Global DC-DC Converter Market – Industry Trends and Forecast to 2031

Report ID: MS-1898 | Electronics and Semiconductors | Last updated: Oct, 2024 | Formats*:

DC-DC Converter Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

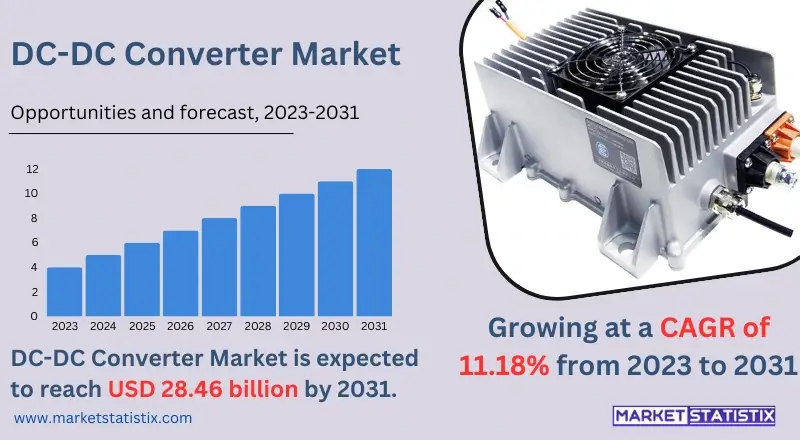

| Growth Rate | CAGR of 11.18% |

| By Product Type | Isolated, Non-Isolated |

| Key Market Players |

|

| By Region |

|

DC-DC Converter Market Trends

The world market for DC-to-DC converters is experiencing healthy growth owing to the rising need for renewable energy sources as well as electric vehicles (EVs). The conversion of industries and consumers to green energy solutions has also resulted in the need for high-quality power conversion systems. DC-DC converters are due to the effective application of renewable sources in practice where there is a need to maintain constant levels of voltage and enhance energy efficiency even in appliances such as solar panels and wind turbines. Moreover, EVs are on the rise, and, as a result, there is a need to come up with efficient and advanced DC-DC converters that are capable of controlling how the batteries are charged and power distributed. Integration of smart technology within the DC-to-DC converter market is another notable trend. Distributers are looking to design small, high-rated converters with extra features such as digital controls. This is because there is an increasing need for hand-held portable devices, IoT, and even plants—all of which require small and light designs.DC-DC Converter Market Leading Players

The key players profiled in the report are Delta Electronics Inc., Flex Ltd, Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductor, Advanced Energy Industries Inc., Analog Devices Inc., ABB, Crane Holdings Co., STMicroelectronics, Texas Instruments Incorporated, Vicor Corporation, Renesas Electronics Corporation, Skyworks Solutions Inc., TDK CorporationGrowth Accelerators

Several factors are expected to facilitate the overall expansion of the global DC-DC converter market, with one of the major ones being the need for energy-efficient solutions in various industries, especially consumer electronics, telecommunications, and renewable energy. Moreover, with the ongoing trend of thinner and smaller devices, there is the need for power management systems that are not only powerful but also compact in order to improve effectiveness and prolong the usage time of the battery. DC-DC converters assist in the conversion of voltages and improvement of energy efficiency in devices; thus, the increasing concern on energy sustainability and the need to cut down on energy consumption throw them into increased demand. Another key factor is the increasing number of electric vehicles (EVs) as well as clean power generation methods such as solar energy. The electric vehicle (EV) initiative entails a lot of power management systems in vehicle battery charging and distribution of power between various systems in an EV and hence posits a challenge to the developing countries. The same applies to solar, where DC-DC converters are installed inside solar energy systems so as to increase the efficiency of incorporated solar panels. With this increasing interest in electric mobility and green energy, the demand for DC-DC converters is likely to increase to allow manufacturers and suppliers to design adequate technologies to fulfil these needs.DC-DC Converter Market Segmentation analysis

The Global DC-DC Converter is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Isolated, Non-Isolated . The Application segment categorizes the market based on its usage such as Healthcare, Automotive, Consumer Electronics, Energy & Power, Telecommunication, Aerospace & Defense, Others Segmentation. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

According to the competitive analysis of the global DC-DC converter market, the market is occupied by both developed and developing countries and continues to change its competitive outlook. Dominant manufacturers such as Texas Instruments, Analogue Devices, and Murata Manufacturing command the largest share of the market thanks to their strong R&D skills and well-established sales and distribution channels, making sure they have product offerings that are cutting-edge and high quality. These players in the market design their DC-DC converters with emphasis on improving their efficiency, making them smaller in size, as well as improving upon their power densities because of the rising demands from industries such as telecommunications, automotive, and renewable energy. In addition to the aforementioned companies, many smaller and younger companies have started to appear in the market with more focused offerings to support a particular application, such as electric cars, handheld devices, and factory automation. This also encourages and intensifies competition as the existing firms have to improve their offerings and embrace technologies such as digital control and wide band gap semiconductors. Also, with the acquisition of novel technologies and resources, expansion in the new product line and the conquests of new markets, strategic alliances, partnerships, and consolidation through M&A are very common. In conclusion, this industry is very dynamic owing to the technological changes and the many applications that exist.Challenges In DC-DC Converter Market

