Global DDoS (Distributed Denial of Service) Mitigation Services Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2097 | Application Software | Last updated: Dec, 2024 | Formats*:

DDoS (Distributed Denial of Service) mitigation services Report Highlights

| Report Metrics | Details |

|---|---|

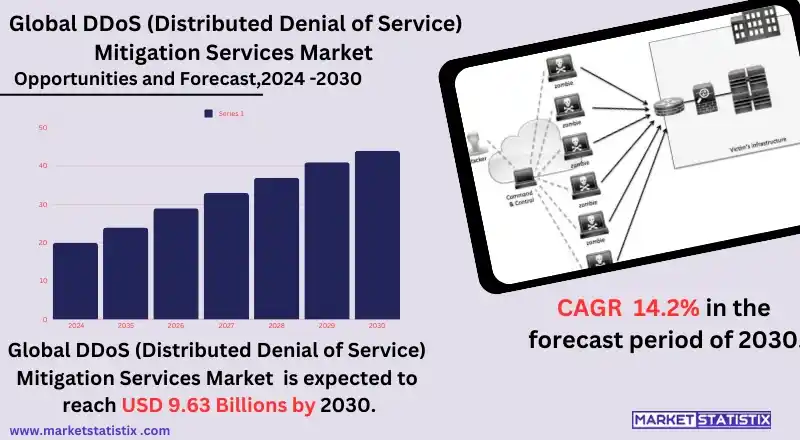

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 14.2% |

| Forecast Value (2030) | USD 9.63 Billion |

| Key Market Players |

|

| By Region |

|

DDoS (Distributed Denial of Service) mitigation services Market Trends

The global DDoS mitigation services market is growing at a tremendous pace, mainly due to an increasing trend of more advanced cyberattacks on organizations and government institutions. As such, there is a heavy use of digital infrastructure among organizations, which has fuelled demand for robust security solutions that might prevent system outages and even lead to financial loss due to DDoS attacks. Scalable, economical, and designed with widely dispersed networks in mind, cloud-based DDoS protection services are building momentum rapidly. One of the most notable trends currently has nothing to do with DDoS mitigation but rather introduces artificial intelligence and machine learning technologies into such products. These technologies help detect attacks in real time and respond automatically, further improving the speed and accuracy of the mitigation process. Growing regulatory requirements for protecting data and enhancing cybersecurity make managed DDoS mitigation services a necessity companies must adopt to avoid resulting penalties.DDoS (Distributed Denial of Service) mitigation services Market Leading Players

The key players profiled in the report are A10 Networks, Inc., Akamai Technologies, F5, Inc., Fortinet, Inc., Imperva, NETSCOUT, Radware, Cloudflare, Inc., Corero, TransUnion LLC.Growth Accelerators

The DDoS mitigation services market in the global scenario can be primarily pushed forth by the growing propensity of attacks on businesses, government organizations, and critical infrastructure. It is more likely that the rise of the digital world will cause cybercriminals to employ more sophisticated methods for disrupting internet services, which in turn boosts demand for strong security solutions. DDoS attacks can cause network or website overloads, causing significant downtime, financial losses, and reputational damage. Thus, organizations are focusing on DDoS protection services to protect their operations and keep the business running. The other critical driver is the adoption of cloud computing as well as digital transformation strategies at a very fast pace. To add to this, the growing number of businesses moving operations to cloud environments and utilizing online platforms to carry out their activities increases the risk that comes along with DDoS attacks. Since more businesses are moving towards larger, real-time DDoS mitigation services, which can protect their infrastructures based on clouds, this environment is more critical for handling that threat. The increasing requirement to design robust defines mechanisms against DDoS attacks amid engagement in e-commerce, online banking, and remote working solutions is driving the market forward.DDoS (Distributed Denial of Service) mitigation services Market Segmentation analysis

The Global DDoS (Distributed Denial of Service) mitigation services is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Network Security, Application Security, Database Security, Endpoint Security. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market thus seems extremely competitive, and market leaders are Cloudflare, Akamai Technologies, and Amazon Web Services, holding a large chunk of the market together just because of the advanced technological offerings and their widespread presence in different parts of the world. Tier 1 companies also keep enriching their portfolio by strategic acquisition and partnerships with other leading players to remain effective against the evolving threat landscape. Also, Tier 2 players like Radware and F5 Networks are gradually expanding their capabilities but cannot yet match up with the bigger brands. The Asia-Pacific region will be the fastest-growing one, driven by rising digitalization and increased exposure to cyberattacks, which require effective DDoS protection solutions for businesses in a wide range of sectors.Challenges In DDoS (Distributed Denial of Service) mitigation services Market

The primary challenges the global DDoS mitigation services market faces are due to the development of cyber-attacks. These attacks are constantly becoming more sophisticated as DDoS continues to evolve: they're getting bigger and harder to detect, and creating even greater demands on much-needed resources and technicalities. These new developments in attack methods and mechanisms, especially multi-vector and volumetric attacks, continue increasing the demand for constant upgrades in technologies and strategies of mitigation. Organizations offering protection against DDoS attacks will have to spend a lot of investments in terms of innovation and infrastructure in order not to be left behind by the rising threats that start emerging, thus increasing their cost of operation. Higher costs of effective DDoS mitigation solutions make all this unviable for SMEs; hence they cannot afford to have advanced protection measures. While large enterprises can invest in all-encompassing, multilayered defence systems, for SMEs the cost and security equations cannot be worked out. This lack of knowledge complicates the ability to expand the market by widely adopting robust services for DDoS mitigation.Risks & Prospects in DDoS (Distributed Denial of Service) mitigation services Market

