Global E-Fuel Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-689 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

The E-Fuel Market concerns the production and distribution of electrofuels acting as synthetic fuels. The fuels are produced by combining captured carbon dioxide (CO₂) with hydrogen made from renewable electricity by electrolysis. Simply put, it is creating an energy-to-liquid or energy-to-gas with the objective of offering a carbon-neutral alternative to fossil fuels. This market is functional because of the growing need to decarbonize industries difficult to electrify directly, like aviation, maritime shipping, and heavy-duty transportation. E-fuels are important, for example, because they use current infrastructure. Since e-fuels can be made to be drop-in replacements for traditional fuels, they would function in current combustion engines and distribution networks without requiring massive overhauls. Progress in the production of renewable energies, especially advancements in carbon capture technologies and electrolysis efficiency, will define the growth in this market. Although still barely nascent, the E-Fuel Market is poised for substantial growth as the world looks toward sustainable solutions to ameliorate greenhouse gas emissions.

E-Fuel Report Highlights

| Report Metrics | Details |

|---|---|

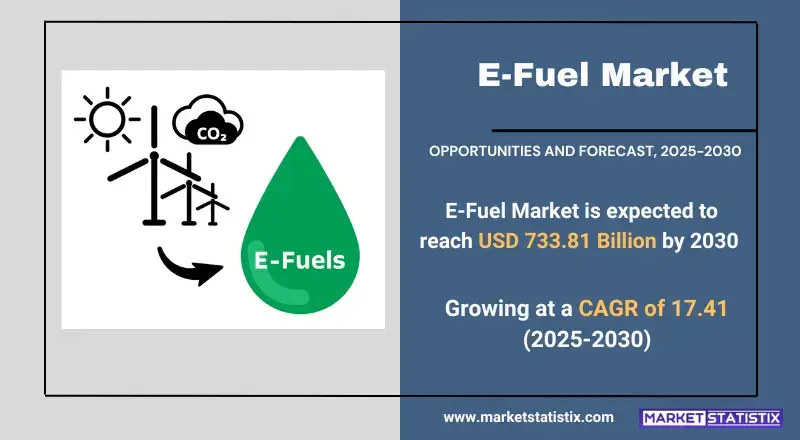

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 17.41% |

| Forecast Value (2030) | USD 733.81 Billion |

| By Product Type | E-gasoline, E-kerosene, E-methanol, Hydrogen, E-diesel, E-methane, Ethanol, Others |

| Key Market Players |

|

| By Region |

|

E-Fuel Market Trends

An important trend is the increase in investment into research and development, which is expected to enhance the efficiency and decrease the production costs of e-fuels. This includes technical developments in electrolysis, in carbon capture methods, and in the synthesis of different e-fuel types, especially in the production of e-kerosene and e-diesel. In addition to this, governments and regulatory authorities are really putting pressure on regions like Europe to develop policies and funding incentives that will drive the adoption of e-fuels, which is a major catalyst in market growth. Another noteworthy trend is the partnerships emerging among energy companies, automotive manufacturers, and the aviation industry for the construction of e-fuel production plants and the incorporation of these fuels into existing infrastructure. Such an alliance is necessary for the scaling-up of e-fuel production and its broad acceptance. Another trend being witnessed in the market now is the involvement of digital technologies and AI in optimizing the e-fuels production scheme.

E-Fuel Market Leading Players

The key players profiled in the report are Ceres Power Holding Plc, Archer Daniels Midland Co., Ballard Power Systems, Inc., E-Fuel Corporation, Clean Fuels Alliance America, Neste, Climeworks AG, Hexagon Agility, eFuel Pacific Limited, Norsk e-Fuel ASGrowth Accelerators

Eminent factors propelling the E-Fuel Market are mainly derived from the highly immediate global decarbonizing agenda. Tighter environmental regulations that include targets for carbon neutrality almost take precedence. Consequently, governments worldwide are devising policies that support or enforce the use of sustainable fuels, thereby generating good demand pull. In addition, the very need to cut down on emissions in industries where direct electrification seems to be a tough challenge—air travel and shipping—puts e-fuels among the prime contenders. The decreasing costs of renewable electricity, along with the developments in the areas of electrolysis or synthetic fuel production methods, greatly contribute to the current economic prospects for e-fuels. Moreover, the fact that e-fuels can be integrated with existing fuel infrastructure offers a meaningful opportunity, thus alleviating the need for an entirely new infrastructure framework that is usually expensive. Combined with the fast-growing corporate interest and activities towards sustainability, this will give high momentum to e-fuel expansion in the market.

