Global Healthy Meal Delivery Services Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-779 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Healthy Meal Delivery Services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

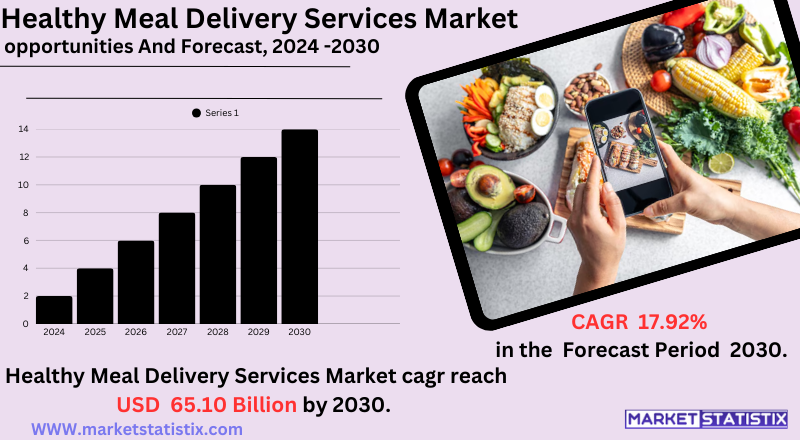

| Growth Rate | CAGR of 17.92% |

| Forecast Value (2030) | USD 65.10 Billion |

| By Product Type | Meal Plans, Meal Variety |

| Key Market Players |

|

| By Region |

|

Healthy Meal Delivery Services Market Trends

Several noteworthy trends are presently affecting the service market for the delivery of healthy meals. The busy lifestyle factor has significantly altered the perception of convenience, leading consumers to seek healthful meals ready for consumption or easy to prepare at the doorstep. The convenience appeal works well for urban dwellers and dual-income households where shopping and cooking time is a premium. Another crucial trend is the ever-growing emphasis on being personalised and dietary-customised. Meal plans targeting particular health goals are more in demand nowadays. Restrictions include gluten-free, vegan, and keto, among others. As a result, meal delivery services are offering expanding options, including AI-based personalised meal recommendations along with flexibility in subscription models, enabling users to modify their plans, skip weeks, or choose their meal selections.Healthy Meal Delivery Services Market Leading Players

The key players profiled in the report are RealEats, BistroMD, Eat Clean Bro, Urban Remedy, Fresh N' Lean, Snap Kitchen, Sun Basket, Freshly, Territory Foods, Veestro, Pete's Paleo, HelloFresh, Provenance MealsGrowth Accelerators

The healthy meal delivery services market is witnessing growth, driven chiefly by increased consumer focus on health and wellness, with the rising demand for convenience due to busy lifestyles. Customers are becoming increasingly conscious of what they eat and are actively searching for ways to eat healthily with the least possible trouble of meal planning and preparation. Practically, such services are an avenue for individuals who are weight-watching, have special dietary needs (for example, gluten intolerance or vegan), or want to enjoy a more wholesome diet. A wide consumer base thus finds appeal in the ability to personalise meal plans, furnish nutritional information, and deliver meals at the doorstep. By the same token, the COVID-19 pandemic accelerated the trend toward healthy meal delivery services, compelling many to stay home in search of safe and convenient food options and thus further securing the place of healthy meal delivery services in modern gastronomy.Healthy Meal Delivery Services Market Segmentation analysis

The Global Healthy Meal Delivery Services is segmented by Type, and Region. By Type, the market is divided into Distributed Meal Plans, Meal Variety . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The healthy meal delivery services market is highly dynamic and heterogeneous and consists of both well-established larger players and many small, niche-focused businesses. Major players include companies such as HelloFresh, Blue Apron (which provides fresh prepared meals), Home Chef, and Freshly (Nestlé owned), which have managed to build considerable scale through national distribution and well-known brands. They compete on several levels, including price, variety of meal options, convenience, and brand loyalty, usually employing subscription-type models for guaranteed revenue. There are also strong competitors in the form of increasing very tiny, regional or speciality services. Some differentiate themselves from the rest by being vegan, keto, paleo, or gluten-free; offering organic or locally sourced goods; and focusing on particular health goals, such as weight management or fitness. Niche players often corroborate strong communities around and offer far greater personalisation.Challenges In Healthy Meal Delivery Services Market

Despite its enormous growth, the healthy meal delivery services market is affected by a number of major challenges. First and foremost, come the costs, which, when compared to traditional meal options, are considered a challenge by many consumers, who are price-sensitive and perceive this service as premium. On the other hand, the preservation of freshness and nutrition during transit of healthy meals poses a logistical challenge, and the possible perception of quality may affect customer trust and satisfaction. There are other market challenges with intense competition and saturation, on account of which businesses have to continuously innovate and differentiate their offerings to remain relevant in the eyes of the customers. Proper supply chain management is critical for timely and fresh delivery, thereby putting a strain on resources, especially in cases of smaller companies. Besides, changing consumer preferences require continuous investments in knowledge and product development concerning personalised and diverse meal plans that would cater to specific dietary needs.Risks & Prospects in Healthy Meal Delivery Services Market

