Global Hydrogen Gas Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-705 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Hydrogen Gas Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

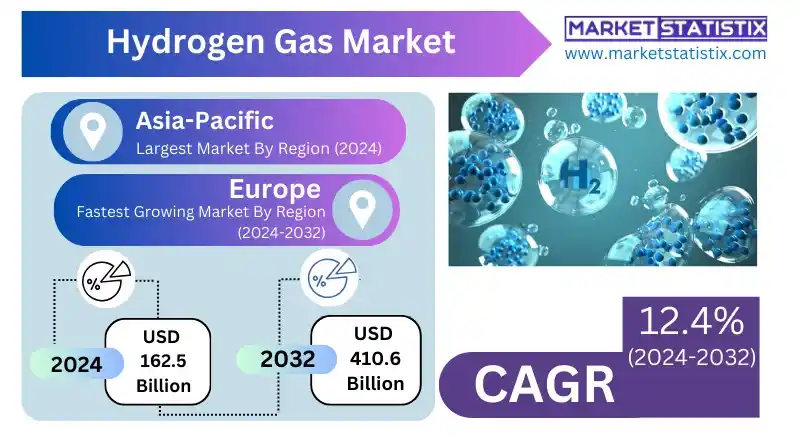

| Growth Rate | CAGR of 12.4% |

| Forecast Value (2032) | USD 410.6 Billion |

| By Product Type | Green Hydrogen, Blue Hydrogen, Grey Hydrogen, Turquoise Hydrogen |

| Key Market Players |

|

| By Region |

|

Hydrogen Gas Market Trends

Decarbonising economies and moving away from fossil fuels are the most important driving factors of hydrogen gas markets. Hydrogen is increasingly considered a clean and versatile energy carrier, clean in the sense that “green hydrogen” is produced from renewable sources, and heavy investments into production plants and infrastructures to support this are booming. Demand for sustainable solutions in development sectors such as transport, industry, and power generation are further fuelling hydrogen-based technologies and applications. Current research and development programmes take on such topics as scaling up electrolysis, developing better storage solutions, and building transportation infrastructures for resilience. The emergence of partnerships and collaborations among industry stakeholders, governments, and research institutions is yet another catalyst for innovations and accelerates the commercialisation of hydrogen technologies.Hydrogen Gas Market Leading Players

The key players profiled in the report are Siemens Energy AG, Air Products and Chemicals Inc., ITM Power plc, Iwatani Corporation, Yingde Gases Group Company Limited, Taiyo Nippon Sanso Corporation, FuelCell Energy Inc., Hydrogenics Corporation, Messer Group GmbH, Air Liquide, Plug Power Inc., Hexagon Composites ASA, Ballard Power Systems Inc., Showa Denko K.K., Cummins Inc., Linde plc, Hyzon Motors Inc., McPhy Energy S.A., Nel ASA, Praxair Inc.Growth Accelerators

The main drivers of markets for hydrogen gas are the increasing global focus on decarbonising economies and the urgent need to move away from fossil fuels. Increasingly, hydrogen is recognised as a versatile and clean energy carrier, especially in the case of “green hydrogen” produced with renewable sources, which is driving heavy investments in production facilities and infrastructure. Demand for sustainable solutions in development sectors such as transport, industry, and power generation are also pushing hydrogen-based technologies and applications. Current research and development programmes take on such agendas as scaling up electrolysis, developing better storage solutions, and building resilient transportation infrastructures. The growing interest in the long-duration energy storage capability of hydrogen, which can smooth the intermittency of renewable energies, is also a key driver of the market growth. Finally, strategic partnerships and collaborations among industry players, governments, and research institutions encourage innovation and hasten commercialisation in hydrogen technologies.Hydrogen Gas Market Segmentation analysis

