Global Connected Car Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2032

Report ID: MS-2593 | Automotive and Transport | Last updated: May, 2025 | Formats*:

Connected Car Market is used to describe the ecosystem around the internet-enabled vehicle that allows vehicles to interact with other devices, networks, and services within and beyond the vehicle. This connectivity makes possible a diverse array of features and functions, such as infotainment (e.g., music streaming and real-time traffic navigation), vehicle diagnostics and health monitoring, security and safety functions (e.g., emergency service and stolen vehicle tracking), software updates over the air, and advanced driver assistance systems (ADAS) dependent on data communication.

This market has a wide range of participants, including car makers incorporating connectivity into cars, telecommunication operators offering network infrastructure, tech firms creating software platforms and applications, and content providers offering infotainment services. The merging of these sectors is propelling the development of the connected car and its capability to transform transport, safety, and in-car experience.

Connected Car Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

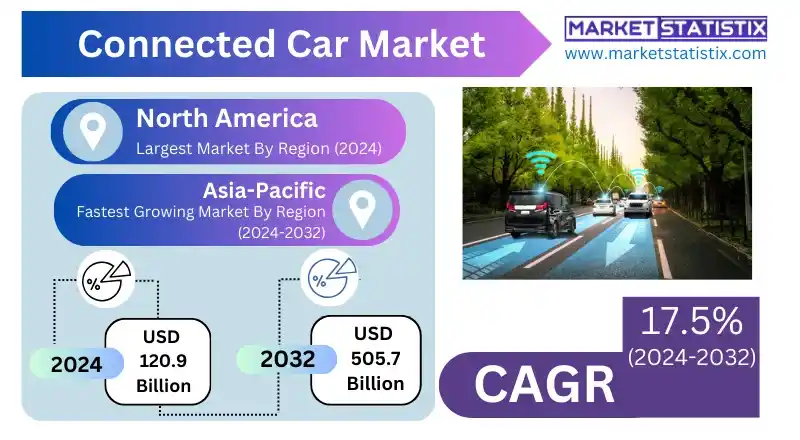

| Growth Rate | CAGR of 17.5% |

| Forecast Value (2032) | USD 505.7 Billion |

| Key Market Players |

|

| By Region |

|

Connected Car Market Trends

One of the important trends is the increasing adoption of Advanced Driver-Assistance Systems (ADAS), which are dependent on connectivity to process real-time data and communicate. In addition, growth in 5G network infrastructure is one of the enabling factors with increased data speeds and reduced latency that are important for sophisticated connected car features as well as the emergence of vehicle-to-everything (V2X) communications. Over-the-air (OTA) software updates are also becoming more popular, enabling ongoing improvement and the introduction of new features without the need for physical trips to service centers.

Another key trend is the direction towards software-based vehicles, with OTA upgrades and infotainment systems becoming the norm. The industry is also seeing powerful partnerships between automotive companies and technology firms to create connected platforms and benefit from 5G for frictionless connectivity

Connected Car Market Leading Players

The key players profiled in the report are Continental AG, Volvo, Morris Garage Motor India, Ford Motor Company, Maruti Suzuki, Payment24, Audi, Daimler AG, Bosch, General Motors, Harman International, Hyundai Motor Group, AirbiguityGrowth Accelerators

The connected car market is largely influenced by growing consumer demand for richer in-car experiences that reflect their digital lives. Capabilities such as seamless smartphone integration, sophisticated infotainment systems, real-time navigation with traffic information, and internet connectivity within the car are increasingly being anticipated by consumers. This is further driven by increasing smartphone penetration and the need for seamless connectivity in every aspect of life, including travel. Additionally, increasing awareness of safety and security functionalities made possible by connectivity, including emergency call support (eCall), vehicle diagnostics, and remote control of the vehicle, is a key adoption driver.

Another key enabler is the automotive sector's emphasis on innovation and the opportunity for new revenue. Connected car technologies facilitate over-the-air software updates for car systems, enabling ongoing improvement and the rollout of new features after purchase. In addition, the data provided by connected cars presents opportunities for multiple services, ranging from usage-based insurance to predictive maintenance and targeted advertising.

