Global Egg White Powder High Gel Market – Industry Trends and Forecast to 2030

Report ID: MS-2173 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

Egg White Powder High Gel Report Highlights

| Report Metrics | Details |

|---|---|

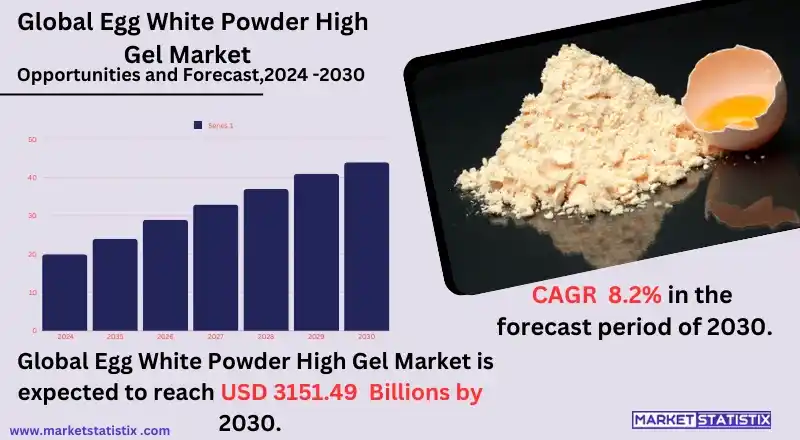

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.2% |

| Forecast Value (2030) | USD 3151.49 billion |

| By Product Type | High-whip egg white powder, High-gel egg white powder |

| Key Market Players |

|

| By Region |

|

Egg White Powder High Gel Market Trends

Currently the egg white powder high gel market experiences a steady rise owing to rising demands for protein ingredients available in food and beverage, cosmetics, and pharmaceuticals. Owing to the rise in health consciousness, individuals prefer diets rich in protein, wherein egg white powder is one of the best sources because of its high amount of protein and functional characteristics. The current trend on plant-based alternatives has also sparked the interest in egg white powder because it is an excellent non-dairy replacement for protein shakes, bakery products, and plant-based meat alternatives. Cosmetics use egg white powder for high gel formulations, too. It is also gaining demand in this segment, especially for skin-tightening, moisturising, and anti-ageing applications because of its natural protein efficacy. The market utilises all such advantages coming from development in food processing and packaging technologies to improve shelf life and increase the stability of products.Egg White Powder High Gel Market Leading Players

The key players profiled in the report are Wilbur-Ellis Company, Eipro™ Egg Products, Taiyo Kagaku Co., Ltd., Sanovo Egg Group, Dai-Ei Corporation, Meggle Group, Cavatina Foodservice, Ingredion Incorporated, OVOBEL Foods Limited, Agrocorp InternationalGrowth Accelerators

There has been a growing demand for functional and quality ingredients among food and beverages, pharmaceuticals, and cosmetics sectors, which would cause the egg white powder high gel industry to thrive in time to come. Egg white powder is a prized form because of its rich protein density and lower fat content. It also has a most commonly encountered property of versatile gel formation, which makes it an indispensable factor in numerous applications such as baking, protein supplements, and personal care products. The increased tendency toward health-pondering diets in conjunction with the rising popularity of such high-protein diets has increased the demand for egg white powder as an excellent natural, nutrient-rich ingredient. Another key driver in the market is an increase in awareness and preference for plant-based and allergen-free alternatives. The egg white powder is becoming popular among the various consumers who are searching for clean label products, e.g., gluten-free, dairy-free, and vegan food products. Apart from that, more people are turning their attention to sports nutrition and functional foods, requiring a higher demand for egg white powder because of its high gel strength and protein efficiency. Further, innovative processing technologies, as well as the availability of customised formulations, are adding up to boost its market potential to ensure sustained growth for the industry.Egg White Powder High Gel Market Segmentation analysis

The Global Egg White Powder High Gel is segmented by Type, Application, and Region. By Type, the market is divided into Distributed High-whip egg white powder, High-gel egg white powder . The Application segment categorizes the market based on its usage such as Food and beverages, Personal care, Confectionery, Dietary Supplements, Ready-to-Eat Meals, Meat and Seafood Products, Infant Nutrition, Other applications. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The egg white powder high gel market is composed of several giant players; these include Rembrandt Foods, Sanovo, and Rose Acre Farms. These companies are said to be the frontrunners of this market due to their well-maintained manufacturing facilities coupled with the extensive global distribution network that these companies hold. They invest in technological advancements through improved production processes and highly functional gel egg white powder. Not only do these players invest towards fulfilling such increasing demand for functional and clean-label products for such industries, but they are also emerging as key suppliers for the food and beverage and sports nutrition industries and pharmaceuticals at large. Apart from that, demand in the industry is caused by the changing trend toward consuming more environmentally friendly and healthier alternatives. All these are components of high-protein, low-fat food ingredients. This brings up the idea of organic egg white powder, which can be certified as vegan and manufactured from pure egg whites. Manufacturers are now interested in introducing organic and vegan egg white powder options to add diversification to the competitive scene.Challenges In Egg White Powder High Gel Market

