Global Gas Compressors Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-1690 | Manufacturing and Construction | Last updated: Sep, 2024 | Formats*:

Gas Compressors Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

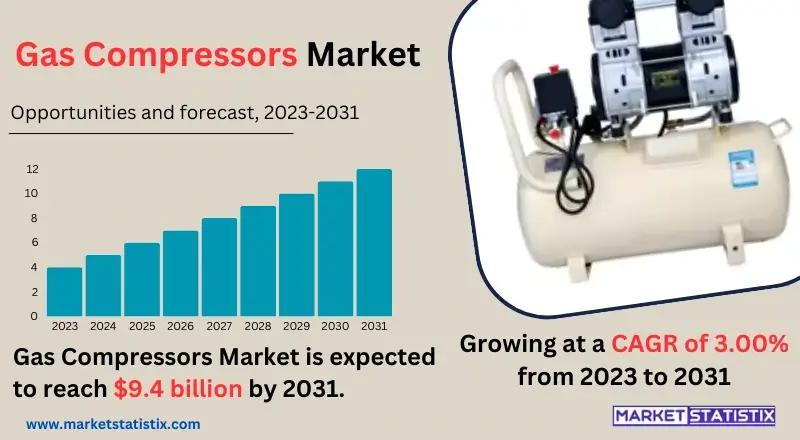

| Growth Rate | CAGR of 3.00% |

| By Product Type | Oil-Based, Oil-free |

| Key Market Players |

|

| By Region |

|

Gas Compressors Market Trends

The gas compressor market is witnessing huge transformation, driven mainly by increasing demands for energy efficiency, sustainability, and automation. Advanced technologies—like IoT and digitalisation, integrated together—are expected to realise predictive maintenance, remote monitoring, and optimised performance. Growing demand for natural gas as a cleaner source of fuel again drives demand for efficient gas compression solutions. The market is driving towards compact, modular compressor designs that meet the requirements of applications where the space is limited further. Low-emission, energy-efficient compressors are therefore even getting a further push from stringent environmental regulations, with an emphasis on reducing carbon emissions. Electrification, in any case, is the trend towards which industries are working to reduce dependence on fossil fuels.Gas Compressors Market Leading Players

The key players profiled in the report are Kaeser Kompressoren SE, Atlas Copco AB, Ariel Corporation, Hitachi Ltd., IDEX Corporation, BAUER COMPRESSORS INC., HAUG Sauer Kompressoren AG, Burckhardt Compression Holding AG, Siemens Energy, Ingersoll Rand Inc.Growth Accelerators

The gas compressor market expands on the back of some major drivers. First and foremost, growth in industry sectors such as oil and gas, chemical processing, and manufacturing increases demand for effective compression solutions. Besides, the growing need to save energy and promote eco-friendliness has stirred interest in new compressor technologies. Another important factor is the rise in natural gas consumption as a cleaner source of energy than fossil fuels. Furthermore, growing applications of compressed air in industrial processes and components for automakers also supplement market growth.Gas Compressors Market Segmentation analysis

The Global Gas Compressors is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Oil-Based, Oil-free . The Application segment categorizes the market based on its usage such as Oil and Gas, Chemical, Automotive, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The gas compressor market contains only a few global established players and regional manufacturers. The major participants in the industry remain focused on research and development activities to bring forth innovative, efficient compressor solutions. Market competition is fairly healthy, wherein companies compete on product differentiation, advancement in technology, and cost-effectiveness. Another active trend is the consolidation trend by way of mergers and acquisitions, which allows these companies to scale up their product offerings while covering more geographical areas. To be successful in this competitive environment, manufacturers emphasise energy efficiency, customisation, and after-sales service. Furthermore, the integration of digital technologies with data analytics is becoming most crucial to compressor performance optimisation and value-added services for customers.Challenges In Gas Compressors Market

The speech of the challenges of the gas compressor market is such that the marketplace has very high energy consumption for instance, compressors themselves are energy-consuming machinery. On the other hand, the designs and operation of the compressors are also greatly strained by the stringent environmental regulations pertaining to emissions and noise pollution. There is intensive competition in the market, hence forcing manufacturers to innovate and make cost-effective solutions. Further, compressor technology is complex, which necessitates high skills for installation, maintenance, and repair in some regional settings.Risks & Prospects in Gas Compressors Market

A number of growth opportunities are located for gas compressor markets. Increasing interest in natural gas as a cleaner source of energy than fossil fuels is likely to increase demand for gas compressors in the energy sector. Besides the rising industrial sectors, such as chemical processing, food and beverages, and mining, that are opening up new vistas for compressor applications, growth opportunities are located for gas compressor markets. Improvements in the areas of energy efficiency and digitalisation of compressor technology create opportunities for product differentiation and market growth. Further, the increasing need to concentrate on sustainability augurs well for developing environment-friendly compressor solutions.Key Target Audience

The major target customers for gas compressors are industries with enormous usage for compressed air or gas. The typical examples are the oil and gas industry, petrochemical industry, chemical industry, manufacturing industry, and the food processing industry. The end-users may include any company, from large groups to small-scale industrial units within these industries. Equipment manufacturers and OEMs who use the compressor while manufacturing their machinery also form a big target market segment. Government and research organisations dealing with energy and environmental studies are another major audience because compressors find applications in many industrial processes.,, The second would be institutional investors and financial analysts who cover the industrial equipment sector, for whom the gas compressor market would represent an investment opportunity.Merger and acquisition

The series of mergers and acquisitions that have taken place in the gas compressor market were all in respect of developing product portfolios, enhancing technological capabilities, and strengthening market positions. Some of the key deals include the acquisition of Compressor Products International by Howden Group to further strengthen its position in the industry and the acquisition by Atlas Copco of Brooks Automation to help it expand its product offering in the process gas compressor segment. The strategic moves have changed the competitive environment, forcing consolidation and fomenting innovation in the market place. Besides, joint ventures and collaborations have been an increasing trend that companies are using to better their market presence. For example, Ariel Corporation and Hoerbiger have collaborated in developing non-lube compressor solutions in the hydrogen compression market. Such strategic alliances allow companies to combine their expertise, resources, and technology in fulfilling evolving market demand and boosting competitiveness.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Gas Compressors- Snapshot

- 2.2 Gas Compressors- Segment Snapshot

- 2.3 Gas Compressors- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Gas Compressors Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Oil-Based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Oil-free

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Gas Compressors Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Oil and Gas

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Chemical

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Automotive

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Gas Compressors Market by Technology

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Positive Displacement

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Dynamic Displacement

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Gas Compressors Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Kaeser Kompressoren SE

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Atlas Copco AB

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Ariel Corporation

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Hitachi Ltd.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 IDEX Corporation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 BAUER COMPRESSORS INC.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 HAUG Sauer Kompressoren AG

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Burckhardt Compression Holding AG

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Siemens Energy

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Ingersoll Rand Inc.

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technology |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Gas Compressors is widely popular?

+

-

What is the growth rate of Gas Compressors Market?

+

-

What are the latest trends influencing the Gas Compressors Market?

+

-

Who are the key players in the Gas Compressors Market?

+

-

How is the Gas Compressors } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Gas Compressors Market Study?

+

-

What geographic breakdown is available in Global Gas Compressors Market Study?

+

-

Which region holds the second position by market share in the Gas Compressors market?

+

-

How are the key players in the Gas Compressors market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Gas Compressors market?

+

-