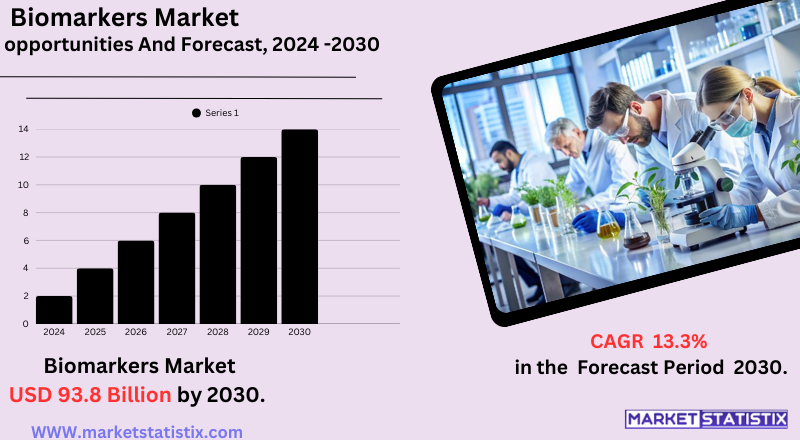

Global Biomarkers Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-903 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

Biomarkers are quantitatively measurable biological markers within the body, for example, molecules, genes, or imaging results, which indicate normal or pathologic processes or the body's reaction to a medical intervention. They are important tools in the understanding of health and disease. For example, a particular protein concentration in blood may reflect a disease's presence or progression, while variations in this over time can be used to track the success of a therapy. Biomarkers vary, from easy-to-measure values such as blood pressure to intricate genetic or protein patterns.

The biomarkers market involves the generation, validation, and utilisation of such markers in different healthcare applications. This involves their application in diagnostics to detect diseases at early stages, drug discovery and development to determine drug safety and efficacy, and in personalised medicine to personalise treatment according to the individual's specific biological profile. The rise in prevalence of chronic conditions, technological progress such as genomics and proteomics, and the trend towards personalised healthcare are major drivers driving the growth of the biomarkers market. This market is important to enhance patient outcomes and to propel innovation in medicine.

Biomarkers Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 13.3% |

| Forecast Value (2030) | USD 93.8 Billion |

| By Product Type | Predictive Biomarkers, Efficacy Biomarkers, Surrogate Biomarkers, Safety Biomarkers, Pharmacodynamic Biomarkers |

| Key Market Players |

|

| By Region |

|

Biomarkers Market Trends

The world biomarkers market is now witnessing tremendous growth and is expected to keep growing in the same direction. There are a number of prominent trends governing its development. First, there is a very high focus on early disease identification and management, and biomarkers play an invaluable role in detecting diseases such as cancer and cardiovascular diseases in their initial stages. Second, the intensifying research and development operations, particularly financed by pharmaceutical and biotechnology firms, are resulting in the identification of new and more potent biomarkers.

The emergence of companion diagnostics, which use biomarkers to indicate a patient's eligibility for a given drug, is also having a strong influence on the market. In addition, advances in genomics, proteomics, and imaging technologies are making it possible to discover and utilise biomarkers more effectively. The growing use of non-invasive testing tools, including liquid biopsies, is also increasing in popularity, enabling less invasive and more frequent monitoring.

Biomarkers Market Leading Players

The key players profiled in the report are Merck KGaA, Epigenomics AG, Abbott, Johnson & Johnson Services, Inc., General Electric, Siemens Healthineers AG, QIAGEN, F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc, Eurofins Scientific, PerkinElmer Inc., Agilent Technologies, Inc.Growth Accelerators

The market for biomarkers is considerably influenced by the rising global burden of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders. With more of these diseases on the rise, the need for early and precise diagnostic markers, as well as efficient monitoring, significantly increases. Biomarkers offer a way to meet these requirements by facilitating early detection, supporting diagnosis, predicting the progression of the disease, and monitoring the treatment response. This increasing disease burden calls for the creation and use of varied biomarkers in different therapeutic segments, driving market growth.

