Global Desktop as a Service (DaaS) Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2032

Report ID: MS-981 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The desktop as a service market comprises cloud-based solutions that provide desktops and virtual applications to end users over the internet. In this model, a third-party provider hosts the back-end infrastructure, including computing, storage and network features, allowing users to access their desktop environments from various devices such as PCs, tablets or smartphones. DAAS allows organizations to offer safe, scalable and economical table experiences without the need for significant initial investments in hardware or continuous maintenance. This approach supports remote and hybrid work models, improves data security by centralising cloud information and simplifies IT management, discharging tasks such as updates and backups for the service provider. Industries such as finance, health, education and government are increasingly adopting DAAS to meet the demands of a mobile workforce and ensure business continuity.

Desktop as a Service (DaaS) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

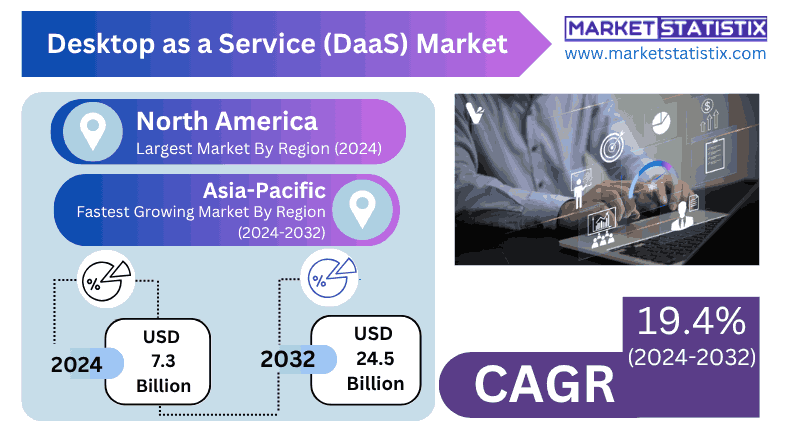

| Growth Rate | CAGR of 19.4% |

| Forecast Value (2032) | USD 24.5 Billion |

| By Product Type | Public Cloud DaaS, Persistent DaaS, Non-persistent DaaS, Private Cloud DaaS, Hybrid DaaS |

| Key Market Players |

|

| By Region |

|

Desktop as a Service (DaaS) Market Trends

Real-time data indicates a strong emphasis on cloud-based solutions, with organizations increasingly leveraging DAAs for scalability, cost-effectiveness (changing Capex to Opex) and simplified IT management. The main trends also include the growing importance of improvement of security and data protection resources in DAAs offers, AI integration and automation for simplified provisioning and management and the growing demand for custom user experiences. North America currently leads the market, but the Asia Pacific region is showing rapid acceleration due to increased cloud digitisation and adoption.

Desktop as a Service (DaaS) Market Leading Players

The key players profiled in the report are Apps4Rent, Citrix, Cloudalize, Anunta, Leostream, Nutanix, Amazon Web Services (AWS), Red Hat, Paperspace, VMware, NetApp, IBM, Huawei, Oracle, Microsoft, Cisco, Dell Technologies, Workspot, dinCloud, Parallel, StratodeskGrowth Accelerators

- Remote and hybrid work trends: The growing adoption of remote and hybrid work models has amplified the demand for safe, scalable and accessible virtual desktop solutions, allowing employees to work in various locations and devices.

- Economic IT Infrastructure: Organizations are changing capital expenses (CAPEX) to operating expenses (OPEX) by adopting DAAs, reducing the need for significant initial investments in hardware and continuous maintenance costs.

- Improved security and compliance: DA Solutions offer centralised data management, encryption and authentication of various factors, helping companies meet strict regulatory requirements and protect confidential information.

Desktop as a Service (DaaS) Market Segmentation analysis

The Global Desktop as a Service (DaaS) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Public Cloud DaaS, Persistent DaaS, Non-persistent DaaS, Private Cloud DaaS, Hybrid DaaS . The Application segment categorizes the market based on its usage such as BFSI, Education, IT & Telecom, Healthcare, Government. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The desktop market as a service (DaaS) presents a highly competitive scenario dominated by major cloud service providers and specialised virtualisation companies. Main players such as Amazon Web Services (AWS) with workspaces, Microsoft with Azure and Windows 365 virtual desktop, Citrix (now part of the Cloud Software Group) and VMware (now Omnissa Horizon Cloud Service) are leading the load. Real-time competition revolves around offering robust scalability, improved security features (including data encryption and authentication of various factors) and perfect integration with existing company IT ecosystems. Suppliers are also differing through AI and machine learning resources for custom user experiences and simplified IT management, as well as supporting various hybrid and various cloud strategies to meet different customer needs and prevent supplier blocking. The ability to meet industry-specific verticals (e.g., healthcare) and offer economic and signature-based models is also crucial to competitive advantage.

