Global Digital Medicine Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-914 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The digital medicine market is a fast-changing area of the healthcare market that utilises digital technologies to augment medical practice, enhance patient care, and revolutionise the delivery of healthcare. This encompasses a broad range of solutions, including mobile health (mHealth) apps, wearable technology, electronic health records (EHRs), telemedicine platforms, artificial intelligence (AI) and machine learning (ML)-based diagnostics, and digital therapies. These technologies seek to deliver more personalised, accessible, efficient, and data-driven care in areas ranging from disease prevention and diagnosis to treatment, recovery, and sustained health management.

The growth of the market is driven by trends including rising smartphone penetration, the incidence of chronic diseases, greater emphasis on patient-centric care, and the imperative of lowering healthcare costs as well as making it more accessible, particularly in remote regions.

Digital Medicine Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

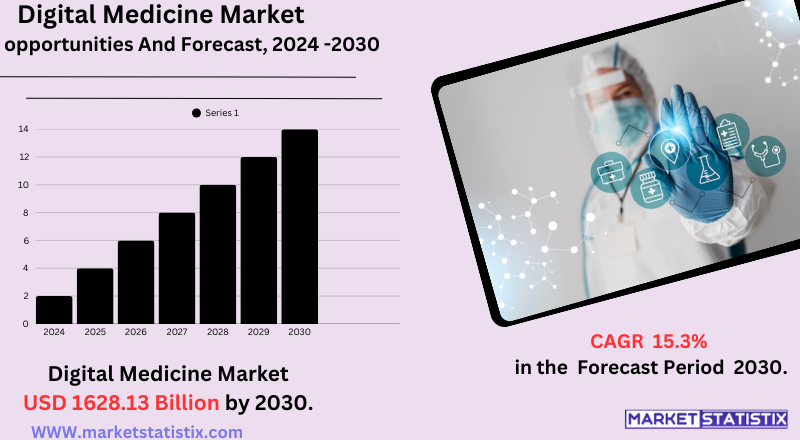

| Growth Rate | CAGR of 15.3% |

| Forecast Value (2030) | USD 1628.13 Billion |

| Key Market Players |

|

| By Region |

|

Digital Medicine Market Trends

The digital medicine market is growing at a fast clip, led by a number of key trends transforming the delivery of healthcare. One of the leading trends is the widespread use of telemedicine and RPM, spurred further in recent times by worldwide health crises. This enables virtual doctor visits, ongoing health monitoring through wearable technology, and remote treatment of chronic conditions, bringing healthcare closer to more patients, particularly those in rural locations. This transition also assists in lessening the cost of healthcare and enhancing patient outcomes by facilitating timely interventions with real-time data.

Yet another key trend is the growing incorporation of Artificial Intelligence (AI) and Machine Learning (ML) in a range of digital medicine applications. AI is transforming diagnosis through examination of enormous amounts of medical data, including medical images, to identify anomalies and aid in early disease detection. In addition to diagnosis, AI plays a vital role in personalised treatment plans, clinical workflow optimisation, automated administrative tasks, and even speeding up drug discovery

Digital Medicine Market Leading Players

The key players profiled in the report are 2morrow, Proteus Digital Health, Inc.WellDoc, Livongo Health, io, Inc., Mocacare, Voluntis, AliveCor, Inc.,, Omada Health, Inc.Ginger, Inc.Akili Interactive LabsGrowth Accelerators

The global market for digital medicine is driven by a number of strong market drivers, chief among them the growing worldwide incidence of chronic diseases like diabetes, cardiovascular and respiratory diseases. These diseases require ongoing monitoring and long-term management for which digital solutions such as remote patient monitoring devices, health monitoring apps, and personalised treatment platforms provide extremely effective and convenient solutions. Also, increasing awareness among people about self-management of health and a strong inclination toward patient-centric care models are driving the uptake of digital medicine, as these technologies enable patients to become proactive in managing their own health.