In addition, the growing emphasis on personalised medicine and advances in technologies are principal drivers of market growth. Personalised medicine is designed to customise treatments to the unique characteristics of individual patients, and biomarkers are absolutely critical to determine patients most likely to benefit from therapy. Advances in technologies such as genomics, proteomics, and other omics have enabled rapid identification and validation of new biomarkers.

Biomarkers Market Segmentation analysis

The Global Biomarkers is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Predictive Biomarkers, Efficacy Biomarkers, Surrogate Biomarkers, Safety Biomarkers, Pharmacodynamic Biomarkers . The Application segment categorizes the market based on its usage such as Diagnostics, Personalized Medicine, Disease Risk Assessment, Drug Discovery & Development, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The biomarkers industry's competitive landscape is dominated by a combination of established major firms and many small, specialised players. Major pharmaceutical and diagnostic firms with substantial resources for research and development and commercialisation are dominant players in this industry. These big players tend to make strategic acquisitions, partnerships, and alliances to diversify their biomarker portfolios and make themselves stronger in the marketplace in diverse disease indications like oncology, cardiology, and neurology. This fierce competition promotes innovation, which is reflected in the creation of new and better biomarkers for diverse uses.

Challenges In Biomarkers Market

The biomarkers market is also confronted with a number of major challenges that are likely to slow down its growth and extensive application. High research and development costs for biomarkers, such as costly and time-consuming validation studies, represent a major obstacle, especially for small firms and resource-constrained environments. Moreover, the absence of cross-organisational standards for data reporting and the multiplicity of combining disparate and large-scale datasets from varying testing platforms hinder the interpretation and aggregation of biomarker information across companies. The problems are further compounded by inconsistencies in access to tests, unaffordability for the uninsured, and data integrity issues, all of which restrict the market's scope and size.

A second key challenge lies in the inherent heterogeneity and complexity of disease, which makes it difficult to identify and validate universal biomarkers that are effective across broad patient populations. Disease biology evolves over time, and differing molecular signatures in individual patients mean that developing accurate and widely generalisable biomarkers is challenging. Overcoming these complex challenges is required for the effective uptake of biomarkers into everyday clinical practice and the full exploitation of their potential within personalised medicine.

Risks & Prospects in Biomarkers Market

Some of the main opportunities are the creation of multi-biomarker panels, the advent of exosome-based and microbiome-based biomarkers, and increasing use of non-invasive methods like liquid biopsy. The use of biomarkers within clinical trials is increasing efficiency and expediting approval of drugs, and developments in technologies such as next-generation sequencing are facilitating the identification of new biomarkers.

Regionally, North America has the largest percentage of the biomarkers market, driven by high R&D spends, strong industry presence, and favourable government policies, especially in the U.S. and Canada. Europe comes next, buoyed by sophisticated healthcare infrastructure and research support. But the Asia-Pacific region is set to record the quickest growth, driven by rising incidence of disease, increasing research activity, and reduced costs of clinical trials in nations such as China, India, and South Korea. These trends point to the fact that while mature markets will still dominate in terms of revenue, Asia-Pacific emerging markets will present huge growth opportunities for biomarker developers and investors over the next few years.

Key Target Audience

,

The primary target client for the biomarkers industry consists of biotech and pharmaceutical firms, which are significantly involved in drug discovery, development, and personalised medicine. These constituents bank on biomarkers to detect disease progression, forecast therapeutic responses, and optimise clinical trials. Regulatory organizations and research institutions also represent a vital constituency, as they utilise biomarkers to further clinical research and create standardised diagnosis protocols.

, Besides, diagnostic laboratories, academic institutions, and hospitals are a critical audience, propelled by the need for precision medicine and early detection of diseases. Indirectly, patients, particularly chronic sufferers of cancer, cardiovascular diseases, and neurological diseases, shape market trends through rising awareness and demand for accurate and non-invasive diagnostic instruments. This heterogeneous audience reaffirms the wide applicability of the market in healthcare, research, and regulatory environments.