Challenges In Desktop as a Service (DaaS) Market

- Data security and compliance: Organizations dealing with confidential data, such as finance and medical assistance, face challenges to ensure data sovereignty and adhere to regulations such as GDPR and HIPAA when using DaaS solutions.

- Internet dependence: The performance of DaAs platforms depends strongly on stable and high-speed connections on the Internet. In regions with limited bandwidth or unspeakable connectivity, users may have latency problems and productivity reduction.

- Cost management: While DAAs can reduce capital expenses, in-progress signature fees can accumulate over time. In addition, unexpected costs may arise from sizing resources or integrating with other services.

- Personalisation limitations: Some DAAs offers may not provide the customisation level that organizations require, potentially limiting their ability to adapt virtual desktops to the user's specific needs.

Addressing these challenges is crucial for organizations to fully leverage the benefits of DaaS while mitigating potential risks.

Risks & Prospects in Desktop as a Service (DaaS) Market

The growing prevalence of BYOD (bring your own device) policies feeds the adoption of DAAs as companies seek safe and managed access to corporate resources on various devices. Main players such as Citrix, VMware and Microsoft are strongly invested in this space, constantly innovating to improve their offers and meet the evolving market needs. Competition is fierce, boosting innovation and accessibility, finally benefiting end users.

Key Target Audience

, ,- ,, ,

,,

- ,

- IT & Telecom: Utilize DaaS to reduce Total Cost of Ownership (TCO) and enhance operational efficiency. ,

- Education: Leverage DaaS to provide students and staff with remote access to educational resources and applications. ,,

,

,

- ,

- ,

- Small and Medium Enterprises (SMEs): Adopt DaaS for cost-effective, scalable desktop solutions without heavy infrastructure investments. ,

- Broadcom's Acquisition of VMware: In November 2023, Broadcom acquired VMware for approximately $ 69 billion. Subsequently, in February 2024, Broadcom sold the VMware end user computing division (EUC), which includes DAS solutions such as Horizon and Workspace One, to private equity KKR. Euc's division was renamed Omnissa.

- Citrix Systems' Acquisition: In January 2022, Citrix Systems was acquired by Equity Partners and Evergreen Coast Capital affiliates in a $ 16.5 billion agreement. This acquisition aimed to improve Citrix's capabilities in the provision of safe and reliable solutions.

- Devoteam's Strategic Acquisitions: In 2024, Devoteam expanded its cloud and DAAS services, acquiring Ubertas Consulting, an AWS partner in the UK, and Inlogiq, a Spanish business automation expert. These acquisitions aimed to strengthen the presence of the devotee in the European market of DAAS.

,,

These sectors are increasingly adopting DaaS solutions to enhance flexibility, security, and efficiency in their operations.

Merger and acquisition

Analyst Comment

The desktop market as a service (DaaS) is undergoing significant growth, driven by the growing demand for flexible, safe and economic virtual desktop solutions. By 2025, the market should be valued at approximately US $ 8.23 billion, with expectations reaching US $ 67.13 billion in 2037. This expansion is fuelled by the wide adoption of remote and hybrid work models, the need for scalable infrastructure and the advantages of central management and safety improvement. Chave industries such as BFSI, health and education are increasingly leveraging DAAS to support their digital transformation initiatives.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Desktop as a Service (DaaS)- Snapshot

- 2.2 Desktop as a Service (DaaS)- Segment Snapshot

- 2.3 Desktop as a Service (DaaS)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Desktop as a Service (DaaS) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Persistent DaaS

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-persistent DaaS

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Public Cloud DaaS

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Private Cloud DaaS

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Hybrid DaaS

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Desktop as a Service (DaaS) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 BFSI

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Healthcare

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Education

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 IT & Telecom

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Government

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Desktop as a Service (DaaS) Market by Deployment Model

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Public Cloud

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Private Cloud

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Hybrid Cloud

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Desktop as a Service (DaaS) Market by User Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Individual Users

