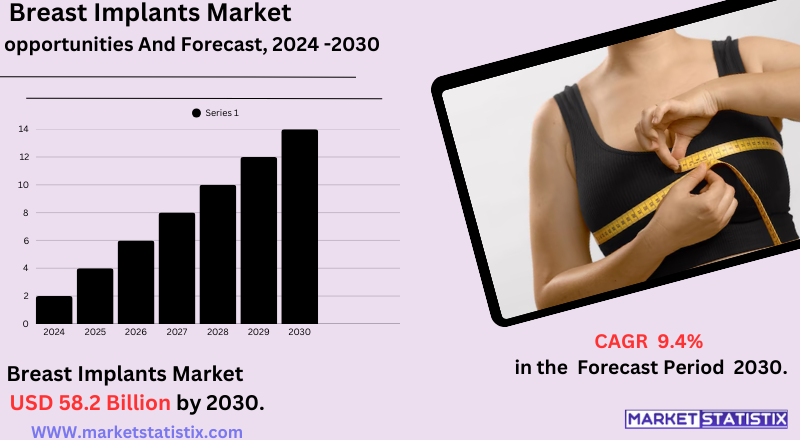

Global Breast Implants Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-906 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The breast implants market entails the production, distribution, and sale of medical devices implanted surgically into the breast tissue or chest muscle. The implants are used majorly for two purposes: breast augmentation to increase the size of breasts and improve aesthetic looks, and breast reconstruction to reconstruct breast volume and form after mastectomy due to cancer, trauma, or congenital deformities. The market is available in different kinds of implants, mostly silicone gel-filled and saline-filled, which vary in material, shape (round or anatomical), and texture on the surface (smooth or textured) to suit the needs of different patients and surgeons' preferences.

The growth in the market is highly dependent on factors like the growing global incidence of breast cancer, thus an increasing number of reconstructive surgeries, and increased demand for cosmetic procedures due to increased awareness of aesthetic improvement and body-consciousness.

Breast Implants Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 9.4% |

| Forecast Value (2030) | USD 58.2 billion |

| By Product Type | Silicone Breast Implants, Saline Breast Implants |

| Key Market Players |

|

| By Region |

|

Breast Implants Market Trends

The market for breast implants is presently defined by a number of emerging trends, led foremost by changing patient demands. There's a significant move towards creating more natural results, with patients seeking increasingly smaller, more proportional implants that fit their specific body type over dramatic changes. The trend is also driving demand for silicone implants as compared to saline, since silicone is seen to provide a more natural appearance and feel. In addition to this, the market is experiencing an increase in tailored implant solutions and the coupling of 3D imaging and AI-backed planning during consultations for more bespoke and predictable results.

There is also increasing demand for hybrid procedures that blend implants with fat transfer to achieve a more polished and natural effect. The increasing incidence of breast cancer and the resulting desire for reconstructive procedures also remain a strong driver, as well as the increasing popularity of cosmetic procedures worldwide.

Breast Implants Market Leading Players

The key players profiled in the report are LABORATOIRES ARION, Shanghai Kangning Medical Supplies Ltd., Establishment Labs S.A., ALLERGAN, Mentor Worldwide LLC; Sientra, Inc.Sientra Inc., GC Aesthetics, Guangzhou Wanhe Plastic Materials Co., Ltd., GROUPE SEBBIN SAS, Polytech Health & Aesthetics GmbH, HANSBIOMED CO. LTD.Growth Accelerators

The global market for breast implants is mostly influenced by the expanding worldwide demand for cosmetic and reconstructive breast surgery. Cosmetically, an expanding emphasis on appearance, fuelled by social media and changing beauty norms, has caused a dramatic rise in breast augmentation surgeries. Drivers such as rising disposable incomes, especially in developing economies, and increased practice of medical tourism also drive this demand, as it makes the procedures more easily accessible and affordable for more populations looking for cosmetic improvements.

In addition, a key driver for the breast implant industry is the increasing rate of breast cancer across the globe. This trend is directly feeding the demand for reconstructive breast surgeries after mastectomies. Ongoing innovation in implant technology, such as greater natural-feeling silicone gels, enhanced surface patterns for lower complication rates, and advances like intelligent implants for greater monitoring, also contribute significantly. These technology advances enhance patient confidence in the safety and performance of implants, further fuelling market expansion.

