Global Electric Vehicle Charging Plugs Market Trends and Forecast to 2030

Report ID: MS-625 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Electric Vehicle Charging Plugs Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

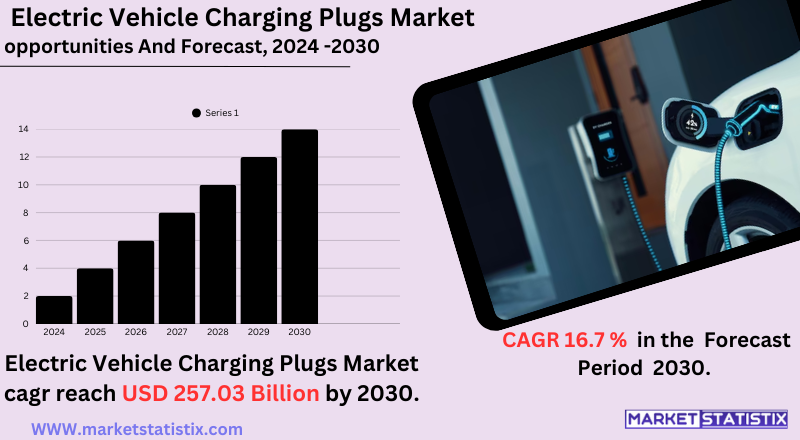

| Growth Rate | CAGR of 16.7% |

| Forecast Value (2030) | USD 257.03 Billion |

| By Product Type | Fast, Slow/Moderate |

| Key Market Players |

|

| By Region |

Electric Vehicle Charging Plugs Market Trends

Standardization is one of the most important trends, working toward harmonization of plug types and charging protocols among different regions to guarantee interoperability. The growing spread of Combined Charging System (CCS) and CHAdeMO standards for fast DC charging and the twisting of AC charging plugs for use in homes and in public are part of it. Changing the scene for innovative smart charging solutions is another market trend. IoT technologies are being integrated so remote monitoring can take place, along with dynamic load management and hassle-free payment systems. The other trends currently unfolding are the development of green charging systems and the research behind vehicle-to-grid (V2G) offerings. These trends will go a long way toward bringing convenience and maintaining grid stability. Automakers, providers of charging infrastructure, and technology companies are increasingly teaming up to ramp up the deployment of reliable and efficient charging solutions, addressing the need for electric-mobility solutions.Electric Vehicle Charging Plugs Market Leading Players

The key players profiled in the report are Schneider Electric (France), EVBox (Netherlands), ABB (Switzerland), Tesla (U.S.), Webasto Group (Germany), Blink Charging Co. (U.S.), Siemens AG (Germany), Eaton (Ireland), ChargePoint Inc. (U.S.), EO Charging (U.K.)Growth Accelerators

The market for electric vehicle (EV) charging plugs' —especially turbochargers—will be driven mostly by the increasing adoption of EVs globally. This new trend is expected to continue influencing political actions toward properly restricting traffic and heightening consumer-awareness initiatives on sustainable transport. It has led to the introduction of different policies to increase the purchase of EVs alongside the installation of charging infrastructure, which directly promotes the requirement for various charging plug types. Increasing public and private infrastructure investment for charging stations adds a significant advantage for market drivers. As public charging becomes more commonplace at homes, workplaces, and highways, it encourages users to own electric vehicles further. Charge standardization protocols and universal charging would be important for interoperability, lessening the anxiety of users over the use of electric vehicles. Technological innovation, such as smart charging and renewables integrated into charging, has resulted in the economic development of EV charging in a sustainable way for the future and continues to create value in the market.Electric Vehicle Charging Plugs Market Segmentation analysis

The Global Electric Vehicle Charging Plugs is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fast, Slow/Moderate . The Application segment categorizes the market based on its usage such as Commercial, Residential. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape for EV charging plugs is characterized by the presence of key players such as ChargePoint, Inc., Tesla, Inc., ABB Ltd., and Blink Charging Co., among others. These companies are focusing on strategic initiatives such as partnerships, acquisitions, and product innovations to strengthen their market position. For example, ChargePoint has made global acquisitions to increase its market presence in addition to having delivered over 87 million charging sessions to date. Similarly, ABB Ltd. is enhancing its manufacturing capability in the U.S. to serve and respond to the increasing demand for EV charging solutions. There are also rapid technological developments, with innovation in fast and ultra-fast charging solutions, wireless charging technologies, and smart grid integration.Challenges In Electric Vehicle Charging Plugs Market

The electric vehicle charging plugs landscape poses several challenges for its growth. High initial installation costs of charging infrastructure, including hardware, operational, and maintenance costs, constitute the major hurdle. Other limitations to large-scale deployment of charging systems are deteriorating power tariffs and the requirement for utility-side upgrades, both of which will lead to greater financial and logistical constraints. The different problems and standards of plug integration in regions such as CCS, CHAdeMO, and GB/T add to the other challenges the market faces in terms of harmonizing global standards for compatibility among different EV models. Another hurdle is that the lack of dedicated charging spaces renders urban settings less accessible to EV users. Supply chain constraints and delays in the deployment of DC fast chargers serve to further compound that market slowdown. In addition, innovations intended to be customer-friendly, such as "Plug and Charge," are hindered by high costs and technical complexities, while uneven regional development of charging infrastructures—Europe being the latest planned rollout—greatly hinders mass adoption of EV charging plugs.Risks & Prospects in Electric Vehicle Charging Plugs Market