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Small and Medium Enterprises

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Large Enterprises

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Desktop as a Service (DaaS) Market by Operating System

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Windows

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Linux

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 MacOS

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

9: Desktop as a Service (DaaS) Market by Service Type

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 Managed Services

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Unmanaged Services

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

10: Desktop as a Service (DaaS) Market by Region

- 10.1 Overview

- 10.1.1 Market size and forecast By Region

- 10.2 North America

- 10.2.1 Key trends and opportunities

- 10.2.2 Market size and forecast, by Type

- 10.2.3 Market size and forecast, by Application

- 10.2.4 Market size and forecast, by country

- 10.2.4.1 United States

- 10.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.1.2 Market size and forecast, by Type

- 10.2.4.1.3 Market size and forecast, by Application

- 10.2.4.2 Canada

- 10.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.2.2 Market size and forecast, by Type

- 10.2.4.2.3 Market size and forecast, by Application

- 10.2.4.3 Mexico

- 10.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.3.2 Market size and forecast, by Type

- 10.2.4.3.3 Market size and forecast, by Application

- 10.2.4.1 United States

- 10.3 South America

- 10.3.1 Key trends and opportunities

- 10.3.2 Market size and forecast, by Type

- 10.3.3 Market size and forecast, by Application

- 10.3.4 Market size and forecast, by country

- 10.3.4.1 Brazil

- 10.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.1.2 Market size and forecast, by Type

- 10.3.4.1.3 Market size and forecast, by Application

- 10.3.4.2 Argentina

- 10.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.2.2 Market size and forecast, by Type

- 10.3.4.2.3 Market size and forecast, by Application

- 10.3.4.3 Chile

- 10.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.3.2 Market size and forecast, by Type

- 10.3.4.3.3 Market size and forecast, by Application

- 10.3.4.4 Rest of South America

- 10.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.4.2 Market size and forecast, by Type

- 10.3.4.4.3 Market size and forecast, by Application

- 10.3.4.1 Brazil

- 10.4 Europe

- 10.4.1 Key trends and opportunities

- 10.4.2 Market size and forecast, by Type

- 10.4.3 Market size and forecast, by Application

- 10.4.4 Market size and forecast, by country

- 10.4.4.1 Germany

- 10.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.1.2 Market size and forecast, by Type

- 10.4.4.1.3 Market size and forecast, by Application

- 10.4.4.2 France

- 10.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.2.2 Market size and forecast, by Type

- 10.4.4.2.3 Market size and forecast, by Application

- 10.4.4.3 Italy

- 10.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.3.2 Market size and forecast, by Type

- 10.4.4.3.3 Market size and forecast, by Application

- 10.4.4.4 United Kingdom

- 10.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.4.2 Market size and forecast, by Type

- 10.4.4.4.3 Market size and forecast, by Application

- 10.4.4.5 Benelux

- 10.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.5.2 Market size and forecast, by Type

- 10.4.4.5.3 Market size and forecast, by Application

- 10.4.4.6 Nordics

- 10.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.6.2 Market size and forecast, by Type

- 10.4.4.6.3 Market size and forecast, by Application

- 10.4.4.7 Rest of Europe

- 10.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.7.2 Market size and forecast, by Type

- 10.4.4.7.3 Market size and forecast, by Application

- 10.4.4.1 Germany

- 10.5 Asia Pacific

- 10.5.1 Key trends and opportunities

- 10.5.2 Market size and forecast, by Type

- 10.5.3 Market size and forecast, by Application

- 10.5.4 Market size and forecast, by country

- 10.5.4.1 China

- 10.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.1.2 Market size and forecast, by Type

- 10.5.4.1.3 Market size and forecast, by Application

- 10.5.4.2 Japan

- 10.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.2.2 Market size and forecast, by Type

- 10.5.4.2.3 Market size and forecast, by Application

- 10.5.4.3 India

- 10.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.3.2 Market size and forecast, by Type

- 10.5.4.3.3 Market size and forecast, by Application

- 10.5.4.4 South Korea

- 10.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.4.2 Market size and forecast, by Type

- 10.5.4.4.3 Market size and forecast, by Application

- 10.5.4.5 Australia

- 10.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.5.2 Market size and forecast, by Type

- 10.5.4.5.3 Market size and forecast, by Application

- 10.5.4.6 Southeast Asia

- 10.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.6.2 Market size and forecast, by Type