Breast Implants Market Segmentation analysis

The Global Breast Implants is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Silicone Breast Implants, Saline Breast Implants . The Application segment categorizes the market based on its usage such as Reconstructive Surgery, Cosmetic Surgery. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the breast implant industry are shaped, to a great extent, by some major players at the global level who command large market shares because of their strong brand recognition, wide ranges of products (ranging from different types, shapes, and textures of implants), and strong R&D intensity. Mentor Worldwide LLC (a subsidiary of Johnson & Johnson), Allergan Aesthetics (an AbbVie subsidiary), GC Aesthetics, Sientra, and Establishment Labs are among the prominent players. These firms spend a lot of money on the creation of new implant technologies, enhancing safety profiles, and increasing geographical reach through strategic alliances, mergers, and acquisitions.

Yet the market also includes a number of smaller, niche, and local manufacturers who tend to specialise in niche markets or competitive pricing. Competition is also influenced by rigorous regulatory standards, which require substantial expenditure on clinical trials and post-marketing surveillance. The growing international demand for both cosmetic breast augmentation and reconstructive procedures, combined with increasing knowledge of potential options and improving technology in implant development, continues to drive competition and innovation in this changing market.

Challenges In Breast Implants Market

The breast implant industry is confronted with serious challenges that are largely connected to safety issues, regulatory pressure, and expense. Safety concerns that include the possibility of breast implant-associated anaplastic large cell lymphoma (BIA-ALCL), capsular contracture, implant rupture, as well as the requirement for revision procedures, have evoked increased wariness by regulatory authorities and have impacted patient and physician choice. The legacy of such events as the PIP breast implant scandal has resulted in tighter regulation, greater requirements for traceability, and demands for stronger pre-market authorisation regimes, all raising the cost and complexity of taking new products to market. Such safety and regulatory issues can lead to product launch delays, elevated costs of compliance, and, in certain circumstances, product recalls.

Second, the expense of breast augmentation operations—be they the implant, surgery, or post-surgical care—precludes market access in areas of lower disposable incomes or poor health care coverage. Even the patient may end up paying extra if complications occur, necessitating additional operations or medical procedures. Social stigma and cultural consideration of cosmetic surgery also limit the market by deterring potential seekers of breast augmentation in some cultures. To overcome these challenges, companies are spending on research and development to enhance implant safety and durability and investigating new pricing and reimbursement models to make the product more affordable and accessible to a larger market.

Risks & Prospects in Breast Implants Market

The increasing incidence of breast cancer and the trend of augmentation treatments, driven by social media and evolving standards of beauty, further propel market growth. Also, the convergence of AI and advanced imaging technologies is enhancing surgical planning and patient outcomes, which provides new opportunities for industry participants to enhance their offerings.

Geographically, North America is the most prominent market, contributing the highest share owing to its advanced healthcare facilities, high disposable income, and extensive presence of market-leading manufacturers. It also enjoys stringent regulatory requirements and high usage of cosmetic treatments. Meanwhile, Asia-Pacific is becoming the region with the most rapid growth, fuelled by increased discretionary expenditure, developing healthcare infrastructure, and increasing medical travel in nations like China, Japan, South Korea, and India. Global firms are investing more in the region, utilising local alliances and cost savings to access the high potential of the market. This geographic dynamism, along with continued product development and strategic partnerships, is creating a competitive and opportunity-driven environment for the breast implant market.

Key Target Audience

,,The target for the breast implant market is primarily women interested in cosmetic improvement and breast reconstruction. Cosmetic use leads the market, with patients looking to enhance body contour and confidence or regain breast volume after pregnancy or weight loss. Social media influence, celebrity support, and changing beauty standards have further contributed to this interest. Moreover, reconstructive procedures, especially post-mastectomy surgeries for breast cancer patients, account for a major share, driven by developments in implant technology and greater awareness of the reconstruction opportunities.

