Global Fruits & vegetable Snacks Market Trends and Forecast to 2030

Report ID: MS-776 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Fruits & vegetable Snacks Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

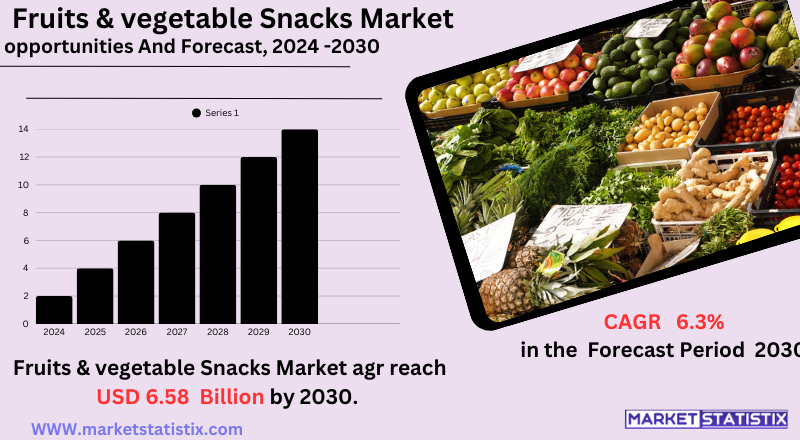

| Growth Rate | CAGR of 6.3% |

| Forecast Value (2030) | USD 6.58 Billion |

| By Product Type | Baked Dried, Freeze Dried, Others |

| Key Market Players |

|

| By Region |

|

Fruits & vegetable Snacks Market Trends

One of the top trends is the growing trend of minimally processed snacks with natural nutrients and flavour profiles intact, such as the growth in categories of freeze-dried fruit and vegetables, air-dried vegetable chips, and fresh-cut fruits and vegetables in convenient single-serve formats. Consumers are going out of their way to find clean-labelled snacks, less artificial content, and transparency around sourcing, and this challenges manufacturers to experiment with natural flavour profiles and health-orientated preparation styles. Another key trend is product diversification to accommodate different dietary habits and consumption moments. This entails the creation of fruit and vegetable snacks that are organic, non-GMO, gluten-free, and plant-based, reflecting the increasing use of specialised diets. In addition, there is growing interest in unique flavour combinations, the use of superfoods and functional ingredients, and the formulation of snacks with added health benefits beyond simple nutrition.Fruits & vegetable Snacks Market Leading Players

The key players profiled in the report are CandyOut, Natural Sins, Lai Yi Fen, Sabawa, Tenwow, Swiig, Nothing But, Qian Jia Su Guo, Three Squirrels, Trader Joe’s, Liang Pin Pu Zi, Bai Cao Wei, One nature, Nim’s Fruit CrispsGrowth Accelerators

First, the consumer is better aware of his or her own health and wellbeing and, consequently, actively pursues healthy, nutritious snack options. This growth is driven by growing concern around obesity and connected health problems that are driving the consumer away from conventional, mostly processed and sugar-laden snack foods towards naturally derived, more wholesome snack items based on genuine fruits and vegetables. Individuals are more aware of ingredient panels and nutritional information, actively seeking snacks that help advance their daily diet of vitamins, minerals, and fibre. Secondly, fast-paced lives and the need for convenience and easy, on-the-go food solutions are strong drivers. Today's consumers, with their busy lives, need easy and quick snacks that seamlessly become part of their daily lives. Conveniently packaged, pre-portioned fruit and vegetable snacks, including vegetable chips, dried fruit packs, and fruit puree in a pouch, serve the purpose exactly. The portability and improved shelf life of many of these compared to fresh products also enhance their popularity, such that they fit well in the workplace, schools, travel, and ready-to-eat use.Fruits & vegetable Snacks Market Segmentation analysis

The Global Fruits & vegetable Snacks is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Baked Dried, Freeze Dried, Others . The Application segment categorizes the market based on its usage such as Food Service Providers, Individual, Food Processing Industry. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Indian fruits and vegetable snacks market competitive environment is becoming more colourful, led by growing health awareness and the need for convenient, healthy food. Although large, traditional snack food manufacturers such as PepsiCo and ITC Limited are there and increasing their healthier products, the market is also marked by the presence of many small, nimble domestic players and some international players making an entry into the Indian market. These firms tend to specialise in new product formats and local tastes and address particular dietary needs like organic, vegan, or gluten-free. Competition in the space revolves around aspects such as product innovation (launching innovative fruit and vegetable combinations and presentation in the form of chips, bars, and purees and introducing traditional Indian taste profiles), competitive pricing to engage a wide audience base, as well as sound distribution through established retail platforms (supermarkets and convenience stores) and the emerging online platforms.Challenges In Fruits & vegetable Snacks Market