- 10.5.4.6.3 Market size and forecast, by Application

- 10.5.4.7 Rest of Asia-Pacific

- 10.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.7.2 Market size and forecast, by Type

- 10.5.4.7.3 Market size and forecast, by Application

- 10.5.4.1 China

- 10.6 MEA

- 10.6.1 Key trends and opportunities

- 10.6.2 Market size and forecast, by Type

- 10.6.3 Market size and forecast, by Application

- 10.6.4 Market size and forecast, by country

- 10.6.4.1 Middle East

- 10.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.1.2 Market size and forecast, by Type

- 10.6.4.1.3 Market size and forecast, by Application

- 10.6.4.2 Africa

- 10.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.2.2 Market size and forecast, by Type

- 10.6.4.2.3 Market size and forecast, by Application

- 10.6.4.1 Middle East

- 11.1 Overview

- 11.2 Key Winning Strategies

- 11.3 Top 10 Players: Product Mapping

- 11.4 Competitive Analysis Dashboard

- 11.5 Market Competition Heatmap

- 11.6 Leading Player Positions, 2022

12: Company Profiles

- 12.1 Amazon Web Services (AWS)

- 12.1.1 Company Overview

- 12.1.2 Key Executives

- 12.1.3 Company snapshot

- 12.1.4 Active Business Divisions

- 12.1.5 Product portfolio

- 12.1.6 Business performance

- 12.1.7 Major Strategic Initiatives and Developments

- 12.2 Microsoft

- 12.2.1 Company Overview

- 12.2.2 Key Executives

- 12.2.3 Company snapshot

- 12.2.4 Active Business Divisions

- 12.2.5 Product portfolio

- 12.2.6 Business performance

- 12.2.7 Major Strategic Initiatives and Developments

- 12.3 Citrix

- 12.3.1 Company Overview

- 12.3.2 Key Executives

- 12.3.3 Company snapshot

- 12.3.4 Active Business Divisions

- 12.3.5 Product portfolio

- 12.3.6 Business performance

- 12.3.7 Major Strategic Initiatives and Developments

- 12.4 VMware

- 12.4.1 Company Overview

- 12.4.2 Key Executives

- 12.4.3 Company snapshot

- 12.4.4 Active Business Divisions

- 12.4.5 Product portfolio

- 12.4.6 Business performance

- 12.4.7 Major Strategic Initiatives and Developments

- 12.5 Nutanix

- 12.5.1 Company Overview

- 12.5.2 Key Executives

- 12.5.3 Company snapshot

- 12.5.4 Active Business Divisions

- 12.5.5 Product portfolio

- 12.5.6 Business performance

- 12.5.7 Major Strategic Initiatives and Developments

- 12.6 IBM

- 12.6.1 Company Overview

- 12.6.2 Key Executives

- 12.6.3 Company snapshot

- 12.6.4 Active Business Divisions

- 12.6.5 Product portfolio

- 12.6.6 Business performance

- 12.6.7 Major Strategic Initiatives and Developments

- 12.7 Cisco

- 12.7.1 Company Overview

- 12.7.2 Key Executives

- 12.7.3 Company snapshot

- 12.7.4 Active Business Divisions

- 12.7.5 Product portfolio

- 12.7.6 Business performance

- 12.7.7 Major Strategic Initiatives and Developments

- 12.8 Huawei

- 12.8.1 Company Overview

- 12.8.2 Key Executives

- 12.8.3 Company snapshot

- 12.8.4 Active Business Divisions

- 12.8.5 Product portfolio

- 12.8.6 Business performance

- 12.8.7 Major Strategic Initiatives and Developments

- 12.9 Oracle

- 12.9.1 Company Overview

- 12.9.2 Key Executives

- 12.9.3 Company snapshot

- 12.9.4 Active Business Divisions

- 12.9.5 Product portfolio

- 12.9.6 Business performance

- 12.9.7 Major Strategic Initiatives and Developments

- 12.10 Dell Technologies

- 12.10.1 Company Overview

- 12.10.2 Key Executives

- 12.10.3 Company snapshot

- 12.10.4 Active Business Divisions

- 12.10.5 Product portfolio

- 12.10.6 Business performance

- 12.10.7 Major Strategic Initiatives and Developments

- 12.11 Parallel

- 12.11.1 Company Overview

- 12.11.2 Key Executives

- 12.11.3 Company snapshot

- 12.11.4 Active Business Divisions

- 12.11.5 Product portfolio

- 12.11.6 Business performance