E-Fuel Market Segmentation analysis

The Global E-Fuel is segmented by Type, Application, and Region. By Type, the market is divided into Distributed E-gasoline, E-kerosene, E-methanol, Hydrogen, E-diesel, E-methane, Ethanol, Others . The Application segment categorizes the market based on its usage such as Automotive, Marine, Industrial, Aviation, Railway, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario in the E-Fuel Market is mixed by established energy companies, promising startups, and technology providers. Key players are after taking dominant positions in different hydrogen production, carbon capture, or synthetic fuel synthesis segments. This competition arises out of the increasing global demand for sustainable fuels, which often urges heavy investments in research and development to enhance efficiency and reduce production costs. Such factors also include the prevailing technological trends, government regulations, and availability of renewable energy sources. For example, companies develop proprietary technology to gain a competitive advantage in advanced electrolysis and efficient carbon capture. The competition is expected to intensify to this very high level as soon as the market phase is reached, and then it will be on how much production volume scales up to meet the demands of e-fuels in aviation and maritime transport at more optimized supply chain levels.

Challenges In E-Fuel Market

Significant obstacles hinder large-scale deployment and economic feasibility of e-fuels. One of the prominent challenges is the high cost of production, which involves expensive processes such as the production of green hydrogen, CO₂ capture, and synthesis. These energy-intensive processes require heavy investments in renewable energy infrastructure, thus giving e-fuels less opulence compared with fossil fuels, which are cheaper. Moreover, e-fuel production remains limited in scalability by widespread infrastructure requirements for storage, distribution, and integration into existing systems. Technological inefficiencies aggravate the situation since current means are still in pilot phases, unable to supply global energy demands efficiently. On top of that, supportive policies and incentives are required to obtain a kind of bridge from production costs to market demand. Without any mandates or subsidies reducing production costs for e-fuels or penalizing emissions of traditional fuels, e-fuels may not gain much traction in the market. All these challenges will need an advancement in technology, economies of scale, and active government intervention before they can make e-fuels a serious alternative for fossil fuels.

Risks & Prospects in E-Fuel Market

The electrification becomes limited from both technical and infrastructural perspectives in the aviation and shipping sectors as well as in heavy transport. Sustainable aviation fuels are becoming increasingly prominent on the production front. Government funds and policies such as those of the EU, which enshrined carbon neutrality by 2050, stimulate investments in e-fuel facilities. Other innovations in electrolysis and carbon capture processes have reduced costs to produce and scaled up the volumes of e-fuels, making the products economically attractive as substitutes for fossil fuels. Geographically, Europe is currently setting the pace in e-fuels on account of its strong regulatory framework as well as its substantial renewable energy infrastructure. The region is likely to retain the first position with huge investments in green energy initiatives. North America is favoured for rapid growth since it adopted policies such as the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standards (LCFS). Lastly, the Asia-Pacific region is on track as a promising marketing framework owing to industrialization and increased awareness of environmental conservation.

Key Target Audience

E-fuels target primarily the automotive manufacturers, the aviation and marine industries, and the governments focusing on sustainability. With respect to automotive and associated heavy-duty transporters, investments in e-fuels represent a viable option toward decarbonizing internal combustion engines and intervening against dependence on fossil fuels while continuing to use the existing infrastructure. As far as the aviation and maritime industries are concerned, e-fuels appear to be a prospective way to comply with the stringent regulations on carbon emissions while serving long-term carbon neutrality objectives. Another primary audience is fuel producers and technology developers, in this case also including consumers who are trying for greener alternatives. E-fuels mean future opportunities for refining companies and energy companies that want to diversify the business portfolio into the renewable fuel production side. A large number of research institutions and tech firms are investing considerably in advancing e-fuel production technologies, improving efficiency, and thereby reducing costs. All of the above clearly show the examples of market drivers contributing to the increasing importance of e-fuels in the global energy transition.

