Global Fresh Pet Food Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-774 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Fresh Pet Food Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

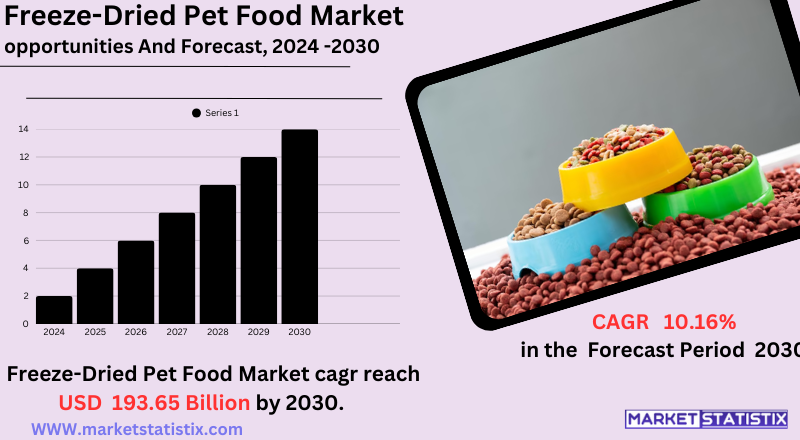

| Growth Rate | CAGR of 10.16% |

| Forecast Value (2030) | USD 193.65 Billion |

| By Product Type | Dog, calt |

| Key Market Players |

|

| By Region |

|

Fresh Pet Food Market Trends

Trends indicate an increasing demand for natural, minimally processed, and human-grade ingredients, following the same trend with human food. These pet owners prefer that their pets eat fresh, refrigerated, or frozen items marketed as healthier and more nutritious than dry kibble or canned items. There is a predominant choice for real meat, whole vegetables, fruits, and the avoidance of artificial additives, fillers, and preservatives. At the same time, another highly regarded trend is the increasing personalised and customized meal plan, usually on subscription. These programmes propose that specific diets based on a pet's age, breed, weight, activity level, and particular health considerations be adopted. Consumers are shifting their focus towards transparency and sustainability: they want to know the source of the ingredients and preferentially use eco-friendly packaging. Increasing access to fresh pet food via online channels and direct-to-consumer models are shaping extreme market trends by providing maximum convenience and choice to pet owners.Fresh Pet Food Market Leading Players

The key players profiled in the report are WellPet LLC, Hill’s Pet Nutrition, Inc., Nestle Purina, The J.M. Smucker Company, Total Alimentos, Mars, Incorporated, General Mills Inc., LUPUS Alimentos, The Hartz Mountain CorporationGrowth Accelerators

The fresh pet food market is skyrocketing due to a range of factors. First, the trend of pet humanisation has a very important share in this case where pet owners, who now tend to treat their animals as members of the family, become more ready to spend on premium, high-quality food products that mimic their own health-conscious dietary choices, which drives the emotional bond between them and calls for nutrition seen as more nourishing and beneficial for their pet's well-being. Thirdly, consumer demand is gradually increasing for pet food that is more natural and rawer. Pet owners are now increasingly sensitive to what is inside that pet food pack, looking for real, whole-food ingredients just like those of human-grade food. Concerns about artificial additives, preservatives, or fillers in traditional kibble and canned food are what draw these consumers to fresh, healthy alternatives that are also more digestible and generally are expanding the market.Fresh Pet Food Market Segmentation analysis

The Global Fresh Pet Food is segmented by Type, and Region. By Type, the market is divided into Distributed Dog, calt . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market competition for the fresh pet food segment is driven by an expanding list of companies competing for space in this popularising segment. Although large pet food brands like Nestlé Purina, Mars, and General Mills are getting into the business of fresh, the market is also largely defined by direct-to-consumer (D2C), specialised companies like Freshpet, JustFoodForDogs, and The Farmer's Dog. These newer firms tend to specialise entirely in new, human-grade ingredients and tailored meal plans, gaining strong brand affinity through their emphasis on quality and convenience. Competing in this market is all about ingredient quality and transparency of sourcing, the convenience of delivery models (particularly subscription models), and the ability to accommodate particular dietary requirements and health issues. Price, the diversity of recipes, and perceived health value are other important differentiators. With increased pet owner knowledge and willingness to spend on quality nutrition for pets, the ability to show the value and nutritional benefit of fresh pet food is also vital for businesses to acquire and retain a market advantage in this fast-changing space.Challenges In Fresh Pet Food Market