The global DC-DC converter market has numerous restraints, and the most significant factors are rapid technological changes and extreme competition within the market. As the demand for better performance in smaller products is increasing, the manufacturers of these devices have to come up with new designs regularly. This race to much innovation in production and design can raise production costs and lengthen lead times, which makes it hard for smaller firms to invest in such high-cost innovations while competing with established players with high R&D capacities. In addition, price instability due to supply-and-demand mismatches is another major market challenge. The DC-DC converter sector is highly sensitive to global dynamics because of its dependence on a select group of materials (semiconductors, magnetic parts, etc.).Risks & Prospects in DC-DC Converter Market

The DC-DC converter market has enormous growth potential, as power management solutions are in great demand in many sectors. The increasing use of renewable energy sources like solar or wind energy plays a vital role in the growth of demand for DC-DC converters, which help in maximising the energy conversion process and enhancing the overall system. In addition, the growing acceptance of electric vehicles (EVs) and developments in battery technologies increase the demand for high-performance DC-DC converters for electric power distribution systems and EV driving range expansion. Given the continued growth of such sectors, manufacturers of DC-DC converters stand to gain from the needs for enhanced energy efficiency, which will encourage efficacy-focused innovations in the development of green energy technologies. Industrial automation and telecommunications offer another market opportunity as there is increased demand for more advanced power management systems due to the inclusion of technologies such as IoT, AI, and 5G networks. Industries automate and introduce ‘smart’ technologies, making it necessary to get reliable, compact DC-DC converters whose input and output voltage levels can shift.Key Target Audience

The primary stakeholders in the global market for DC-DC converters are manufacturers and designers from several sectors, including automotive, consumer electronics, telecommunications, and renewable energy. These players need efficient DC-DC converters for various power supply and distribution applications, including electric vehicles, battery management systems, mobile and handheld devices, and solar power systems. With the increasing emphasis on energy efficiency as well as smaller designs, these sectors are more in need of converters that provide high reliability, performance, and cost benefits to improve the operational capabilities of their products.,, Another important portion of the target audience consists of original equipment manufacturers (OEM) and distributors of electronic components who install DC-DC converters into their systems or offer them to their clients. These organisations are looking for such partners who make forward-looking designs of converters to keep up with customer technology and policies.Merger and acquisition

In the global DC-DC converter business, one can observe the latest merger and acquisition activity as an attempt by companies to improve their technology as well as their reach or base of operations. For example, early in the year 2023, Texas Instruments publicly disclosed that it would purchase the automotive focused DC-DC converter business unit of Aptiv. This acquisition will allow Texas Instruments to grow further in the accelerating global electric vehicle industry as it integrates the DC-DC converter technology of Aptiv. Moreover, in the second half of 2023, Infineon Technologies appointed Cypress Semiconductor, similar to DC-DC suppliers, strengthening the power management range. The merger is likely to shorten the time to market for Infineon’s new high-performance power supply solutions for industrial, automotive, and consumer electronics. The analysis of these developments suggests the growing need for effective solutions for power conversion and constant search for new technologies in the industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 DC-DC Converter- Snapshot

- 2.2 DC-DC Converter- Segment Snapshot

- 2.3 DC-DC Converter- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: DC-DC Converter Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Isolated

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-Isolated

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: DC-DC Converter Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Healthcare

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Energy & Power

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Telecommunication

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Aerospace & Defense

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others Segmentation

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: DC-DC Converter Market by Input Voltage

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Upto 40V

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 40V to 100V

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 100V to 500V

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 500V to 1000V

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: DC-DC Converter Market by Output Voltage

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Upto 100V

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 100V to 500V

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 500V to 1000V

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: DC-DC Converter Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Delta Electronics Inc.

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Flex Ltd

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Infineon Technologies AG

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Murata Manufacturing Co. Ltd.

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 NXP Semiconductor

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Advanced Energy Industries Inc.

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Analog Devices Inc.

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 ABB

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Crane Holdings Co.

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 STMicroelectronics

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Texas Instruments Incorporated

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Vicor Corporation

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Renesas Electronics Corporation

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Skyworks Solutions Inc.

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 TDK Corporation

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Input Voltage |

|

By Output Voltage |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of DC-DC Converter is widely popular?

+

-

What is the growth rate of DC-DC Converter Market?

+

-

What are the latest trends influencing the DC-DC Converter Market?

+

-

Who are the key players in the DC-DC Converter Market?

+

-

How is the DC-DC Converter } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the DC-DC Converter Market Study?

+

-

What geographic breakdown is available in Global DC-DC Converter Market Study?

+

-

Which region holds the second position by market share in the DC-DC Converter market?

+

-

How are the key players in the DC-DC Converter market targeting growth in the future?

+

-

What are the opportunities for new entrants in the DC-DC Converter market?

+

-