Merger and acquisition

The e-fuel market has enjoyed many mergers and acquisitions as companies look to bolster their positions in sustainable energy. In January 2023, VARO Energy acquired 80 percent of Bio Energy Coevorden BV, which is one of the biggest biogas producers in Europe and strengthens its biogas production potential. VARO also increased its stake in E-Flux to 67.9 percent and intends to invest heavily for the purpose of market expansion across many European countries. The company purchased Renewable Energy Services, a biogas trading company, thereby enlarging its biogas trading business across ten European countries. VARO, moreover, declared plans to invest $600 million in the building of a major Sustainable Aviation Fuel (SAF) manufacturing site in Rotterdam, with a target of fulfilling up to 7 % of the EU's 2030 SAF goal. The U.S.-based Sunoco LP has also been active in the expansion of its terminal network. The acquisition of Zenith Energy for a total of 16 refined product terminals along the East Coast and Midwest was finalized in May 2023. This acquisition increased Sunoco's midstream infrastructure and storage capabilities considerably. These acquisitions, made as part of the strategic expansion, reflect capital expenditure trends across the sector geared towards meeting the growing investment demands for e-fuels and sustainable energy solutions.

>Analyst Comment

With the growing population and demand for sustainable energy solutions along with reducing fossil fuel dependence, the e-fuel market is booming. The value of the e-fuel market was USD 43.84 billion in 2022, and it is expected to further grow to USD 293 billion by 2031 during the forecast period. Major drivers include the advancement in renewable energy technologies, government incentives, and increasing carbon emission regulations. Substantial use of e-fuels, such as e-diesel and hydrogen, is being witnessed across major industries, transportation, and power generation, where their reduced greenhouse gas emissions and usage with existing internal combustion engine infrastructure are increasingly attractive, all these with negligible modifications to their combustion engine infrastructure.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 E-Fuel- Snapshot

- 2.2 E-Fuel- Segment Snapshot

- 2.3 E-Fuel- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: E-Fuel Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 E-diesel

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 E-gasoline

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Ethanol

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Hydrogen

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 E-kerosene

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 E-methane

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 E-methanol

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Others

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: E-Fuel Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Automotive

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Marine

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Railway

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Aviation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: E-Fuel Market by State

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Liquid

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Gas

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: E-Fuel Market by Production Method

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Power-to-liquid

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Power-to-gas

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Gas-to-liquid

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Biologically derived fuels

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: E-Fuel Market by Technology

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Hydrogen technology (Electrolysis)

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Fischer-tropsch

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Reverse-water-gas-shift (RWGS)

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

9: E-Fuel Market by Carbon Source

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 Point source

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Smokestack

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

- 9.4 Gas well

- 9.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.2 Market size and forecast, by region

- 9.4.3 Market share analysis by country

- 9.5 Direct air capture

- 9.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.2 Market size and forecast, by region

- 9.5.3 Market share analysis by country

10: E-Fuel Market by Carbon Capture

- 10.1 Overview

- 10.1.1 Market size and forecast

- 10.2 Post-combustion

- 10.2.1 Key market trends, factors driving growth, and opportunities

- 10.2.2 Market size and forecast, by region

- 10.2.3 Market share analysis by country

- 10.3 Pre-combustion

- 10.3.1 Key market trends, factors driving growth, and opportunities

- 10.3.2 Market size and forecast, by region

- 10.3.3 Market share analysis by country

11: E-Fuel Market by Region

- 11.1 Overview

- 11.1.1 Market size and forecast By Region

- 11.2 North America

- 11.2.1 Key trends and opportunities

- 11.2.2 Market size and forecast, by Type

- 11.2.3 Market size and forecast, by Application

- 11.2.4 Market size and forecast, by country

- 11.2.4.1 United States

- 11.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 11.2.4.1.2 Market size and forecast, by Type

- 11.2.4.1.3 Market size and forecast, by Application

- 11.2.4.2 Canada

- 11.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 11.2.4.2.2 Market size and forecast, by Type

- 11.2.4.2.3 Market size and forecast, by Application

- 11.2.4.3 Mexico

- 11.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 11.2.4.3.2 Market size and forecast, by Type

- 11.2.4.3.3 Market size and forecast, by Application

- 11.2.4.1 United States

- 11.3 South America

- 11.3.1 Key trends and opportunities

- 11.3.2 Market size and forecast, by Type

- 11.3.3 Market size and forecast, by Application

- 11.3.4 Market size and forecast, by country

- 11.3.4.1 Brazil

- 11.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 11.3.4.1.2 Market size and forecast, by Type

- 11.3.4.1.3 Market size and forecast, by Application

- 11.3.4.2 Argentina

- 11.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 11.3.4.2.2 Market size and forecast, by Type

- 11.3.4.2.3 Market size and forecast, by Application

- 11.3.4.3 Chile

- 11.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 11.3.4.3.2 Market size and forecast, by Type

- 11.3.4.3.3 Market size and forecast, by Application

- 11.3.4.4 Rest of South America

- 11.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 11.3.4.4.2 Market size and forecast, by Type

