Global Healthcare Data Annotation Tools Market – Industry Trends and Forecast to 2030

Report ID: MS-925 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

Healthcare Data Annotation Tools The market includes software programs and services used to classify, tag, and label enormous amounts of medical data so that they become understandable and usable for artificial intelligence (AI) and machine learning (ML) models. The data can vary from medical images (such as X-rays, CT scans, MRIs, and ultrasounds) to clinical notes in the form of text, electronic health records (EHRs), audio recordings of patient-physician consultations, and genomic data. The main function of these tools is to generate high-quality, annotated datasets that are critical for training AI algorithms to execute a host of tasks in healthcare, including proper diagnosis, individualised treatment planning, drug discovery, and even robotic surgery.

The expansion of this market is inextricably interlinked with the rising use of AI and ML in the healthcare industry, which requires a steady flow of carefully annotated data. These tools are essential in overcoming the intrinsic complexity and sensitivity of healthcare data, which may need expert medical knowledge for correct labelling. Some use cases include annotating medical images to identify tumours or anomalies, organising clinical notes for predictive analysis, and labelling genomic data to analyse disease predisposition.

Healthcare Data Annotation Tools Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

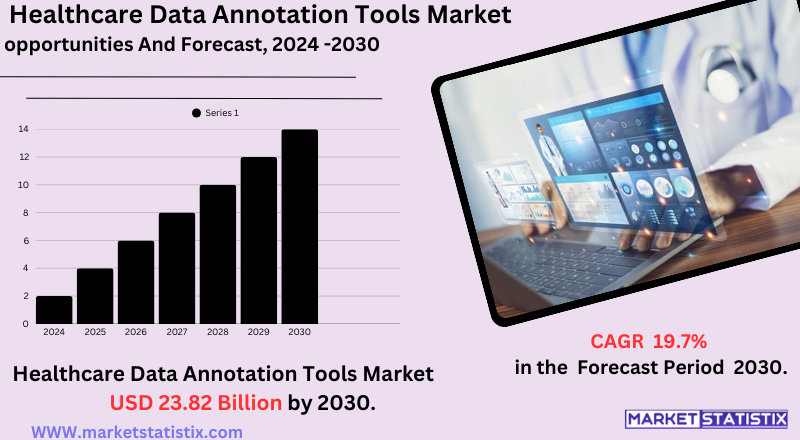

| Growth Rate | CAGR of 19.7% |

| Forecast Value (2030) | USD 23.82 Billion |

| By Product Type | Text, Image/Video |

| Key Market Players |

|

| By Region |

|

Healthcare Data Annotation Tools Market Trends

One of the key trends is growing demand for high-quality, carefully annotated medical data for training advanced AI models to solve complex problems in diagnostic imaging analysis, drug discovery, and custom treatment planning. This calls for more sophisticated annotation tools that can handle a wide variety of data types, such as medical images (X-rays, MRIs), clinical text, audio recordings, and genomic sequences, and tight controls for guaranteeing data quality and consistency.

Another key trend is the move towards embracing automation and semi-supervised methods in annotation processes. Although manual annotation is vital in cases of complex medical data, sheer volumes of data being created render pure manual processes unviable. Hence, solutions that blend human expertise with AI-driven automation are gaining momentum to enhance efficiency, lower costs, and speed up the labelling process.

Healthcare Data Annotation Tools Market Leading Players

The key players profiled in the report are Infosys Limited, Anolytics, iMerit, V7, Capestart, Shaip, Ango AI, Lynxcare, Innodata, SuperAnnotate LLCGrowth Accelerators

The Market Report of Healthcare Data Annotation Tools is mostly fuelled by the growing prevalence of Artificial Intelligence (AI) and Machine Learning (ML) across healthcare applications. As AI-enabled solutions find their way into diagnostics, drug discovery, personalised treatment plans, and robotic surgery, demand for highly labelled and structured medical data to train these sophisticated algorithms in turn grows as well. The exponential increase in the amount of varied healthcare data, such as medical images (CT, MRI, and X-rays), clinical notes, and genomic sequences, makes it imperative to effectively annotate it in order to derive its full potential for AI-based insights.

