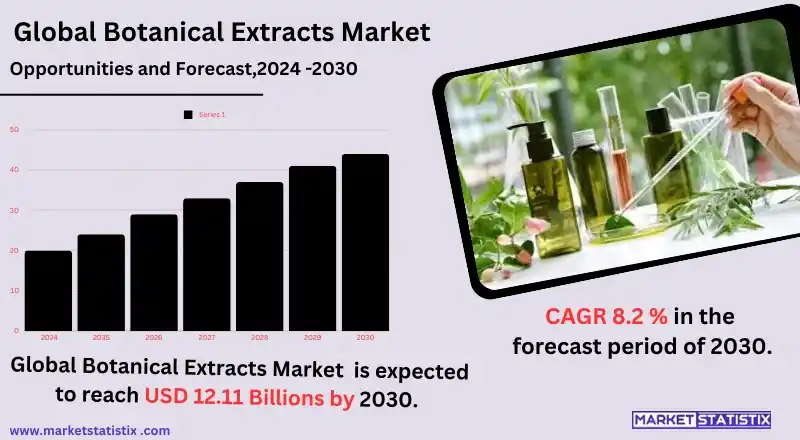

Global Botanical Extracts Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-191 | Healthcare and Pharma | Last updated: Dec, 2024 | Formats*:

Botanical Extracts Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.2% |

| Forecast Value (2030) | USD 12.11 Billion |

| By Product Type | Hydrosols, Alcohol Tinctures, CO2 extracts, Glycerites, Powdered Extracts, Others |

| Key Market Players |

|

| By Region |

Botanical Extracts Market Trends

Botanical extract sales are continuously growing by the day, reporting an increase in the emerging use of botanical extracts in all forms—from food and beverage to cosmetics to vitamins and pharmaceuticals. Likewise boosted by consumer preference for plant-based, chemical-free products, functional benefits from botanical extracts are also gaining popularity through these antioxidant, anti-inflammatory, and antimicrobial attributes. North America and Asia-Pacific are the regions that accounted for most of the revenue share in the market: while the former benefits from extra awareness about natural product competences and advancements in extraction technologies, the latter is forecasted to grow rapidly, spurred by the food and beverage industry and a growing healthy-living orientation. Other impediments to market growth are raw material price variation and supply chain challenges. Future growth opportunities in this dynamic market are likely to come from innovation in extraction methods and strategic partnering among key players.Botanical Extracts Market Leading Players

The key players profiled in the report are Frutarom Industries Ltd. (Israel), Blue Sky Botanics Ltd (United Kingdom),, Ransom Naturals Ltd (United Kingdom), Prinova Group LLC. (United States), Pt. Indesso Aroma (Indonesia),, Synergy Flavors (United States), Haldin Natural (Indonesia), Kalsec Inc. (United States), Synthite Industries Ltd. (India), Döhler GmbH (Germany)Growth Accelerators

Demand for botanical extracts is expected to increase as consumers demand natural and plant-based products in various industries, especially food and beverages, personal care, and pharmaceuticals. With consumer trends toward health and wellness, manufacturers are turning to botanical extracts to provide additional value in terms of functionality, where they can add claimed antioxidants, vitamins, and anti-inflammatory compounds. The clean-label trend also drives demand as consumers want information about the ingredients used in the least-processed forms. Demand becomes additional pressure from regulations on the reduction of synthetic additives in consumables and cosmetics. Veganism and sustainable concepts have also increased the use of botanical extracts with environments because these extracts are generally perceived to be eco-friendly and ethically sourced. Therefore, more investment is now being made in research and development to implement new extraction technologies and innovative plant-based use.Botanical Extracts Market Segmentation analysis

The Global Botanical Extracts is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hydrosols, Alcohol Tinctures, CO2 extracts, Glycerites, Powdered Extracts, Others . The Application segment categorizes the market based on its usage such as Food {Bakery & Confectionery, Sauces & Dressings}, Beverages {Alcoholic Beverages, Carbonated Soft Drinks, Ice Tea, Flavored Dairy Products}, Cosmetics & Personal Care {Skin Care, Hair Care, and Others}, Pharmaceuticals, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Growing the market has certainly become sprightly competitive and quite fragmented. This is primarily brought about by the rising demands for natural as well as organic ingredients among food and beverage, cosmetics, and pharmaceutical industries. Important companies dealing with botanical extracts, like Givaudan, Dohler, Kerry Group, etc., invest vigorously in innovations and product diversifications in order to meet the ever-changing tastes of consumers regarding clean labels and plant-based items. Several small and medium enterprises have made appreciable contributions toward this development, as they tap lucrative regional resources and niche markets. Technologically advanced methods of extraction coupled with the green initiatives have heightened competition, as almost everyone seems to be focusing on making their extraction different quality-wise, efficacy-wise, and environmental aspects-wise.Challenges In Botanical Extracts Market

Apart from the potential, the market for botanical extracts is further faced with a few challenges. Among them is the availability and sourcing cost fluctuation of seasonal and geographic raw materials. Natural and artificial climatic changes, disasters, and excessive harvesting can lead to supply chain disruptions, affecting production and prices. Quality and consistency in efficacy among botanical extracts is challenging, as how a particular plant is cultivated, harvested, and processed changes the final outcome. The most critical of these is regulatory complexity in that different countries have different criteria regarding labelling, safety, and efficacy claims, putting up barriers to the global market. More so, adulteration and counterfeiting have increased lately in the market, and these are factors that will shake consumer confidence and create health hazards. For these reasons, effective quality control, transparency throughout the supply chain, and stringent adherence to regulatory standards are needed to maintain market growth.Risks & Prospects in Botanical Extracts Market