The other key driver is the fast pace of innovation and deepening penetration of digital technologies, such as mainstream smartphone adoption, enhanced internet connectivity, and technological leaps in artificial intelligence (AI) and machine learning (ML). These technological advances facilitate the creation of advanced digital health solutions, ranging from AI-driven diagnostics and predictive analytics to highly interactive mobile health applications and telehealth platforms.

Digital Medicine Market Segmentation analysis

The Global Digital Medicine is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Heart Disease, Mental Health, Drug Non-adherence, Diabetes, Obesity, COPD, Smoking, Asthma. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the digital medicine industry are extremely dynamic and fractured, with a large variety of participants, from established tech behemoths and mainstream healthcare organizations to new-age startups. Large tech companies such as Apple, Google, Amazon, and Microsoft are investing heavily in digital health, utilising their massive user bases, data analytics strengths, and cloud infrastructure to provide comprehensive solutions. Historical healthcare providers, pharmaceutical firms, and medical device makers also are venturing or extending their digital offerings, sometimes by acquisition, collaboration, or internal development, to keep pace and respond to changing patient needs.

The major competitive drivers in this industry are technological innovation (particularly in AI, machine learning, and IoT), the capacity to prove clinical effectiveness and gain regulatory approval (especially for digital therapeutics), data privacy and security, user experience, and easy integration with current healthcare systems. Firms are competing to offer holistic, personalised, and accessible solutions across different applications such as chronic disease management, mental health care, remote monitoring of patients, and medication compliance.

Challenges In Digital Medicine Market

The market for digital medicine is confronted by a number of high-level challenges that may hinder its growth and uptake in 2025. Foremost among these are regulatory challenges, with variable, out-of-date, or vague guidelines frequently falling behind high-speed technological innovation, hindering developers and adopters alike. Second, data protection and cybersecurity issues continue to be of main importance, as greater use of digital health solutions puts sensitive patient data at risk of unauthorised breaches, endangering patient confidence and organisational reputation.

Competition in the market is growing, with dense environments where it is challenging for new players to differentiate their products and raise investment. Healthcare buyers' financial limitations, economic turmoil, and raising capital are also significant challenges for companies in digital medicine. Technical hurdles, such as few digital infrastructures in rural areas and the persistent lack of skilled healthcare workers, add complexity to growth in the market. To overcome these challenges, there will be a need for ongoing regulatory innovation, increased data protection safeguards, and strategic technology and workforce development investments.

Risks & Prospects in Digital Medicine Market

Critical market opportunities are fuelled by the convergence of innovative technologies like wireless sensors, mobile health apps, and artificial intelligence to provide more accurate, individualised, and convenient care. The growing deployment of healthcare IT across both private and public sectors, pressure for remote patient monitoring, and the transition to data-driven, preventive care are reshaping patient management and broadening the scope of digital medicine across therapeutic categories.

Geographically, North America and Europe are presently dominating the market for digital medicine, driven by high adoption of healthcare IT, robust infrastructure, and positive government policies. Europe, more than anything else, possesses a great market share due to increasing healthcare expenditure, an ageing population, and extensive campaigns in digital health. The Asia Pacific region is expected to grow at the highest rate, driven by growing implementation of healthcare IT, governmental encouragement, and increased awareness of digital health benefits. These local dynamics, coupled with continuing technology improvements and rising internet and smartphone penetration, are likely to propel long-term global market growth in the years ahead.

Key Target Audience

,,

The market for digital medicine mainly reaches out to patients who live with chronic conditions like diabetes, hypertension, cardiovascular disease, and mental illnesses. Patients in search of improved medication compliance, real-time monitoring, and individualised treatment regimens are the most significant consumers. Ingestible sensors, wearable sensors, and mobile apps are combined to enable continuous tracking of health and prompt interventions, allowing patients to be actively involved in managing their healthcare. This method is especially useful for individuals in rural settings or with poor access to conventional healthcare centers.

