Global Household Cleaners Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-493 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Household Cleaners Report Highlights

| Report Metrics | Details |

|---|---|

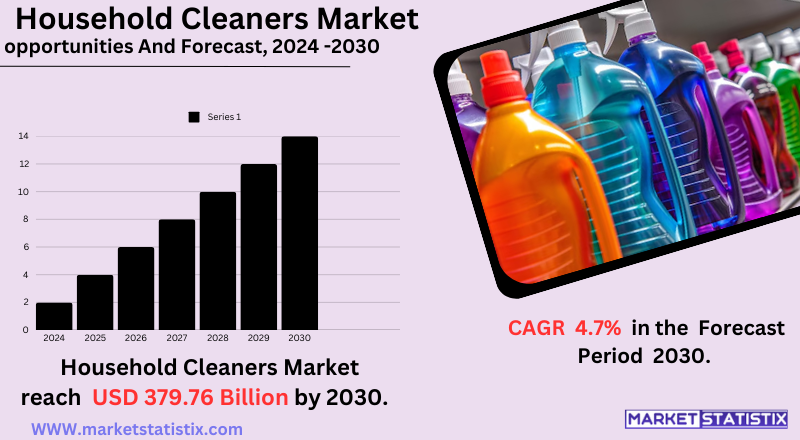

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 4.7% |

| Forecast Value (2030) | USD 379.76 Billion |

| By Product Type | Dishwashing Detergents, Surface Cleaners, Laundry Detergents, Others |

| Key Market Players |

|

| By Region |

Household Cleaners Market Trends

The household cleaners market is going through a very important transformation, and that is becoming greener and more sustainable. The green consumers are choosing products with natural ingredients and biodegradable packaging, which can lower the impact on the environment. This trend stems from increased awareness of the health and environmental hazards of traditional cleaning chemicals. In response, manufacturers are coming up with innovations in the area of plant-based formulations, concentrated products that minimise packaging waste disposal, and refills that reduce plastic consumption. Additionally, another area that observes growth in this market is digital shopping and direct-to-consumer models. E-commerce platforms are further widening the market reach and allowing consumers access to a greater variety of cleaning products, including niche and speciality products. The COVID-19 pandemic prompted a spike in disinfectants and sanitisers' demand, giving a permanent push on hygiene and cleanliness. As a result, advanced technology and the development of disinfection products with superior antimicrobial properties have emerged.Household Cleaners Market Leading Players

The key players profiled in the report are Church & Dwight Co., Inc. (United States), S. C. Johnson & Son Limited (Canada), Henkel AG & Co. KGaA (Germany), The Clorox Company (United States), Procter & Gamble Co. (United States), The Clorox Company of Canada (Canada), SC Johnson & Son, Inc. (United States), Reckitt Benckiser Group plc (United Kingdom), Colgate-Palmolive Company (United States), McBride plc (United Kingdom)Growth Accelerators

The drivers of the household cleaners market is most significant among these; the rising awareness of hygiene following various global health events has also led to higher demand for disinfectants and sanitisers. Low disposable incomes in emerging economies allow consumers greater expenditure on cleaning products, even speciality ones. Increased dual-income households and busy life schedules also increase demand for easy and effortless cleaning methodologies, such as ready-to-use wipes and multipurpose cleaners. Moreover, the market benefits from the great impact of online shopping that cuts across geographical boundaries, so consumers can find any product they want with the click of a button. Another main driver boosting the market is the increasing shift towards sustainable living and green consciousness; this is intended to push manufacturers to develop and market more environmentally friendly cleaning products with natural ingredients and biodegradable packaging.Household Cleaners Market Segmentation analysis

The Global Household Cleaners is segmented by Type, and Region. By Type, the market is divided into Distributed Dishwashing Detergents, Surface Cleaners, Laundry Detergents, Others . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The household cleaner market is highly competitive, with the likes of Procter & Gamble, Unilever, Reckitt Benckiser, Henkel, and Colgate-Palmolive emerging as industry titans. Product innovation, sustainability, and aggressive marketing are the factors driving these companies to increase their respective market share. Competition also arises from lower-priced private-label brands, making consumers more price-sensitive. Major players use mergers, acquisitions, and partnerships to fortify their portfolios and to enhance their global footprint. The emergence of natural and rather eco-friendly household cleaners has also opened up opportunities for smaller and niche brands to compete by satisfying the ever-increasing consumer demand for sustainable products. On the other hand, as a response to regulatory pressures and consumer preference, companies are formulating solutions that are biodegradable and non-toxic. The intensifying popularity of online sales channels has enhanced the level of competition since many more brands can reach their target consumers.Challenges In Household Cleaners Market

