Global Healthcare Supply Chain Managements Market – Industry Trends and Forecast to 2030

Report ID: MS-927 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Healthcare Supply Chain Management (SCM) Market refers to the systems, software, hardware, and services that enable the strategic coordination and integration of processes connected to the procurement, storage, distribution, and consumption of goods and services in the healthcare environment. This complex system engages a myriad of players, ranging from producers of pharmaceuticals, medical equipment, and other equipment to distributors, group purchasing organizations (GPOs), healthcare providers (hospitals, clinics, pharmacies), and finally patients. The ultimate goal is to have the right products at the right moment, in the right amount, and at an optimal price, all with the highest quality and patient safety standards.

Solutions for this market typically consist of demand forecasting applications, stock optimisation software, transportation and logistics management software, and analytics solutions to deliver real-time visibility and data-driven insights. A well-functioning healthcare supply chain is the foundation of operational effectiveness, financial sustainability, and ongoing delivery of high-quality patient care.

Healthcare Supply Chain Managements Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

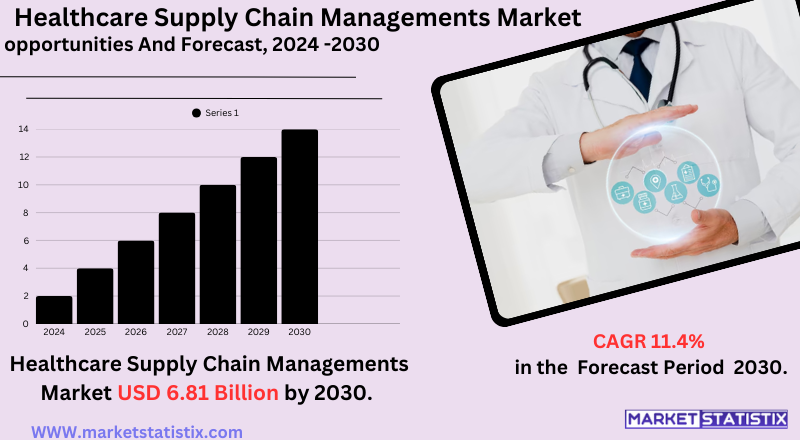

| Growth Rate | CAGR of 11.4% |

| Forecast Value (2030) | USD 6.81 Billion |

| Key Market Players |

|

| By Region |

|

Healthcare Supply Chain Managements Market Trends

The healthcare supply chain management market is being influenced by a number of major trends, the most important among which is the growing emphasis on supply chain resilience and visibility. The COVID-19 pandemic brought vulnerabilities to the forefront, so healthcare organizations are now looking for solutions with real-time tracking of goods, good demand forecasting, and diversified supply networks to help insulate them from future disruption. Technologies such as the Internet of Things (IoT) and RFID are key to this, enabling minute-level data on stock levels and product movement, while advanced analytics and AI are being used to anticipate likely shortages and drive optimum stock levels, moving from reactive to proactive management.

There is also increasing focus on sustainability and environmental responsibility. With healthcare being a major producer of carbon emissions and waste globally, there is strong pressure on "green" supply chain practices. This encompasses sustainable sourcing, minimisation of single-use plastics through innovative packaging and reworking, and logistics optimisation for reduced emissions (e.g., electric transport, route optimisation). Healthcare professionals increasingly favour vendors with confirmed environmental disclosures and investing in energy-efficient facilities and equipment, a wider measure of a commitment to minimising the ecological impact of the industry while ensuring cost-effectiveness and safety for patients.

Healthcare Supply Chain Managements Market Leading Players

The key players profiled in the report are Cardinal Health (U.S.), Ochsner Health (U.S.), Global Healthcare Exchange, LLC. (U.S.), Tecsys Inc. (Canada), Oracle (U.S.), Banner Health (U.S.), McKesson CORPORATION (U.S.), Henry Schein, Inc. (U.S.), Ascension (U.S.), Epicor Software Corporation (U.S.)Growth Accelerators

The Healthcare Supply Chain Management (SCM) Market is considerably influenced by the growing pressure on the healthcare providers to increase operational effectiveness and contain costs. With increasing healthcare spending across the world, there's a growing need to enhance efficiency, reduce waste, and enhance profitability. This encompasses improved inventory management, minimising stockouts and overstock, and optimising procurement.