- 12.11.7 Major Strategic Initiatives and Developments

- 12.12 Leostream

- 12.12.1 Company Overview

- 12.12.2 Key Executives

- 12.12.3 Company snapshot

- 12.12.4 Active Business Divisions

- 12.12.5 Product portfolio

- 12.12.6 Business performance

- 12.12.7 Major Strategic Initiatives and Developments

- 12.13 Workspot

- 12.13.1 Company Overview

- 12.13.2 Key Executives

- 12.13.3 Company snapshot

- 12.13.4 Active Business Divisions

- 12.13.5 Product portfolio

- 12.13.6 Business performance

- 12.13.7 Major Strategic Initiatives and Developments

- 12.14 dinCloud

- 12.14.1 Company Overview

- 12.14.2 Key Executives

- 12.14.3 Company snapshot

- 12.14.4 Active Business Divisions

- 12.14.5 Product portfolio

- 12.14.6 Business performance

- 12.14.7 Major Strategic Initiatives and Developments

- 12.15 Cloudalize

- 12.15.1 Company Overview

- 12.15.2 Key Executives

- 12.15.3 Company snapshot

- 12.15.4 Active Business Divisions

- 12.15.5 Product portfolio

- 12.15.6 Business performance

- 12.15.7 Major Strategic Initiatives and Developments

- 12.16 Paperspace

- 12.16.1 Company Overview

- 12.16.2 Key Executives

- 12.16.3 Company snapshot

- 12.16.4 Active Business Divisions

- 12.16.5 Product portfolio

- 12.16.6 Business performance

- 12.16.7 Major Strategic Initiatives and Developments

- 12.17 Apps4Rent

- 12.17.1 Company Overview

- 12.17.2 Key Executives

- 12.17.3 Company snapshot

- 12.17.4 Active Business Divisions

- 12.17.5 Product portfolio

- 12.17.6 Business performance

- 12.17.7 Major Strategic Initiatives and Developments

- 12.18 Red Hat

- 12.18.1 Company Overview

- 12.18.2 Key Executives

- 12.18.3 Company snapshot

- 12.18.4 Active Business Divisions

- 12.18.5 Product portfolio

- 12.18.6 Business performance

- 12.18.7 Major Strategic Initiatives and Developments

- 12.19 NetApp

- 12.19.1 Company Overview

- 12.19.2 Key Executives

- 12.19.3 Company snapshot

- 12.19.4 Active Business Divisions

- 12.19.5 Product portfolio

- 12.19.6 Business performance

- 12.19.7 Major Strategic Initiatives and Developments

- 12.20 Anunta

- 12.20.1 Company Overview

- 12.20.2 Key Executives

- 12.20.3 Company snapshot

- 12.20.4 Active Business Divisions

- 12.20.5 Product portfolio

- 12.20.6 Business performance

- 12.20.7 Major Strategic Initiatives and Developments

- 12.21 Stratodesk

- 12.21.1 Company Overview

- 12.21.2 Key Executives

- 12.21.3 Company snapshot

- 12.21.4 Active Business Divisions

- 12.21.5 Product portfolio

- 12.21.6 Business performance

- 12.21.7 Major Strategic Initiatives and Developments

13: Analyst Perspective and Conclusion

- 13.1 Concluding Recommendations and Analysis

- 13.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Deployment Model |

|

By User Type |

|

By Operating System |

|

By Service Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Desktop as a Service (DaaS) in 2032?

+

-

Which application type is expected to remain the largest segment in the Global Desktop as a Service (DaaS) market?

+

-

How big is the Global Desktop as a Service (DaaS) market?

+

-

How do regulatory policies impact the Desktop as a Service (DaaS) Market?

+

-

What major players in Desktop as a Service (DaaS) Market?

+

-

What applications are categorized in the Desktop as a Service (DaaS) market study?

+

-

Which product types are examined in the Desktop as a Service (DaaS) Market Study?

+

-

Which regions are expected to show the fastest growth in the Desktop as a Service (DaaS) market?

+

-

Which application holds the second-highest market share in the Desktop as a Service (DaaS) market?

+

-

Which region is the fastest growing in the Desktop as a Service (DaaS) market?

+

-