Global Fast Casual Restaurants Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-748 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Fast Casual Restaurants Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

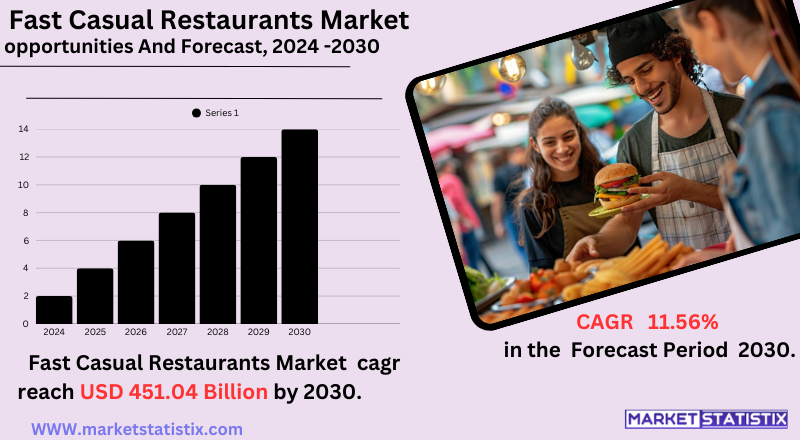

| Growth Rate | CAGR of 11.56% |

| Forecast Value (2030) | USD 451.04 Billion |

| By Product Type | Burger/Sandwich, Pizza/Pasta, Chicken, Asian/Latin American Food, Others |

| Key Market Players |

|

| By Region |

Fast Casual Restaurants Market Trends

A very significant trend is the rising nutrition and sustainability-in-food outlook for the customers. The more health-conscious consumers are concerning themselves with how their food is put together and where it is sourced from, which has caused fast-casual restaurants to emphasise fresh, high-quality, and often locally sourced produce. Plant-based menu items are springing up everywhere, and there is an increased focus on transparency concerning food origins and culinary processes. And customisation remains a big trend, where several fast-casual places allow customers the option of third ingredients and combinations to meet their dietary preferences and individual tastes. Technology integration to augment customer experience and operational efficiency is another key trend. It comprises widespread acceptance of online ordering systems, mobile applications for ordering and loyalty programmes, and digital kiosks for ordering in-store. Also, many fast-casual restaurants are taking up delivery either on their own or via partners; third-party delivery apps create an avenue to cater to the growing demand for off-premises dining.Fast Casual Restaurants Market Leading Players

The key players profiled in the report are Qdoba Mexican Eats, Zaxby's, Five Guys, Sweetgreen, Panda Express, Wingstop, Chipotle Mexican Grill, Noodles & Company, Panera Bread, Jersey Mike's Subs, CAVA, Blaze Pizza, MOD Pizza, Shake Shack, Pret A MangerGrowth Accelerators

The fast-casual restaurant market is being fully driven by changing behaviours and shifting lifestyle patterns. The first is increasing demand for distinctly better food compared with all that traditional fast food has to offer, with none of the formal or higher costs characteristic of casual dining. The other forms of consumer demand come from those millennials and Gen Z, who crave freshly prepared, customizable, mostly healthier dishes, organic and often locally sourced, along with the convenience that fast casual has actually been providing. Fast casuals have filled that niche with quick, attractive service. Another major catalyst is undoubtedly technology. It is in the fact that online ordering systems, mobile apps, and third-party delivery services have all combined to provide their customers with improved access and convenience. That is, fast casuals can afford to move beyond their four walls and fill a larger pool of customers with this full-fledged existence in the digital world. It is better than opening a full-service restaurant in that its entry barriers are comparatively lower. Yet it also holds the potential for high profits, fuelling entrepreneurship and market growth.Fast Casual Restaurants Market Segmentation analysis

The Global Fast Casual Restaurants is segmented by Type, and Region. By Type, the market is divided into Distributed Burger/Sandwich, Pizza/Pasta, Chicken, Asian/Latin American Food, Others . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The fast-casual restaurant industry is quite competitive, with old and huge national and international chains on the one hand and a large number of regional small chains on the other hand. The competitive environment is thereby defined by such factors as name recognition, menu development, price point, speed of service, restaurant ambiance, and nature and source of ingredients. Major players generally benefit through economies of scale in purchasing and marketing and enjoy strong brand allegiance as well as a wide geographical outreach. In fact, these amenities allow establishing and opening new concepts and niche entrants in specific cuisine or dietary trends given the relatively lower barriers to entry compared to full-service dining.Challenges In Fast Casual Restaurants Market

The fast-casual restaurant industry is marred with chronic supply chain disruptions, fluctuating raw material prices, and inflationary tendencies in several primary markets. Such factors have increased the input costs tremendously, putting a squeeze on profit margins, despite a high consumer demand. These increased operational difficulties are further complicated by stringent regulations on food safety standards and labelling. The geopolitical uncertainties involved – such as tariff changes under the new U.S. administration – are driving additional unpredictability in international trade and procurement strategies. Increasing competition from other segments of the food service industry serves as another hindrance, requiring fast-casual restaurants to innovate ever so often to remain in the market. Balancing affordability with fast-changing preferences is another serious obstacle ahead. Increasingly, there is a demand for healthier, organic, and customizable menu options that may involve more costly quality ingredients, sustainable practices, and, on occasion, even upgrading the formulating chain. Cloud kitchens and delivery services present stiff competition by lowering barriers to entry for new players. Financially, digitalisation and automation required to streamline processes may prove to be another major challenge for smaller establishments.Risks & Prospects in Fast Casual Restaurants Market