Connected Car Market Segmentation analysis

The Global Connected Car is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Mobility Management, Infotainment, Telematics, Driver Assistance. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the connected car market are extremely complex and dynamic, with a convergence of automotive manufacturers, technology leaders, telecommunication firms, and specialised software and hardware vendors. Conventional automakers such as BMW, Mercedes-Benz, Ford, and GM are making significant investments in embedding connectivity features in their vehicles and creating their own proprietary platforms and services. At the same time, technology leaders like Google (with Android Automotive), Apple (with CarPlay), and Amazon (with Alexa Auto) are competing to control in-car ecosystems with their operating systems and voice assistants. Telecommunications operators like Vodafone, AT&T, and Deutsche Telekom are also important for offering the network infrastructure and data services that support connected car functionality.

This comprehensive competition is fostering innovation in several dimensions of the connected car, such as infotainment platforms, navigation capabilities, safety applications, vehicle-to-everything (V2X) connectivity features, and over-the-air software update solutions. The significant competitive differentiators are the user-friendliness and seamlessness of the digital in-car experience, the connectivity infrastructure's resilience and security, the extent and integration of supported services and apps, and data leveraging for enabling personalised experiences as well as emerging business models.

Challenges In Connected Car Market

The market for connected cars is confronted with daunting challenges revolving around data privacy, cybersecurity, and the complexity of regulation. Connected cars capture and send enormous amounts of sensitive personal information – including driving behaviours and real-time locations – and apprehensions about data breaches and unauthorised access have escalated, eroding user confidence and hindering adoption. Manufacturers need to have rigorous security measures and open privacy policies and also contend with fragmented regulations across geographies, especially Europe, where cross-border interoperability continues to be an obstacle.

Moreover, the high cost of implementation, particularly for sophisticated 5G-capable vehicle-to-everything (V2X) ecosystems, is a hindrance for smaller OEMs and fleet operators. Consumer take-up is also inhibited by a perceived lack of value in existing connected car solutions, restricted app selection, and the dominance of older vehicle fleets that are not capable of supporting new technologies. Subscription complexity and recurring expenses discourage most likely users, and the gradual rollout of robust network infrastructure and the necessity for future-proof vehicle architectures create additional barriers to broad market penetration. Overcoming these challenges will necessitate cross-industry collaboration, harmonisation of regulations, and greater emphasis on providing an unambiguous, tangible advantage to end users.

Risks & Prospects in Connected Car Market

Major growth areas are the integration of advanced driver assistance systems (ADAS), predictive maintenance, usage-based insurance, and personalised in-car experiences. Autonomous driving, blockchain for secure data management, and over-the-air software updates are likely to further boost the market.

Regionally, the connected car market is dominated by North America, with more than a 39% share in 2024, due to sophisticated automotive infrastructure, high consumer acceptance, and early 5G deployment. Europe is the next in line, driven by stringent emissions and safety regulations, as well as the presence of top motor manufacturers. The Asia-Pacific is the fastest-growing market, driven by China, Japan, and South Korea, thanks to high government support, urbanisation, and investments in smart transportation and 5G networks. At the same time, areas such as Latin America and the Middle East & Africa exhibit promising growth, driven by investment in connected vehicle projects and growing requirements for sophisticated vehicle connectivity in urban areas.

Key Target Audience

,,

The market for connected cars targets mainly automotive original equipment manufacturers (OEMs), technology companies, and telecommunication firms. OEMs such as Ford, BMW, and Toyota embed connected technologies to improve vehicle safety, navigation, and infotainment systems. Technology companies such as Qualcomm and NVIDIA provide essential hardware and software solutions for vehicle connectivity, while telecom firms such as AT&T and Verizon offer the infrastructure required for real-time data transmission and vehicle-to-everything (V2X) communication. Such collaborations focus on providing hassle-free connectivity and innovative features in cars.