The egg white powder high-gel market has a number of problems, mostly regarding sourcing and supply chain. The perfect eggs must be under strict quality control practices with careful management in egg sourcing and processing to produce high egg white powder. Changes in egg supply due to avian diseases, for instance, or even the differences in poultry farming practices can directly affect the consistency of production. Even as the raw materials' prices shoot up, a direct consequence of increased pressure on producers from global supply chain interruptions is that they will have to keep those prices low at the expense of highly maintained quality products. Another problem that is observed in this market is competition with other sources of protein, namely plant-based proteins and synthetic egg whites. The prices are dropping because many people do not think they need to ingest animal-based sources for products whose functional benefits of gelling and foaming they claim to mimic. Additionally, they do not go through allergy problems.Risks & Prospects in Egg White Powder High Gel Market

The high gel egg white powder market has outstanding potential in terms of demand for functional food ingredients, majorly in health and wellness. High gel egg whites are the richest in gelling and foaming abilities and find applications in a number of food types, including baked products, beverages, confectionery, and sports nutrition. The trend among consumers towards food products that are protein-rich, low-fat, and clean-label positions egg white powder as one of the most attractive options, and as such, food manufacturers have attractive options in this segment for meeting space needs; thus, market potential increases. Besides food, egg white powder holds opportunities in cosmetics and medicines, where it is appreciated for its skin-tightening and nourishing properties. Thus, demand may grow thanks to the rising popularity of natural and organic personal care products. As market demand for plant-based and vegan substitutes is also surging, innovations related to egg white powder substitutes from sources like plants may create cash streams for producers.Key Target Audience

Okay, so the target consumers in the high gel egg white powder industry are food and beverage manufacturers, with a big tilt towards baked items, confectionery, and sports nutrition. It is primarily used to improve texture, structure, and protein content in egg white powder products. Egg white powder is lovable in meal replacements, protein bars, and beverages since these are the types of market products, we're selling for a growing market segment of health-conscious consumers who want functional and protein-rich foods.,, Besides, egg white powder is extensively used by the food industry in this respect; the other sectors are proper industries: the pharmaceutical and cosmetics industries, which consume egg white powder. Egg white powder is used by these sectors for the nature of its emulsifying and gelling properties. Into that, there are limited pharmaceutical companies that purchase egg white powder to be incorporated into vaccine and other formulation production. To the cosmetic industry, egg white powder-based products are employed in products that have skincare moisturising and healing properties. These sectors keep growing because of an increased appetite among consumers for natural and high-quality ingredients.Merger and acquisition

The recent trend of mergers and acquisitions in the high-gel egg white powder industry shows an active picture of the market as firms target product improvement and geographical expansion. One such company is Tate & Lyle PLC, which keeps making strategic acquisitions and partnerships to enhance its presence in the egg white powder sector of the food ingredients market. This is in line with the ever-increasing demand for egg white products of high quality across applications such as bakery and confectionery. The company's strategy of focusing on innovation and pursuing acquisitions to broaden its portfolio is no different from what other key players in the industry are doing to put themselves in a better position to share in an anticipated market growth to $2.5 billion by 2032. Notable examples include Cargill, Incorporated and Glanbia plc, two notable players that are engaging heavily in mergers and acquisitions to strengthen their foothold in the egg white powder high gel market. These would also be complemented by extensive networks created across countries to cover distribution and product development to capture consumer trends leaning towards functional and nutritious food ingredients.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Egg White Powder High Gel- Snapshot

- 2.2 Egg White Powder High Gel- Segment Snapshot

- 2.3 Egg White Powder High Gel- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Egg White Powder High Gel Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 High-whip egg white powder

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 High-gel egg white powder

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Egg White Powder High Gel Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food and beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Personal care

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Confectionery

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Dietary Supplements

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Ready-to-Eat Meals

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Meat and Seafood Products

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Infant Nutrition

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Other applications

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

6: Egg White Powder High Gel Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Wilbur-Ellis Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Eipro™ Egg Products

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Taiyo Kagaku Co.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Sanovo Egg Group

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Dai-Ei Corporation

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Meggle Group

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Cavatina Foodservice

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Ingredion Incorporated

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 OVOBEL Foods Limited

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Agrocorp International

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Egg White Powder High Gel in 2030?

+

-

How big is the Global Egg White Powder High Gel market?

+

-

How do regulatory policies impact the Egg White Powder High Gel Market?

+

-

What major players in Egg White Powder High Gel Market?

+

-

What applications are categorized in the Egg White Powder High Gel market study?

+

-

Which product types are examined in the Egg White Powder High Gel Market Study?

+

-

Which regions are expected to show the fastest growth in the Egg White Powder High Gel market?

+

-

What are the major growth drivers in the Egg White Powder High Gel market?

+

-

Is the study period of the Egg White Powder High Gel flexible or fixed?

+

-

How do economic factors influence the Egg White Powder High Gel market?

+

-