Global Fresh and Seafood Absorbent Pads Market – Industry Trends and Forecast to 2030

Report ID: MS-2132 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

Fresh and Seafood Absorbent Pads Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

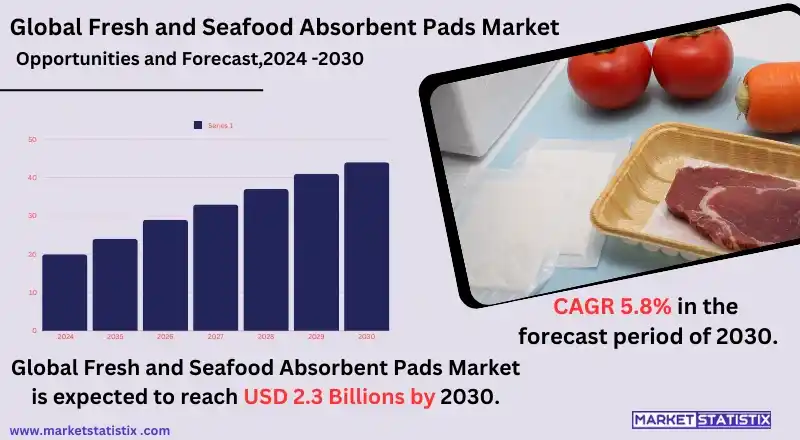

| Growth Rate | CAGR of 5.8% |

| Forecast Value (2030) | USD 2.3 Billion |

| By Product Type | Universal Absorbent Pads, Oil Absorbent Pads, Hazmat Absorbent Pads |

| Key Market Players |

|

| By Region |

|

Fresh and Seafood Absorbent Pads Market Trends

The global demand for fresh and seafood absorbent pads is escalating due to the rising demand for food safety and quality. These pads are designed to preserve food such as seafood and other perishable products by soaking in excess moisture during storage and transport to avoid spoilage and enhance the product’s shelf life. The increasing number of fresh seafood consumers, plus the inevitable rise in sustainable packaging solutions, are other aspects of the market forcing it to grow, with the consumers searching for ways of packing food without harming the environment. Besides this, material technology is also shaping the market trends as the manufacturers are coming up with more advanced, eco-friendly absorbent pads, which are made of degradable or recyclable materials, due to innovations. This trend is strongly reinforced by regulation as well as by customer surveys that show a marked preference for greener alternatives. Retailers and foodservice providers are finding more of these pads due to the demand for seafood products that last longer and are fresher, with suppliers improving the performance and cost of the absorbent materials for use by both producers and consumers.Fresh and Seafood Absorbent Pads Market Leading Players

The key players profiled in the report are W. Dimer GmbH (Germany), Pactiv LLC (U.S.), ESP Sorbents (U.S.), Cellcomb AB (Sweden), Novipax LLC (U.S.),, Brady Corporation (U.S.), AptarGroup Inc. (U.S.), Sirane Limited (U.K.), Cool-Direct (U.K.), Elliott Absorbent Products (U.K.), Meltblown Technologies Inc. (U.S.), Fentex Ltd (U.K.), CoCopac (U.K.), Azapak (South Africa), 3M Company (U.S.)Growth Accelerators

The market for absorbent pads that are used for fresh and seafood applications is growing primarily with the growing need for packaged and processed types of seafood. This is used due to the fact that, driven by growing seafood demand, mainly from the retail and food service industries, this aspect of managing moisture level becomes very important, more so in transportation and storage. Absorbent pads restrict moisture diffusion into the product, thus enhancing its freshness, preventing spoilage due to bacterial growth, and thereby extending the lifespan of the product. This aspect makes such materials very important in the fresh seafood supply chain from the point it is harvested to the time the end user consumes it. Another key driver is the growing focus on food safety and sustainability. While there is an increasing appreciation amongst consumers for hygiene and quality, retailers and suppliers have to use absorbent pads not only for protection but also for increasing the appeal of fresh seafood. The quest for sustainable packaging options has also resulted in new developments in the materials used in making absorbent pads, where manufacturers are looking for ways to produce such products that are green or recyclable in response to the consumers that are looking for greener packaging.Fresh and Seafood Absorbent Pads Market Segmentation analysis

The Global Fresh and Seafood Absorbent Pads is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Universal Absorbent Pads, Oil Absorbent Pads, Hazmat Absorbent Pads . The Application segment categorizes the market based on its usage such as Red Meat, Poultry, Fish, Fruit & Vegetables. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Moreover, in this area of business, it can be observed that there are various alliances formed by the key players for the improvement of their technological capabilities and revenue scale. Sirane Limited and AptarGroup are among the companies that have been recognized for developing sustainable absorbent solutions, with the latest offerings from Sirane being recyclable materials for fruit packing. These measures are being taken not only to adapt to the changing consumer tastes for sustainability but also to reinforce the existing relations that could culminate into future mergers and acquisitions as companies try to pull together resources and skill sets to cater to the increasing fresh and seafood markets.Challenges In Fresh and Seafood Absorbent Pads Market

