Global Carob Protein Market – Industry Trends and Forecast to 2030

Report ID: MS-2292 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

Carob Protein Report Highlights

| Report Metrics | Details |

|---|---|

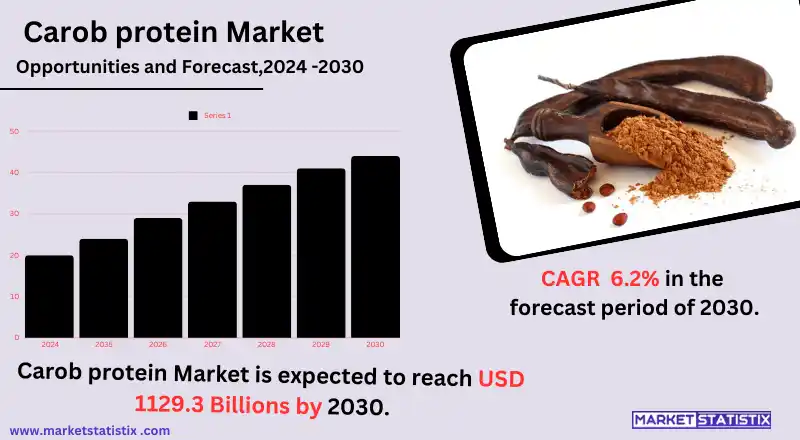

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.2% |

| Forecast Value (2030) | USD 1129.3 Billion |

| By Product Type | Natural, Organic |

| Key Market Players |

|

| By Region |

|

Carob Protein Market Trends

The carob protein market is growing due to increasing demand for plant-based and allergen-free sources of protein. Health-conscious and allergy-restricted consumers, such as the vegan population or those with gluten or lactose intolerance, are increasingly turning to carob. For its consumers, carob is becoming more popular because it is naturally gluten-, dairy-, and fibre-rich free. The trend toward clean-label products and more natural ingredients fuels this growing market with carob protein, which is increasingly recognised as healthier and more sustainable than animal proteins in food and beverages. Another emerging trend in the market is that of carob protein increasingly being incorporated within the nutrition and functional food industries. Such products include carob protein in protein bars, snacks, and meat alternatives made from plant protein. The fortification exploits inherent high-fibre, antioxidant, and low-glycaemic profiles.Carob Protein Market Leading Players

The key players profiled in the report are Australian Carobs pty ltd in Australia, Tate and Lyke of United Kingdom,, DuPont of United States, Starvos Papis Food ltd of Cyprus, Altrafine Gums of India, Pedro Perez of Spain, THE AUSTRALIAN CAROB CO., The Carob Kitchen, Frontier Co-op., Chatfield’s, OliveNation, NOW Foods, Ingredients UKGrowth Accelerators

The carob protein market is gaining traction due to the growing inclination towards plant-based protein options devoid of allergens and which are sustainable. With this increase in awareness pertaining to plant-based health benefits, people are turning to carob protein as one non-dairy and gluten-free option for those who have restrictions in dietary habits. This is also considered one of the finest sources of antioxidants, as well as its naturally sweet property, which enhanced its acceptability for more healthy masses searching for a nutritious alternative to conventional protein sources like soy, etc., or dairy. Another factor driving the market is the evolving demand for clean-label products and natural ingredients within the food and beverage applications. In this regard, carob protein is a naturally sourced and less processed option to meet some expectations of consumers who prefer being free from artificial materials. This, coupled with the rising trend for health foods and beverages such as protein bars and plant-based snacks, is boosting the growth of demand for carob protein ingredients by necessitating versatility between nutritional and ethical consumerism.Carob Protein Market Segmentation analysis

The Global Carob Protein is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Natural, Organic . The Application segment categorizes the market based on its usage such as Food & Beverages, Animal Feed, Personal Care. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

There are both big and small companies in the competitive base of the carob protein market. These established companies primarily focus on producing high-quality and sustainable carob protein obtained from carob beans due to the growing demand for plant-based proteins. Most companies are majorly emphasising their efforts toward natural and organic sourcing and eco-friendly methods of production to lure consumers who are health-conscious, often allocating budgets for research and development to improve formulations of the final products for better nutritional benefits and innovative options in food, beverages, and supplements.Challenges In Carob Protein Market

Firstly, a very limited consumer awareness is proving to be a major challenge in carob protein acceptance as a source of protein. In fact, carob is an important substitute for cocoa and a natural sweetening agent among many people, although its protein richness has not been made known to many of them. Therefore, it can be termed as a constrainer for market growth. The other constraint is the lack of expensive infrastructure for mass production of carob protein, making it more inaccessible and expensive compared to other plant sources such as soy or pea protein. Additionally, there are upcoming challenges that include competition from several other plant-based proteins already having a commanding position in the market, such as those from hemp, soy, and pea sources. These alternatives have great market penetration, tested health benefits, and greater consumer acceptance.Risks & Prospects in Carob Protein Market