The demand for botanical extracts in the food and beverage industry is due to their use as agents for flavouring, natural colouration, and functionality, which goes hand in hand with the increasing tendency towards clean-label and organic products. Demand for such extracts has grown, thanks to the burgeoning health and wellness industry, for the added fetch to these extracts as perceived health using goods such as dietary supplements, functional foods, and nutraceuticals. The cosmetics and personal care industry contributes to the growth of this market as consumers want products that are more natural and sustainable than synthetic ingredients. At the same time, there is a great opportunity in the pharmaceutical field since the application of botanical extracts is a major component of herbal medicine and alternative practice. Emerging technologies in extraction and sustainable sourcing are contributing to the increased availability and efficiency of those products. In terms of geography, areas such as emerging markets in Asia-Pacific and Latin America contribute to growth because of their incredible genetic and biological diversity, growing awareness about plant-based products, and expanding middle-class populations. This, combined with great loud speaking in consumer sentiment with open regulatory frameworks, gives a bright future for the botanical extracts market.Key Target Audience

Thus, the major target audience of the botanical extracts market would include food and beverages, pharmaceuticals, cosmetic products, and personal care industries. In the food and beverage section of the manufacturing, examples include using botanical extracts as their sources for natural flavours, colours, and health benefits, keeping in mind the current trend for clean-label and functional products. The same goes for the pharmaceuticals, which would use the botanical extracts for therapy and health.,, Cosmetics and personal care would act as other very important segments where practitioners encourage botanical extract because of its natural provenance, skin benefits, and antiaging. These extracts consider the prevailing popularity of green and organic products that appeal to ecologically aware consumers.Merger and acquisition

Mergers and acquisitions in the botanical extracts industry have already hinted that they aim at broadening their product offerings and establishing a firmer marketplace. In April 2022, for instance, Kerry Group plc, a food company based in Ireland, bought US-based Natreon Inc., a botanical extract ingredient company. The acquisition aims to seal Kerry's ProActive Health portfolio with branded ingredients from Natreon, thus fostering technology development in this sector. Furthermore, in July 2023, Nordmann, a German chemical manufacturing company, initiated a joint venture with Plantapharm GmbH, an Austrian personal care company, to provide the personal care industry with high-quality plant extracts from personal care products like hair care and toiletries. This partnership is supposed to show that natural and sustainable attributes are in growing demand. According to forecasts, the botanical extracts market will grow significantly—to $6.51 billion in 2023 and then to $7.13 billion in 2024—that was driven by the health awareness and demand for natural products. Significant players are increasingly active in merger and acquisition activities for innovation and improved reach. International Flavours & Fragrances Inc., Himalaya Herbal Health Care, Synthite Industries Ltd., and many others are part of the new trend. >Analyst Comment

"The growing popularity of natural and organic products among consumers has consequently resulted in the growth of the botanical extracts market. The increase in awareness of health benefits, concern over synthetic ingredients, and the growing popularity of functional foods and beverages are significant reasons behind this shift. ' The market is currently witnessing demand increase from several sectors, including food and beverages, pharmaceuticals, cosmetics, and personal care. The primary drivers for growth are the increased number of applications botanical extracts are used for, they bestow various functional properties, and the improvement seen on the extraction technologies."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Botanical Extracts- Snapshot

- 2.2 Botanical Extracts- Segment Snapshot

- 2.3 Botanical Extracts- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Botanical Extracts Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hydrosols

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Alcohol Tinctures

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 CO2 extracts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Glycerites

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Powdered Extracts

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Botanical Extracts Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food {Bakery & Confectionery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Sauces & Dressings}

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Beverages {Alcoholic Beverages

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Carbonated Soft Drinks

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Ice Tea

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Flavored Dairy Products}

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Cosmetics & Personal Care {Skin Care

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Hair Care

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 and Others}

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

- 5.11 Pharmaceuticals

- 5.11.1 Key market trends, factors driving growth, and opportunities

- 5.11.2 Market size and forecast, by region

- 5.11.3 Market share analysis by country

- 5.12 Others

- 5.12.1 Key market trends, factors driving growth, and opportunities

- 5.12.2 Market size and forecast, by region

- 5.12.3 Market share analysis by country

6: Botanical Extracts Market by Source

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Flowers

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Herbs

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Fruits

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Spices

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Tea Leaves

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Others

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Frutarom Industries Ltd. (Israel)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Blue Sky Botanics Ltd (United Kingdom)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Ransom Naturals Ltd (United Kingdom)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Prinova Group LLC. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Pt. Indesso Aroma (Indonesia)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Synergy Flavors (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Haldin Natural (Indonesia)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Kalsec Inc. (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Synthite Industries Ltd. (India)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Döhler GmbH (Germany)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Source |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Botanical Extracts in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Botanical Extracts market?

+

-

How big is the Global Botanical Extracts market?

+

-

How do regulatory policies impact the Botanical Extracts Market?

+

-

What major players in Botanical Extracts Market?

+

-

What applications are categorized in the Botanical Extracts market study?

+

-

Which product types are examined in the Botanical Extracts Market Study?

+

-

Which regions are expected to show the fastest growth in the Botanical Extracts market?

+

-

Which application holds the second-highest market share in the Botanical Extracts market?

+

-

What are the major growth drivers in the Botanical Extracts market?

+

-