Global CPQ Software Tool Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-1093 | IT and Telecom | Last updated: Jul, 2025 | Formats*:

The CPQ (configure, price, quote) software tool sector revolves around digital solutions that help companies optimise and automate the complex product configuration process, determine accurate prices, and generate professional sales quotes. These tools are especially critical in B2B sectors such as manufacturing, IT, and telecommunications, where personalisation and dynamic prices are predominant. Modern CPQ platforms are part of CRM and ERP systems to ensure seamless sales workflows, reduce manual errors, accelerate quotation response time, and improve sales team productivity. With the growing demand for personalised offers and digital sales training, CPQ tools are becoming essential to companies that aim to efficiently size and improve customer experience.

CPQ Software Tool Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

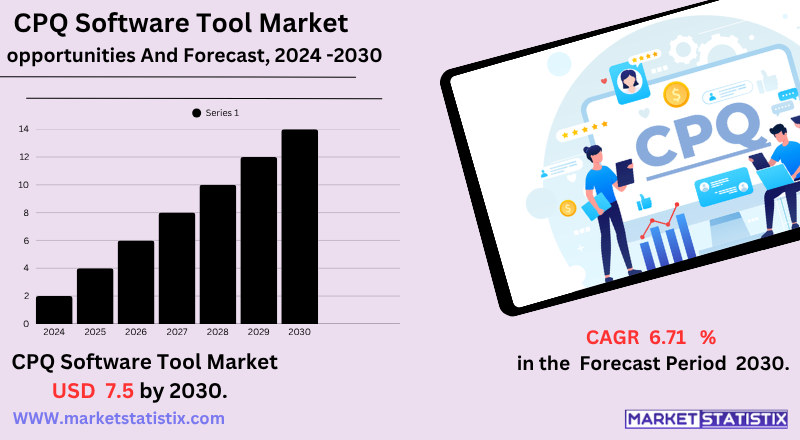

| Growth Rate | CAGR of 6.71% |

| Forecast Value (2030) | USD 7.5 Billion |

| By Product Type | Guided CPQ Software, Basic CPQ Software, Mobile CPQ Software, Visual CPQ Software, Others |

| Key Market Players |

|

| By Region |

|

CPQ Software Tool Market Trends

- AI-driven pricing and quoting

CPQ platforms increasingly incorporate AI/ML to recommend ideal prices, predict customer preferences, and automate approval workflows, enabling faster, smarter, and highly personalised offers.

- Conversational and predictive configuration

Emerging AI and LLM interfaces allow users to configure products through natural language and predictive automation, transforming CPQ into an intuitive guided selling experience.

- Integration, mobility & global compliance

Seamless CRM/ERP integration, mobile accessibility, multilingual quoting, and regulatory alignment (price rules, ESG metrics) are becoming essential, especially for global sales teams and complex industries.

CPQ Software Tool Market Leading Players

The key players profiled in the report are Experlogix (United States), CallidusCloud (United States), Apttus (United States), Configure One (United States), FPX (United States), Cincom (United States), Oracle (United States), Salesforce (United States), SAP (Germany), Infor (United States), PROS (United States), Vendavo (United States)Growth Accelerators

- Rising complexity in product bundles and configurations

As companies offer increasingly customizable and modular products, CPQ solutions are essential for managing configuration rules and ensuring quote accuracy, reducing manual errors.

- Demand for faster, more efficient sales cycles

Sales teams are under pressure to rapidly generate quotes and close deals faster, so CPQ tools simplify workflows, automate pricing logic, and accelerate proposal generation.

- Need for seamless integration with CRM and ERP systems

To ensure end-to-end visibility, lead generation of contract businesses requires strong integration between CPQ, CRM, and ERP systems, boosting the adoption of CPQ platforms.

CPQ Software Tool Market Segmentation analysis

The Global CPQ Software Tool is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Guided CPQ Software, Basic CPQ Software, Mobile CPQ Software, Visual CPQ Software, Others . The Application segment categorizes the market based on its usage such as Manufacturing Industry, Healthcare Industry, Telecom and Communications Industry, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the CPQ software tools industry is characterised by a mixture of established corporate software suppliers and agile SaaS suppliers that dispute market share through innovation, integration resources, and specific resources from the sector. Key players such as Salesforce (with Salesforce CPQ), Oracle, and SAP configure a dominance of the state-of-the-art corporate segment, offering deeply integrated solutions within the larger CRM and ERP ecosystems. Meanwhile, niche suppliers such as Apttus (Conga), Dealhub, and PROS are concentrated on agility, AI-orientated prices, and friendly interfaces to attract medium-sized companies and rapidly growing startups. Strategic acquisitions, AI enhancements, and cloud-native architectures are shaping competition as suppliers seek to differentiate themselves in a market by demanding speed, personalisation, and scalability.