Consumers are gravitating toward convenient, healthy, and customized meal solutions, thus enticing providers to go far and wide in offering vegan, vegetarian, gluten-free, and keto-friendly plans. Geographically, North America leads the market, with the United States and Canada showing strong adoption owing to high disposable income and awareness about health. Europe is another important market, with strong demands in the UK, Germany, and France, where health trends as well as convenience are main drivers. The Asia-Pacific region is expected to witness fast growth, with India and China experiencing high levels of demand fostered by urbanisation, a rising middle-class population, and increasing digital penetration. In contrast, Latin America and the Middle East emerge as developing markets whose growth is spurred by urban centers and increasing consumer awareness of nutrition and wellness.Key Target Audience

, The primary target consumer for healthy meal delivery services is a complex amalgam of people whose needs will transmit the overall focus on health and convenience due to varied lifestyle factors. Many busy professionals and working couples constitute a large chunk of this target audience who often do not have the time to prepare, shop, or cook for healthy home-style meals. Typically, this audience is away from making regular decisions about their meal subscriptions. They are usually tech-savvy millennials and Gen X'ers with mid-to-high disposable income, living in urban or suburban areas and familiar with online ordering and delivery applications., Beyond being pure convenience, another core segment is health-orientated consumers with precise dietary needs or wellness aims. This would include people with dietary restrictions such as gluten-free, vegan, paleo, or keto; those wishing to lose weight or gain muscle; or those coping with health issues such as diabetes. This audience requires high-quality, fresh ingredients, transparent and clear nutritional information, and meals that can meet their tailored requirements.Merger and acquisition

Meal delivery services for healthy nutrition have definitely been active in merger and acquisition (M&A) activities over time because such companies have inclined more towards sweet consumer preferences and market conditions. Just Eat Takeaway's U.S. subsidiary, Grubhub, was sold off to Wonder Group for a price of $650 million, stitches and stitches from its before acquisition for $7.3 billion back in 2020. This divestiture also illustrates the difficulties that Just Eat is currently facing in the U.S. market, such as stiff competition and regulatory hurdles, all thus pointing to the refocus of Just Eat's core operations in Europe. Earlier in 2020, Nestlé had also bought the healthy prepared meal delivery service, Freshly, for as much as $1.5 billion, thereby enhancing its position in the direct-to-consumer food segment. However, freshly stopped functioning in early 2023, proving just how volatile and competitive the meal delivery industry really is. In another case, in December 2021, Sunbasket merged with Prüvit Ventures, a keto supplement maker, to create PSB Holdings, which would offer more products and reach out to healthy meal solutions. This clearly shows how the industry strategic realignment is shifting towards consolidation and diversification to match changing consumer demand. >Analyst Comment

The healthy meal delivery services market is rapidly evolving and expected to reach a world value of US$ 8.92 billion in 2024 and US$ 20.58 billion by 2033. The expansion is primarily due to more consumers demanding accessible, nourishing meals for a wide variety of dietary choices like vegan, gluten-free, keto, and low-carb diets. The growth of this market is further fuelled by factors such as increasing health awareness, busy lifestyles, and preference towards organic and locally sourced ingredients, coupled with an increasing prevalence of lifestyle-related diseases, thereby encouraging healthy eating habits.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Healthy Meal Delivery Services- Snapshot

- 2.2 Healthy Meal Delivery Services- Segment Snapshot

- 2.3 Healthy Meal Delivery Services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Healthy Meal Delivery Services Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Meal Plans

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Meal Variety

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Healthy Meal Delivery Services Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Fresh N' Lean

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Sun Basket

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 HelloFresh

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Eat Clean Bro

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 RealEats

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 BistroMD

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Territory Foods

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Freshly

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Snap Kitchen

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Pete's Paleo

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Urban Remedy

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Veestro

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Provenance Meals

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Healthy Meal Delivery Services in 2030?

+

-

How big is the Global Healthy Meal Delivery Services market?

+

-

How do regulatory policies impact the Healthy Meal Delivery Services Market?

+

-

What major players in Healthy Meal Delivery Services Market?

+

-

What applications are categorized in the Healthy Meal Delivery Services market study?

+

-

Which product types are examined in the Healthy Meal Delivery Services Market Study?

+

-

Which regions are expected to show the fastest growth in the Healthy Meal Delivery Services market?

+

-

What are the major growth drivers in the Healthy Meal Delivery Services market?

+

-

Is the study period of the Healthy Meal Delivery Services flexible or fixed?

+

-

How do economic factors influence the Healthy Meal Delivery Services market?

+

-