, Another important audience is consumers, especially technology-orientated individuals who want to experience better driving through features such as real-time traffic information, remote diagnostics, and customized infotainment. Fleet operators and ride-sharing businesses also use connected car technologies for effective fleet management, predictive maintenance, and enhanced customer service. The increasing demand for safety and security features, including advanced driver-assistance systems (ADAS), also appeals to government agencies and regulatory organizations concerned with minimising road accidents and optimising transportation efficiency.Merger and acquisition

Recent merger and acquisition (M&A) action in the connected car segment highlights strategic focus on digitalisation and software strengths. In February 2024, Karma Automotive acquired Airbiquity's technology assets and software portfolio, bolstering its connected vehicle offerings with more-than-a-year-over-the-air updates and data analytics functionality. Likewise, in January 2024, Samsung and Hyundai collaborated to bring Samsung's SmartThings platform to Hyundai and Kia vehicles, allowing users to remotely control car systems as well as home appliances.

The market also saw substantial cross-border M&A transactions. In January 2025, American Axle & Manufacturing reached an agreement to buy British car components company Dowlais for £1.2 billion to strengthen capabilities in the transition to electric vehicles. Also, talks of a merger between Nissan and Honda, which could create the world's third-largest carmaker, emphasised the need for consolidation in Japan's auto industry.

These M&A activities reflect a broader trend of integrating advanced technologies and consolidating resources to stay competitive in the rapidly evolving connected car market.

>Analyst Comment

The worldwide connected car market is growing rapidly, with estimates suggesting a growth from USD 12.4 billion in 2024 to USD 26.4 billion by 2030. This growth is driven by increasing consumer demand for continuous connectivity, technological advancements in automotive technologies like 5G and AI, and regulatory requirements for vehicle-to-vehicle and vehicle-to-infrastructure communication. The convergence of IoT, intelligent sensors, and over-the-air (OTA) updates is revolutionising safety, navigation, infotainment, and car performance, creating a differentiator of connected features across passenger as well as commercial vehicles.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Connected Car- Snapshot

- 2.2 Connected Car- Segment Snapshot

- 2.3 Connected Car- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Connected Car Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mobility Management

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Telematics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Infotainment

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Driver Assistance

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Connected Car Market by Network Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 3G

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 4G

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 5G

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Satellite

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Connected Car Market by Connectivity Solutions

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Embedded

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Tethered

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Integrated

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Connected Car Market by Sales Channel

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 OEM

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Aftermarket

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Connected Car Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Volvo

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Harman International

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Continental AG

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Morris Garage Motor India

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Audi

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Maruti Suzuki

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Bosch

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Daimler AG

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 General Motors

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Payment24

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Ford Motor Company

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Hyundai Motor Group

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Airbiguity

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Network Type |

|

By Connectivity Solutions |

|

By Sales Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Connected Car in 2032?

+

-

How big is the Global Connected Car market?

+

-

How do regulatory policies impact the Connected Car Market?

+

-

What major players in Connected Car Market?

+

-

What applications are categorized in the Connected Car market study?

+

-

Which product types are examined in the Connected Car Market Study?

+

-

Which regions are expected to show the fastest growth in the Connected Car market?

+

-

Which region is the fastest growing in the Connected Car market?

+

-

What are the major growth drivers in the Connected Car market?

+

-

The connected car market is largely influenced by growing consumer demand for richer in-car experiences that reflect their digital lives. Capabilities such as seamless smartphone integration, sophisticated infotainment systems, real-time navigation with traffic information, and internet connectivity within the car are increasingly being anticipated by consumers. This is further driven by increasing smartphone penetration and the need for seamless connectivity in every aspect of life, including travel. Additionally, increasing awareness of safety and security functionalities made possible by connectivity, including emergency call support (eCall), vehicle diagnostics, and remote control of the vehicle, is a key adoption driver.

Another key enabler is the automotive sector's emphasis on innovation and the opportunity for new revenue. Connected car technologies facilitate over-the-air software updates for car systems, enabling ongoing improvement and the rollout of new features after purchase. In addition, the data provided by connected cars presents opportunities for multiple services, ranging from usage-based insurance to predictive maintenance and targeted advertising.

Is the study period of the Connected Car flexible or fixed?

+

-