Challenges In CPQ Software Tool Market

- Performance bottlenecks

Dealing with large volumes of transactions—such as thousands of pricing rules or multidimensional quotes—can significantly decrease CPQ engines and cause system downtime, interrupting sales workflows.

- Data fragmentation and integration hurdles

CPQ systems usually depend on data scattered across CRM, ERP, spreadsheets, and legacy platforms. Disconnected data lead to manual consolidation, errors, and bad quote accuracy.

- Complex implementation and customisation

Deployments require a profound understanding of business, custom integrations, and careful data migration. Without specialisation and clear planning, scopes balloon, causing inflated delays and costs.

Risks & Prospects in CPQ Software Tool Market

The CPQ software tool industry presents significant market opportunities driven by the growing adoption of digital transformation between companies that seek to optimise complex sales cycles. As companies advance towards automation and AI-orientated sales, CPQ tools offer a scalable solution to dealing with product customisation, dynamic prices, and rapid quote generation. The rise of business- and service-based business models, especially in the SaaS, telecom, and manufacturing sectors, further accelerates the need for CPQ platforms. These industries dominate due to their intricate price structures, multi-layer settings, and demand for speed and accuracy in sales processes, making CPQ tools indispensable to improve operational efficiency and customer satisfaction.

Key Target Audience

,- , CPQ systems enable integrated portals or B2B portals or platforms, ensuring that they can independently configure customizable products, access up-to-date prices, and produce accurate quotes—reducing dependence on internal stakeholders.

- End Customers (via Self-Service Portals)

,- Channel Partners & Distributors

,

, In digital or e-commerce settings, customers take advantage of CPQ's qualified configurators, usually with 2D/3D views, to build their own product settings and get instant quotes, prioritising their purchase experience and allowing business-level automation.- Sales Representatives & Account Managers

, - Channel Partners & Distributors

, They use CPQ tools to set up complex product offers through guided sales, apply price rules, and generate professional quotes—all in a few minutes. This automation reduces manual errors and changes its focus from administrator tasks to selling high value.

, ,

Merger and acquisition

- Performance bottlenecks

Dealing with large volumes of transactions—such as thousands of pricing rules or multidimensional quotes—can significantly decrease CPQ engines and cause system downtime, interrupting sales workflows.

- Data fragmentation and integration hurdles

CPQ systems usually depend on data scattered across CRM, ERP, spreadsheets, and legacy platforms. Disconnected data lead to manual consolidation, errors, and bad quote accuracy.

- Complex implementation and customisation

Deployments require a profound understanding of business, custom integrations, and careful data migration. Without specialisation and clear planning, scopes balloon, causing inflated delays and costs.

Analyst Comment

The CPQ (Configure Price Quote) software industry is experiencing robust, double-digit growth as organizations increasingly prioritize sales efficiency and tailor-made customer experiences. It is expanding rapidly, with market value estimated to increase from around $3 billion in 2024 to over USD 3.9 billion by 2030. Dominated by North America and still running the fastest in Asia Pacific, the market is very fragmented, with large suppliers such as Salesforce, Oracle, SAP, IBM, and Konga.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 CPQ Software Tool- Snapshot

- 2.2 CPQ Software Tool- Segment Snapshot

- 2.3 CPQ Software Tool- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: CPQ Software Tool Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Basic CPQ Software

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Guided CPQ Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Mobile CPQ Software

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Visual CPQ Software

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: CPQ Software Tool Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Manufacturing Industry

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Healthcare Industry

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Telecom and Communications Industry

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: CPQ Software Tool Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Apttus (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CallidusCloud (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cincom (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Configure One (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Experlogix (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 FPX (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Infor (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Oracle (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 PROS (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Salesforce (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 SAP (Germany)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Vendavo (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of CPQ Software Tool in 2030?

+

-

Which application type is expected to remain the largest segment in the Global CPQ Software Tool market?

+

-

How big is the Global CPQ Software Tool market?

+

-

How do regulatory policies impact the CPQ Software Tool Market?

+

-

What major players in CPQ Software Tool Market?

+

-

What applications are categorized in the CPQ Software Tool market study?

+

-

Which product types are examined in the CPQ Software Tool Market Study?

+

-

Which regions are expected to show the fastest growth in the CPQ Software Tool market?

+

-

Which application holds the second-highest market share in the CPQ Software Tool market?

+

-

What are the major growth drivers in the CPQ Software Tool market?

+

-

- Rising complexity in product bundles and configurations

As companies offer increasingly customizable and modular products, CPQ solutions are essential for managing configuration rules and ensuring quote accuracy, reducing manual errors.

- Demand for faster, more efficient sales cycles

Sales teams are under pressure to rapidly generate quotes and close deals faster, so CPQ tools simplify workflows, automate pricing logic, and accelerate proposal generation.

- Need for seamless integration with CRM and ERP systems

To ensure end-to-end visibility, lead generation of contract businesses requires strong integration between CPQ, CRM, and ERP systems, boosting the adoption of CPQ platforms.