Global Chromatography Syringes Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-885 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The market for chromatography syringes involves the manufacturing, distribution, and selling of special syringes for accurate sample introduction in all forms of chromatography. Chromatography, a robust analytical tool employed to distinguish as well as identify the constituents of a mixture, depends extensively upon the reproducible and accurate injection of samples into the system of chromatography. Chromatography syringes are designed to withstand these stringent conditions, with features including close tolerances, inert materials to avoid sample contamination, and accurate volume gradations to guarantee correct delivery. Chromatography syringes are basic tools in the hands of researchers, scientists, and technicians in a wide range of fields, from pharmaceuticals to environmental analysis, food and beverage analysis, and clinical diagnostics.

These custom syringes come in a broad selection of volumes, needle sizes, and tip designs to accommodate various chromatography methods such as gas chromatography (GC), high-performance liquid chromatography (HPLC), and thin-layer chromatography (TLC). The materials of construction, including borosilicate glass and chemically inert polymers, preserve the integrity of the sample and avoid any adverse interactions with the parts of the syringe.

Chromatography Syringes Report Highlights

| Report Metrics | Details |

|---|---|

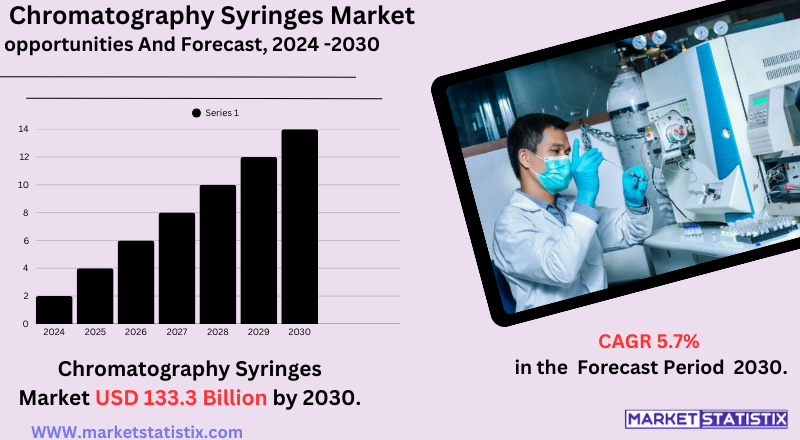

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 5.7% |

| Forecast Value (2030) | USD 133.3 billion |

| By Product Type | Manual Syringes, Autosampler Syringes |

| Key Market Players |

|

| By Region |

|

Chromatography Syringes Market Trends

The market for chromatography syringes is undergoing trends fuelled by the demand for high accuracy and precision in analytical methods, especially in the emerging pharmaceutical and biotechnology industries. The requirement for accurate sample handling in drug discovery, quality control, and research purposes is a key driver. Additionally, the regulations related to food safety and environmental surveillance are increasing the use of chromatography methods, thereby propelling the demand for the specialised syringes employed in the tests.

The other important trend is the ongoing evolution of technologies in chromatography itself, which requires more advanced syringes to be developed. This comprises advancements in material constructions (such as inert polymers to reduce sample interaction), enhanced needle constructions to minimise dead volume and improve injection efficiency, and ergonomic designs for operator comfort. Disposable syringes are also increasingly preferred to avoid the risk of cross-contamination, particularly in sensitive usage. Laboratory automation is also impacting the market, and there is a need for autosampler-compatible syringes to increase efficiency and throughput.

Chromatography Syringes Market Leading Players

The key players profiled in the report are Gilson Inc, Perkin Elmer Inc, zAgilent Technologies Inc., Thermo Fisher Scientific Inc., Spectrum Chromatography, Hamilton Company, Valco Instruments Company Inc,, Ace Glass Inc, GE Healthcare, Valiant Co. LtdGrowth Accelerators

Market expansion for the chromatography syringes is driven mainly by the growing pharmaceutical and biotech industries. These industries are greatly dependent on chromatography for pharmaceutical product quality control, development, analysis, and drug discovery and therefore require accurate and stable sample introduction through high-quality syringes. Regulatory standards for purity and safety of pharmaceutical products further stimulate the need for precise analytical methods such as chromatography and hence, the demand for reliable chromatography syringes.