, Healthcare payers and providers are important stakeholders in the digital medicine ecosystem as well. Providers use digital platforms to track patient progress, modify treatments, and enhance clinical outcomes, ultimately improving the quality of care. Payers, such as employers and insurance companies, are increasingly embracing digital medicine solutions to save healthcare costs by offering preventive care and better disease management.

Merger and acquisition

The digital medicine space saw a significant pick-up in merger and acquisition (M&A) action in 2024, after a slowing of the pace. The U.S. digital health market saw $2.4 billion in venture investment in 110 transactions in Q3 2024, signifying an increase in more targeted investments. Companies are also buying up startups to infuse new capabilities and features within their current offerings, a technique that has come to be known as "tapestry weaving". This enables companies to improve their product lines and respond to changing market needs. Even though there was an increase in M&A activity, the total number of digital health deals continued to be lower than before.

In H1 2024, 96 digital health M&A deals were done, up slightly from 94 deals during the same period in 2023. Yet, that is down from the 2021 and 2022 peak years. The trend of companies going private or being acquired to streamline performance and eliminate operating expenses has also been seen. This strategic merger mirrors the maturity of the industry and the demand for companies to grow successfully in a competitive environment.

>

Analyst Comment

The market for digital medicine is growing at a high pace, with the global market projecting growth from USD 8.15 billion in 2024 to USD 44.11 billion by 2032, demonstrating a strong CAGR. The growth is driven by the adoption of sophisticated digital technologies—like wireless sensors, mobile health apps, and AI-based analytics—into healthcare to facilitate personalised care, real-time monitoring, and enhanced control of acute and chronic diseases. Digital medicine is differentiated by its accuracy, effectiveness, and accessibility and provides solutions for monitoring body vital signs, stress management, and disease prevention and control.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Digital Medicine- Snapshot

- 2.2 Digital Medicine- Segment Snapshot

- 2.3 Digital Medicine- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Digital Medicine Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Diabetes

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Mental Health

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Heart Disease

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Smoking

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Drug Non-adherence

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Obesity

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 COPD

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Asthma

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: Digital Medicine Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Proteus Digital Health

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Inc.WellDoc

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc.Ginger

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 io

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Inc.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Voluntis

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Livongo Health

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Mocacare

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 AliveCor

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Omada Health

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 2morrow

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Inc.Akili Interactive Labs

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Digital Medicine in 2030?

+

-

What is the growth rate of Digital Medicine Market?

+

-

What are the latest trends influencing the Digital Medicine Market?

+

-

Who are the key players in the Digital Medicine Market?

+

-

How is the Digital Medicine } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Digital Medicine Market Study?

+

-

What geographic breakdown is available in Global Digital Medicine Market Study?

+

-

Which region holds the second position by market share in the Digital Medicine market?

+

-

How are the key players in the Digital Medicine market targeting growth in the future?

+

-

The other key driver is the fast pace of innovation and deepening penetration of digital technologies, such as mainstream smartphone adoption, enhanced internet connectivity, and technological leaps in artificial intelligence (AI) and machine learning (ML). These technological advances facilitate the creation of advanced digital health solutions, ranging from AI-driven diagnostics and predictive analytics to highly interactive mobile health applications and telehealth platforms.

,,

The global market for digital medicine is driven by a number of strong market drivers, chief among them the growing worldwide incidence of chronic diseases like diabetes, cardiovascular and respiratory diseases. These diseases require ongoing monitoring and long-term management for which digital solutions such as remote patient monitoring devices, health monitoring apps, and personalised treatment platforms provide extremely effective and convenient solutions. Also, increasing awareness among people about self-management of health and a strong inclination toward patient-centric care models are driving the uptake of digital medicine, as these technologies enable patients to become proactive in managing their own health.

,

What are the opportunities for new entrants in the Digital Medicine market?

+

-