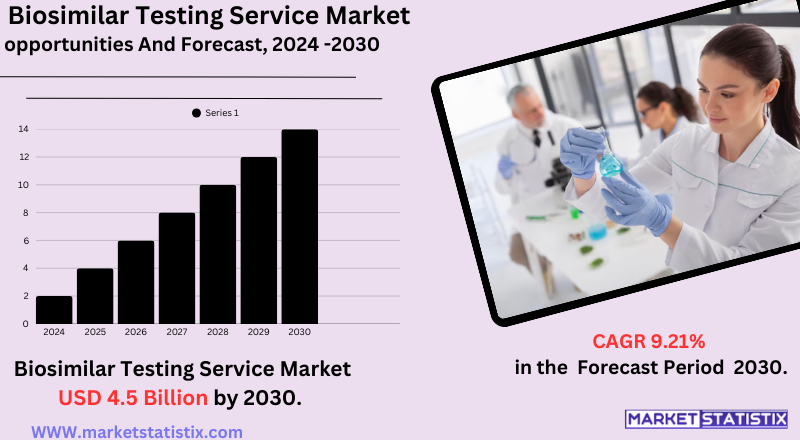

Global Biosimilar Testing Service Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-904 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Biosimilar Testing Service Market is the latest industry offering a complete set of analytical, functional, and clinical testing services that are required to develop and gain regulatory approval for biosimilar products. Biosimilars cover biological drugs that are highly similar to approved original biologic drugs (so-called reference products). In contrast to small-molecule generics made chemically, biologics are intricate molecules from living organisms, and their replication and characterisation are much more complex. Hence, extensive testing must be conducted to prove that a biosimilar is indistinguishable from its reference product with no clinically significant differences in safety, purity, and potency.

These testing services encompass the different phases of biosimilar development, such as physicochemical characterisation, higher-order structure assessment, assays of biological activity, immunogenicity testing (to gauge possible immune reactions), and stability testing. The players in this market, usually represented by contract research organizations (CROs) and expert analytical laboratories, are instrumental in guiding pharmaceutical and biotechnology firms through the strict regulatory channels laid down by the likes of the FDA and EMA.

Biosimilar Testing Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 9.21% |

| Forecast Value (2030) | USD 4.5 billion |

| By Product Type | Analytical Testing, In-Vivo Testing, In-Vitro Testing, Comparative Testing |

| Key Market Players |

|

| By Region |

|

Biosimilar Testing Service Market Trends

The main trend here is the growing rate of occurrence of chronic diseases worldwide, creating more demand for affordable and low-cost treatment, a gap which biosimilars are uniquely positioned to address.

In addition, strong outsourcing trends to Contract Research Organizations (CROs) and specialised analytical labs for biosimilar development and testing exist. This enables pharmaceutical and biotech firms to tap into the technical capabilities and sophisticated facilities of these service providers, maximising their development schedules while minimising internal expenses. Advances in analytical technology, including high-throughput screening and sophisticated spectroscopy, are also enhancing the accuracy and productivity of biosimilar characterisation, continuing to drive the market forward.

Biosimilar Testing Service Market Leading Players

The key players profiled in the report are Kymos Pharma Services, Eurofins Scientific, Merck, Medicilon, PPD, Antibody Analytics, LAB Holdings, SGS, Pacific BioLabs, Charles River Laboratories Inteational, Profacgen, Intertek, SartoriusGrowth Accelerators

The biosimilar testing service industry is also led by the growth in the number of patent expirations of blockbuster biologic drugs. When these extremely costly original biologics have their patents expire, pharmaceutical companies are heavily investing in bringing to market biosimilar versions that are more affordable. This uptick in biosimilar pipeline products directly translates into an increased demand for testing services with specialised expertise to prove their "biosimilarity" and receive regulatory approval. The economic motive to win a piece of the multi-billion-dollar biologics market drives this high-flying development activity.

A further major spur is the increased worldwide focus on healthcare cost savings. Biologics are effective but terribly costly, with an enormous impact on healthcare systems and patients. Biosimilars provide a cost-saving solution, and governments and payers across the globe are taking an active role in their promotion to enhance patient access to essential medicines and keep healthcare costs under control. All this pressure for cost savings, along with changing and ever-better regulatory pathways to approval for biosimilars in various regions, provides a positive setting for growth for the biosimilar testing service market.