Merger and acquisition

The biomarkers industry has seen an explosion of mergers and acquisitions (M&A) since pharmaceutical and biotech firms want to augment their therapeutic and diagnostic offerings. Interestingly enough, Johnson & Johnson's January 2025 $14.6 billion takeover of Intra-Cellular Therapies highlights this trend, as it gives J&J access to Caplyta, a central nervous system disorder drug. In the same vein, Bristol Myers Squibb's $14 billion March 2024 acquisition of Karuna Therapeutics broadened its neuropsychiatric product portfolio. Such moves signal a wider industry trend toward incorporating biomarker-led strategies to tackle multifactorial disease.

The focus on biomarkers is also reflected in the acquisition of advanced diagnostic platforms. For example, Eurofins Scientific's August 2024 acquisition of Orchid Cellmark strengthened its genetic and forensic testing capability. AstraZeneca's $2.4 billion acquisition of Fusion Pharmaceuticals in June 2024 also increased its radiopharmaceutical capability, which is very much dependent on biomarker detection for targeted cancer treatments. AstraZeneca. These advancements portend a strategic change towards personalised medicine, with biomarkers at the centre of directing therapeutic strategies and enhancing patient outcomes.

>

Analyst Comment

The world market for biomarkers is growing at a fast pace, with market sizes for 2025 estimated at about USD 79 billion to USD 94.24 billion and the projections placing growth between USD 200 billion and more than USD 318 billion by 2034. The acceleration in the growth of the market is fuelled by the increasing incidence of long-term diseases like cancer, cardiovascular disease, and diabetes and by research advancements in the fields of genomics, proteomics, and diagnostics. North America is the global market leader at present, with high rates of disease incidence, a large healthcare infrastructure, and high research and development expenditures, while the Asia-Pacific region will experience the most rapid growth as a result of rising healthcare expenditures and improvements in infrastructure.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Biomarkers- Snapshot

- 2.2 Biomarkers- Segment Snapshot

- 2.3 Biomarkers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Biomarkers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Safety Biomarkers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Efficacy Biomarkers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Predictive Biomarkers

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Surrogate Biomarkers

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Pharmacodynamic Biomarkers

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Biomarkers Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Diagnostics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Drug Discovery & Development

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Personalized Medicine

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Disease Risk Assessment

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Biomarkers Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 F. Hoffmann-La Roche AG

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Epigenomics AG

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Abbott

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Thermo Fisher Scientific Inc

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 General Electric

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Eurofins Scientific

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Johnson & Johnson Services

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 QIAGEN

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Bio-Rad Laboratories

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Siemens Healthineers AG

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Merck KGaA

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 PerkinElmer Inc.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Agilent Technologies

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Inc.

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Biomarkers in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Biomarkers market?

+

-

How big is the Global Biomarkers market?

+

-

How do regulatory policies impact the Biomarkers Market?

+

-

What major players in Biomarkers Market?

+

-

What applications are categorized in the Biomarkers market study?

+

-

Which product types are examined in the Biomarkers Market Study?

+

-

Which regions are expected to show the fastest growth in the Biomarkers market?

+

-

Which application holds the second-highest market share in the Biomarkers market?

+

-

What are the major growth drivers in the Biomarkers market?

+

-

The market for biomarkers is considerably influenced by the rising global burden of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders. With more of these diseases on the rise, the need for early and precise diagnostic markers, as well as efficient monitoring, significantly increases. Biomarkers offer a way to meet these requirements by facilitating early detection, supporting diagnosis, predicting the progression of the disease, and monitoring the treatment response. This increasing disease burden calls for the creation and use of varied biomarkers in different therapeutic segments, driving market growth.

In addition, the growing emphasis on personalised medicine and advances in technologies are principal drivers of market growth. Personalised medicine is designed to customise treatments to the unique characteristics of individual patients, and biomarkers are absolutely critical to determine patients most likely to benefit from therapy. Advances in technologies such as genomics, proteomics, and other omics have enabled rapid identification and validation of new biomarkers.