Global Herbal Medicine Market – Industry Trends and Forecast to 2030

Report ID: MS-928 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The herbal medicine market refers to the worldwide industry involved in the manufacture, sale, and use of plant- or plant-extract-based natural health products for medicinal use. These medicines, commonly referred to as botanical medicines or phytotherapy, are put to different health uses such as prevention of diseases, control of long-term conditions, and overall health. This market is quite heavily reliant on those traditional healing systems like Ayurveda, Traditional Chinese Medicine (TCM), and local knowledge and provides a vast variety of products in the form of teas, capsules, tinctures, extracts, and topical products.

The growth of the market is fuelled by rising consumer demand for natural and organic health remedies, heightened awareness of the probable side effects of man-made medications, and enhanced emphasis on preventative care. It comprises a wide array of products categorised into segments such as herbal supplements, herbal cosmetics, herbal drinks, and herbal medicines.

Herbal Medicine Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

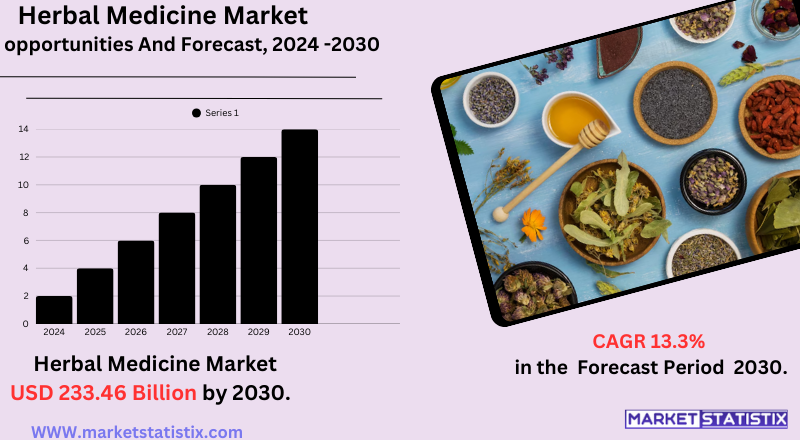

| Growth Rate | CAGR of 13.3% |

| Forecast Value (2030) | USD 233.46 Billion |

| Key Market Players |

|

| By Region |

|

Herbal Medicine Market Trends

The herbal medicine market is growing strongly on the back of a few major trends. One key driver is the rising consumer demand for natural and organic health solutions, which is being driven by growing awareness of the possible side effects of man-made drugs and more emphasis on preventive healthcare. This development is contributing to an increased use of conventional healing methods such as Ayurveda and Traditional Chinese Medicine (TCM) all over the world, usually backed by government encouragement of alternative medicine.

The other major trend is the diversification of herbal medicine products outside the conventional forms. This incorporates the expansion into functional foods, herbal teas, and personal care and beauty products incorporating natural products. The industry is also witnessing growing innovation in product development, including more focus on scientific proof and clinical testing to justify the efficacy and safety of herbal drugs. Moreover, the proliferation of e-commerce and broader distribution channels is making the herbal products much more accessible to a wider array of consumers, pushing them mainstream and into daily wellness regimens.

Herbal Medicine Market Leading Players

The key players profiled in the report are KindCare Medical Center, Pascoe Natural Medicine, AYUSH Ayurvedic Pte Ltd., The Center for Natural and Integrative Medicine, Sheng Chang Pharmaceutical Company, Herb Pharm, Herbal Hills, International Chinese Body Care Houses, LKK Health Products Group Limited, Ming Chen Clinic, Nordic Nutraceuticals (now a part of Oy Verman Ab), Bionorica SE, SinomedicaGrowth Accelerators

The herbal medicine industry is growing at a healthy rate, led by a major change in consumer attitudes towards holistic and natural health care options. One of the driving factors is an enhanced health awareness among consumers across the globe, who are looking for preventive health care and organic treatments of diseases, primarily out of fear of the side effects of chemical drugs. This trend is further reinforced by the increased incidence of lifestyle and chronic diseases, leading consumers to seek safer, chemical-free treatment options and incorporate herbal products into their day-to-day wellness regimen for overall well-being and immunity enhancement.

