Global Green Hydrogen Energy Storage System Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-699 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Green Hydrogen Energy Storage System Report Highlights

| Report Metrics | Details |

|---|---|

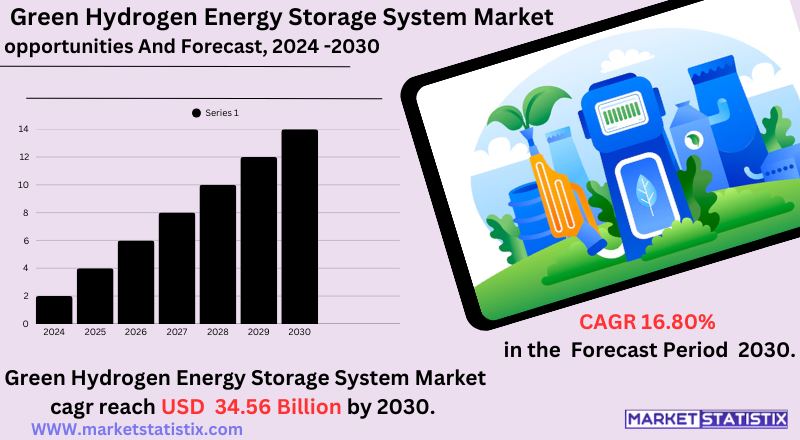

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 16.80% |

| Forecast Value (2030) | USD 34.56 Billion |

| Key Market Players |

|

| By Region |

|

Green Hydrogen Energy Storage System Market Trends

One of the trends that have stood out is the integration of increasingly green hydrogen storage systems with renewable power generation, all to stabilise power grids and ensure consistent energy delivery. Additionally, there is also significant development toward the creation of large-scale storage solutions, like underground salt caverns and advanced liquid hydrogen storage, to service industrial applications and long-duration energy needs. Efficiency and reduction of costs for all forms of production and storage of green hydrogen will be delivered by new technologies for electrolysis, compression, and liquefaction. Government policies and investments, especially in propagation regions such as Europe, Asia-Pacific, and North America, are also inextricably looking to accelerate hydrogen infrastructure. These investments will develop hydrogen pipelines, refuelling stations, and storage facilities, which, in turn, will create a strong ecosystem in green hydrogen energy storage.Green Hydrogen Energy Storage System Market Leading Players

The key players profiled in the report are Air Liquide, Air Products Inc., Engie, Cummins Inc., Nedstack Fuel Cell Technology BV, ITM Power, Iwatani Corporation, Linde plc, Nel ASA, Steelhead Composites Inc.Growth Accelerators

Primary motivators for the market include the need to decarbonise energy systems worldwide to attain climate targets. Increasing government policies and regulations towards renewable energy adoption and carbon emission reduction are fast-tracking growth. Subsidies and tax reliefs, along with mandates for renewable hydrogen use, have formed a conducive regulatory environment to draw heavy investments in hydrogen storage infrastructure. In addition, the increasing cost-competitiveness of renewable energy sources, particularly solar and wind, makes green hydrogen environments more cost-effective and attractive for hydrogen storage solutions. One of the most crucial drivers is indeed the growing recognition of green hydrogen as a long-duration storage medium. While hydrogen is clearly not a battery, it will enable large-volume storage over long periods and, therefore, smooth out seasonal fluctuations in renewable energy generation and grid stability. The demand for clean energy applications in almost all heavy-duty transportation, industrial processes, and power generation is also going to drive growth for the market.Green Hydrogen Energy Storage System Market Segmentation analysis

The Global Green Hydrogen Energy Storage System is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Commercial, Residential, Industrial. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The landscape of competition within the green hydrogen energy storage system market is hastily changing and characterised by a pastiche of well-established industrial gas companies, emerging technology startups, and big conglomerates dealing in energy. The major players are focusing on producing and installing innovative storage solutions, such as development compression technologies, cryogenic storage, and solid-state materials. Therefore, strategic partnerships and collaborations are built-in due to the proximity of different companies to experts and resources that, when maximised, will speed penetration into the market. Regional dynamics play a crucial role, as Europe and Asia-Pacific are ahead of the competition in terms of government support and investment for hydrogen infrastructure. The industry has been experiencing a rise in mergers and acquisitions from which companies are consolidating their ground for competition in this budding industry.Challenges In Green Hydrogen Energy Storage System Market

The market for green hydrogen energy storage systems is severely hindered by high costs of production and infrastructural constraints. Green hydrogen production involves electrolysis run on renewable energy, and high costs of electrolysers and the limited availability of cheap renewable electricity have prevented a truly cost-competitive scenario. Besides, this cost differential, usually referred to as the green premium, keeps dissuading investors and obstructing market development in the absence of real incentives or government mandates. Development of the infrastructure is another salient hurdle to growth. The construction of a strong production plant, storing systems, a transportation network, and refuelling stations for hydrogen will require huge investment and coordination among various stakeholders. In addition, retrofitting the existing infrastructure for the use of green hydrogen adds to the technical and financial challenges. Supply chain constraints also work against scalability, such as securing raw materials that are needed for electrolysis, such as catalysts. Innovative solutions will therefore need to combine technology, policy support, and even international collaboration in order to render green hydrogen energy storage systems economically viable and broadly accessible.Risks & Prospects in Green Hydrogen Energy Storage System Market

