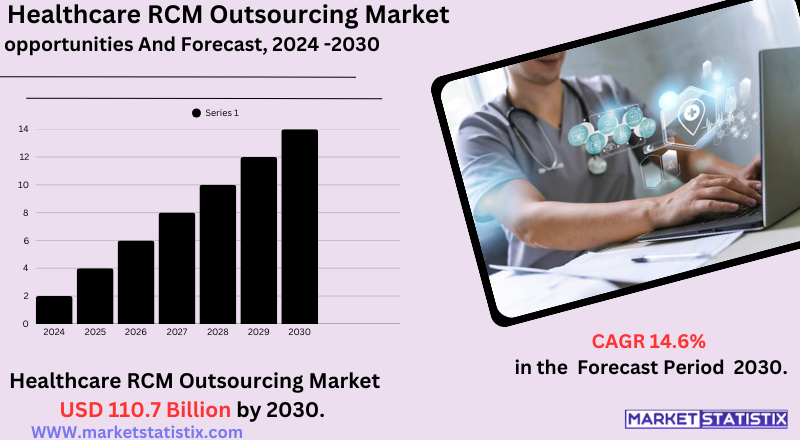

Global Healthcare RCM Outsourcing Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-926 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Healthcare Revenue Cycle Management (RCM) Outsourcing Market is the industry through which healthcare providers, such as clinics, hospitals, and private practices, outsource their administrative and financial processes involved in the patient revenue cycle to third-party specialised service providers. This includes the whole process from a patient's first appointment scheduling and registration to the last payment for services provided. Principal tasks normally outsourced are verification of patient eligibility, submission of insurance claims, medical coding, billing, denial, and follow-up on accounts receivables.

By outsourcing RCM, health organizations hope to increase financial effectiveness, decrease operational expenditure, and increase cash flow by taking advantage of the capabilities and cutting-edge technology of outside vendors. This enables them to maintain their central mission of delivering quality patient care while outsourcing partners handle the billing, coding, and compliance with continually changing healthcare rules.

Healthcare RCM Outsourcing Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 14.6% |

| Forecast Value (2030) | USD 110.7 Billion |

| By Product Type | Patient Access, Patient Encounter, Patient Billing |

| Key Market Players |

|

| By Region |

|

Healthcare RCM Outsourcing Market Trends

One of the biggest trends is the rapid uptake of sophisticated technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA). They are being applied to RCM services to automate routine tasks including eligibility checking, claim processing, and denial management, resulting in greater accuracy, lower error rates, and quicker cash flow for healthcare providers. This technology transition is allowing outsourced RCM providers to deliver more streamlined and advanced solutions.

Another leading trend is the increased movement towards value-based care models, which are drifting from the conventional fee-for-service framework. This shift necessitates RCM processes to respond to emerging reimbursement models that tie payments to quality metrics and patient outcomes. As a result, outsourced RCM companies are increasingly turning towards providing specialised services facilitating such intricate payment models, such as full-scale data analytics and reporting to prove value.

Healthcare RCM Outsourcing Market Leading Players

The key players profiled in the report are parallon,, MedData, Conifer Health Solutions, Optum360, R1 RCM Inc., eCatalyst Healthcare Solutions, Kareo, Cerner Corporation, LLC, Visionary RCM, McKesson Corporation.Growth Accelerators

The healthcare RCM outsourcing industry is most spurred by the growing complexity of healthcare billing and coding procedures. Ongoing changes in regulatory demands, changing modes of reimbursement, and the complexity of multiple insurance plans (such as the shift to new coding systems such as ICD-10) make it challenging for healthcare providers to cope in-house. Outsourcing enables them to tap into specialist skills and technology that can effectively navigate these complexities, guarantee precise claims submission, minimise denial rates, and maximise revenue capture. This is especially important since healthcare margins tend to be narrow, with effective RCM being essential for financial health.

The other key driver is the growing need to drive down operational expenses and administrative tasks facing healthcare organizations. Operational management of an in-house RCM department involves significant funding in personnel, education, technology infrastructure, and compliance updates. Outsourcing enables the providers to transform fixed costs into variable costs, reduce overhead costs, and have access to sophisticated RCM technologies such as AI, machine learning, and robotic process automation (RPA) without having to spend significant amounts upfront. This enables them to maximise operational effectiveness, enhance cash flow, and ultimately allocate more resources to patient care.

