Global Earthquake Early Warning System Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-623 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

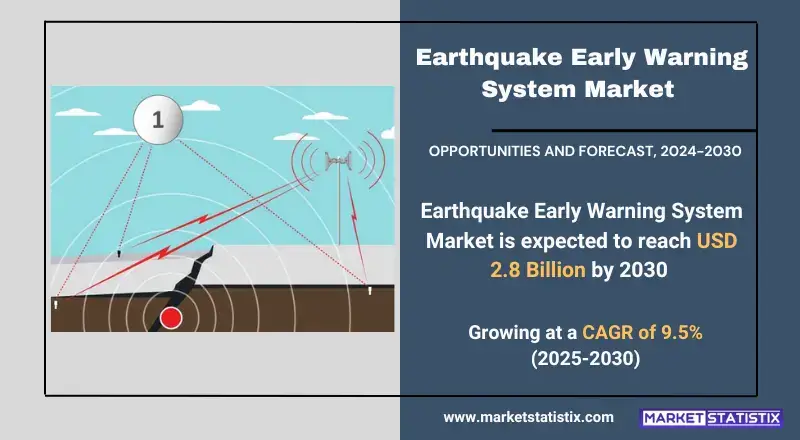

Earthquake Early Warning System Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 9.5% |

| Forecast Value (2030) | USD 2.8 Billion |

| By Product Type | Software, Sensors, Services |

| Key Market Players |

|

| By Region |

Earthquake Early Warning System Market Trends

A very significant trend is an increased governmental and public-sector investment in EEWS infrastructure, especially in regions prone to earthquakes. Governments are starting to understand the importance of these systems and their role in reducing the impact of earthquakes and protecting lives and property. Hence, national and regional EEWS networks are being developed, implemented, and integrated into urban planning and infrastructure development. There is additional focus on launching public education and awareness campaigns so members of the public know how to respond to early warnings in a manner that maximizes the benefits deriving from these life-saving systems.Earthquake Early Warning System Market Leading Players

The key players profiled in the report are Reftek Systems Inc., Geosense Ltd., GeoSIG AG, Kinemetrics Inc., SeismicAI, Güralp Systems Ltd., QMI Manufacturing Inc., Seismic Warning Systems Inc., Mitcham Industries Inc., Seismicom Pte Ltd., GeoSIG Ltd., Rion Co., Ltd., Trimble Inc., Early Warning Labs LLC, Tokyo Sokushin Co., Ltd., Nanometrics Inc., OptiSense Network LLC, Zizmos Inc., Seismic Instruments Inc.Growth Accelerators

Market growth for the Earthquake Early Warning System (EEWS) is spurred by global awareness of seismic hazards, focusing very much on preparedness in case of calamities. Urban populations have been increasing in vulnerable areas to earthquakes, leading to high casualties or losses from massive destruction. Hence, governments and the private sector are investing in modern warning systems. Such horrifying increases, joined with the number of recorded activities occurring increasingly in the area, call for a demand to find reliable EEWS solutions. The artificial intelligence integration plus machine learning algorithm envisions greater prediction capacities within these systems. A government move toward making mandatory use of EEWS in essential infrastructure and other public spaces is further driving market growth.Earthquake Early Warning System Market Segmentation analysis

The Global Earthquake Early Warning System is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Software, Sensors, Services . The Application segment categorizes the market based on its usage such as Residential, Commercial, Government, Industrial. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the Earthquake Early Warning System (EEWS) market has been created with a lot of key players like SeismicAI, Jenlogix, Zizmos, and GeoSIG Ltd. These companies are involved in innovation, strategic partnerships, and geographical expansions, the way that they can best position themselves in the market. The industry now seems to be shifting toward advanced technologies such as artificial intelligence (AI) and machine learning (ML), which support enhanced prediction and response capabilities. The trend of public-private partnerships is also on the rise, wherein governments work together with research institutes and technology providers to develop sound systems as per regional specifications.Challenges In Earthquake Early Warning System Market

The major challenges to the broader adoption and effectiveness of an Earthquake Early Warning System (EEWS) are related to the high-cost development, deployment, and maintenance of such a system. For example, in the case of developing countries, costs incurred in building a dense network of seismic sensing and data processing centers, as well as a reliable communication infrastructure for the operation of these two, prohibit the establishment of the networks. Besides all these effective costs, maintenance and upgrading of the systems are continuous and incur monthly fees. Limited financial resources and other priorities in disaster risk reduction often limit most governments in seismically active regions from committing funds to EEWS infrastructure. Another difficulty is that the technical complexity involved in ensuring accurate and timely alerting is high. The Early Earthquake Warning System depends on the detection of the early seismic wave (P-wave), which functions as an indicator to give warning before the destructive waves arrive; however, it is still very difficult to predict with high precision due to variability in the dynamics of the earthquakes themselves. Public understanding and trust of these mechanisms have also proven to be a challenge. Many are not educated on how to react under warning conditions for effective functioning of such systems.Risks & Prospects in Earthquake Early Warning System Market