Also, advancements in technology are serving as a key driver for the market growth. The growth in the use of digital technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and blockchain is transforming healthcare SCM. They facilitate real-time monitoring and predictive analysis to forecast demand, greater transparency, and better traceability of products, which are essential to ensure patient safety and fight against counterfeiting of drugs. The growth of cloud-based solutions also streamlines deployment, lowers infrastructure expenses, and enables improved data sharing and collaboration throughout the complex health care environment.

Healthcare Supply Chain Managements Market Segmentation analysis

The Global Healthcare Supply Chain Managements is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Healthcare Providers, Healthcare Manufacturers, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape in the Healthcare Supply Chain Management (SCM) market has a huge diversity of big-company software providers, specialised healthcare IT companies, and logistics organizations present. Major global players such as Oracle, SAP SE, IBM, and Infor offer all-encompassing SCM software suites that provide end-to-end visibility and control over the healthcare supply chain while being integrated with broader enterprise resource planning (ERP) systems. These big organizations really play the client card well, using heavy-duty research-and-development capabilities coupled with big plus global outreach to give their clients high-end solutions for procurement, inventory management, warehousing, and logistics, often sprinkled with very fancy analytics, AI, and cloud deployment.

Then there are core healthcare companies such as McKesson, Cardinal Health, and Global Healthcare Exchange (GHX) that have an in-depth knowledge of the industry and strong relationships with healthcare providers and manufacturers, making the competition even tougher by means of strategic partnerships, mergers, and acquisitions, as the companies attempt to augment their service portfolios and embed fresh technologies such as RFID and blockchain for improved traceability, enhanced data security, and compliance. With an increase in emphasis on reducing costs, improving operational efficiency, and strengthening the supply chain, resilience further ignites innovation and competition in a developing industry, especially following global disruptions.

Challenges In Healthcare Supply Chain Managements Market

Various unyielding and developing challenges hamper the efficiency and resilience of current healthcare supply chain management. Some of these weathering issues include ongoing supply disruption scenarios due to global phenomena such as pandemics, geopolitical crises, natural disasters, and tariff fluctuations, thus often resulting in heavy delays, stockouts, and higher costs for essential medical supplies. Another major roadblock during the course of regulatory compliance involves negotiating shifting standards, rigid documentation requirements, and cybersecurity mandates that increase the operational burden and pose financial risks to the organizations.

On a practical note, currently characterised by fractured data systems with no integration between ERP and EHR platforms while procurement and inventory management remain largely manual, it is crippled. This results in a lack of real-time data visibility, diminished forecasting accuracy, and constrains collaborative efforts across the supply chain ecosystem. The modernisation effort is further stymied by talent shortage and rapid changes in technology requiring advanced technical knowledge, particularly for cloud-based automated solutions. Another challenge in modernisation ensues from consolidations through mergers and acquisitions, for integrated or disentangled supply chain systems need attention for further innovation and digitalisation;

Risks & Prospects in Healthcare Supply Chain Managements Market

Market opportunities are being created by the fast pace of adoption of digital technologies like automation, AI, blockchain, and IoT-backed tracking, which are boosting real-time visibility, predictive analytics, and operational effectiveness in procurement, inventory, and distribution processes. Furthermore, the pharmaceutical and biotechnology segments will also experience the quickest growth due to rising demand for innovative drugs, vaccines, and advanced therapies that necessitate strong, adaptable supply chain systems.

Region-wise, North America dominates the market, followed by the presence of strong healthcare infrastructure, early usage of supply chain management technologies, and prominent solution providers. Europe is witnessing high growth because of rising regulatory needs, usage of RFID and barcode traceability, and AI-based solution funding by governments. The Asia-Pacific area is set for the highest CAGR, driven by fast development in healthcare IT, government spending, and the adoption of cutting-edge technologies like AI and blockchain, especially in China and India. These regional trends, coupled with increasing globalisation and the imperative of having cost-efficient, transparent, and sustainable supply chains, are opening up sizeable opportunities for technology vendors and healthcare organizations globally.

Key Target Audience

,GPOs also coordinate purchasing volumes for healthcare providers to achieve improved pricing and terms from suppliers. These organizations are key drivers of cost savings as well as streamlining procurement practices across institutions. The growing use of cloud-based SCM solutions is revolutionising the landscape with scalability, real-time data analytics, and improved collaboration between stakeholders. This digital revolution is strongly felt in markets such as North America and Asia-Pacific, where the healthcare infrastructure is changing swiftly to cater to the needs of a growing, ageing population.

