Global GNSS Chip Market – Industry Trends and Forecast to 2032

Report ID: MS-630 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

GNSS Chip Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

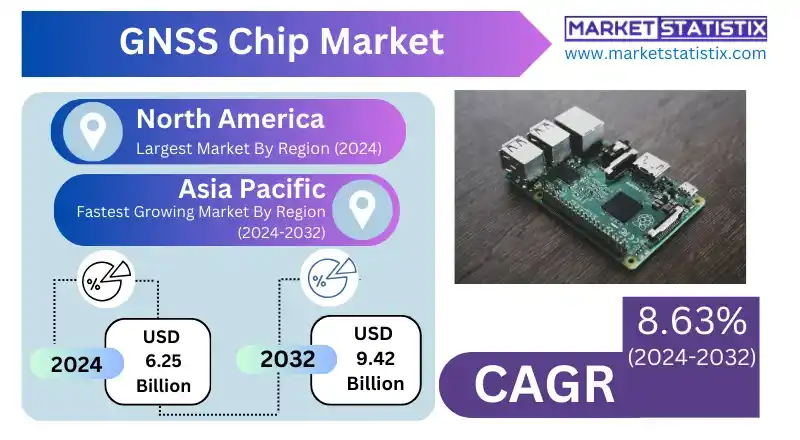

| Growth Rate | CAGR of 8.63% |

| Forecast Value (2032) | USD 9.42 Billion |

| By Product Type | Multi-frequency, Integrated, Single-band, Dual-band, Standalone |

| Key Market Players |

|

| By Region |

|

GNSS Chip Market Trends

An increasingly noticeable trend is the pursuit of low-power GPS chips for usage in battery-powered devices like wearables and asset trackers. That is, these chips really emphasize energy consumption with reasonable accuracy, allowing for longer possible operation times of the devices. The shrinking of GNSS chips is allowing them to be incorporated into even smaller devices or applications that stress portability; thus, it's continuing to spur innovation in consumer electronics and applications for mobile use. The market is also witnessing growing demand for such secure GNSS solutions, particularly in defense and critical infrastructure applications; signal spoofing and jamming mitigation require stringent security measures.GNSS Chip Market Leading Players

The key players profiled in the report are Intel, Infineon Technologies, Mediatek, ublox, Qualcomm, STMicroelectronics, NovAtel, Atheros Communications, Thales Group, Skyworks Solutions, NXP Semiconductors, Broadcom, Cerner, Texas Instruments, GarminGrowth Accelerators

Accurate location-based services are still high in demand in diverse applications, and this describes the GNSS chip market well. Indeed, there's widespread proliferation of legions of smartphones, a fast-expanding subsector of automotive development wholly dedicated to installing navigation systems and autonomous driving mechanisms, and an ever-growing field of IoT devices that drive this demand. The present GNSS market is also gaining ground through increased application of the technology in drones, wearables, and asset tracking. Different industries, such as logistics, agriculture, and public safety, have created ongoing demand for advanced GNSS chips through some of their requirements for reliable and precise positioning data. These developments improve accuracy, reduce power consumption, and signal robustness, promoting a versatile GNSS chip tailored for various applications. The constant development of new GNSS constellations and modernizing existing ones, coupled with the emphasis on critical infrastructure for accurate timing synchronization, keeps the demand for cutting-edge GNSS chip solutions long-term unmet.GNSS Chip Market Segmentation analysis

The Global GNSS Chip is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Multi-frequency, Integrated, Single-band, Dual-band, Standalone . The Application segment categorizes the market based on its usage such as Automotive, Aerospace, Consumer Electronics, Telecommunications, Agriculture. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The GNSS chip market is highly competitive by nature, with all major players haphazardly fighting for technological advancements and strategic alliances with one another. Chiefly, these chips should have better accuracy, reduced power consumption, and increased multi-constellation features. Again, it is the growth of applications such as automotive and consumer electronics with IoT that increases the demand for truly accurate location facilities that intensify competition. As a result, leading contenders have invested in research and development to remain ahead in the game as this area accelerates day by day. Thus, the regional aspects and improving trends of using GNSS technology with other technologies such as 5G and AI also weigh on the competitiveness of the industry. All these elements end up delivering companies to provide integrated solutions better for themselves instead of industry fragmentation and competitiveness.Challenges In GNSS Chip Market

Despite witnessing a strong momentum, the GNSS chip market has several challenges. One was the relentless march of technology to improve accuracy and reliability: everything from signal interference in densely populated urban environments to the handling of multi-constellation signals. Then, the continuous push for lower power consumption in portable devices has sustained a demand for chips that are more and more power-efficient. Another major challenge has to do with the increasing complexity of integration: GNSS chips are being integrated into an ever-wider range of devices, from simple trackers to highly complex autonomous vehicles, each with varying requirements. Due to these diverging requirements, there is a need for extreme customization and flexibility, which can mean bigger development costs and time-to-market. Concerns are still arising about data security and privacy with the sensitivity of location data, which continue to be raised among both manufacturers and consumers.Risks & Prospects in GNSS Chip Market