Biosimilar Testing Service Market Segmentation analysis

The Global Biosimilar Testing Service is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Analytical Testing, In-Vivo Testing, In-Vitro Testing, Comparative Testing . The Application segment categorizes the market based on its usage such as Autoimmune Diseases, Cancer Treatment, Infectious Diseases, Hormonal Disorders. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The biosimilar testing service market's competitive environment is extremely dynamic, with a few large global players and increasingly specialised contract research organizations (CROs). Large, full-service CROs with large global footprints and extensive analytical capabilities across a wide swath of modalities, including Charles River Laboratories, SGS, and Intertek Group, are major market shareholders. These firms utilise their capabilities at different stages of drug development to provide end-to-end holistic solutions for biosimilar comparability studies in the form of physicochemical characterisation, biological activity assays, and immunogenicity testing. Their expertise in managing intricate regulatory requirements and providing service across the globe provides a competitive advantage.

In addition to these large players, there are also small, speciality laboratories and analytical service companies that specialise in niche areas of biosimilar testing or serve particular regional needs. The growing number of patent expirations for blockbuster biologic medicines is fuelling the need for biosimilar development, which is, in turn, driving the expansion of this testing market.

Challenges In Biosimilar Testing Service Market

The biosimilar testing service industry is confronted with a number of challenging obstacles that affect its growth and effectiveness. The main challenge for the industry is the complicated and dynamic regulatory environment that necessitates biosimilar developers to undergo extensive analytical, preclinical, and clinical tests to demonstrate similarity to reference biologics. Regulations vary between regions and are often modified, resulting in uncertainty, enhanced development costs, and extended approval times compared to conventional generics. Such complexity is exacerbated by the necessity of specialised knowledge, sophisticated analytical tools, and quality standards that must be complied with stringently, all of which lead to increased operational expenses and longer time-to-market for biosimilar products.

Aside from regulatory and technical hurdles, the market also faces issues relating to market uptake and intellectual property. Clinicians and patients tend to be reluctant to adopt biosimilars because of gaps in information, safety and efficacy concerns, and lack of experience with transitioning from reference biologics. Additionally, legal tactics and patent shields from reference product producers like "patent thickets" can impede biosimilar launch and prompt expensive litigation. In spite of these hindrances, the pressure for cost-saving biologic options and increasing cases of chronic diseases continue to fuel the demand for robust biosimilar testing services, where the significance of overcoming such hindrances lies in providing greater access to affordable treatments.

Risks & Prospects in Biosimilar Testing Service Market

Major opportunities include the growth of outsourcing of clinical, analytical, and laboratory testing to specialised contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs), providing state-of-the-art characterisation, bioanalytical, and regulatory compliance services. Leverage of state-of-the-art analytical technologies, automation, and AI-based analytics is also increasingly improving the accuracy and efficiency of biosimilar testing, making outsourcing an increasingly appealing option for pharmaceutical and biotechnology companies looking to lower costs and speed time to market.

Regionally, North America is dominating the market for biosimilar testing services now, thanks to high healthcare spending, a robust presence of global biopharmaceutical giants, and the largest number of biosimilar approvals. The Asia-Pacific region, though, is poised to witness the quickest expansion driven by growing government support, growing healthcare investments, and the development of cost-reducing testing centers in India, China, and South Korea. Europe continues to be an important market because of its well-established regulatory environment and increasing adoption of biosimilars. In total, the worldwide expansion of biosimilar pipelines across therapeutic categories like oncology and autoimmune diseases, along with the outsourcing trend, is providing profitable opportunities for service providers globally.

Key Target Audience

,

The biosimilar testing service market mainly focuses on pharmaceutical and biopharmaceutical firms, which are also the biggest customers of these services. These firms spend a lot on biosimilar development in order to increase their product offerings and gain a part of the expanding biosimilar market. The stringent regulatory conditions and necessity for exhaustive testing and validation propel the demand for biosimilar testing and development services among pharma firms.

