Global Dermatology OTC Drugs Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-912 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Dermatology OTC (Over-The-Counter) Drugs Market involves a broad array of non-prescription drugs and products that are used to treat most skin, hair, and nail disorders. These drugs and products are easily available to customers without the necessity of a prescription from a physician, providing ready-to-use solutions to prevalent dermatology problems. This market consists of a varied range of products like creams, ointments, gels, lotions, oils, tablets, capsules, and sprays, with indications like acne, dermatitis (e.g., eczema), psoriasis, fungal infections (e.g., athlete's foot, ringworm), dry skin, sun protection, and other minor skin irritations.

This is fuelled by rising awareness among consumers regarding skin health, growing incidence of skin diseases worldwide, and the cost-effectiveness and convenience of self-medication for mild and moderate diseases. Technological advancements in product formulation, the launch of active ingredients that have had prescription-only availability into OTC formulations, and successful marketing campaigns have further fuelled its growth. The market reflects intense demand from consumers looking for symptomatic relief as well as preventative treatment for their skin, usually driven by trends in skincare and increased emphasis on personal health.

Dermatology OTC Drugs Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

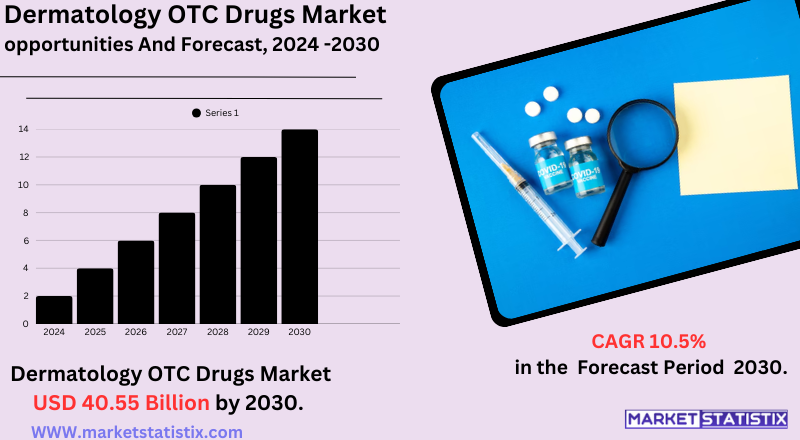

| Growth Rate | CAGR of 10.5% |

| Forecast Value (2030) | USD 40.55 Billion |

| By Product Type | Prescription, Over-the-counter (OTC) |

| Key Market Players |

|

| By Region |

|

Dermatology OTC Drugs Market Trends

A dominant trend is the surge of personalised skincare and the impact of online platforms. Shoppers are increasingly looking for products that address their individual skin issues, driven by social media, online reviews, and direct-to-consumer companies. This has contributed to a boom in products with cutting-edge ingredients such as ceramides, hyaluronic acid, and niacinamide, more formerly found in professional skincare, that are now easily accessible OTC. The ease of access via online pharmacies and e-commerce sites is also a key contributor to their wider reach.

Increasing demand for "clean" and "natural" beauty is another clear trend, pointing to a wider cultural move towards wellness and health. This is expressed as greater interest in OTC dermatology medications that contain fewer synthetic chemicals, are certified cruelty-free, and have eco-friendly packaging. In addition, there is a growing focus on products for chronic skin diseases such as eczema and psoriasis, with advances in formulation technology providing enhanced efficacy and more sensitive skin-friendly formulations. This, combined with the rising global incidence of skin diseases, drives ongoing innovation and new product launches across OTC dermatology.

Dermatology OTC Drugs Market Leading Players

The key players profiled in the report are GALDERMA, Eli Lilly and Company, GSK plc., Almirall, S.A, AbbVie Inc., Johnson & Johnson Services, Inc., Novartis AG, Sun Pharmaceutical Industries Ltd., Amgen Inc., Pfizer Inc., Bausch Health Companies Inc.Growth Accelerators

The global dermatology OTC medicines market is dominated by the soaring incidence of diverse skin-related conditions all over the world, including acne, eczema, psoriasis, and fungal infection. Increased pollution, lifestyle changes, and increasing awareness regarding skin well-being are some of the contributing factors in this rising tide of dermal diseases. Customers are constantly on the lookout for easily accessible and convenient remedies for such widespread ailments, thereby rendering OTC medicines an extremely desirable choice in terms of availability without prescription.