- 11.3.4.4.3 Market size and forecast, by Application

- 11.3.4.1 Brazil

- 11.4 Europe

- 11.4.1 Key trends and opportunities

- 11.4.2 Market size and forecast, by Type

- 11.4.3 Market size and forecast, by Application

- 11.4.4 Market size and forecast, by country

- 11.4.4.1 Germany

- 11.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.1.2 Market size and forecast, by Type

- 11.4.4.1.3 Market size and forecast, by Application

- 11.4.4.2 France

- 11.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.2.2 Market size and forecast, by Type

- 11.4.4.2.3 Market size and forecast, by Application

- 11.4.4.3 Italy

- 11.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.3.2 Market size and forecast, by Type

- 11.4.4.3.3 Market size and forecast, by Application

- 11.4.4.4 United Kingdom

- 11.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.4.2 Market size and forecast, by Type

- 11.4.4.4.3 Market size and forecast, by Application

- 11.4.4.5 Benelux

- 11.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.5.2 Market size and forecast, by Type

- 11.4.4.5.3 Market size and forecast, by Application

- 11.4.4.6 Nordics

- 11.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.6.2 Market size and forecast, by Type

- 11.4.4.6.3 Market size and forecast, by Application

- 11.4.4.7 Rest of Europe

- 11.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 11.4.4.7.2 Market size and forecast, by Type

- 11.4.4.7.3 Market size and forecast, by Application

- 11.4.4.1 Germany

- 11.5 Asia Pacific

- 11.5.1 Key trends and opportunities

- 11.5.2 Market size and forecast, by Type

- 11.5.3 Market size and forecast, by Application

- 11.5.4 Market size and forecast, by country

- 11.5.4.1 China

- 11.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.1.2 Market size and forecast, by Type

- 11.5.4.1.3 Market size and forecast, by Application

- 11.5.4.2 Japan

- 11.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.2.2 Market size and forecast, by Type

- 11.5.4.2.3 Market size and forecast, by Application

- 11.5.4.3 India

- 11.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.3.2 Market size and forecast, by Type

- 11.5.4.3.3 Market size and forecast, by Application

- 11.5.4.4 South Korea

- 11.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.4.2 Market size and forecast, by Type

- 11.5.4.4.3 Market size and forecast, by Application

- 11.5.4.5 Australia

- 11.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.5.2 Market size and forecast, by Type

- 11.5.4.5.3 Market size and forecast, by Application

- 11.5.4.6 Southeast Asia

- 11.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.6.2 Market size and forecast, by Type

- 11.5.4.6.3 Market size and forecast, by Application

- 11.5.4.7 Rest of Asia-Pacific

- 11.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 11.5.4.7.2 Market size and forecast, by Type

- 11.5.4.7.3 Market size and forecast, by Application

- 11.5.4.1 China

- 11.6 MEA

- 11.6.1 Key trends and opportunities

- 11.6.2 Market size and forecast, by Type

- 11.6.3 Market size and forecast, by Application

- 11.6.4 Market size and forecast, by country

- 11.6.4.1 Middle East

- 11.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 11.6.4.1.2 Market size and forecast, by Type

- 11.6.4.1.3 Market size and forecast, by Application

- 11.6.4.2 Africa

- 11.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 11.6.4.2.2 Market size and forecast, by Type

- 11.6.4.2.3 Market size and forecast, by Application

- 11.6.4.1 Middle East

- 12.1 Overview

- 12.2 Key Winning Strategies

- 12.3 Top 10 Players: Product Mapping

- 12.4 Competitive Analysis Dashboard

- 12.5 Market Competition Heatmap

- 12.6 Leading Player Positions, 2022

13: Company Profiles

- 13.1 Archer Daniels Midland Co.

- 13.1.1 Company Overview

- 13.1.2 Key Executives

- 13.1.3 Company snapshot

- 13.1.4 Active Business Divisions

- 13.1.5 Product portfolio

- 13.1.6 Business performance

- 13.1.7 Major Strategic Initiatives and Developments

- 13.2 Ballard Power Systems

- 13.2.1 Company Overview

- 13.2.2 Key Executives

- 13.2.3 Company snapshot

- 13.2.4 Active Business Divisions

- 13.2.5 Product portfolio

- 13.2.6 Business performance

- 13.2.7 Major Strategic Initiatives and Developments

- 13.3 Inc.