,,, ,

Healthcare supply chain management (SCM) market caters to a wide array of stakeholders, who have specific needs and imperatives. Hospitals, clinics, and other healthcare facilities are some of the key end-users who are looking for effective systems to streamline procurement, inventory, and distribution of medical supplies. These organizations need to save costs, avoid wastage, and maintain timely delivery of critical products to improve patient care. Pharmaceutical and medical device manufacturers are also responsible, dependent on strong SCM solutions that can automate production processes, ensure regulatory compliance, and keep up with increasing demands for their products.

,

Merger and acquisition

The mergers and acquisitions activities seen in the healthcare supply chain management (SCM) sector in 2024 have been huge, driven by the need for better logistics offerings and technological integration. While UPS announced plans to acquire Canada's Andlauer Healthcare Group for $1.6 billion to ramp up its healthcare logistics operations and cold chain capabilities, Temasek and Warburg Pincus, on the other hand, are seeking to sell a supplier healthcare supply chain management company, GHX, aiming for close to a $5 billion valuation.

Such strategic developments weigh the consolidation of resources and the scale of ramping up to meet the increasing demands from the healthcare industry. An acquired area of focus is the enhancement of logistics networks and implementation of state-of-the-art technologies to ensure efficient and cost-effective healthcare supply chains. With the sector being a moving target, these M&As are surely going to hold the limelight in determining the future of healthcare logistics and supply chain management.

>Analyst Comment

The global healthcare supply chain management industry is evolving strongly, with estimates from around USD 3.43 billion to USD 3.95 billion in 2025 and potential reaching up to USD 5.06 billion to USD 9.53 billion by 2032. The growth is driven by the rising demand for efficiency in operations, cost-cutting, and regulation adherence in healthcare provision and the increased complexity of managing medical supplies, drugs, and equipment. North America is at the forefront of the market today, influenced by top-notch healthcare infrastructure, heavy expenditure, and fast adoption of digital technologies, and Asia-Pacific is poised to witness increased growth as a result of increased healthcare spending and digitisation.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Healthcare Supply Chain Managements- Snapshot

- 2.2 Healthcare Supply Chain Managements- Segment Snapshot

- 2.3 Healthcare Supply Chain Managements- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Healthcare Supply Chain Managements Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Healthcare Providers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Healthcare Manufacturers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Healthcare Supply Chain Managements Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Oracle (U.S.)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Tecsys Inc. (Canada)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Global Healthcare Exchange

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 LLC. (U.S.)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Ascension (U.S.)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Ochsner Health (U.S.)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Banner Health (U.S.)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Henry Schein

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Inc. (U.S.)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 McKesson CORPORATION (U.S.)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Cardinal Health (U.S.)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Epicor Software Corporation (U.S.)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Healthcare Supply Chain Managements in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Healthcare Supply Chain Managements market?

+

-

How big is the Global Healthcare Supply Chain Managements market?

+

-

How do regulatory policies impact the Healthcare Supply Chain Managements Market?

+

-

What major players in Healthcare Supply Chain Managements Market?

+

-

What applications are categorized in the Healthcare Supply Chain Managements market study?

+

-

Which product types are examined in the Healthcare Supply Chain Managements Market Study?

+

-

Which regions are expected to show the fastest growth in the Healthcare Supply Chain Managements market?

+

-

Which application holds the second-highest market share in the Healthcare Supply Chain Managements market?

+

-

What are the major growth drivers in the Healthcare Supply Chain Managements market?

+

-

The Healthcare Supply Chain Management (SCM) Market is considerably influenced by the growing pressure on the healthcare providers to increase operational effectiveness and contain costs. With increasing healthcare spending across the world, there's a growing need to enhance efficiency, reduce waste, and enhance profitability. This encompasses improved inventory management, minimising stockouts and overstock, and optimising procurement.

Also, advancements in technology are serving as a key driver for the market growth. The growth in the use of digital technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and blockchain is transforming healthcare SCM. They facilitate real-time monitoring and predictive analysis to forecast demand, greater transparency, and better traceability of products, which are essential to ensure patient safety and fight against counterfeiting of drugs. The growth of cloud-based solutions also streamlines deployment, lowers infrastructure expenses, and enables improved data sharing and collaboration throughout the complex health care environment.