The absorbent pads market for refrigerated below-the-counter and seafood is significantly challenged by the factors such as increasing preference for eco-friendly and sustainable packaging materials amongst consumers. With the growing awareness of consumers and businesses to protect the environment, there is more demand to cut down on the use of plastic materials that are single-use and switch for the ones that are biodegradable or recyclable. In addition, developing and implementing these sustainable absorbent pads for use is expensive and has to deal with external factors that may inhibit the manufacturers desire to be cost-friendly to the environment by performance and cost; hence, therein lies the challenge. Meanwhile, the other factor is the unstable prices and supply of the raw materials that make the substrates for absorbent pads: cellulose and superabsorbent polymers. Due to these materials, they are affected by the supply chain, price changes, and quality issues attached, which in turn affects the production prices and the sales forecast. Moreover, another food safety regulatory and certification requirement limits the efficiency of the manufacturing process, thereby enhancing the costs and lead time for introducing the products in the market. These factors may restrict profit margin and retard the growth of the market segment.Risks & Prospects in Fresh and Seafood Absorbent Pads Market

The global fresh and seafood absorbent pads market is poised for growth due to increasing consumption of fresh and safe seafood. The main restraint includes the growing concerns regarding hygiene in processing and movement of seafood. Due to the rising global consumption of seafood, especially in North America, Europe, and Asia Pacific, the demand for absorbent pads comes into play to help enhance the storage and transport of fish and fish products devoid of exposing them to unfavourable conditions that may compromise their quality. The growing awareness among the consumers and the food businesses regarding contamination and spoilage is also contributing to the demand for such protective pads. Further, improving innovations in absorbent pad packaging is able to negate the concerns of plastic waste. Manufacturers are actively producing and sourcing one-way absorbent pads that do not cause pollution by biodegradability or are recyclable in order to comply with the requirements of the consumers and legislations regulating food packing industries. Absorbent materials that help in the maintenance of product quality during checking out and shipping to consumers are also on the rise with the changing trends, especially with the growth of the e-commerce seafood business. Therefore, there is a huge demand for creative and green technologies geared toward making absorbent pad solutions that will cater to the needs of the seafood industry.Key Target Audience

The core demographic of the global fresh and seafood absorbent pads market comprises fresh food and seafood-related industries such as food processors, wholesalers, and retailers. These organizations extensively use absorbent pads so as to shield the products and uphold their freshness from the time of storage to the time of display or sales. Absorbent pads are also used in supermarkets, seafood markets, and foodservice establishments for the fresh fish, shellfish, and other perishable commodities for hygiene purposes and aesthetics for the consumers for a longer time.,, Besides them, there are packaging companies and producers of absorbent materials, who are important, as their involvement is essential because they develop such products that are suited to the requirements of certain food industries. Also, thanks to the exporters and distributors who operate within the global seafood market, there is demand for this type of product since they also need good quality absorbent pads for transporting seafood products over long distances.Merger and acquisition

Recent trends in the mergers and acquisitions in the fresh and seafood absorbent pads market show that the focus has shifted to product portfolio development and increasing the market share. Of particular interest is Novipax, which is known for the manufacture of absorbent pads and whose activities have been geared towards strengthening the market dominance. In February 2023, Novipax announced the relaunch of its XtendaPak absorbent pad, this time targeted at the food pouching sector, which is supposed to extend the shelf life of chicken, meat, and seafood alike. Customers are looking for such innovative solutions, which is why the development of the product itself is becoming a competitive strategy within companies, and this is shown by the way these companies are innovating into the products.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Fresh and Seafood Absorbent Pads- Snapshot

- 2.2 Fresh and Seafood Absorbent Pads- Segment Snapshot

- 2.3 Fresh and Seafood Absorbent Pads- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Fresh and Seafood Absorbent Pads Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Universal Absorbent Pads

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Oil Absorbent Pads

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Hazmat Absorbent Pads

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Fresh and Seafood Absorbent Pads Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Red Meat

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Poultry

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Fish

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Fruit & Vegetables

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Fresh and Seafood Absorbent Pads Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 W. Dimer GmbH (Germany)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Pactiv LLC (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 ESP Sorbents (U.S.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Cellcomb AB (Sweden)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Novipax LLC (U.S.)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Brady Corporation (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 AptarGroup Inc. (U.S.)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Sirane Limited (U.K.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Cool-Direct (U.K.)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Elliott Absorbent Products (U.K.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Meltblown Technologies Inc. (U.S.)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Fentex Ltd (U.K.)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 CoCopac (U.K.)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Azapak (South Africa)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 3M Company (U.S.)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Fresh and Seafood Absorbent Pads in 2030?

+

-

What is the growth rate of Fresh and Seafood Absorbent Pads Market?

+

-

What are the latest trends influencing the Fresh and Seafood Absorbent Pads Market?

+

-

Who are the key players in the Fresh and Seafood Absorbent Pads Market?

+

-

How is the Fresh and Seafood Absorbent Pads } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Fresh and Seafood Absorbent Pads Market Study?

+

-

What geographic breakdown is available in Global Fresh and Seafood Absorbent Pads Market Study?

+

-

Which region holds the second position by market share in the Fresh and Seafood Absorbent Pads market?

+

-

How are the key players in the Fresh and Seafood Absorbent Pads market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Fresh and Seafood Absorbent Pads market?

+

-