DIY and natural alternatives pose serious challenges to the household cleaners market. Consumers are drawn to economical homemade cleaning solutions utilising commonly found products such as vinegar and baking soda since these consumers tend to prefer non-toxic natural products. Such a trend proposes a challenge to conventional manufacturers to innovate and manufacture eco-friendly, chemical-free alternatives that still work. Furthermore, the increased demand for sustainable products has amplified the pressure on the companies to reformulate their products, which is in itself a costly and often lengthy procedure. Another hurdle is the low level of customer loyalty and product differentiation in a highly competitive market. Consumers frequently switch brands looking for innovative products or lower prices, which makes it hard for companies to hold onto their customers. Small and medium manufacturers are particularly challenged in keeping up with rapidly changing consumer tastes and trends. These factors, overall, serve to impede market growth and require continuous change from manufacturers to meet the ever-changing needs of consumers.Risks & Prospects in Household Cleaners Market

Rising consumer awareness about hygiene, health, and sustainable living has created huge opportunities in the household cleaners market. The demand for natural and eco-friendly products presents another key growth opportunity as consumers switch away from chemical-based cleaning products due to health and environmental concerns. Brands that can offer biodegradable, non-toxic, and plant-based formulations would be ideally suited to leverage this expanding area. Another factor broadening accessibility is the growth of e-commerce platforms, enabling brands to reach a broader audience with diverse preferences. On a regional basis, North America stands as a stronghold in the market buoyed by high disposable incomes, strong awareness-hygiene practices, and admiration for premium cleaning products. Rapid urbanisation along with increasing middle-class populations and the adoption of modern cleaning solutions are turning the Asia-Pacific region into a prominent area for growth. Europe is another major region with huge shares being facilitated by strictly enforced regulations promoting sustainable products in the region. Emerging markets in Latin America and Africa offer infinite growth potential, with improving economic conditions driving increasing demand for household cleaners.Key Target Audience

The household cleaner's target audience is very much heterogeneous. It includes different homeowners and renters who always want their homes clean and hygienic. Families with children generally need effective cleaning products for spills and messes. Professionals need efficient products with regard to saving time. Older people and people with specific health conditions also contribute a large share to the market, as they may require products that can provide safe cleaning and ensure sanitisation in their living environments.,, The target audience is, however, extended to people who may have specific cleaning requirements, such as pet owners who require odour control, stain removers, or products for use with allergies or sensitivities who may want to avoid hypochlorite, fragrance, and other allergens; and those who want convenience through single-use wipes, pre-measured liquids, and their mechanical devices made for cleaning activity. Effective marketing strategies will target these customer segments according to lifestyle, demographics, and specific cleaning priorities, with well-tailored offerings and messaging.Merger and acquisition

The household cleaners market has witnessed considerable merger and acquisition (M&A) activity recently, which is a manifestation of firms' strategic endeavours to optimise portfolios and hone down to core market segments. In February 2025, Reckitt Benckiser identified private equity firms Lone Star Funds, Advent, and Apollo Global as potential buyers for its homecare brands, including Air Wick and Cillit Bang, estimated to be worth around £4 to £5 billion. This move is consistent with Reckitt's strategy of disposing of non-core assets to focus on areas of higher growth. Previously, in April 2021, Spectrum Brands Holdings acquired For Life Products LLC, a U.S.-based manufacturer of household cleaning and maintenance products, for an estimated $300 million. The acquisition was intended to expand Spectrum's product offerings and strengthen its position in the household cleaners market. This clearly demonstrates a scenario in which companies in the household cleaning industry seem to be engaging in M&A activities to streamline businesses, focus operations, and expand their footprint. >Analyst Comment

Rising consumer awareness about hygiene and sanitation, raised by recent global health concerns, keeps the household cleaners market highly growing. Some contributing factors include increasing demand for effective and convenient cleaning solutions coupled with urbanisation and dual-income households. The market is also witnessing a significant shift to more eco-friendly and sustainable cleaning products due to consumers' growing preference toward natural and organic formulations. This generates pressure on the manufacturers to invent and develop products with a smaller footprint, including biodegradable packaging and plant-based ingredients.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Household Cleaners- Snapshot

- 2.2 Household Cleaners- Segment Snapshot

- 2.3 Household Cleaners- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Household Cleaners Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Surface Cleaners

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Dishwashing Detergents

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Laundry Detergents

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Procter & Gamble Co. (United States)

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 The Clorox Company (United States)

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Reckitt Benckiser Group plc (United Kingdom)

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Colgate-Palmolive Company (United States)

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 SC Johnson & Son

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Inc. (United States)

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Henkel AG & Co. KGaA (Germany)

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 S. C. Johnson & Son Limited (Canada)

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Church & Dwight Co.

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Inc. (United States)

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 The Clorox Company of Canada (Canada)

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 McBride plc (United Kingdom)

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Household Cleaners in 2030?

+

-

How big is the Global Household Cleaners market?

+

-

How do regulatory policies impact the Household Cleaners Market?

+

-

What major players in Household Cleaners Market?

+

-

What applications are categorized in the Household Cleaners market study?

+

-

Which product types are examined in the Household Cleaners Market Study?

+

-

Which regions are expected to show the fastest growth in the Household Cleaners market?

+

-

What are the major growth drivers in the Household Cleaners market?

+

-

Is the study period of the Household Cleaners flexible or fixed?

+

-

How do economic factors influence the Household Cleaners market?

+

-