Furthermore, firm government backing and rising popularity of traditional medicine systems across the world are driving market growth immensely. There is a strong cultural heritage in countries, especially from Asia, such as India and China, of utilising herbal medicine, and their governments are actively promoting and mainstreaming these systems into healthcare through regulatory endorsement, research funding, and public health programmes.

Herbal Medicine Market Segmentation analysis

The Global Herbal Medicine is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Food & Beverages, Pharmaceutical & Nutraceutical, Personal Care & Beauty Products. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the market for herbal medicines are varied and consist of a combination of legacy herbal businesses, established pharma businesses expanding into natural products, and rising numbers of wellness brands. The major players, such as Dabur India Ltd., Himalaya Wellness Company, Blackmores Limited, and Patanjali Ayurved Limited, are dominant, particularly in markets with rich traditional medicine cultures such as Asia. These firms capitalise on their brand name, large product ranges (such as supplements, personal care, and functional foods), and widespread distribution channels to sustain their market shares.

Drivers for competition are increased consumer demand for natural solutions, increased preventive healthcare focus, and greater awareness of the side effects of man-made drugs. This has generated increased research and development activity into proving the effectiveness and safety of herbal remedies, extraction methodologies, and product formulations. Strategic partnerships, mergers, and acquisitions are prevalent as companies look to widen their geographical presence, gain proprietary herbal knowledge, and diversify their product line to address the shifting consumer demand for natural and holistic wellness solutions.

Challenges In Herbal Medicine Market

The market for herbal medicine is confronted with a number of major challenges that negatively impact its growth and integration into mainstream medicine. Foremost among these are the absence of standardised manufacturing processes that create variations in potency, purity, and quality control among products. Regulatory barriers also stand out, given that herbal remedies are regulated differently and sometimes strictly across the globe and thus go through long and complex approval processes that can slow down new product launches and limit market entry for new medicines. Further, the market has too little scientific substantiation, with most herbal products having inadequate research to support claims of efficacy and safety, which generates scepticism among consumers as well as healthcare providers.

Supply chain volatility adds further complexity to the market, as herbal ingredients tend to be region-dependent and prone to changes in supply and price. This is added to by competition from traditional pharmaceuticals, which control healthcare markets and find it difficult for herbal products to command widespread confidence and usage. In most developing areas, poor regulatory environments, poor labelling, and lack of monitoring further jeopardise product safety and efficacy. Together, these issues highlight the importance of more robust regulation harmonisation, investment in science and research, and enhanced quality assurance to establish consumer trust and enable stable market development.

Risks & Prospects in Herbal Medicine Market

Major opportunities are the inclusion of herbal drugs within the pharmaceutical sector, the development of new forms of products (e.g., tablets and capsules), and the growth of e-commerce, whereby herbal drugs become more affordable to a wider population. Moreover, expanding demand for well-being, beauty, and nutraceuticals, along with more government support for traditional medicine systems, is driving market growth.

Geographically, Europe dominates the herbal medicine market with around 44–45% of global market shares due to high consumer education, robust regulatory infrastructure, and the incorporation of herbal medicines within national healthcare schemes—especially in nations such as Germany, France, and the UK. The Asia-Pacific region trails closely, driven by the increased use of conventional medicine systems like Ayurveda and Traditional Chinese Medicine, particularly in China and India, where government programs and cultural acceptance are prevalent. Growth is also occurring in North America, with growing interest in natural health products and preventive care. Its growth is also backed by advances in technology, the development of e-commerce, and increasing worry about the side effects of man-made drugs, though there are still issues surrounding regulation and standardisation.

Key Target Audience

,The herbal medicine industry serves a wide variety of target markets, which have unique needs and preferences. The principal consumers are health-savvy individuals from different age segments, but especially Millennials and Gen Z, who prefer organic and natural products as part of their well-being regimes. Older people, particularly Baby Boomers, also represent a large demographic group and look for herbal solutions to treat chronic diseases and undertake preventive healthcare practices. In addition, individuals with certain health issues, including chronic illnesses, will use herbal medicines more frequently, usually as complementary therapies in addition to standard therapies.