Another major contributor is the rising use of chromatography methods in other industries, such as environmental analysis, food and beverage analysis, and clinical diagnostics. Increased food safety concerns, increasing environmental compliance, and demands for precise diagnostic processes are driving the use of chromatography higher. This widened range of applications directly contributes to the demand for chromatography syringes, as they are a necessary consumable in these analytical processes.

Chromatography Syringes Market Segmentation analysis

The Global Chromatography Syringes is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Manual Syringes, Autosampler Syringes . The Application segment categorizes the market based on its usage such as Gas Chromatography, High Pressure Liquid Chromatography, Thin Layer Chromatography. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for chromatography syringes has a moderately concentrated competitive environment composed of a combination of regional and global players. The main strategies adopted by the companies are innovation in products with an emphasis on precision, ruggedness, and usability, as well as diversifying their product offerings to support various types of chromatography techniques such as GC and HPLC. Joint ventures with instrument distributors and manufacturers, as well as strategic acquisition, are also frequent methods of increasing market reach and access to a greater number of customers, such as pharmaceutical firms, research organizations, and environmental testing laboratories.

Competition revolves around considerations like material quality (e.g., inertness for avoiding sample contamination), volume delivery precision, and the presence of specialised types of syringes for autosamplers and manual injections. The demand for high-throughput analysis and increasing stress on sample integrity are pushing the need for sophisticated syringe designs.

Challenges In Chromatography Syringes Market

The market for chromatography syringes is confronted with a number of major challenges that affect its growth and uptake. The high cost of equipment and syringes, particularly for specialised or high-precision syringes, may restrict access for small laboratories and research institutions with limited budgets. Furthermore, technological sophistication in sophisticated syringe designs tends to require specialised training, which may discourage some users from embracing new products. Compatibility problems also exist, as no syringes are suitable for all chromatography equipment or methods, limiting their applicability in various laboratory environments. Sample contamination risk associated with faulty handling or material interactions of syringes also threatens market acceptance since sample integrity must be preserved in analytical analysis.

The market is also subject to competitive stress from other technologies like autosamplers and microfluidic devices, which can provide more throughput or ease of use. Environmental sustainability is increasingly significant, compelling manufacturers to create recyclable or reusable syringes – a transition that poses both technical and economic hurdles. Finally, lack of skilled personnel and compliance with changing safety standards remain obstacles to widespread market

Risks & Prospects in Chromatography Syringes Market

Major market opportunities arise from the growing application of chromatography in pharmaceutical and biotechnology research, food safety testing, environmental monitoring, and forensic science. The rising regulatory standards for drug and food safety, along with the growth in R&D expenditure and government initiatives, are likely to continue the growth momentum of the market.

Region-wise, North America leads the market at present with its well-developed pharmaceutical industry, high research and development activity, and strong demand for analytical sciences, especially in the U.S. Asia-Pacific, however, is expected to be the fastest-growing region with fast growth in pharmaceutical and biotechnology sectors, enhanced healthcare infrastructure, and increased adoption of sophisticated analytical methods in nations such as China and India. China is also anticipated to experience a 7.5% CAGR, with gains accruing from industrialisation, heightened environmental monitoring, and massive government investment in life sciences. These regional forces point to healthy global potential for manufacturers with a focus

Key Target Audience

,,

,

The market for chromatography syringes is mainly focused on research institutions and pharmaceutical & biotech firms. Research institutes with a market share of around 45% majorly use chromatography syringes in academic research, chemical studies, and life sciences research. Both manual and autosampler-compatible syringes are depended upon by these institutions for precise sample injections in methods such as High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC). Pharmaceutical and biopharmaceutical industries, which constitute approximately 35% of the market, use chromatography syringes for drug development, regulatory compliance, and quality control, requiring rigorous analytical validation and accuracy.