Potential opportunities are in the creation of common and speedy charging plugs for various models of EVs, apart from smart payment system integration to convenience users. Synergies between automobile and plug manufacturers are likely to promote ingenuity and increase usage across geographies. On a regional basis, Asia-Pacific has a strong hold on the market for EV charging plugs due to dedicated policies by governments, with some of the highest numbers of electric vehicles in China, Japan, and South Korea, in addition to urbanization. On the other hand, North America is growing quickly due to federal funding for EV infrastructure and the presence of several leading manufacturers of electric vehicles. Europe has followed closely with its strong supportive regulations on sustainable transport. Emerging markets in Latin America and the Middle East are also promising because of increasing investments toward clean energy solutions and developing electric vehicle fleets. Such regional dynamics undoubtedly highlight a global trend towards a sustainable transportation ecosystem.Key Target Audience

The Electric Vehicle (EV) Charging Plugs market primarily targets EV manufacturers, charging infrastructure providers, and end-users such as owners of residential and commercial properties. EV manufacturers are concerned with compatibility with different plug types like CCS, CHAdeMO, and GB/T depending on the different global markets that they are pursuing. Charging infrastructure companies, such as ChargePoint and ABB, represent a critical stakeholder group offering fast-charging technologies that correspond to the consumer's desire for convenience.,, Fleet operators and public transportation agencies are another critical target audience, as they require working charging solutions for large operations. Home charging solutions are steadily increasing in interest among residential users, especially in developed regions, whilst charging stations are being installed in commercial facilities such as malls and workplaces to woo EV users. The Asia-Pacific region is a major growth area, especially with China and India driving government incentives and extended EV infrastructure.Merger and acquisition

In efforts to fortify technological competency and market reach, the EV charging industry has witnessed many mergers and acquisitions (M&A) to consolidate. One such instance occurred in March 2023, when Shell USA acquired Volta Charging for somewhere around $169 million, thus adding Volta's 2,000-plus charging stations scattered across 23 U.S. states into its portfolio. On similar lines, in October 2023, Wallbox acquired the German EV charging and energy management company ABL GmbH for €15 million, with a view to strengthening its presence in the European market. Strategic partnerships have played an equally important role in the evolution of the industry. ChargeScape—a vehicle-to-grid integration initiative—welcomed Nissan in October 2024, together with BMW, Ford, and Honda, to help facilitate the communication between utility companies and EVs to optimize home charging and energy redistribution. In September 2024, Siemens announced plans to carve out its EV charging division, Siemens eMobility, and integrate it with Heliox, which specializes in DC fast-charging solutions, to take advantage of the growing EV charging market. These developments therefore underline the growing tendency towards consolidation to achieve economies of scale in response to the rapidly expanding global demand for EV infrastructure. >Analyst Comment

The Electric Vehicle (EV) Charging Plugs industry is witnessing rapid growth, with the global surge in EV adoption and a corresponding requirement for a firm charging infrastructure. The market is being driven primarily by strict government regulations promoting zero-emission vehicles, growing consumer awareness about environmental sustainability, and ongoing advancements in EV battery technology. The growing diversities in charging plug types necessitate the varying charging speeds and regional standards demanded in this dynamic environment. Considerable investments are being made in research and development to improve charging efficiency, reduce charging times, and provide interoperability among different EV models and networks.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electric Vehicle Charging Plugs- Snapshot

- 2.2 Electric Vehicle Charging Plugs- Segment Snapshot

- 2.3 Electric Vehicle Charging Plugs- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electric Vehicle Charging Plugs Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fast

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Slow/Moderate

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Electric Vehicle Charging Plugs Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Residential

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Siemens AG (Germany)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Eaton (Ireland)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 ChargePoint Inc. (U.S.)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 ABB (Switzerland)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Schneider Electric (France)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 EVBox (Netherlands)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Webasto Group (Germany)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Tesla (U.S.)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Blink Charging Co. (U.S.)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 EO Charging (U.K.)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Electric Vehicle Charging Plugs in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Electric Vehicle Charging Plugs market?

+

-

How big is the Global Electric Vehicle Charging Plugs market?

+

-

How do regulatory policies impact the Electric Vehicle Charging Plugs Market?

+

-

What major players in Electric Vehicle Charging Plugs Market?

+

-

What applications are categorized in the Electric Vehicle Charging Plugs market study?

+

-

Which product types are examined in the Electric Vehicle Charging Plugs Market Study?

+

-

Which regions are expected to show the fastest growth in the Electric Vehicle Charging Plugs market?

+

-

Which application holds the second-highest market share in the Electric Vehicle Charging Plugs market?

+

-

Which region is the fastest growing in the Electric Vehicle Charging Plugs market?

+

-