In addition, the growing emphasis on precision medicine and the necessity for highly accurate diagnostic assistance are strong drivers of the market. Annotation tools for data allow for the accurate identification and tagging of anomalies in radiological images and vital information in patient charts, directly aiding in the accuracy and reliability of AI models in clinical decision-making.

Healthcare Data Annotation Tools Market Segmentation analysis

The Global Healthcare Data Annotation Tools is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Text, Image/Video . The Application segment categorizes the market based on its usage such as Diagnostic Support, Virtual Assistants, Conversational Bots, Drug Development Process. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for healthcare data annotation tools is highly competitive but growing rapidly, comprising a combination of expert annotation service vendors, AI/ML platform providers, and conventional IT services firms. Major players such as Appen, iMerit, Scale AI, and Infosys BPM are all major players, providing a variety of annotation services and platforms specifically tailored to the nuances of medical data, including images (X-rays, MRIs, and CT scans), clinical notes, and genomic sequences. These businesses distinguish themselves based on their experience working with sensitive healthcare information, maintaining compliance with regulations such as HIPAA and GDPR, and providing high-quality, frequently expert-level annotation to ensure the high level of accuracy required for medical AI use.

The industry is also experiencing more strategic partnerships and acquisitions as firms look to bring in advanced technologies such as automated and semi-supervised annotation software to enhance efficiency and scalability. Smaller, more agile startups concentrating in specialised areas such as a particular medical imaging modality or natural language processing for clinical text are starting to appear, frequently becoming targets for acquisition by larger players that wish to broaden their capabilities.

Challenges In Healthcare Data Annotation Tools Market

The market for healthcare data annotation tools is confronted with a few major challenges in spite of its fast development. These are headed by data privacy and compliance issues since healthcare annotation entails the processing of personal patient data governed by stringent regulations such as HIPAA and GDPR. Most firms are reluctant to buy such tools without strong guarantees of compliance, thereby curbing market growth. Second, the significant investment required to build and operate sophisticated annotation infrastructure is a hurdle, particularly for smaller-sized research institutions and hospitals, and may lead to technology disparities.

The other principal problem is the lack of adept professionals with both domain knowledge and technical expertise to accurately annotate medical data. This talent shortage hinders scalability and wider usage of annotation software, especially in areas where there is scanty healthcare IT infrastructure. In addition, the absence of standardisation in varied healthcare data formats, such as electronic health records and medical images, makes integration difficult and more prone to annotation error, which can degrade the integrity of AI models trained on such data.

Risks & Prospects in Healthcare Data Annotation Tools Market

Key growth opportunities are in medical imaging annotation, clinical data management, and genomic data annotation, as these segments are critical for training AI models and enhancing patient care. The market is also being driven by regulatory pressures for enhanced data management, continuing digitalisation in healthcare, and the creation of collaborative and automated annotation platforms.

Geographically, North America dominates the market based on high uptake of AI technologies, well-established healthcare infrastructure, and high investments in medical AI startups, with the U.S. being a leading contributor. Europe is closely behind, driven by data privacy efforts and investment in AI-based healthcare technology in nations like Germany, the U.K., and France. Asia-Pacific is witnessing the highest growth, led by China, Japan, and India, based on growing investments in healthcare IT, favourable government policies, and outsourcing of annotation services. Latin America and the Middle East & Africa are up-and-coming markets with strong interest from Brazil, Argentina, the UAE, and Saudi Arabia in AI-driven healthcare solutions, although infrastructural problems might restrain accelerated adoption in some regions.

Key Target Audience

,The major target customers of the healthcare data annotation tool market include hospitals, diagnostic imaging facilities, and healthcare technology firms. Hospitals, the largest end-user category, use these tools to organise and classify electronic health records (EHRs), label medical images, and aid in clinical research, improving patient care and operational performance. Diagnostic imaging centers rely on annotation tools to label complex image-based information from modalities like CT scans, MRIs, and ultrasounds, facilitating accurate disease detection and diagnosis. Healthcare technology companies integrate these tools into AI-driven applications for diagnostics, treatment planning, and drug development, underscoring the importance of accurate and comprehensive data annotation in advancing healthcare solutions.

