Global Health Insurance Market – Industry Trends and Forecast to 2031

Report ID: MS-232 | Business finance | Last updated: Dec, 2024 | Formats*:

Health Insurance Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

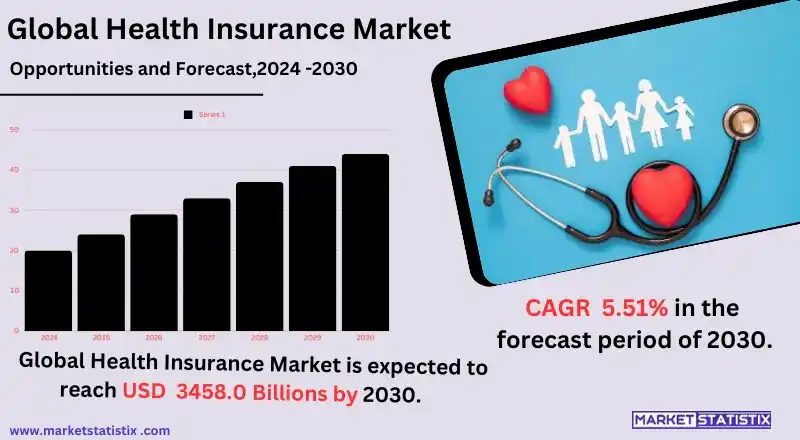

| Growth Rate | CAGR of 5.51% |

| Forecast Value (2031) | USD 3458.0 Billion |

| By Product Type | Life-Time Coverage, Term Insurance |

| Key Market Players |

|

| By Region |

Health Insurance Market Trends

Robust growth is being witnessed in the health insurance market, which has burgeoned because of heightened awareness related to healthcare benefits, increased medical expenses, and government programs to enhance health coverage. The integration of AI and telemedicine with other technologies is redefining the industry in a more personalised and efficient manner. People are moving toward digital modes, part of which includes the fact that people buy policies online for their convenience and visibility. Many insurers currently work with big data analytics to design their policies, improve information processing for claims, and boost customer experience. Another concept in micro-insurance plans and subscription-based models to afford and expand accessibility is emerging. Rapid growth is seen in the emerging markets as disposable income rises and government support is given, which is a prime focus for many international insurers.Health Insurance Market Leading Players

The key players profiled in the report are Aetna Inc. (United States), AIA Group Limited (China), Allianz SE (Germany), American International Group, Inc. (United States), Chubb (United States), Axa S.A. (France),, Berkshire Hathaway Inc. (United States), Bupa Global (United Kingdom),, The Cigna Group (United States), Generali Global Assistance (Unites States), Nationwide (United States), IMG (United States), Prudential plc (United Kingdom).Growth Accelerators

There are many important market drivers in the health insurance sector. The increasing awareness regarding the importance of health coverage due to soaring healthcare costs is one major driver. Moreover, it has been very important for individuals as well as employees to have access to affordable healthcare options for dealing with the increasing prevalence of chronic diseases and lifestyle-related disorders that have resulted in making access to affordable healthcare inevitable. There is also emerging demand owing to government initiatives and mandates promoting health insurance coverage, such as subsidies or tax benefits. The economic growth due to urbanisation also tends to correlate with disposable income, which further allows most individuals to avail themselves of health insurance. The COVID-19 pandemic has also accelerated the trend toward health insurance adoption since it has brought out the shortcomings surrounding the lack of healthcare insurance. Further diversification by way of custom plans that cater to specific needs, like family plans, critical illness policies, and senior citizen coverage, also adds to the traditional base of consumers. Hence, all of them would substantially create an excellent trajectory for growth in the health insurance market across the globe.Health Insurance Market Segmentation analysis

The Global Health Insurance is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Life-Time Coverage, Term Insurance . The Application segment categorizes the market based on its usage such as Architecture Parts, Musical Instruments, Industrial Parts, Transportation Parts, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The health insurance markets around the world are very competitive. Healthcare costs keep increasing, and many chronic diseases are exploding in prevalence. In addition, there are regulatory policies that are pushing for coverage expansion. The key players in the market include UnitedHealth Group, Anthem, Cigna, Aetna, and Humana, all of whom create better plans, make the digital experience customer-centric, and personalise healthcare solutions through technology. Smaller, sometimes called regional insurers, tend to concentrate on a small niche or demographic to gain a competitive advantage. The new entrants to the competition, like Amazon, are those trying to cement themselves within the healthcare space. With their entry, traditional insurers were pressed to innovate in a hurry.Challenges In Health Insurance Market