In addition, increasing consumer preference for self-medication and proactive skincare heavily drives the market. This is complemented by the cost-effectiveness of OTC products over prescription drugs and heightened social media and beauty awareness, which promote proactive skincare habits. Ongoing advancements in product formulations, such as the formulation of innovative ingredients and easy-to-use delivery systems (such as creams, gels, and sprays), further drive market growth through more effective and appealing solutions for consumers.

Dermatology OTC Drugs Market Segmentation analysis

The Global Dermatology OTC Drugs is segmented by Type, and Region. By Type, the market is divided into Distributed Prescription, Over-the-counter (OTC) . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The dermatology OTC medications market is extremely competitive, with the presence of many international pharmaceutical majors and increasing local and regional participants. Top multinational players such as Johnson & Johnson, Bayer AG, GlaxoSmithKline (rebranded as Haleon), Sanofi, and Galderma possess large market shares through strong R&D resource bases, strong brand names, and extensive distribution channels. These firms tend to compete on the basis of ongoing product innovation, reformulation of existing products for better efficacy or improved aesthetic profiles, and the introduction of new actives or delivery systems to meet changing consumer demands.

Apart from product innovation, competition is also fuelled by intense marketing and online engagement activities. Businesses are spending a lot on online advertising, social media promotion, and influencer marketing to reach consumers directly, especially younger populations who are highly dependent on online platforms for health and beauty information. The growth of private label brands and online stores also introduces another level of competition, providing consumers with cheaper and easier options for their dermatological requirements.

Challenges In Dermatology OTC Drugs Market

The OTC dermatology drugs market is confronted with a number of serious challenges despite its consistent growth. One of the key hurdles is the complicated and stringent regulatory system, which differs by region and could restrict the availability of products and hinder marketing strategies. The regulatory bodies impose strict standards on safety and efficacy, such that companies find it tough to bring new products to the market or enter new markets unless they comply with tough demands.

Another challenge is consumer education on responsible self-medication and awareness of possible risks. With increasing market size, particularly with the growth of e-commerce and online pharmacies, it becomes even more critical to ensure that consumers possess proper information about product use and safety. The companies also need to deal with increased competition, consumer demands for innovative and multi-functional products, and shifting consumer trends toward sustainability and clean beauty. These issues are important to overcome in order to sustain market growth and to enable the safe and effective use of dermatology OTC medications.

Risks & Prospects in Dermatology OTC Drugs Market

The main growth prospects are the ageing demography, environmental concerns, and the rise of telemedicine and remote consultations that enable greater access to OTC dermatological products. The main trends in the market are the rise of niche, condition-specific offerings; gender-neutral and multi-functional products; microbiome-safe and CBD-based skincare; and increasing demand for sustainable and clean beauty products.

Geographically, the market is dominated by North America, driven by a high incidence of skin disorders, strong healthcare infrastructure, and the presence of industry giants. For example, the U.S. experiences strong demand arising from widespread diseases such as eczema and high product launches and awareness campaigns. In contrast, Asia-Pacific is growing at the highest rate, driven by growing healthcare awareness, rising middle-class populations, and growing access to dermatological products. This regional momentum, combined with continuing product innovation and focused marketing, should continue to drive and fuel market expansion worldwide through the next few years.

Key Target Audience

The major target market for the dermatology OTC drugs market is wide and involves people of all ages with ordinary skin, hair, and nail-related conditions. This would largely involve consumers who are looking for convenient, accessible, and frequently less expensive treatments for mild to medium dermatological conditions such as acne, dryness, eczema, psoriasis, fungal infections, and sun protection. A large section of this audience is proactive in self-care and skin health, and they prefer dealing with their conditions themselves without seeking instant professional advice for minor symptoms.