,,,

Another important audience is Contract Research Organizations (CROs), pharma companies, and AI technology startups that work on healthcare innovations. CROs and pharma companies are increasingly outsourcing data annotation to specialised partners to lower operational expenses and guarantee expert annotations on various formats of data, which is critical for drug discovery and clinical trials. AI startups and tech companies require high-quality annotated datasets to train machine learning models for various applications, including virtual assistants, diagnostic support, and robotic surgery.

Merger and acquisition

The market for healthcare data annotation tools has witnessed considerable merger and acquisition (M&A) activity, spearheaded by the expansion in demand for AI-based diagnosis and personalised treatment. In 2023, there were more than 150 strategic M&A deals in the space of AI and data annotation, worth around USD 20 billion altogether. These partnerships are focused on combining strength and enhancing the quality of tagged datasets, with the healthcare sector spearheading the M&A deals.

Leading firms such as Datavant have been aggressively seeking acquisitions to increase their data exchange capacities. In September 2024, Datavant bought the data privacy firm Trace Data and two data analysis tools from healthcare AI firm Apixio. Likewise, Commure has acquired several companies, including care coordination platform Memora Health and medical scribing firm Augmedix, to reinforce its foothold in the healthcare data annotation sector.

>Analyst Comment

The market for healthcare data annotation tools is expanding at a breakneck pace, with its overall value expected to jump from about USD 212.8 million in 2024 to more than USD 1.4 billion by 2032. This expansion is largely fuelled by the growing use of artificial intelligence (AI) and machine learning (ML) in healthcare, which need huge amounts of correctly tagged data to support applications like medical imaging, diagnostics, drug development, and predictive analytics. The growth of telehealth, healthcare digitalisation, and innovations in medical imaging technologies are also key drivers of market momentum.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Healthcare Data Annotation Tools- Snapshot

- 2.2 Healthcare Data Annotation Tools- Segment Snapshot

- 2.3 Healthcare Data Annotation Tools- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Healthcare Data Annotation Tools Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Text

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Image/Video

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Healthcare Data Annotation Tools Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Virtual Assistants

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Conversational Bots

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Diagnostic Support

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Drug Development Process

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Healthcare Data Annotation Tools Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Infosys Limited

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Shaip

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Innodata

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ango AI

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Capestart

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Lynxcare

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 iMerit

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Anolytics

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 V7

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SuperAnnotate LLC

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Healthcare Data Annotation Tools in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Healthcare Data Annotation Tools market?

+

-

How big is the Global Healthcare Data Annotation Tools market?

+

-

How do regulatory policies impact the Healthcare Data Annotation Tools Market?

+

-

What major players in Healthcare Data Annotation Tools Market?

+

-

What applications are categorized in the Healthcare Data Annotation Tools market study?

+

-

Which product types are examined in the Healthcare Data Annotation Tools Market Study?

+

-

Which regions are expected to show the fastest growth in the Healthcare Data Annotation Tools market?

+

-

Which application holds the second-highest market share in the Healthcare Data Annotation Tools market?

+

-

What are the major growth drivers in the Healthcare Data Annotation Tools market?

+

-

The Market Report of Healthcare Data Annotation Tools is mostly fuelled by the growing prevalence of Artificial Intelligence (AI) and Machine Learning (ML) across healthcare applications. As AI-enabled solutions find their way into diagnostics, drug discovery, personalised treatment plans, and robotic surgery, demand for highly labelled and structured medical data to train these sophisticated algorithms in turn grows as well. The exponential increase in the amount of varied healthcare data, such as medical images (CT, MRI, and X-rays), clinical notes, and genomic sequences, makes it imperative to effectively annotate it in order to derive its full potential for AI-based insights.

In addition, the growing emphasis on precision medicine and the necessity for highly accurate diagnostic assistance are strong drivers of the market. Annotation tools for data allow for the accurate identification and tagging of anomalies in radiological images and vital information in patient charts, directly aiding in the accuracy and reliability of AI models in clinical decision-making.