Healthcare RCM Outsourcing Market Segmentation analysis

The Global Healthcare RCM Outsourcing is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Patient Access, Patient Encounter, Patient Billing . The Application segment categorizes the market based on its usage such as Hospitals and Clinics, Ambulatory Surgical Centers, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive industry of the healthcare RCM outsourcing market is dominated by a blend of large, established firms and specialist niche providers. Dominant global players such as R1 RCM Inc., Conifer Health Solutions, Optum360 (a subsidiary of Optum, which is owned by UnitedHealth Group), McKesson Corporation, and Change Healthcare (now owned by Optum) possess major market share. Such leaders provide integrated, end-to-end RCM offerings through the use of cutting-edge technologies such as AI and automation to drive greater efficiency, lower denials, and maximise collections for a broad variety of healthcare providers, ranging from large hospital systems to independent physician groups. The competitive advantage usually comes from having deep industry knowledge, extensive technology infrastructure, and stringent compliance infrastructures.

Such a market is also dominated by high levels of competition fuelled by technological advancements and strategic alliances. Smaller, niche RCM outsourcing companies tend to concentrate on specific service segments (e.g., medical coding, denial management) or healthcare verticals, distinguishing themselves through customized solutions and tight client relationships. Major competitive trends include expanding use of AI and machine learning to automate claim processing and predictive analytics, greater focus on data protection and HIPAA compliance, and creation of value-based care models that demand more advanced RCM capabilities.

Challenges In Healthcare RCM Outsourcing Market

The healthcare RCM (Revenue Cycle Management) outsourcing industry is plagued by several critical issues despite its explosive growth and wide usage. Data security and privacy are among the most prominent issues, considering that outsourcing involves sharing sensitive patient data with third-party vendors and thus increases the threat of data breaches and compliance issues. The requirement of ensuring partners comply with strict data protection measures and regulatory requirements like HIPAA is essential but an ongoing challenge for healthcare organizations.

Operationally, the market is also under pressure from increasing payer scrutiny, rising claim denials, and ongoing pressure to accommodate changing regulatory demands. Staffing gaps and the technical complexity of implementing leading-edge technologies such as AI and automation complicate outsourcing plans further, as providers need to weigh the advantages of efficiency and scalability against the risks of vendor lock-in and possible service breakdowns. Keeping the outsourcing partners at arm's length through seamless collaboration, open reporting, and frequent performance monitoring is vital to prevent these risks and guarantee that both short-term bottom-line benefits and long-term strategic goals are met.

Risks & Prospects in Healthcare RCM Outsourcing Market

Embracing cutting-edge technologies, including automation and artificial intelligence, is also increasing the attractiveness of outsourcing by automating administrative work and reducing errors. The increasing focus on optimising revenue cycles, reducing billing errors, and handling rising volumes of patient data is also driving demand for RCM outsourcing services.

Regionally, North America holds the lion's share of the healthcare RCM outsourcing market due to its sophisticated healthcare infrastructure, high healthcare spending, and the intricacy of the U.S. reimbursement system, requiring effective management of compliance and billing. The concentration of large market players and early implementation of digital health technologies further reinforce the leadership of the region. Conversely, the Asia-Pacific region is expected to witness the highest growth, spurred by growing healthcare infrastructures, increasing healthcare spending, and the development of medical tourism centers in India and China. The presence of a large, educated workforce and low-cost outsourcing options, along with government efforts to improve healthcare services, make Asia-Pacific a growth driver for the entire RCM outsourcing market worldwide.

Key Target Audience

The main target customers for the healthcare revenue cycle management (RCM) outsourcing market are hospitals, clinics, and diagnostic labs. Hospitals, especially the large and academic medical centers, are the principal early adopters because of the complexity of their billing arrangements and the need for high-volume processing of claims. Outsourcing RCM functions allows them to simplify operations, lower the administrative load, and improve cash flow so that they can concentrate more on treating patients. Physician back offices and clinics, which usually do not have ample administrative personnel, also stand to gain from outsourcing through enhanced billing accuracy and timely reimbursements.

,,,, ,

Another substantial segment includes small and medium-sized healthcare organizations, ambulatory surgery centers, and newer telehealth services. These institutions do not have the infrastructure within themselves to handle complicated billing and compliance burdens. By outsourcing RCM functions, they have access to specialised knowledge and state-of-the-art technologies like AI and automation to drive efficiency and lower expenses. Also, the increasing focus on value-based care models and compliance with changing healthcare regulations make RCM outsourcing a desirable option for these providers.