, Furthermore, contract research organizations (CROs), food and beverage companies, and environmental testing labs are key segments in the chromatography syringes industry. CROs assist pharma and biotech industries with niche services in transcriptomic analysis, enabling large-scale research and clinical trials. Chromatography syringes are used in the food and beverage sector for quality checks, authenticity, and contaminant analysis to ensure compliance with safety regulations.,

Merger and acquisition

The market for chromatography syringes is confronted with a number of major challenges that affect its growth and uptake. The high cost of equipment and syringes, particularly for specialised or high-precision syringes, may restrict access for small laboratories and research institutions with limited budgets. Furthermore, technological sophistication in sophisticated syringe designs tends to require specialised training, which may discourage some users from embracing new products. Compatibility problems also exist, as no syringes are suitable for all chromatography equipment or methods, limiting their applicability in various laboratory environments. Sample contamination risk associated with faulty handling or material interactions of syringes also threatens market acceptance since sample integrity must be preserved in analytical analysis.

The market is also subject to competitive stress from other technologies like autosamplers and microfluidic devices, which can provide more throughput or ease of use. Environmental sustainability is increasingly significant, compelling manufacturers to create recyclable or reusable syringes – a transition that poses both technical and economic hurdles. Finally, lack of skilled personnel and compliance with changing safety standards remain obstacles to widespread market

>

Analyst Comment

The chromatography syringes market is witnessing steady growth due to rising demand from the pharmaceutical, biotechnology, food safety, and environmental testing industries. The market is anticipated to achieve about $317.27 million by 2032. Some of the key drivers of growth are the increasing use of chromatography in drug discovery, food quality testing, and environment monitoring, coupled with continuous technological advancements that enhance precision, automation compatibility, and chemical resistance of syringes. The pharmaceutical and biotechnology sectors are likely to control market share as a result of increasing R&D expenditures and the increasing demand for good-quality analytical instruments.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Chromatography Syringes- Snapshot

- 2.2 Chromatography Syringes- Segment Snapshot

- 2.3 Chromatography Syringes- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Chromatography Syringes Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Manual Syringes

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Autosampler Syringes

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Chromatography Syringes Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Gas Chromatography

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 High Pressure Liquid Chromatography

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Thin Layer Chromatography

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Chromatography Syringes Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Ace Glass Inc

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 zAgilent Technologies Inc.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 GE Healthcare

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Gilson Inc

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hamilton Company

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Perkin Elmer Inc

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Spectrum Chromatography

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Thermo Fisher Scientific Inc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Valco Instruments Company Inc

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Valiant Co. Ltd

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Chromatography Syringes in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Chromatography Syringes market?

+

-

How big is the Global Chromatography Syringes market?

+

-

How do regulatory policies impact the Chromatography Syringes Market?

+

-

What major players in Chromatography Syringes Market?

+

-

What applications are categorized in the Chromatography Syringes market study?

+

-

Which product types are examined in the Chromatography Syringes Market Study?

+

-

Which regions are expected to show the fastest growth in the Chromatography Syringes market?

+

-

Which application holds the second-highest market share in the Chromatography Syringes market?

+

-

What are the major growth drivers in the Chromatography Syringes market?

+

-

Market expansion for the chromatography syringes is driven mainly by the growing pharmaceutical and biotech industries. These industries are greatly dependent on chromatography for pharmaceutical product quality control, development, analysis, and drug discovery and therefore require accurate and stable sample introduction through high-quality syringes. Regulatory standards for purity and safety of pharmaceutical products further stimulate the need for precise analytical methods such as chromatography and hence, the demand for reliable chromatography syringes.

Another major contributor is the rising use of chromatography methods in other industries, such as environmental analysis, food and beverage analysis, and clinical diagnostics. Increased food safety concerns, increasing environmental compliance, and demands for precise diagnostic processes are driving the use of chromatography higher. This widened range of applications directly contributes to the demand for chromatography syringes, as they are a necessary consumable in these analytical processes.