- 13.3.1 Company Overview

- 13.3.2 Key Executives

- 13.3.3 Company snapshot

- 13.3.4 Active Business Divisions

- 13.3.5 Product portfolio

- 13.3.6 Business performance

- 13.3.7 Major Strategic Initiatives and Developments

- 13.4 Ceres Power Holding Plc

- 13.4.1 Company Overview

- 13.4.2 Key Executives

- 13.4.3 Company snapshot

- 13.4.4 Active Business Divisions

- 13.4.5 Product portfolio

- 13.4.6 Business performance

- 13.4.7 Major Strategic Initiatives and Developments

- 13.5 Clean Fuels Alliance America

- 13.5.1 Company Overview

- 13.5.2 Key Executives

- 13.5.3 Company snapshot

- 13.5.4 Active Business Divisions

- 13.5.5 Product portfolio

- 13.5.6 Business performance

- 13.5.7 Major Strategic Initiatives and Developments

- 13.6 Climeworks AG

- 13.6.1 Company Overview

- 13.6.2 Key Executives

- 13.6.3 Company snapshot

- 13.6.4 Active Business Divisions

- 13.6.5 Product portfolio

- 13.6.6 Business performance

- 13.6.7 Major Strategic Initiatives and Developments

- 13.7 E-Fuel Corporation

- 13.7.1 Company Overview

- 13.7.2 Key Executives

- 13.7.3 Company snapshot

- 13.7.4 Active Business Divisions

- 13.7.5 Product portfolio

- 13.7.6 Business performance

- 13.7.7 Major Strategic Initiatives and Developments

- 13.8 eFuel Pacific Limited

- 13.8.1 Company Overview

- 13.8.2 Key Executives

- 13.8.3 Company snapshot

- 13.8.4 Active Business Divisions

- 13.8.5 Product portfolio

- 13.8.6 Business performance

- 13.8.7 Major Strategic Initiatives and Developments

- 13.9 Hexagon Agility

- 13.9.1 Company Overview

- 13.9.2 Key Executives

- 13.9.3 Company snapshot

- 13.9.4 Active Business Divisions

- 13.9.5 Product portfolio

- 13.9.6 Business performance

- 13.9.7 Major Strategic Initiatives and Developments

- 13.10 Neste

- 13.10.1 Company Overview

- 13.10.2 Key Executives

- 13.10.3 Company snapshot

- 13.10.4 Active Business Divisions

- 13.10.5 Product portfolio

- 13.10.6 Business performance

- 13.10.7 Major Strategic Initiatives and Developments

- 13.11 Norsk e-Fuel AS

- 13.11.1 Company Overview

- 13.11.2 Key Executives

- 13.11.3 Company snapshot

- 13.11.4 Active Business Divisions

- 13.11.5 Product portfolio

- 13.11.6 Business performance

- 13.11.7 Major Strategic Initiatives and Developments

14: Analyst Perspective and Conclusion

- 14.1 Concluding Recommendations and Analysis

- 14.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By State |

|

By Production Method |

|

By Technology |

|

By Carbon Source |

|

By Carbon Capture |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of E-Fuel in 2030?

+

-

How big is the Global E-Fuel market?

+

-

How do regulatory policies impact the E-Fuel Market?

+

-

What major players in E-Fuel Market?

+

-

What applications are categorized in the E-Fuel market study?

+

-

Which product types are examined in the E-Fuel Market Study?

+

-

Which regions are expected to show the fastest growth in the E-Fuel market?

+

-

Which region is the fastest growing in the E-Fuel market?

+

-

What are the major growth drivers in the E-Fuel market?

+

-

Eminent factors propelling the E-Fuel Market are mainly derived from the highly immediate global decarbonizing agenda. Tighter environmental regulations that include targets for carbon neutrality almost take precedence. Consequently, governments worldwide are devising policies that support or enforce the use of sustainable fuels, thereby generating good demand pull. In addition, the very need to cut down on emissions in industries where direct electrification seems to be a tough challenge—air travel and shipping—puts e-fuels among the prime contenders. The decreasing costs of renewable electricity, along with the developments in the areas of electrolysis or synthetic fuel production methods, greatly contribute to the current economic prospects for e-fuels. Moreover, the fact that e-fuels can be integrated with existing fuel infrastructure offers a meaningful opportunity, thus alleviating the need for an entirely new infrastructure framework that is usually expensive. Combined with the fast-growing corporate interest and activities towards sustainability, this will give high momentum to e-fuel expansion in the market.

Is the study period of the E-Fuel flexible or fixed?

+

-