The market for fruit & vegetable snacks is confronted by a number of major challenges affecting its competitiveness and growth. The major challenge among these is the stiff competition from convenience and processed foods, which tend to draw consumers due to their greater accessibility, high-profile marketing, and perceived convenience. Even with increasing health consciousness, consumers are readily influenced by innovative marketing of less healthy foods and tend to see fruit and vegetable snacks as being less convenient or more costly. Logistical issues are also a huge hindrance, particularly with regards to the perishability and limited shelf life of fruit and vegetable snacks as opposed to processed snack foods. It results in added costs of storage, transportation, and inventory, especially in infrastructurally undeveloped parts of the country. In addition, the pressure of ongoing product innovation and straightforward labelling to cope with changing consumer tastes adds yet another burden to manufacturers to shift gears fast while ensuring affordability and quality in the highly competitive snacking market.Risks & Prospects in Fruits & vegetable Snacks Market

Innovations like clean-label, organic, gluten-free, and sugar-free foods and beverages, as well as sustainable packaging, are drawing a broad consumer base—health-minded adults and younger consumers looking for convenient nutrition on the go. Technological advances in the production process and the addition of functional ingredients are allowing manufacturers to expand product lines, enhance flavour and texture, and address specific health issues, driving strong market expansion. Regionally, North America and Europe dominate the market based on high health consciousness, developed retail channels, and high demand for premium, clean-label snacks. The USA alone is expected to account for a large revenue share, in line with mature consumer behaviour and purchasing power. Asia-Pacific, in the meantime, is being driven by urbanisation, increasing disposable incomes, and growing consumption of Western snacking habits. Other areas like Latin America and the Middle East & Africa are also seeing growth, as they are being driven by increasing distribution networks and increasing health awareness.Key Target Audience

The major target audience of the fruit & vegetable snacks market is varied, with a high focus on health-focused consumers, millennials, working professionals, and children's families. Millennials are the most dominant with their online presence, snacking frequency, and liking for easy, on-the-go products. Online stores are successfully targeting this segment with cashback and discount offers, while product innovation in the form of fruit and vegetable cereal bars and functional ingredient-containing snacks addresses their need for healthy, plant-based, and clean-label products.,, Additional major segments include older consumers who look for convenient, healthy snack options brought to their doorsteps and younger shoppers driven by trends such as paleo diets and raw food that focus on fresh fruits and vegetables. Targeted marketing campaigns directed at moms and teenagers have also been shown to boost purchase intentions and usage of fruit and vegetable snacks, pointing to the effectiveness of targeted communication for these segments.Merger and acquisition

Fruit and vegetable snacks have seen high levels of merger and acquisition activity as the trend has developed towards healthier snacking. In August 2024, Mars Incorporated revealed that it has acquired Kellanova, which owns brands such as Pringles and Cheez-It, for around $35.9 billion. This transaction, the biggest for the snacking sector, enables Mars to expand its portfolio from confectionery and draw on the increased demand for savoury and plant-based snacks. The purchase is expected to strengthen Mars' footprint in 180 markets and drive its goal of doubling its snacking business in the next decade. The overall snacking industry is seeing increased M&A activity due to trends toward "better-for-you" and "healthy indulgence" snacks on the part of consumers. Firms are hunting for acquisitions that have strategic merit, including geographic reach and diversification of product offerings. Mondelēz International's investment in healthier doughnut chain Urban Legend, for example, is a prime example of this trend. Analysts expect to see more consolidation in the industry as companies look to get in line with changing consumer trends and shore up their market positions. >Analyst Comment

The market for vegetable snacks and fruits is witnessing vigorous growth across the world, driven by increased health awareness, changes in dietary patterns, and increased demand for easy-to-consume, healthy snacking foods. Fruit- and vegetable-based snacks are being increasingly sought after by consumers, particularly millennials and working adults, because they are highly nutrient-dense with vitamins, minerals, fibre, and antioxidants. The market is also aided by the prevalence of plant-based eating, the trend of adopting vegan lifestyles, and the increasing popularity of on-the-go, functional snacks like vegetable and fruit chips.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Fruits & vegetable Snacks- Snapshot

- 2.2 Fruits & vegetable Snacks- Segment Snapshot

- 2.3 Fruits & vegetable Snacks- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Fruits & vegetable Snacks Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Baked Dried

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Freeze Dried

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Fruits & vegetable Snacks Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Individual

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Food Service Providers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Food Processing Industry

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Fruits & vegetable Snacks Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Bai Cao Wei

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CandyOut

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Three Squirrels

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Tenwow

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Qian Jia Su Guo

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Nothing But

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Trader Joe’s

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Natural Sins

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Sabawa

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Lai Yi Fen

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Liang Pin Pu Zi

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Swiig

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 One nature

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Nim’s Fruit Crisps

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Fruits & vegetable Snacks in 2030?

+

-

Which type of Fruits & vegetable Snacks is widely popular?

+

-

What is the growth rate of Fruits & vegetable Snacks Market?

+

-

What are the latest trends influencing the Fruits & vegetable Snacks Market?

+

-

Who are the key players in the Fruits & vegetable Snacks Market?

+

-

How is the Fruits & vegetable Snacks } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Fruits & vegetable Snacks Market Study?

+

-

What geographic breakdown is available in Global Fruits & vegetable Snacks Market Study?

+

-

Which region holds the second position by market share in the Fruits & vegetable Snacks market?

+

-

How are the key players in the Fruits & vegetable Snacks market targeting growth in the future?

+

-