Global Cashew Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-755 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Cashew Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

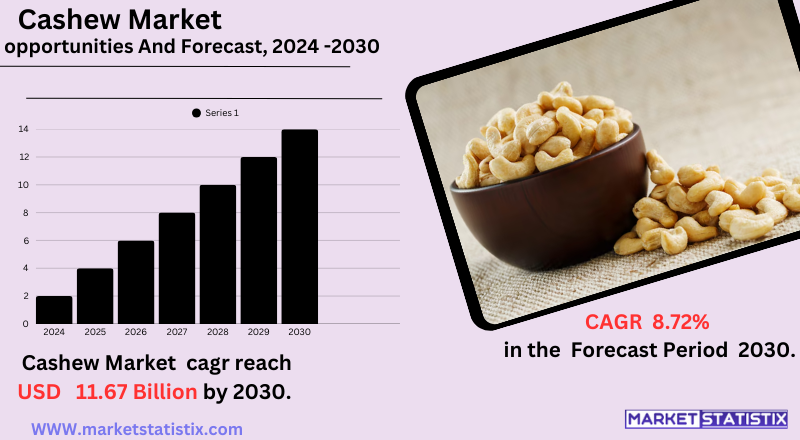

| Growth Rate | CAGR of 8.72% |

| Forecast Value (2030) | USD 11.67 Billion |

| By Product Type | Unsalted Cashew Nuts, Roasted Cashew Nuts, Salted Cashew Nuts, Flavored Cashew Nuts |

| Key Market Players |

|

| By Region |

|

Cashew Market Trends

On the one hand, the demand for cashew nuts is increasing worldwide, fuelled by consumers' health consciousness and awareness of the nutritional benefits of cashews as a source of healthy fats, protein, vitamins, and minerals. This demand is also being boosted by the rising popularity of plant-based diets, wherein cashews have become an ingredient in many applications as well as for snacking. The market has, therefore, been experiencing continuous consumption growth for cashew nuts, primarily as whole kernels and transformation into processed forms such as snacks, confections, and dairy alternatives such as cashew milk and butter. On the other hand, there are dynamic changes in production and processing areas in the market. The traditional major producers, such as India and Brazil, still remain significant, but now African nations, especially West Africa, and certain Southeast Asian countries, such as Vietnam and the Philippines, are coming up as important players in both cultivation and processing. There is an increasing value-addition trend at the source, with African countries investing in processing capabilities for the purpose of exporting kernels, not just raw nuts. Online distribution is also getting an increasing importance as a channel to distribute products and to reach a wider consumer base.Cashew Market Leading Players

The key players profiled in the report are Aryan Food Ingredients Limited, John B. Sanfilippo & Son Inc., Emerald Nuts LLC, Lien Anh Co. Ltd, Archer Daniels Midland Company, Haldiram Foods International Private Limited, Bunge Limited, Diamond Foods LLC, Vietnam Cashew Corporation (VINACAS), The Kraft Heinz Company, CBL Natural Foods Private Limited, Aurora Products Inc., Nestlé S.A., Alphonsa Cashew Industries, Nutsco Inc.Growth Accelerators

Health awareness among the consumers worldwide expects the majority of this increasing demand. Cashews are acknowledged to be nutritious, rich in healthy fats, protein, vitamins, and minerals. Therefore, cashew nut healthy snack demand is high, as it forms an important ingredient in other health-orientated food products. The demand is also growing because of the increasing popularity of plant-based and vegan diets, promoting the use of cashews in dairy alternatives like cashew milk or cheese, which are products generally targeted to a wide consumer base for those interested in non-animal-based products. Another major driving force is the increase in the food processing sector and product innovations. Cashew nuts are being used increasingly in a wide variety of food applications, such as confectioneries, baking products, snack bars, and ready-to-eat food. The promotion of flavoured and gourmet varieties of cashews and cashew-based products, such as cashew butter, also helps in their appeal and reach in the market. Moreover, the growth of e-commerce and other retail channels like supermarkets, hypermarkets, and speciality stores is actively contributing to the availability of cashew products to consumers across the globe, aiding immensely in the market growth.Cashew Market Segmentation analysis

The Global Cashew is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Unsalted Cashew Nuts, Roasted Cashew Nuts, Salted Cashew Nuts, Flavored Cashew Nuts . The Application segment categorizes the market based on its usage such as Food Service, Household, Industrial. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

When it comes to competitive cashew markets, the game is moderately consolidated in that it is a mix of global agricultural trading companies, large food processing corporations, and many other smaller or regional processors and exporters. The big players compete on volume and continuity of supply, processing efficiencies, quality control, and whether or not certain product claims can be met, i.e., the ability to offer organic and/or Fair-Trade certified cashews as part of their portfolio. Vertical integration management, where companies control some of their supply chain – from raw material growing to processing and distribution – would provide a cost and trackability competitive advantage. Geographies playing major roles in terms of competition encompass processing hubs in nations like India and Vietnam, with most of their developed infrastructure and sufficient skills to enable them to remain strong in the supply chain. However, cashew-producing countries in Africa send signals of increasing concern over developing their processing capabilities towards raw cashew nut value addition. A few more emerging trends that will shape the competitive strategies of market players include fast-growing demand for healthy snacks, plant-based diets, and novel cashew innovations such as cashew butter and cashew milk.Challenges In Cashew Market