,, ,,

Within this overall audience, there are particular segments. Teenagers and young adults form a large segment, particularly for the treatment of acne, since the condition is highly prevalent in this age group and has a major impact on self-esteem. Women of all ages represent a significant segment of the market, propelled by greater overall awareness and interest in skincare. Furthermore, those of lower to middle incomes who might not be readily accessible to dermatologists or who prefer to avoid prescription fees also represent a significant segment, falling back on OTC solutions for treating their conditions.

,,

Merger and acquisition

The over-the-counter (OTC) dermatology drugs market has been highly active in terms of merger and acquisition (M&A) deals in recent years, reflecting the dynamic nature of the industry and strategic consolidation efforts by major players to reinforce market positions. For example, in September 2024, Organon agreed to acquire Roivant's dermatology business, Dermavant, for up to $1.2 billion. This deal enables Organon to enter the market for treating skin disorders, with Dermavant's Vtama cream, which received FDA approval in 2022 as a treatment for psoriasis, being a strong asset. The transaction involves an upfront payment of $175 million and potential future payments upon achievement of future milestones.

Likewise, in August 2024, L'Oréal purchased a 10% stake in dermatology company Galderma, returning to the market for anti-wrinkle injectables after 10 years of concentrating on conventional cosmetics. The move is a signal that L'Oréal is stepping into the burgeoning aesthetics market, as Galderma offers acne treatments and aesthetic injectables. The stake is valued by analysts at approximately €1.7 billion. These M&A transactions reflect the sector's emphasis on diversifying product lines and entering high-growing segments in the dermatology OTC medications market.

>

Analyst Comment

The over-the-counter (OTC) dermatology drugs market is growing steadily, with the global market standing at around USD 16.41 billion in the year 2025 and set to grow to USD 20.16 billion by the year 2029. The growth comes as a result of increased awareness about skin health, an ageing world, rising prevalence of skin defects like psoriasis and melanoma, and the increasing power of e-commerce and online pharmacies, which enhance availability of these products to larger populations. The market is also experiencing a trend towards condition-specific, niche products, multi-functional products, and gender-neutral skin care.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Dermatology OTC Drugs- Snapshot

- 2.2 Dermatology OTC Drugs- Segment Snapshot

- 2.3 Dermatology OTC Drugs- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Dermatology OTC Drugs Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Prescription

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Over-the-counter (OTC)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Dermatology OTC Drugs Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 AbbVie Inc.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Pfizer Inc.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 GSK plc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Sun Pharmaceutical Industries Ltd.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 GALDERMA

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Amgen Inc.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Johnson & Johnson Services

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Novartis AG

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Eli Lilly and Company

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Almirall

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 S.A

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Bausch Health Companies Inc.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Dermatology OTC Drugs in 2030?

+

-

Which type of Dermatology OTC Drugs is widely popular?

+

-

What is the growth rate of Dermatology OTC Drugs Market?

+

-

What are the latest trends influencing the Dermatology OTC Drugs Market?

+

-

Who are the key players in the Dermatology OTC Drugs Market?

+

-

How is the Dermatology OTC Drugs } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Dermatology OTC Drugs Market Study?

+

-

What geographic breakdown is available in Global Dermatology OTC Drugs Market Study?

+

-

Which region holds the second position by market share in the Dermatology OTC Drugs market?

+

-

How are the key players in the Dermatology OTC Drugs market targeting growth in the future?

+

-

,

The global dermatology OTC medicines market is dominated by the soaring incidence of diverse skin-related conditions all over the world, including acne, eczema, psoriasis, and fungal infection. Increased pollution, lifestyle changes, and increasing awareness regarding skin well-being are some of the contributing factors in this rising tide of dermal diseases. Customers are constantly on the lookout for easily accessible and convenient remedies for such widespread ailments, thereby rendering OTC medicines an extremely desirable choice in terms of availability without prescription.

,, ,In addition, increasing consumer preference for self-medication and proactive skincare heavily drives the market. This is complemented by the cost-effectiveness of OTC products over prescription drugs and heightened social media and beauty awareness, which promote proactive skincare habits. Ongoing advancements in product formulations, such as the formulation of innovative ingredients and easy-to-use delivery systems (such as creams, gels, and sprays), further drive market growth through more effective and appealing solutions for consumers.