Emerging enterprises and organizations have adopted smart city initiatives to empower this advanced and sophisticated navigation system even to get better prospects. Such demand will also come from the need to have higher accuracy and reliability under challenging conditions, namely in urban canyons and indoors, stimulating innovations on multi-frequency and multi-constellation GNSS solutions. Regionally, the Asia Pacific is expected to experience the fastest growth as the electronics manufacturing industry in this region will see significant use of GNSS-enabled devices in countries like China, India, and Japan. North America and Europe use most of the market in the area because of their superior automotive and aerospace industries and the presence of great technology companies. Increasing demand for precise location data from emerging markets like Latin America and Africa offers another important opportunity for growth of these infrastructure-poor regions adopting advanced technologies.Key Target Audience

The GNSS chip market targets a broad spectrum of audiences, reflecting the wide applications of location-based technologies. First and foremost, among the OEMs are automotive, consumer electronics (smartphones, wearables), and industrial sectors. These are the sectors that require GNSS chips for injecting location and timing functionalities into their products, anything from navigation systems to asset trackers, precision agriculture tools, and drones. Such OEMs are mainly concerned with chip accuracy, power efficiency, and localization-integration compatibility.,, Another important target audience is system integrators and solution providers focusing on location-based services. These industries develop and run applications such as fleet management, emergency services, and geospatial mapping, requiring GNSS chips for precision positioning data. They are looking for chips that will work with good performance in harsh environments and on smooth integration with various communication technologies.Merger and acquisition

The Global Navigation Satellite System (GNSS) chip market has seen considerable activities involving mergers and acquisitions, which are intended to further enhance technological prowess and availability in the marketplace. In January 2025, Hexagon AB intends to acquire Septentrio N.V., a designer and manufacturer of high-end multi-frequency GNSS receivers based in Belgium. This particular strategy will give Hexagon a better foothold for mission-critical navigation and autonomy applications. In October 2023, CNH Industrial completed its acquisition of Hemisphere GNSS and its subsidiary, Outback Guidance, developers of precision agriculture solutions. With this move, advanced GNSS technologies may be integrated into CNH Industrial's agricultural machines, enhancing precision and efficiency. Meanwhile, u-blocks AG has been busy building its GNSS capabilities through acquisitions such as Sapcorda Services GmbH, a provider of high-precision GNSS services in 2021, and Naventik GmbH, which specializes in safe positioning solutions for autonomous driving. >Analyst Comment

The GNSS chip market is flourishing owing to the increasing integration of location-based services in various applications. High-precision GNSS chips are in demand due to the rising adoption of smartphones, autonomous vehicles, drones, and IoT devices. The expanding automotive sector, rising adoption of wearable devices, and growing demand for precision positioning in sectors like logistics, agriculture, and surveying are some of the key factors driving this market. With technological advancements such as multi-frequency and multi-constellation GNSS chips, the accuracy and reliability are increased, promoting the growth of the market.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 GNSS Chip- Snapshot

- 2.2 GNSS Chip- Segment Snapshot

- 2.3 GNSS Chip- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: GNSS Chip Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dual-band

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Single-band

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Multi-frequency

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Integrated

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Standalone

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: GNSS Chip Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Automotive

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Aerospace

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Telecommunications

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Agriculture

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: GNSS Chip Market by Technology

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Global Navigation Satellite System

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Global Positioning System

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Galileo

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Compass

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 QZSS

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: GNSS Chip Market by End Use

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Personal Navigation

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Fleet Management

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Location-Based Services

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Military

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Surveying

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

8: GNSS Chip Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Broadcom

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Qualcomm

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 NovAtel

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 ublox

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Atheros Communications

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Infineon Technologies

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Thales Group

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 NXP Semiconductors

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Cerner

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Skyworks Solutions

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 STMicroelectronics

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Intel

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Mediatek

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Texas Instruments

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 Garmin

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technology |

|

By End Use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of GNSS Chip in 2032?

+

-

What is the growth rate of GNSS Chip Market?

+

-

What are the latest trends influencing the GNSS Chip Market?

+

-

Who are the key players in the GNSS Chip Market?

+

-

How is the GNSS Chip } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the GNSS Chip Market Study?

+

-

What geographic breakdown is available in Global GNSS Chip Market Study?

+

-

Which region holds the second position by market share in the GNSS Chip market?

+

-

Which region holds the highest growth rate in the GNSS Chip market?

+

-

How are the key players in the GNSS Chip market targeting growth in the future?

+

-