,Major end-users in the market for breast implants are hospitals, clinics, and ambulatory surgical facilities. Hospitals command a major share due to their sophisticated infrastructure and integrated healthcare services; hence, they are the first choice for intricate reconstructive procedures. Specialised cosmetic and plastic surgery clinics appeal to patients who desire individualised treatment and cosmetic procedures. Ambulatory surgery centers provide a cost-saving and convenient way of performing outpatient breast implant surgery, which is enticing for patients who want convenience and shorter hospital stays.

,,,

Merger and acquisition

Recent acquisitions and mergers have profoundly transformed the market for breast implants, with firms focusing on increasing their product offerings and their international reach. In December 2022, Integra LifeSciences bought Surgical Innovation Associates (SIA) for $50 million, strengthening its leadership in the breast reconstruction business through FDA-approved devices for implant-based surgery. In the same vein, French maker Symatese Group acquired Groupe Sebbin, which specialises in handmade silicone implants, with the aim of solidifying its presence in the surgical and medical aesthetics sector.

Such strategic actions are a part of a larger trend towards consolidation and innovation in the industry. For example, Establishment Labs gained FDA approval for its Motiva breast implants, a major milestone in its growth initiatives. Also, firms such as Sientra and GC Aesthetics have been in the process of introducing new products and expansion into new markets, showing a dynamic and competitive environment. Such actions attest to the industry's attention towards addressing various patient needs and responding to changing regulatory requirements.

>

Analyst Comment

The worldwide breast implant market is facing sustained growth, with estimates of market size in 2025 varying from about USD 1.62 billion to as high as USD 3 billion, and projections anticipating the market value in the range between USD 4.1 billion and USD 5.75 billion by 2033-2034. This growth is attributed to increasing demand for cosmetic and reconstructive breast procedures, growing incidence of breast cancer, and increased aesthetic awareness due to social media and celebrity culture. At present, North America has the largest share in the market due to advanced healthcare infrastructure, a high incidence of cosmetic procedures, and immense investment in research and development.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Breast Implants- Snapshot

- 2.2 Breast Implants- Segment Snapshot

- 2.3 Breast Implants- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Breast Implants Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Silicone Breast Implants

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Saline Breast Implants

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Breast Implants Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Reconstructive Surgery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cosmetic Surgery

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Breast Implants Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 ALLERGAN

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 GC Aesthetics

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 GROUPE SEBBIN SAS

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Mentor Worldwide LLC; Sientra

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.Sientra Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Polytech Health & Aesthetics GmbH

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Establishment Labs S.A.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Shanghai Kangning Medical Supplies Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Guangzhou Wanhe Plastic Materials Co.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Ltd.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 LABORATOIRES ARION

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 HANSBIOMED CO. LTD.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Breast Implants in 2030?

+

-

Which type of Breast Implants is widely popular?

+

-

What is the growth rate of Breast Implants Market?

+

-

What are the latest trends influencing the Breast Implants Market?

+

-

Who are the key players in the Breast Implants Market?

+

-

How is the Breast Implants } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Breast Implants Market Study?

+

-

What geographic breakdown is available in Global Breast Implants Market Study?

+

-

Which region holds the second position by market share in the Breast Implants market?

+

-

How are the key players in the Breast Implants market targeting growth in the future?

+

-

, In addition, a key driver for the breast implant industry is the increasing rate of breast cancer across the globe. This trend is directly feeding the demand for reconstructive breast surgeries after mastectomies. Ongoing innovation in implant technology, such as greater natural-feeling silicone gels, enhanced surface patterns for lower complication rates, and advances like intelligent implants for greater monitoring, also contribute significantly. These technology advances enhance patient confidence in the safety and performance of implants, further fuelling market expansion.,

The global market for breast implants is mostly influenced by the expanding worldwide demand for cosmetic and reconstructive breast surgery. Cosmetically, an expanding emphasis on appearance, fuelled by social media and changing beauty norms, has caused a dramatic rise in breast augmentation surgeries. Drivers such as rising disposable incomes, especially in developing economies, and increased practice of medical tourism also drive this demand, as it makes the procedures more easily accessible and affordable for more populations looking for cosmetic improvements.

,