The challenges that this market is facing mainly relate to high health care costs and complex regulations. Soaring medical inflation adds more cost to medical services, which makes room for insurers to mop up and provide affordable premiums with profit margins. Apart from these, the difference in health insurance regulatory changes and compliance requirements across regions gives another operational and legal responsibility. Then again, such uncertainty makes the ability to create adaptable, viable, and customer-friendly products practically difficult. Another is the ignorance and misconception that consumers have regarding the benefits of health insurance, which often leads to underinsurance or a complete brush-off of the purchase of policies. Digitalising processes and adapting to cyber threats are among the top disruptions; not to mention, they've thrust in additional pressure for innovations while putting security on data. In addition, an incomplete pool of health data, especially in developing markets, becomes a risk assessment and credit-management complication for market growth because it restricts making business decisions.Risks & Prospects in Health Insurance Market

The global health crisis is critical, especially chronic diseases and pandemics. This implies the need for a comprehensive insurance policy whereby the government, along with private players, has to increase their coverage. New, emerging markets with a rising middle class and increasing disposable incomes represent the untapped markets for insurance. Compulsory health insurance and subsidies help create a better ecosystem for the insurance industry. The demand for specialised insurance products such as critical illness insurance and wellness-orientated plans enables companies to access niche markets but remain profitable. These and many other factors shall hold the health insurance market in the progressive phase indefinitely.Key Target Audience

The health insurance market's primary audience is individuals, families, and organisations seeking the financial protection needed against health care expenses. More refined targeting would rely upon demographics, such as age, income levels, and employment status. Young professionals and young families may focus entirely on health insurance as a solution for unexpected situations. In contrast, senior citizens may also want health insurance but will be keen on finding insurance schemes explicitly created or prescribed to the health needs accompanying one's age.,, Then again, self-employed individuals and such who work in risky professions become important segments where employers do not provide insurance plans. Emerging markets would piggyback heavily on millennials and Gen Z, heavily shouting affordability and digital access. Pre-existing conditions and those suffering from chronic disease would also require specific plans but with all-encompassing cover. With growing awareness around health and wellness, interest is also rising within the sector's fitness enthusiasts and preventive care seekers, thus creating plasticity in this market.Merger and acquisition

The most recent mergers and acquisitions in the health insurance market have been significantly transformative. For example, Elevance Health is merging with Blue Cross Blue Shield of Louisiana (BCBS-LA), which would create a bigger footprint in Louisiana and make it the top insurer in 12 states. Most importantly, the deal is expected to convert BCBS-LA's pharmacy management from Express Scripts to CarelonRx, subject to requirements from regulators because of BCBS-LA's nonprofit status. Health Care Service Corporation (HCSC) further announced that it is buying Cigna's Medicare business for $3.3 billion. This deal would skyrocket the membership of HCSC from less than 500,000 to over 3.6 million, making it the fifth largest Medicare insurer in the U.S. Another major deal is the Rite Aid sale of its pharmacy benefit manager, Elixir, to MedImpact for $576.5 million during its bankruptcy proceedings. The purchase adds more than 1 million PBM lives for MedImpact, enhancing its reach of mail-order and speciality pharmacy capabilities. Notably, all these mergers and acquisitions well depict the current trend of consolidation in the healthcare insurance industry, which reflects the urgency for companies to increase their market share and operational efficiencies in a still-very-competitive landscape. >Analyst Comment

"The health insurance market is experiencing significant growth due to rising healthcare costs, aging populations, and increased awareness of health insurance benefits. This growth is further fuelled by government initiatives to improve healthcare access and the rising demand for comprehensive coverage plans. The market is segmented by type, coverage, and end-user, with medical insurance and PPO plans dominating the market."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Health Insurance- Snapshot

- 2.2 Health Insurance- Segment Snapshot

- 2.3 Health Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Health Insurance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Life-Time Coverage

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Term Insurance

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Health Insurance Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Architecture Parts

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Musical Instruments

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial Parts

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Transportation Parts

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Health Insurance Market by End User

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Industrial

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Architecture

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Marine

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Infrastructure and Construction

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Automotive and Transportation

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Aerospace and Defence

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 Electrical and Electronics

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Aetna Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 AIA Group Limited (China)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Allianz SE (Germany)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 American International Group

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc. (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Chubb (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Axa S.A. (France)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Berkshire Hathaway Inc. (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Bupa Global (United Kingdom)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 The Cigna Group (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Generali Global Assistance (Unites States)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Nationwide (United States)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 IMG (United States)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Prudential plc (United Kingdom).

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Health Insurance in 2031?

+

-

Which type of Health Insurance is widely popular?

+

-

What is the growth rate of Health Insurance Market?

+

-

What are the latest trends influencing the Health Insurance Market?

+

-

Who are the key players in the Health Insurance Market?

+

-

How is the Health Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Health Insurance Market Study?

+

-

What geographic breakdown is available in Global Health Insurance Market Study?

+

-

Which region holds the second position by market share in the Health Insurance market?

+

-

How are the key players in the Health Insurance market targeting growth in the future?

+

-