Global Carrageenan Market – Industry Trends and Forecast to 2030

Report ID: MS-821 | Healthcare and Pharma | Last updated: Apr, 2025 | Formats*:

Carrageenan Report Highlights

| Report Metrics | Details |

|---|---|

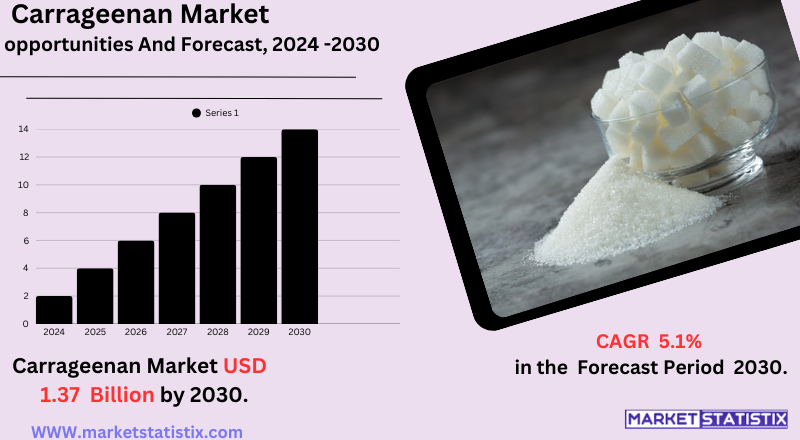

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 5.1% |

| Forecast Value (2030) | USD 1.37 Billion |

| By Product Type | Kappa, Lota, Lambda |

| Key Market Players |

|

| By Region |

|

Carrageenan Market Trends

Several important developments are underway in the carrageenan market today. One of these is the increasing consumer demand for natural and clean-label ingredients incorporated into various food and beverage products, and carrageenan competes as a plant-derived thickening agent, stabiliser, and gelling agent. This applies even more to the increasing number of people who are adopting vegan and vegetarian dietary lifestyles, as carrageenan has shown itself as an alternative for animal-derived gelatin in various uses. The upcoming applications of carrageenan are now part of the region of innovation and new applications in the pharmaceutical industry that are illustrated by the recognised potentials in drug formulations and tissue engineering. Thus, the current carrageenan market is now expanding, notwithstanding the challenges from the price volatility of this substance due to the availability of seaweed and reservations on its safety from the many negative reports. Overall, however, the carrageenan market has a very favourable growth path propelled by the demands for naturals and extended applications across industries.Carrageenan Market Leading Players

The key players profiled in the report are Archer Daniels Midland (ADM) (United States), Egalis (France), BASF (Germany), Marcelle (France), Altra (Iceland), Nestlé (Switzerland), Hayden (United States), Cargill (United States), FMC BioPolymer (United States), Danone (France), Seasol (Australia), DuPont (United States), Moleculin Bioactives (India), CP Kelco (United States), Thompson Teel Seeds (United States)Growth Accelerators

The carrageenan market is driven mainly by the rising demand for its versatile functionalities across various industries. In the food and beverage industry, increasing consumption of processed food and growing preference for natural and plant-based ingredients give impetus to the carrageenan demand as thickening, gelling, and stabilising agents for products such as dairy alternatives, processed meat, and confectionery. Further, the clean-label trend, where consumers seek natural and recognisable ingredients, favours carrageenan as a good linchpin over synthetic additives. Lessening competition in the food industry, the upsurge of aggressiveness of applications of carrageenan in the pharmaceutical and personal care sectors also becomes a key driver now. For pharmaceutical uses, its application as an excipient in drug-delivery systems and also for its use as an antiviral contributes to the growth of this market. In cosmetics and personal care applications, it further fuels demand due to its thickening and stabilising properties in lotions, creams, and toothpaste.Carrageenan Market Segmentation analysis

The Global Carrageenan is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Kappa, Lota, Lambda . The Application segment categorizes the market based on its usage such as Food, Personal, Pharmaceutical, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive arena of the carrageenan market is somewhat consolidated, with both global and regional players participating in this market. Cargill, CP Kelco, Kerry Group, and Ingredion are a few major international companies with considerable market shares. These leading companies enjoy established distribution channels, R&D support, and multiple product offerings for various application industries such as food and beverage, pharmaceuticals, and personal care. The threshold for market entry remains very low for this segment, and thus maintaining end-to-end quality without compromising on global expansion remains their strategy. On the other hand, there are several smaller and medium-sized companies, especially in regions where seaweed cultivation is significant, such as in the Philippines and Indonesia. These are typically quite small players competing in terms of prices, specific grades of carrageenan (kappa, iota, lambda), or perhaps niche markets such as organic or semi-refined carrageenan. Strategic alliances, mergers, and acquisitions are rampant, as companies tend to improve their product portfolios and market presence.Challenges In Carrageenan Market