, Contract research organizations (CROs) are another major segment of the biosimilar testing service market. CROs offer various services such as analytical testing, bioanalytical testing, stability testing, and clinical trial management. The increasing trend of outsourcing in the pharmaceutical and biotechnology sectors is fuelling demand for CRO services. Firms are getting into collaborations with CROs to utilise their capabilities and infrastructure, hence boosting the biosimilar testing and development services market.

Merger and acquisition

The market for biosimilar testing services has witnessed significant merger and acquisition activity over the last few years as a result of strategic moves by large pharmaceutical firms to increase biosimilar offerings and strengthen research and development capabilities. In August 2023, Viatris acquired a biotechnology company that is an expert in monoclonal antibody biosimilars in a move to augment its R&D infrastructure and expand its biosimilar pipeline. This deal reflects a larger industry trend by which mature players are trying to augment their portfolios through buyouts instead of organic growth alone.

In the Indian pharma market, Aurobindo Pharma Ltd acted strategically in acquiring four licensed biosimilars from Swiss company TL Biopharmaceutical AG. This deal gives Aurobindo the right to develop, market, and sell these biosimilars, three of which are anticancer monoclonal antibodies. The group is to undertake clinical trials of its lead molecule, bevacizumab, and expand its portfolio through the acquisition of more biosimilars. The deal puts Aurobindo as a solid player in the fast-changing biosimilars market.

>Analyst Comment

The biosimilar testing service market is witnessing strong growth, driven by increased demand for affordable substitutes to biologic drugs and rising global incidence of chronic diseases. Market size projections differ, with valuations between USD 1.5 billion and USD 3.68 billion in 2024 and projections of between USD 4.5 billion and USD 8.1 billion by the year 2030. This growth is attributed to patents expiring on originator biologics, which has necessitated big investments by pharmaceutical firms in biosimilar development and required stringent testing for safety, efficacy, and compliance regulations. Regulatory bodies like the FDA and EMA are imposing strict approval criteria, adding pressure for sophisticated analytical testing, bioassays, and pharmacovigilance studies.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Biosimilar Testing Service- Snapshot

- 2.2 Biosimilar Testing Service- Segment Snapshot

- 2.3 Biosimilar Testing Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Biosimilar Testing Service Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 In-Vitro Testing

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 In-Vivo Testing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Analytical Testing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Comparative Testing

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Biosimilar Testing Service Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cancer Treatment

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Autoimmune Diseases

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Infectious Diseases

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Hormonal Disorders

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Biosimilar Testing Service Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Charles River Laboratories Inteational

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Merck

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 PPD

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 LAB Holdings

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Eurofins Scientific

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Intertek

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 SGS

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Profacgen

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Antibody Analytics

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Kymos Pharma Services

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Medicilon

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Pacific BioLabs

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Sartorius

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Biosimilar Testing Service in 2030?

+

-

Which type of Biosimilar Testing Service is widely popular?

+

-

What is the growth rate of Biosimilar Testing Service Market?

+

-

What are the latest trends influencing the Biosimilar Testing Service Market?

+

-

Who are the key players in the Biosimilar Testing Service Market?

+

-

How is the Biosimilar Testing Service } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Biosimilar Testing Service Market Study?

+

-

What geographic breakdown is available in Global Biosimilar Testing Service Market Study?

+

-

Which region holds the second position by market share in the Biosimilar Testing Service market?

+

-

How are the key players in the Biosimilar Testing Service market targeting growth in the future?

+

-

The biosimilar testing service industry is also led by the growth in the number of patent expirations of blockbuster biologic drugs. When these extremely costly original biologics have their patents expire, pharmaceutical companies are heavily investing in bringing to market biosimilar versions that are more affordable. This uptick in biosimilar pipeline products directly translates into an increased demand for testing services with specialised expertise to prove their "biosimilarity" and receive regulatory approval. The economic motive to win a piece of the multi-billion-dollar biologics market drives this high-flying development activity.

,

, A further major spur is the increased worldwide focus on healthcare cost savings. Biologics are effective but terribly costly, with an enormous impact on healthcare systems and patients. Biosimilars provide a cost-saving solution, and governments and payers across the globe are taking an active role in their promotion to enhance patient access to essential medicines and keep healthcare costs under control. All this pressure for cost savings, along with changing and ever-better regulatory pathways to approval for biosimilars in various regions, provides a positive setting for growth for the biosimilar testing service market.