Public-private partnerships favour innovation, which is complemented by wide-ranging accessibility facilitated by mobile and cloud technologies. The faster-growing industry is expected, with North America in the lead owing to high seismic activity and big investments, followed by the Asia-Pacific regions of China and India focusing on resilient infrastructure. North America has a strong hold on the EEWS market, with advanced systems such as ShakeAlert in the U.S., with federal funding backing it. Japanese and Chinese firms are investing in advanced technologies, including extensive sensor networks, real-time data processing systems, and communication technologies. Europe is also growing, with government support geared towards improving seismic networks after moderate-impact earthquakes. Meanwhile, developing countries face challenges due to the high costs of installation and maintenance. However, global awareness in disaster preparedness still fuels market growth, as the integration of AI-based algorithms and fiber-optic monitoring opens new grounds for growth.Key Target Audience

The main target group for the EEWS market comprises government agencies, especially in seismically active areas such as Japan, Indonesia, and the Western United States, which will invest heavily in EEWS to mitigate earthquake damage and save lives. Initiatives to this end, such as the JMA in Japan and the ShakeAlert in the U.S. Geological Survey, exemplify the firm governmental commitment to public safety.,, Other significant target groups include operators of critical infrastructures, health institutions, transportation systems, and research institutions. Urban planners and developers in earthquake risk areas are showing a growing interest as the demand for reliable, robust early warning systems mounts with urbanization. At the same time, one can see an emerging trend of public-private partnerships and stakeholder collaboration to enhance the EEWSs' effectiveness, suggesting that providers of technology and local communities are becoming important parts of the target audience for these systems.Merger and acquisition

In recent years, M&A activities have been seen as strategic tools for businesses that want to consolidate their positions within the market or expand their technological capabilities. For example, Kinemetrics, Jenlogix, and Reftek Systems are some of the leading companies in the development of modern EEWS solutions. Although the available literature lacks details of any M&A activities undertaken by the mentioned companies, this overall trend in the market indicates a focus on collaborations and partnerships for improved product offerings and global reach. The entry of advanced technology, including alliances with artificial intelligence technologies and the integration of IoT devices, has raised the stakes among competitors to such a level that companies are now forming strategic alliances and acquisitions to counter this rapidly changing phenomenon. >Analyst Comment

The Earthquake Early Warning System (EEWS) market is rapidly growing because of the elevated global awareness of seismic risk, as well as improvement in technology. This refers to the creation, installation, and maintenance of earthquake warning systems designed to warn the public of impending destructive earthquake waves. An increase in government regulations demanding preparedness for disasters is one such key driver, with the protection of critical infrastructure also being another. Investment is being ramped up within the market in sensor technology, data processing software, and communication networks, all of which are critical to the existence of good early warning systems.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Earthquake Early Warning System- Snapshot

- 2.2 Earthquake Early Warning System- Segment Snapshot

- 2.3 Earthquake Early Warning System- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Earthquake Early Warning System Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Sensors

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Services

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Earthquake Early Warning System Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Government

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Residential

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Industrial

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Earthquake Early Warning System Market by Technology

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Seismic

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Geodetic

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Others

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Seismic Warning Systems Inc.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Early Warning Labs LLC

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 GeoSIG Ltd.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Kinemetrics Inc.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Rion Co.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 SeismicAI

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Nanometrics Inc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Güralp Systems Ltd.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Zizmos Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Tokyo Sokushin Co.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Ltd.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Reftek Systems Inc.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Trimble Inc.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 QMI Manufacturing Inc.

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Mitcham Industries Inc.

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Geosense Ltd.

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 OptiSense Network LLC

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Seismicom Pte Ltd.

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 GeoSIG AG

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 Seismic Instruments Inc.

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technology |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Earthquake Early Warning System in 2030?

+

-

How big is the Global Earthquake Early Warning System market?

+

-

How do regulatory policies impact the Earthquake Early Warning System Market?

+

-

What major players in Earthquake Early Warning System Market?

+

-

What applications are categorized in the Earthquake Early Warning System market study?

+

-

Which product types are examined in the Earthquake Early Warning System Market Study?

+

-

Which regions are expected to show the fastest growth in the Earthquake Early Warning System market?

+

-

Which region is the fastest growing in the Earthquake Early Warning System market?

+

-

What are the major growth drivers in the Earthquake Early Warning System market?

+

-

Is the study period of the Earthquake Early Warning System flexible or fixed?

+

-