,,,

The market also includes health practitioners, such as practitioners of traditional systems of medicine like Ayurveda and Traditional Chinese Medicine (TCM), who incorporate herbal products into their treatment regimens. In addition, pharmaceutical corporations and nutraceutical companies are vital stakeholders, engaging in research and development to establish standardised herbal formulations and diversify their product lines. Offline and online retailers are major vehicles in the distribution of herbal products and reach the consumers by different channels like e-commerce websites, special health food stores, and spas.

Merger and acquisition

The market for herbal medicines has seen major mergers and acquisitions (M&A) over the past few years, indicative of its increasing visibility within the worldwide health and wellness industry. Mitsui & Co., Ltd., a Japanese conglomerate, acquired Singaporean Eu Yan Sang International Ltd., which operates in traditional Chinese medicine, in April 2024 for $584.6 million. The strategic acquisition aims to enhance Mitsui's hold in the Asian market and realise the growing demand for herbal remedies.

One such significant deal happened in 2024 when Affinity Equity Partners parted with its 17.1% stake in Indonesia's top herbal medicine maker, Sido Muncul, to the Hidayat family for $227.5 million. The transaction, involving a 105% markup of the original investment, highlights the returns generated by strategy-driven management and diversification into new distribution channels and product lines. Sido Muncul's growth in revenues and higher export activities, especially in Southeast Asia and Nigeria, reflect the international popularity and marketability of herbal medicine.

>

Analyst Comment

The international market for herbal medicine is growing firmly and consistently, and its value is expected to grow from around USD 214–251 billion in 2025 to between USD 356 billion and more than USD 580 billion in 2032–2034. The growth is propelled by growing consumer demand for nature-based and plant-based medicines, a rising consciousness of the side effects of chemical drugs, and an overall movement towards preventive health care and wellness worldwide. Ayurveda and Traditional Chinese Medicine are the practices widely being accepted, backed by state efforts and increasing integration with conventional healthcare mechanisms.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Herbal Medicine- Snapshot

- 2.2 Herbal Medicine- Segment Snapshot

- 2.3 Herbal Medicine- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Herbal Medicine Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pharmaceutical & Nutraceutical

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Food & Beverages

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Personal Care & Beauty Products

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Herbal Medicine Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Sheng Chang Pharmaceutical Company

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Nordic Nutraceuticals (now a part of Oy Verman Ab)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 AYUSH Ayurvedic Pte Ltd.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Herbal Hills

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Herb Pharm

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 LKK Health Products Group Limited

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 International Chinese Body Care Houses

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 KindCare Medical Center

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Pascoe Natural Medicine

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Bionorica SE

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Ming Chen Clinic

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 The Center for Natural and Integrative Medicine

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Sinomedica

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Herbal Medicine in 2030?

+

-

What is the growth rate of Herbal Medicine Market?

+

-

What are the latest trends influencing the Herbal Medicine Market?

+

-

Who are the key players in the Herbal Medicine Market?

+

-

How is the Herbal Medicine } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Herbal Medicine Market Study?

+

-

What geographic breakdown is available in Global Herbal Medicine Market Study?

+

-

Which region holds the second position by market share in the Herbal Medicine market?

+

-

How are the key players in the Herbal Medicine market targeting growth in the future?

+

-

The herbal medicine industry is growing at a healthy rate, led by a major change in consumer attitudes towards holistic and natural health care options. One of the driving factors is an enhanced health awareness among consumers across the globe, who are looking for preventive health care and organic treatments of diseases, primarily out of fear of the side effects of chemical drugs. This trend is further reinforced by the increased incidence of lifestyle and chronic diseases, leading consumers to seek safer, chemical-free treatment options and incorporate herbal products into their day-to-day wellness regimen for overall well-being and immunity enhancement.

,,,

Furthermore, firm government backing and rising popularity of traditional medicine systems across the world are driving market growth immensely. There is a strong cultural heritage in countries, especially from Asia, such as India and China, of utilising herbal medicine, and their governments are actively promoting and mainstreaming these systems into healthcare through regulatory endorsement, research funding, and public health programmes.

,,

What are the opportunities for new entrants in the Herbal Medicine market?

+

-