The Global Hydrogen Gas is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Green Hydrogen, Blue Hydrogen, Grey Hydrogen, Turquoise Hydrogen . The Application segment categorizes the market based on its usage such as Industrial, Power Generation, Transportation, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scene in the hydrogen gas market is fast changing and is influenced by a mix of entrenched industrial gas giants and the newer players in renewable energy. While green hydrogen production and distribution, with their present-day infrastructure and gas handling expertise, are traditional players' focus, the startups and niche technology companies are innovating electrolysis, fuel cell technology, and hydrogen storage solutions. The competition is tightening across each segment of the value chain – from production and transportation to end-use applications. Some regional dynamics are predominant in Europe and Asia-Pacific on the grounds of policy support and backing from infrastructure. The market is currently under a scramble to establish dominant positions in critical segments, with firms focusing on cost advantages, technological differentiation, and securing long-term supply contracts. Success in this rapidly growing and competitive market will be determined by the ability to scale up production and to develop efficient distribution networks.Challenges In Hydrogen Gas Market

The hydrogen market is contending with various challenges that obstruct its sweeping adoption and scaling-up. Most prominently among these barriers is the high cost of green hydrogen production through renewable energy sources such as solar and wind. These energy sources are costlier for hydrogen production than fossil fuel-based grey hydrogen, thus undermining green hydrogen's commercial viability. Further, a poorly developed infrastructure for hydrogen storage, transportation, and refuelling adds to the threat since it curtails efficient hydrogen distribution and end use in a cross-regional or cross-industrial manner. Another alarming challenge is energy loss in the hydrogen chain, from production through to end-use application. This inefficiency reduces the overall effectiveness of the system while increasing the cost of operation. In addition, the presence of alternative low-emission fuels puts extra competitive pressure on hydrogen adoption. Together, these considerations suggest that technological advancements, cost reductions, and active government intervention are necessary to overcome barriers explaining hydrogen gas's market potential.Risks & Prospects in Hydrogen Gas Market

Key opportunities include the expansion of green hydrogen production via renewable power this is becoming more attractive with plummeting costs for renewable electricity and improvements in electrolyser technology. The multiple applications of hydrogen as an energy carrier give rise to opportunities in transportation, industrial production, and energy storage. Rapidly emerging applications include fuel cell vehicles, replacement of coal for steel production, and long-term storage of renewable energy. Further boosting market development are initiatives by governments such as the EU's commitment to 40 GW of electrolyser capacities by 2030 and investments by the USA under the Inflation Reduction Act. Although North America remains the leader with strong policy impetus and investments in hydrogen infrastructure, including hydrogen hubs and refuelling stations, Europe is another major player with its ambitious hydrogen roadmaps focusing on domestic production and international supply chains. Countries in the Asia-Pacific region, like Japan, South Korea, and China, are promoting hydrogen technologies and mainstreaming them into their energy strategies. These regions enjoy the benefit of supportive policies as well as rising demand for clean fuels across mobility and industrial applications.Key Target Audience

Hydrogen gas finds its key end-user market in adverse industrial sectors ranging from oil refining, chemical manufacturing, and steel, where it is extensively used for processes such as hydrocracking, ammonia synthesis, and metal treatment. These industries have been engaged in the long-term and high-volume consumption of hydrogen because they use its chemical properties along with its energy potential for various processes. As clean industrial process requirements are gaining traction, these sectors are seen to be gearing up for the transition from grey to green hydrogen.,, Another emerging target audience will be energy providers, transport, and government agencies that will contribute to decarbonisation. Hydrogen is increasingly seen as a clean fuel alternative to heavy-duty vehicles, public transport systems, and energy storage facilities, provided the hydrogen derives from renewables. They are also playing critical roles in scaling the hydrogen economy, such as policymakers, infrastructure developers, and investors driving the development of hydrogen ecosystems of fuelling stations, pipelines, and storage facilities.Merger and acquisition