Supply chain disruptions and rising raw material prices have created serious challenges for the cashew market. On these issues weigh additional difficulties ranging from geopolitical concerns such as tariff adjustments under the new U.S. administration to inflation in important markets. The stringent food safety and labelling regulations provide additional woes for manufacturers in the industry. At the same time, competition internationally from Southeast Asian producers puts on additional market pressure. The exposure of cashew production to climate change, adverse weather, and diseases afflicting cashew trees are slow but steady long-term risks to sustain the industry. Consumer demand remains strong for healthy snacks, but very low profit margins continue to give headaches to all players in the market. An absolute necessity is for proper procurement and inventory management so that price volatility can be managed with minimal impact and supply can be consistent. Besides, to balance supply-demand dynamics and ensure sustainable practices, cooperation across the entire industry is critical to address the regulatory aspect involved. Companies are looking into automation and artificial intelligence (AI) investments to streamline their operations, increase traceability, and minimise their carbon footprints.Risks & Prospects in Cashew Market

Asia-Pacific and Africa are emerging as strong markets for growth, with increasing production capacities and export potential. Innovations in product diversification, especially targeted at introducing cashew-based snacks, dairy alternatives, and protein bars, open up further areas for expanding the market. Advances in processing technologies include more automation and AI-driven sorting, which will boost efficiency and output. In effect, regionally, some markets may show substantial differences. The North American and European markets concentrate on premium and sustainably sourced products to comply with strict regulations. However, production and exports remain in Asia-Pacific, where it enjoys favourable climates and lower labour costs. Even African nations are emerging powerhouses, investing heavily in processing infrastructure to promote value-added exports.Key Target Audience

, The core cashew target market consists of health-conscious consumers, plant-based eaters, and snack lovers seeking nutritious alternatives. Cashews are nutrient powerhouses containing healthy fats, protein, and minerals, which has made this nut the choice of many for conscious eating and heart health. It comprises professionals in cities, millennials, and families who incorporate nuts daily as snacks, toppings for salads, or add them into home cooking., The other major consumer group consists of food and beverage manufacturers and those producing plant-based dairy alternatives such as cashew milk, cheese, and yoghurts. Demand for such products is driven by vegetarians and vegans, who appreciate their creaminess and nutritional credentials. For culinary enthusiasts and chefs, cashews also figure prominently in international cuisine. Furthermore, the cashew market receives demand from the confectionery and bakery industries, where cashews are used as premium ingredients.Merger and acquisition

Recently, mergers and acquisitions in the cashew industry are strategic moves for the purpose of increasing processing capability and gaining access to premium product segments. The Netherlands-based Monchy Food Company acquired the significant cashew processing facility called Amama Farms located in Tanzania in April 2023. This acquisition will help Monchy establish itself in the dried fruit market with direct access to cashew processing operations. Likewise, in February 2022, India's Vikas Lifecare Ltd acquired a cashew-processing unit in Mangalore, Karnataka, to double processing capacity. The decision was made to cater to the premium cashew nuts market, which is buoyed by increasing per capita income and changes in consumer preferences toward premium products. >Analyst Comment

The global cashew market looks promising regarding its growth, with a projected market size of USD 8.08 billion by 2025. Rising demand for healthy and natural products, such as extensive uses of cashews in snacks, dairy alternatives, and nutrition bars, will continue to drive the market. On the other hand, technological advancements in production, such as AI sorting systems, improve efficiency and product quality. Sustainable sourcing behaviours and clean-label trends are becoming buzzwords among health-orientated shoppers; however, fluctuating raw material prices, supply chain disruptions, and several other stringent food safety regulations are still major barriers for the manufacturers.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Cashew- Snapshot

- 2.2 Cashew- Segment Snapshot

- 2.3 Cashew- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Cashew Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Roasted Cashew Nuts

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Salted Cashew Nuts

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Unsalted Cashew Nuts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Flavored Cashew Nuts

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Cashew Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Household

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Food Service

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Cashew Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Nestlé S.A.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Archer Daniels Midland Company

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bunge Limited

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 The Kraft Heinz Company

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 John B. Sanfilippo & Son Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Vietnam Cashew Corporation (VINACAS)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Lien Anh Co. Ltd

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Haldiram Foods International Private Limited

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Alphonsa Cashew Industries

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Diamond Foods LLC

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Emerald Nuts LLC

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Aurora Products Inc.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Aryan Food Ingredients Limited

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 CBL Natural Foods Private Limited

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Nutsco Inc.

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Cashew in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Cashew market?

+

-

How big is the Global Cashew market?

+

-

How do regulatory policies impact the Cashew Market?

+

-

What major players in Cashew Market?

+

-

What applications are categorized in the Cashew market study?

+

-

Which product types are examined in the Cashew Market Study?

+

-

Which regions are expected to show the fastest growth in the Cashew market?

+

-

Which application holds the second-highest market share in the Cashew market?

+

-

What are the major growth drivers in the Cashew market?

+

-