,

Merger and acquisition

Healthcare revenue cycle management (RCM) outsourcing has seen considerable merger and acquisition (M&A) activity in recent years, with drivers being technological upgrading and expanding markets. Swedish investment company EQT, for instance, agreed to take a controlling interest in GeBBS Healthcare Solutions (read deal) for more than $850 million, with the acquisition intended to facilitate GeBBS' growth and innovation in RCM services. Further, Bain Capital signed a $2.6 billion agreement to buy HealthEdge, a U.S.-based healthcare software company, from Blackstone, with the goal of leveraging HealthEdge's abilities to extend the use of generative AI in healthcare.

These strategic buys are part of a wider trend of consolidation within the RCM outsourcing industry as firms attempt to upgrade their technological capabilities and offer more services. The integration of cutting-edge technologies like artificial intelligence and machine learning is becoming more critical in automating RCM processes, minimising errors, and making operations more efficient. As the healthcare sector evolves with regulatory reforms and value-based care, the need for end-to-end and technologically enhanced RCM solutions is anticipated to increase, leading to more M&A in this market.

>Analyst Comment

The outsourcing market of healthcare revenue cycle management (RCM) is growing very rapidly, with estimates of global size ranging from about USD 27.5 billion to USD 34.67 billion in 2024 and with an expected growth to between USD 67.35 billion and USD 110.7 billion by 2033. The growth in this industry is fuelled by the rising complexity of healthcare coding and billing, growing healthcare spending, and the demand for cost-effective, streamlined administrative operations. Outsourcing RCM activities such as claims management, coding, billing, and collections allows healthcare providers to decrease operational expenses, enhance financial outcomes, and concentrate on patient care, taking advantage of the knowledge and high-technology capabilities provided by specialised vendors.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Healthcare RCM Outsourcing- Snapshot

- 2.2 Healthcare RCM Outsourcing- Segment Snapshot

- 2.3 Healthcare RCM Outsourcing- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Healthcare RCM Outsourcing Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Patient Access

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Patient Encounter

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Patient Billing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Healthcare RCM Outsourcing Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hospitals and Clinics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Ambulatory Surgical Centers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Healthcare RCM Outsourcing Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 parallon

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Optum360

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Visionary RCM

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Conifer Health Solutions

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 LLC

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 MedData

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Kareo

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 eCatalyst Healthcare Solutions

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Cerner Corporation

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 R1 RCM Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 McKesson Corporation.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Healthcare RCM Outsourcing in 2030?

+

-

Which type of Healthcare RCM Outsourcing is widely popular?

+

-

What is the growth rate of Healthcare RCM Outsourcing Market?

+

-

What are the latest trends influencing the Healthcare RCM Outsourcing Market?

+

-

Who are the key players in the Healthcare RCM Outsourcing Market?

+

-

How is the Healthcare RCM Outsourcing } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Healthcare RCM Outsourcing Market Study?

+

-

What geographic breakdown is available in Global Healthcare RCM Outsourcing Market Study?

+

-

Which region holds the second position by market share in the Healthcare RCM Outsourcing market?

+

-

How are the key players in the Healthcare RCM Outsourcing market targeting growth in the future?

+

-

The healthcare RCM outsourcing industry is most spurred by the growing complexity of healthcare billing and coding procedures. Ongoing changes in regulatory demands, changing modes of reimbursement, and the complexity of multiple insurance plans (such as the shift to new coding systems such as ICD-10) make it challenging for healthcare providers to cope in-house. Outsourcing enables them to tap into specialist skills and technology that can effectively navigate these complexities, guarantee precise claims submission, minimise denial rates, and maximise revenue capture. This is especially important since healthcare margins tend to be narrow, with effective RCM being essential for financial health.

,, ,The other key driver is the growing need to drive down operational expenses and administrative tasks facing healthcare organizations. Operational management of an in-house RCM department involves significant funding in personnel, education, technology infrastructure, and compliance updates. Outsourcing enables the providers to transform fixed costs into variable costs, reduce overhead costs, and have access to sophisticated RCM technologies such as AI, machine learning, and robotic process automation (RPA) without having to spend significant amounts upfront. This enables them to maximise operational effectiveness, enhance cash flow, and ultimately allocate more resources to patient care.

,