy. In contrast, smaller niche brands as well as artisanal producers focus on uniqueness, premium, or local offerings that cater to specific consumer preferences and trends. This segment of the market is driven by demand for high-quality ingredients, unique flavours, personalised experiences, etc. Nevertheless, despite being overshadowed by major players, the market remains competitive, with continuing innovation as well as changes in taste among consumers determining how all actors behave.Challenges In Ice Cream Market

The ice cream market has to deal with several challenges, some of which include fluctuating prices of raw materials and disrupted supply chains. Factors like agricultural conditions and market dynamics make it possible for milk, cream, or even sugar that are part of the main ingredients to experience price volatility affecting production cost and profit margins. Moreover, disrupting the supply chain can result in late deliveries of ingredients or finished products, hence incurring excess operational costs. Another major issue facing ice cream companies is rising demand for healthier alternatives, forcing them to shift their focus to low-fat, low-sugar, or dairy-free ice creams. Thus, manufacturers need to keep up with such changes as far as quality and taste are concerned. However, despite these problems faced by this particular sector, it still flourished through continuous innovation in product creation, including changes made to customer preferences from time to time.Risks & Prospects in Ice Cream Market

The ice cream market is full of growth prospects as a result of changing consumer preferences and emerging trends. An important opportunity is for the premium or artisanal kind, which has distinctive flavours, top-notch ingredients, and traditional methods of making it. This has been necessitated by customers’ propensity to pay more for indulgent gourmet experiences. In addition, another segment that is experiencing increased demand includes healthier alternatives such as low-sugar, dairy-free, or organic. This will involve health-focused consumers or those under diet restrictions. Furthermore, there lies another opportunity in more expanded distributional channels and geographical reach across different countries. These online grocery stores or direct-to-consumer deliveries provide right platform where ice-cream brands have ability to expand their target audience thus becoming popular. Also, entering into emerging markets with better standards of living could potentially lead to growth due to changing desired lifestyle patterns. Companies can therefore utilise these alternatives to tap into new market segments while taking care of diverse client needs; this will cause general growth within the entire ice cream industry.Key Target Audience

The Ice Cream Market’s key target audience encompasses a wide demographic range encompassing different finds of preferences and ages. One major group is families with children due to the fact that ice cream remains an important treat for kids as well as a classic choice during family gatherings. Besides, millennials and young adults are also greatly interested in this product because they are interested in gourmet options, a variety of flavours, and high-end products. This audience often seeks innovative and unique ice cream experiences, such as plant-based or gourmet varieties.,, Another important segment includes those who are very concerned with their health looking for lower-fat, lower-sugar, or non-dairy substitutes. The market also targets individuals seeking convenience, like those who buy instant gratification before moving on to another errand line up again. Consequently, the Ice Cream Market serves numerous clients, ranging from traditional family buyers to wandering foodies and health-conscious people, through product varieties that meet their broad spectrum of tastes and preferences.Merger and acquisition

The ice cream industry has been consolidating lately, as seen through recent mergers and acquisitions that are aimed at expanding their product lines, moving to new regions, or even giving them a competitive advantage over others. For instance, huge multinational companies have been acquiring small innovative ice cream brands in order to broaden their range of products and capture the taste of consumers on the rise. For example, strategic acquisitions by major players such as Unilever and Nestlé have included famous artisanal and premium ice cream names into their portfolios so that they can strengthen market position and reach out to more people at once. Factors driving these MAs include the increase in demand for more exotic flavours of ice cream; a health-conscious approach to indulgent treats; and taking advantage of already existing channels within distribution networks. While acquisitions provide avenues for growth and expansion of market share, they also pose challenges such as merging with new brands, aligning business strategies across different lines, and maintaining operational efficiency. >Analyst Comment

The global ice cream market is expected to witness steady growth. The valuation is projected between USD 102.38 billion and USD 125.62 billion by 2033, markedly up from its valuation of about USD 78.57 billion in 2024. This growth is driven by increasing levels of disposable income, shifting consumer preference toward premium, artisanal, and health-friendly products, along with growing preferences for dairy-free, low-sugar, and plant-based options. Regional consumption patterns, however, differ. While the developed markets of Europe and North America show strong demand for quality and innovative flavours, the emerging markets of the Asia-Pacific countries like India and China are growing rapidly owing to their enormous consumer bases and rapidly growing middle class.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Ice Cream- Snapshot

- 2.2 Ice Cream- Segment Snapshot

- 2.3 Ice Cream- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Ice Cream Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dairy & Water-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Vegan

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Ice Cream Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Foodservice

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Retail

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Ice Cream Market by Flavor

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Chocolate

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Vanilla

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Fruit

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Ice Cream Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Unilever PLC

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 American Dairy Queen Corporation

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Wells Enterprises

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Nestlé SA

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Blue Bell Creameries

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 General Mills

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Inc.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Inspire Brands

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Inc. (Baskin Robbins)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Cold Stone Creamery

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Danone S.A.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 NadaMoo

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Flavor |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Ice Cream in 2030?

+

-

Which type of Ice Cream is widely popular?

+

-

What is the growth rate of Ice Cream Market?

+

-

What are the latest trends influencing the Ice Cream Market?

+

-

Who are the key players in the Ice Cream Market?

+

-

How is the Ice Cream } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Ice Cream Market Study?

+

-

What geographic breakdown is available in Global Ice Cream Market Study?

+

-

Which region holds the second position by market share in the Ice Cream market?

+

-

How are the key players in the Ice Cream market targeting growth in the future?

+

-