Global DDoS Mitigation Services Market: opportunity over growing attacks There is a great scope for the global DDoS mitigation services market, which is initiated by the rising numbers and sophistication of cyberattacks. With increased dependence on the online services, businesses and organizations also take into serious consideration the fear of DDoS attacks, which disrupt sites, networks, and other online operations. The rapid uptake of cloud computing and IoT devices, as well as digital transformation initiatives, increases the attack surface, making effective DDoS mitigation solutions indispensable. This represents a robust opportunity for service providers to develop business through improvement in business development and better provision for advanced, real-time protection solutions that would limit disruptions and result in business continuity. In addition to regulatory pressures and the need to comply with cybersecurity, market growth is also being furthered by growing regulatory pressures and compliance requirements for cybersecurity. More so, organizations that are in need of effective DDoS mitigation services are numerous as governments and industries impose more onerous data protection laws. Small and medium-sized enterprises (SMEs) have also grown in understanding better cyber threats, hence putting their digital assets in protection by gaining DDoS protection. The closer integration of artificial intelligence and machine learning into DDoS defense systems further unlocks the development of service capabilities so that innovation and differentiation occur in an increasingly competitive market.Key Target Audience

Key target users in the global DDoS mitigation services market are organizations and companies that rely heavily on online operations, like that of e-commerce sites, financial sectors, and cloud service providers. These sectors represent crucial targeted areas for DDoS attacks, which may disrupt their services, further leading to high financial and reputational damage.,, The following significant consumers of DDoS mitigation services are government agencies, telecom providers, and large firms that operate critical infrastructures. These firms are concerned with securing their networks from attacks that may compromise national security, public service operations, or corporate activities. It is for this reason that large and critical infrastructure operators deploy DDoS mitigation solutions to ensure system security, resilience, and access are maintained even in the presence of malicious traffic. With the increasing probability of cyberattacks, along with the complexity of DDoS tactics, these services become important for organizations seeking to minimize risks without causing disruptions in their digital environments.Merger and acquisition

Recent mergers and acquisitions in the global DDoS mitigation services market indicate strategic moves toward strengthening cybersecurity capabilities in response to increasing cyber threats. Notable in this regard is the strategic alliance formed by Akamai Technologies with Corero Network Security in September 2023. The plan includes expanding its Prolexic DDoS protection platform, integrating advanced technologies for DDoS mitigation to protect it from increasingly sophisticated attacks. For instance, in November 2023, NETSCOUT announced Adaptive DDoS Protection for Arbor Edge Defence, thereby showing its commitment to protecting ISPs and corporations from the dynamic nature of threats, such as DNS water torture attacks. More importantly, large market share is held by big companies, including Cloudflare, Amazon Web Services, and Fortinet. These companies have executed numerous acquisition initiatives to expand their service portfolio. For example, Cloudflare has expanded its portfolio through strategic acquisitions within its efforts to enhance DDoS protection. The reason for this is because new generations of 5G networks and IoT devices create increasingly complex attacks against networks. As such, organizations will require solutions with increased scalability that can help them withstand disruptions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 DDoS (Distributed Denial of Service) mitigation services- Snapshot

- 2.2 DDoS (Distributed Denial of Service) mitigation services- Segment Snapshot

- 2.3 DDoS (Distributed Denial of Service) mitigation services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: DDoS (Distributed Denial of Service) mitigation services Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Network Security

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Application Security

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Database Security

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Endpoint Security

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: DDoS (Distributed Denial of Service) mitigation services Market by Deployment

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cloud

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 On-premise

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Hybrid

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: DDoS (Distributed Denial of Service) mitigation services Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 A10 Networks

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Akamai Technologies

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 F5

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Fortinet

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Imperva

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 NETSCOUT

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Radware

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Cloudflare

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Inc.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Corero

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 TransUnion LLC.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Deployment |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of DDoS (Distributed Denial of Service) mitigation services in 2030?

+

-

How big is the Global DDoS (Distributed Denial of Service) mitigation services market?

+

-

How do regulatory policies impact the DDoS (Distributed Denial of Service) mitigation services Market?

+

-

What major players in DDoS (Distributed Denial of Service) mitigation services Market?

+

-

What applications are categorized in the DDoS (Distributed Denial of Service) mitigation services market study?

+

-

Which product types are examined in the DDoS (Distributed Denial of Service) mitigation services Market Study?

+

-

Which regions are expected to show the fastest growth in the DDoS (Distributed Denial of Service) mitigation services market?

+

-

What are the major growth drivers in the DDoS (Distributed Denial of Service) mitigation services market?

+

-

Is the study period of the DDoS (Distributed Denial of Service) mitigation services flexible or fixed?

+

-

How do economic factors influence the DDoS (Distributed Denial of Service) mitigation services market?

+

-