The growth of the carrageenan business and operational stability face a multitude of serious challenges. Persistent supply chain disruptions and raw material price rises are causing an increase in input cost and creating uncertainty for manufacturers. The market further suffers from stringent regulations of food safety and labelling, forcing companies to comply and adapt to disparate standards around different regions. Continued competition and prolonged inflation in key markets are again squeezing profit margins, affecting the ability of players to sustain their cost model and fulfil a healthy appetite from consumer demand. Another major challenge would be the mounting health concerns and scepticism raised by consumers against carrageenan, which affects its acceptability in foods and personal care products. Environmental concerns surrounding harvesting seaweed are causing sourcing practices to come under scrutiny regarding sustainability. Overcoming such hurdles will require companies to implement digitalisation, enhancing their supply chain resilience, and cooperating throughout the value chain for regulatory compliance and sustained growth.Risks & Prospects in Carrageenan Market

The key market prospects include wider application in processed foods, particularly dairy and plant-based alternatives, where the thickening and stabilising properties of carrageenan are highly esteemed. This accelerative trend can be blamed on the attitude of people towards veganism and vegetarianism on the one hand and the demand for bio-based, eco-friendly additives on the other. Regionally, Asia-Pacific is a dominant figure in the production and consumption of carrageenan, as the region enjoys abundant resources of red seaweed and high demand for food processing purposes. Growth is also witnessed in North America and Europe, backed by increasing awareness regarding health issues and regulations in favour of natural food additives. In this region, the ones denying labels and organic product constituents witness high retention for carrageenan, while manufacturers also look to build consumer trust through transparent sourcing and sustainable practices.Key Target Audience

, The major focus areas of the carrageenan market target food and beverage manufacturers, especially those within the dairy, meat, and plant-based product submarkets. Carrageenan is largely utilised as a thickening, gelling, and stabilising agent in the areas of dairy alternatives, processed meat, and sauces. The food companies value its ability to enhance texture, increase shelf life, and improve mouthfeel; this makes carrageenan the choice of an ingredient across various processed and convenience foods., Beyond food manufacturers, some other core segments of the market also include pharmaceutical companies, cosmetic brands, and personal care product manufacturers. Carrageenan is also applied in manufacturing medicinal syrups, toothpaste, and cosmetics thanks to its emulsifying and binding properties. These markets are guided by the desire for natural, plant-based ingredients; carrageenan's seaweed-derived origin, therefore, stands as an important selling point among eco- and health-minded consumers.Merger and acquisition

There have been recent strategic mergers and acquisitions within the carrageenan market to increase product lines and geographical presence. While this acquisition intends to develop Huber's plant nutrition and biostimulants capabilities, in November 2022, J.M. Huber Corporation purchased Biolchim Group, which brought into its portfolio West Coast Marine-Bio Processing Corp., which provides a variety of seaweeds, including carrageenan. Similarly, in April 2021, Bang & Bonsomer acquired all the shares of Eurogum A/S in Denmark and EurogumPolskaSp Zoo in Poland, both manufacturers of carrageenan and alginate for food processing. This acquisition has strengthened Bang & Bonsomer's foothold on food ingredients while opening avenues for business growth in Europe. These mergers and acquisitions are seen as part of the diversifying trend where significant players in the carrageenan market focus on diversifying their product lines and regional footprints in response to the growing demand for carrageenan in an ever-expanding array of applications, including food, pharmaceuticals, and personal care products. >Analyst Comment

The global carrageenan market is valued at around USD 1 billion in 2025 and is expected to grow to reach USD 1.5 billion by 2035. Carrageenan, a natural thickening and gelling agent derived from red seaweed, is widely used in food products such as dairy, desserts, sauces, and plant-based alternatives due to its stabilizing and emulsifying properties. The market growth is driven by increasing consumer preference for natural and plant-based ingredients, rising demand in food, personal care, and pharmaceutical sectors, and the trend toward clean-label and sustainable products- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Carrageenan- Snapshot

- 2.2 Carrageenan- Segment Snapshot

- 2.3 Carrageenan- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Carrageenan Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Kappa

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lota

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Lambda

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Carrageenan Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceutical

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Personal

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Carrageenan Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Altra (Iceland)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Archer Daniels Midland (ADM) (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 BASF (Germany)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Cargill (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 CP Kelco (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Danone (France)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 DuPont (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Egalis (France)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 FMC BioPolymer (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Hayden (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Marcelle (France)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Moleculin Bioactives (India)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Nestlé (Switzerland)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Seasol (Australia)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Thompson Teel Seeds (United States)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Carrageenan in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Carrageenan market?

+

-

How big is the Global Carrageenan market?

+

-

How do regulatory policies impact the Carrageenan Market?

+

-

What major players in Carrageenan Market?

+

-

What applications are categorized in the Carrageenan market study?

+

-

Which product types are examined in the Carrageenan Market Study?

+

-

Which regions are expected to show the fastest growth in the Carrageenan market?

+

-

What are the major growth drivers in the Carrageenan market?

+

-

Is the study period of the Carrageenan flexible or fixed?

+

-