The carob protein market is very promising due to the increase in interest in plant-based, allergen-free, and sustainable alternatives to animal proteins. The increased adaptation of plant-based diets by consumers due to health, environmental, and ethical concerns has increased the use of carob protein derived from its pods as a natural, non-GMO protein source rich in fibre, antioxidants, and essential nutrients. This has put carob protein as one of the potential ingredients in food and beverage products, especially among the growing vegan, vegetarian, and gluten-free populations. Most notable is increasing demand for clean label products: consumers now demand that the products be made up of simple and naturally processed ingredients. This is propelling the market for carob protein further. For example, the health and wellness industry, especially for the markets in snacks, protein bars, and supplements, is searching for carob protein as one more option for protein that is healthier than most traditional sources such as soy or whey. The more consumers become aware of the environmental impacts brought about by conventional protein sources, the more carob protein will become a sustainable option—providing high nutrition with less resource input. This will create room for market expansion in almost all regions.Key Target Audience

Health-conscious consumers make up a major target consumer base in the carob protein market. These are people who are on the lookout for a plant-based, gluten-free protein alternative that is allergen-free. People with dietary restrictions, such as vegans, vegetarians, or those with gluten or soy allergies, will be targeted by carob protein for use as a healthy, natural substitute for other protein food sources.,, Another significant consumer group for carob protein is the food and beverage manufacturers who seek clean-label, sustainable, and functional ingredients that help enhance the overall nutritional profile of the product. These include companies that are in the organic and natural as well as plant-based food domains, together with the ones focusing on functional food and beverages in their portfolios. The versatility of carob protein as a plant-based protein source, with a mild flavour, makes it very interesting for different applications—preparing mock dairy products, smoothies, and baked goods—thus fostering the capability to drive its adoption across food production.Merger and acquisition

Mergers and acquisitions in the carob protein market have surged lately due to the increasing consumption of plant-based products and health matters. In 2023, Tate & Lyle, one of the top global food ingredient providers, announced acquiring Auroduna Americas the company specialising in natural ingredients, including carob. The strategic merger will create synergies for Tate & Lyle in diversifying its portfolio of sustainable and health-orientated ingredients supplied to the emerging vegan and gluten-free market segments. DuPont has also put a considerable investment in tying up with smaller companies with carob proteins in their modules. This, coupled with acquisitions, is just another way to consolidate the industry. An increase in the popularity of carob as a natural sweetener and its healthy nutritional value are the determinants for this growth. Enterprises are laying emphasis on innovation in products and expanding their distribution networks to meet the increased demand for carob- and health-orientated snacks and supplements. >Analyst Comment

"The worldwide carob protein industry is adopting a booming trend, and most of it is being driven by the increasing demand for plant and vegan protein sources. Carob protein is provided from the carob tree and is rich in health benefits such as high protein, fibre, and antioxidants; it is free from caffeine and also gluten-free. Another driving factor of this market includes the increased awareness of the health and wellness benefits of plant-based diets. As consumers naturally respond to the effects of health on animal protein, carob protein will consequently gain acceptance because it is a natural and nutritious alternative."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Carob Protein- Snapshot

- 2.2 Carob Protein- Segment Snapshot

- 2.3 Carob Protein- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Carob Protein Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Natural

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Organic

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Carob Protein Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food & Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Animal Feed

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Personal Care

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Carob Protein Market by Form

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Powder

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Gum

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Carob Protein Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Australian Carobs pty ltd in Australia

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Tate and Lyke of United Kingdom

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 DuPont of United States

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Starvos Papis Food ltd of Cyprus

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Altrafine Gums of India

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Pedro Perez of Spain

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 THE AUSTRALIAN CAROB CO.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 The Carob Kitchen

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Frontier Co-op.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Chatfield’s

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 OliveNation

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 NOW Foods

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Ingredients UK

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Form |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Carob Protein in 2030?

+

-

Which type of Carob Protein is widely popular?

+

-

What is the growth rate of Carob Protein Market?

+

-

What are the latest trends influencing the Carob Protein Market?

+

-

Who are the key players in the Carob Protein Market?

+

-

How is the Carob Protein } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Carob Protein Market Study?

+

-

What geographic breakdown is available in Global Carob Protein Market Study?

+

-

Which region holds the second position by market share in the Carob Protein market?

+

-

Which region holds the highest growth rate in the Carob Protein market?

+

-