Recently, mergers and acquisitions in the hydrogen gas domain became a reflection of a growing trend towards strategic consolidation as well as expansion. Among noteworthy acquisitions is the $359 million acquisition by Bondalti of Ercros, implying large investments within the oil and gas sector into hydrogen-related assets. Furthermore, Samsung E&A's equity acquisition in the Norwegian company Nel ASA emphasises efforts toward improving hydrogen business capabilities, specifically in the electrolyser technology area. Such acquisitions represent an ever-increasing focus on hydrogen as a vital element of energy transition, with companies trying to consolidate their positions in an evolving hydrogen economy. The hydrogen market has witnessed impressive activity relative to M&A, with aggregate transaction values for the market in 2022 amounting to $24.4 billion, an increase of 288% over 2021. It shows that this surge expresses the developing potential of said markets and its strategic heft in the path to decarbonisation. Players like Air Liquide, Linde, and Air Products are now spearheading the market through strategic alliances and acquisitions toward green hydrogen production and innovative storage solutions. >Analyst Comment

Upscaling the industry with decarbonisation as the operating principle, the hydrogen gas market seems to be in transition. Also, as per market studies, the hydrogen market shows great potential for growth, chiefly owing to the increasing recognition of hydrogen as a clean energy carrier valid for multilateral applications. A major trend indicates that "green hydrogen" is produced on the basis of renewable resources, and investment will be seen in electrolysis--both technologies and infrastructure. This paradigm shift, however, is bolstered by emerging policies and government incentives seeking to promote a hydrogen economy.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Hydrogen Gas- Snapshot

- 2.2 Hydrogen Gas- Segment Snapshot

- 2.3 Hydrogen Gas- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Hydrogen Gas Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Grey Hydrogen

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Blue Hydrogen

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Green Hydrogen

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Turquoise Hydrogen

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Hydrogen Gas Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Transportation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Power Generation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Hydrogen Gas Market by Production Method

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Steam Methane Reforming

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Electrolysis

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Coal Gasification

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Hydrogen Gas Market by Distribution Method

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Pipeline

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 High-Pressure Tube Trailers

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Others

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Hydrogen Gas Market by End-User

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Chemical

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Oil Refining

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Metal Processing

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Others

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

9: Hydrogen Gas Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Nel ASA

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Yingde Gases Group Company Limited

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Ballard Power Systems Inc.

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Hyzon Motors Inc.

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Iwatani Corporation

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 McPhy Energy S.A.

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Siemens Energy AG

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Air Products and Chemicals Inc.

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Messer Group GmbH

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Linde plc

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Plug Power Inc.

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 ITM Power plc

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 Cummins Inc.

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Showa Denko K.K.

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 Hydrogenics Corporation

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 Air Liquide

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 Taiyo Nippon Sanso Corporation

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

- 11.18 FuelCell Energy Inc.

- 11.18.1 Company Overview

- 11.18.2 Key Executives

- 11.18.3 Company snapshot

- 11.18.4 Active Business Divisions

- 11.18.5 Product portfolio

- 11.18.6 Business performance

- 11.18.7 Major Strategic Initiatives and Developments

- 11.19 Hexagon Composites ASA

- 11.19.1 Company Overview

- 11.19.2 Key Executives

- 11.19.3 Company snapshot

- 11.19.4 Active Business Divisions

- 11.19.5 Product portfolio

- 11.19.6 Business performance

- 11.19.7 Major Strategic Initiatives and Developments

- 11.20 Praxair Inc.

- 11.20.1 Company Overview

- 11.20.2 Key Executives

- 11.20.3 Company snapshot

- 11.20.4 Active Business Divisions

- 11.20.5 Product portfolio

- 11.20.6 Business performance

- 11.20.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Production Method |

|

By Distribution Method |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Hydrogen Gas in 2032?

+

-

How big is the Global Hydrogen Gas market?

+

-

How do regulatory policies impact the Hydrogen Gas Market?

+

-

What major players in Hydrogen Gas Market?

+

-

What applications are categorized in the Hydrogen Gas market study?

+

-

Which product types are examined in the Hydrogen Gas Market Study?

+

-

Which regions are expected to show the fastest growth in the Hydrogen Gas market?

+

-

Which region is the fastest growing in the Hydrogen Gas market?

+

-

What are the major growth drivers in the Hydrogen Gas market?

+

-

Is the study period of the Hydrogen Gas flexible or fixed?

+

-