The main growth drivers are the low initial investment in cloud kitchens and advances in technology, such as the introduction of online ordering and delivery services, which directly facilitate consumer convenience. The demand for locally grown organic ingredients is synchronised with the increasing consumer focus on sustainability and quality, thus furnishing opportunities for innovative menu creation. In terms of regions, North America leads the market, with the largest share due to established restaurant chains and adoption of digital solutions, while Europe is forecast to increase at a faster pace. In Europe, a high standard of living linked to large disposable income, a penchant for locally sourced, organic products, and busy lifestyles converge to make fast-casual dining an appealing prospect. Emerging markets in the Asia-Pacific region will also provide growth opportunities due to increased urbanisation and changes in food habits. Industry leaders such as Chipotle Mexican Grill and Five Guys Enterprises have capitalised on these regional dynamics and trends to widen their global reach.Key Target Audience

The fast-casual restaurant niche is primarily addressed to a young demographic: Millennials and Generation Z are hot for a quick food experience without sacrificing food quality. These consumers favour offers for fresh, customizable, and healthier meal choices interlocked with their busy lifestyles and health-conscious preferences. What matters is the equilibrium between convenience and quality, offering a dining experience that connects with their value system and expectations.,, Also, fast-casual restaurants appeal to urban professionals, families, and health-conscious people with varying income levels. Urban professionals appreciate the convenience of these restaurants because they merge well with their hectic lifestyles. Families are interested in gourmet options with diverse, customizable menus so that tastes and dietary needs are being catered for. The health-conscious client is attracted to fresh ingredients, locally sourced culinary innovations, and other offerings.Merger and acquisition

The fast-casual restaurant industry saw various mergers and acquisitions during 2024, showcasing its dynamic evolution. In what was the industry's largest acquisition during the period, private equity Blackstone acquired Jersey Mike's Subs for almost $8 billion to enhance its growth and technological capability. In that vein, Blackstone also invested about $2 billion in Tropical Smoothie Café, further emphasising its desire to grow its restaurant portfolio. Meanwhile, Freddy's Frozen Custard & Steakburgers was looking for a greater-than-$1 billion sale, attracting interest from a variety of investment funds. Also, Azzurri Group acquired Boojum, a Mexican fast-food chain, in a deal worth €27 million, intended to diversify its offerings and appeal to a wider customer base. These strategic moves indicate that the industry is focused on growth, diversification, and fast adaptation to changing consumer preferences. >Analyst Comment

Rising consumer desire for healthy, customizable, and quickly prepared food is responsible for the rapid growth of the fast-casual restaurant market. Valued at $179.19 billion in 2024, the market is projected to reach $191.02 billion by 2025. Fast-casual restaurants deliver a fast-food experience blended with a casual dining setting, serving a wide variety of menu options with salads, bowls, burgers, and ethnic-inspired foods served using quality organic ingredients from local growers. Growth in this segment is buoyed by its health-conscious options and affordability compared to fine dining, as well as creative service models for takeaway and cloud kitchens.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Fast Casual Restaurants- Snapshot

- 2.2 Fast Casual Restaurants- Segment Snapshot

- 2.3 Fast Casual Restaurants- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Fast Casual Restaurants Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Burger/Sandwich

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Pizza/Pasta

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Asian/Latin American Food

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Chicken

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Chipotle Mexican Grill

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Panera Bread

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Shake Shack

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Five Guys

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Noodles & Company

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Panda Express

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Wingstop

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Zaxby's

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Qdoba Mexican Eats

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Blaze Pizza

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 Jersey Mike's Subs

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 MOD Pizza

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

- 6.13 Sweetgreen

- 6.13.1 Company Overview

- 6.13.2 Key Executives

- 6.13.3 Company snapshot

- 6.13.4 Active Business Divisions

- 6.13.5 Product portfolio

- 6.13.6 Business performance

- 6.13.7 Major Strategic Initiatives and Developments

- 6.14 CAVA

- 6.14.1 Company Overview

- 6.14.2 Key Executives

- 6.14.3 Company snapshot

- 6.14.4 Active Business Divisions

- 6.14.5 Product portfolio

- 6.14.6 Business performance

- 6.14.7 Major Strategic Initiatives and Developments

- 6.15 Pret A Manger

- 6.15.1 Company Overview

- 6.15.2 Key Executives

- 6.15.3 Company snapshot

- 6.15.4 Active Business Divisions

- 6.15.5 Product portfolio

- 6.15.6 Business performance

- 6.15.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Fast Casual Restaurants in 2030?

+

-

Which type of Fast Casual Restaurants is widely popular?

+

-

What is the growth rate of Fast Casual Restaurants Market?

+

-

What are the latest trends influencing the Fast Casual Restaurants Market?

+

-

Who are the key players in the Fast Casual Restaurants Market?

+

-

How is the Fast Casual Restaurants } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Fast Casual Restaurants Market Study?

+

-

What geographic breakdown is available in Global Fast Casual Restaurants Market Study?

+

-

Which region holds the second position by market share in the Fast Casual Restaurants market?

+

-

How are the key players in the Fast Casual Restaurants market targeting growth in the future?

+

-