Green hydrogen acts as an energy carrier in many ways to stabilise the grid by storing excess renewable energy and converting it back into electricity when the grid is under peak demand. This process aids in the transition towards a cleaner energy system and the mitigation of the challenge associated with the intermittent nature of renewable sources such as wind and solar energy. Additionally, new infrastructure for hydrogen is coming into the market, such as cost-effective stations for hydrogen storage and distribution, which then promote the collaboration of governments, industries, and research institutes to further expedite market growth. Countries such as Japan, Korea, and India are now acting substantially in green hydrogen, with initiatives such as India's 100 MW pilot project for round-the-clock renewable energy supply. In a regional perspective, Asia Pacific is on the rise as a key player because of abundant renewable resources and increasing energy demand. Governments in this region are incentivising hydrogen adoption in sectors like transportation through fuel cell electric vehicles (FCEVs). On the other hand, Europe is pushing forward with large-scale green hydrogen projects, such as Orsted's wind-powered electrolysis initiative in the North Sea. The United States has focused on establishing hydrogen hubs such as the Mississippi Clean Hydrogen Hub (MCHH), strategically positioned to serve industrial applications and exports to undersupplied markets in Europe and Latin America.Key Target Audience

Green hydrogen energy storage systems, primarily such key targets for decarbonisation and energy resilience, encompass industries and sectors. Heavy industries such as steelmaking, cement, and petrochemicals change significant amounts of green hydrogen, which can substitute for common carbon feedstocks. The transportation sector is adopting green hydrogen as a clean fuel in this regard, encompassing shipping and heavy-duty trucking. Then we have utility companies and grid operators, forming yet another key audience, using green hydrogen storage to balance out renewable energy intermittency and ensure grid stability during peak demand.Merger and acquisition

The recent merger and acquisition activities are reflective of a growing trend toward strategic partnerships and investments for accelerating the adoption of hydrogen technologies in the green hydrogen energy storage system market. For example, ITM Power, a leading manufacturer of electrolysers, formed an equally owned joint venture with Linde to provide hydrogen in large-scale industrial projects, emphasising collaborative efforts to scale up green hydrogen production. Companies like Air Liquide have made acquisitions of major magnitude, for example, the Sasol purchase of air separation units, which shows the industry push for an increase in capacity and emissions reduction. The M&A picture in the hydrogen industry has been a jagged one lately, with the values of deals falling off in recent quarters, but the number of transactions on the rise. This paints a picture of deliberate development of more strategic and smaller partnerships for such firms. Companies have been acquiring others to expand their renewable energy portfolios in hydrogen technologies. Furthermore, investing in startups like Hydrogenious LOHC Technologies and H2Go Power displays trust in the innovative hydrogen storage solutions. In such an environment, these developments illustrate a buoyant market whereby firms are agitating for M&A activities to reinforce their capabilities in green hydrogen production and storage, thus driving the sector in growth and technological advancement. >Analyst Comment

The green hydrogen energy storage system market is clearly burgeoning, with the advancing global agenda of net zero carbon emissions serving as the propellant. The analyses from various organisations have said that investments and technology have grown in hydrogen production, storage, and transportation. The growth is occurring due to the understanding that green hydrogen is an essential facilitator for long-duration energy storage and for the decarbonisation of hard-to-abate sectors. The market is experiencing considerable activity in R&D and efforts for enhancing storage efficiency and lowering costs. While challenges related to infrastructure development and cost competitiveness are still being worked on, the future looks even brighter, as many collaborations and pilot projects are opening the door for commercial-scale deployments.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Green Hydrogen Energy Storage System- Snapshot

- 2.2 Green Hydrogen Energy Storage System- Segment Snapshot

- 2.3 Green Hydrogen Energy Storage System- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Green Hydrogen Energy Storage System Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Residential

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Commercial

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Industrial

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Green Hydrogen Energy Storage System Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Air Liquide

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Air Products Inc.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Cummins Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Engie

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 ITM Power

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Iwatani Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Linde plc

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Nedstack Fuel Cell Technology BV

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Nel ASA

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Steelhead Composites Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Green Hydrogen Energy Storage System in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Green Hydrogen Energy Storage System market?

+

-

How big is the Global Green Hydrogen Energy Storage System market?

+

-

How do regulatory policies impact the Green Hydrogen Energy Storage System Market?

+

-

What major players in Green Hydrogen Energy Storage System Market?

+

-

What applications are categorized in the Green Hydrogen Energy Storage System market study?

+

-

Which product types are examined in the Green Hydrogen Energy Storage System Market Study?

+

-

Which regions are expected to show the fastest growth in the Green Hydrogen Energy Storage System market?

+

-

Which application holds the second-highest market share in the Green Hydrogen Energy Storage System market?

+

-

What are the major growth drivers in the Green Hydrogen Energy Storage System market?

+

-