The new pet food industry is confronted with a number of serious challenges, such as ongoing supply chain disruptions, economic and geopolitical instability, and the risk of tariff change impact, especially in major markets like the United States. These have resulted in variable growth and have compelled firms to bolster domestic supply chains, implement digital solutions, and make strategic acquisitions of suppliers to manage risks. Furthermore, the sector has limited profit margins amidst strong consumer demand, and as such, companies must adapt to particular regional market conditions and effectively work together in the value chain to comply with strict regulatory standards. Another significant challenge lies in the logistics of keeping pet food fresh and safe, with fresh pet food needing cold chain distribution and same-day delivery for quality. Expensive fresh ingredients and specialised packaging to maintain shelf life further exert operational pressures. In addition, consumer price sensitivity among Millennials and Gen Z buyers, along with premium pricing for fresh pet food, raises concern over affordability.Risks & Prospects in Fresh Pet Food Market

Some of the major drivers for growth are the growing pet humanisation trend, need for transparency in sourcing, and growth in e-commerce and subscription-based models, which render new pet food more convenient and accessible. Consumers can also be further leveraged by brands by providing grain-free, hypoallergenic, and age-related diets and by using environmentally friendly packaging and sustainability in sourcing. Regionally, North America dominates the market, fuelled by high pet ownership and strong demand for premium, health-driven pet food. Europe is the next in line, fuelled by the same patterns and growing fresh pet food adoption. The Asia-Pacific is developing comparatively quickly with increased disposable income and increased pet wellness awareness, whereas South America and the Middle East & Africa are relatively smaller yet show high growth opportunity with rising pet ownership and urbanisation. Each has its own set of challenges, including regulatory environments and complexity in supply chains, necessitating specially devised strategies for market penetration and long-term growth.Key Target Audience

The market for fresh pet food targets primarily health-conscious pet owners, particularly millennials and Gen Z, who consider their pets as family and place a premium on high-quality, natural ingredients. These buyers are predisposed to fresh, minimally processed diets that reflect their own health and wellness preferences. Busy professionals in urban areas also represent a large segment, looking for convenient, ready-to-eat meals that provide optimal nutrition for their pets without the inconvenience of preparation.,, Another primary audience is pet owners whose pets have particular nutritional requirements, e.g., allergies or sensitivities. These customers tend to use veterinarian advice and prefer specific diets, such as grain-free or high-protein ones. The market is also geared toward premium shoppers who are willing to pay for subscription-based offerings and environmentally friendly items that align with their values on sustainability and ethical sourcing.Merger and acquisition

The market for fresh pet food has seen a great deal of merger and acquisition action as businesses try to take advantage of increasing demand for premium, health-orientated pet nutrition. In February 2025, Colgate-Palmolive acquired Prime100, an Australian fresh pet food company recognised for its veterinarian-approved, high-priced products. The action is intended to boost Colgate's Hill's Pet Nutrition business and grow its share in the fresh pet food market. Private equity companies have also been keen in the market. In 2023, PAI Partners purchased Alphia Inc., an American superpremium pet food manufacturing company, from J.H. Whitney Capital Partners. The acquisition fits PAI Partners' expansion strategy in investing in the pet food sector following its earlier investment in companies such as Royal Canin. >Analyst Comment

The new pet food industry is growing globally at a fast pace due to increasing awareness of pet health among consumers, the desire for natural and minimally processed foods, and the pet humanisation trend. The industry is expected to grow from USD 105.09 billion in 2024 to USD 172.19 billion. North America is at the forefront with a market share of 38% due to high rates of pet ownership and the need for premium, human-grade pet foods. E-commerce and subscription-based delivery systems are making new pet food more convenient, while consumers increasingly want products free of artificial ingredients and specifically designed for their pet's individual dietary requirements.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Fresh Pet Food- Snapshot

- 2.2 Fresh Pet Food- Segment Snapshot

- 2.3 Fresh Pet Food- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Fresh Pet Food Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dog

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 calt

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Fresh Pet Food Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 The J.M. Smucker Company

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Nestle Purina

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Mars

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Incorporated

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 LUPUS Alimentos

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Total Alimentos

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Hill’s Pet Nutrition

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 General Mills Inc.

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 WellPet LLC

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 The Hartz Mountain Corporation

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Fresh Pet Food in 2030?

+

-

Which type of Fresh Pet Food is widely popular?

+

-

What is the growth rate of Fresh Pet Food Market?

+

-

What are the latest trends influencing the Fresh Pet Food Market?

+

-

Who are the key players in the Fresh Pet Food Market?

+

-

How is the Fresh Pet Food } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Fresh Pet Food Market Study?

+

-

What geographic breakdown is available in Global Fresh Pet Food Market Study?

+

-

Which region holds the second position by market share in the Fresh Pet Food market?

+

-

How are the key players in the Fresh Pet Food market targeting growth in the future?

+

-