Global Biodegradable Polymers Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-1703 | Chemicals And Materials | Last updated: Oct, 2024 | Formats*:

Biodegradable Polymers Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

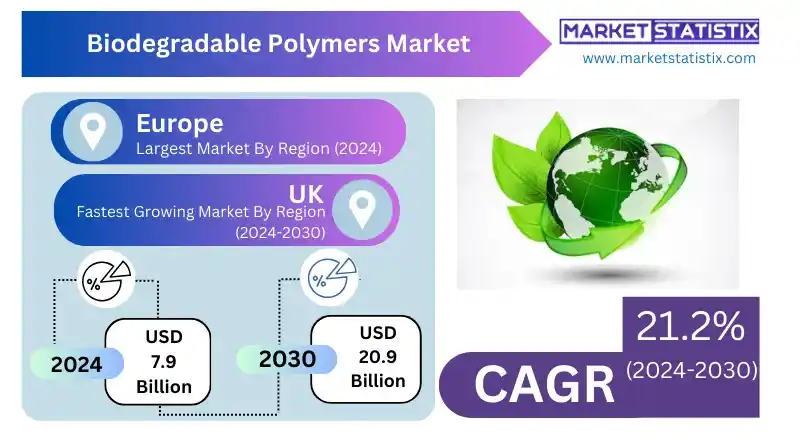

| Growth Rate | CAGR of 21.2% |

| By Product Type | Starch-based Polymers, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), Polyesters, Others |

| Key Market Players |

|

| By Region |

|

Biodegradable Polymers Market Trends

With increasing concerns on the environment and stringent regulations over plastic wastes, plus consumers' preference for sustainable products, the rapid growth of biodegradable polymers is expected. This market is likely to be driven majorly by the packaging sector, as huge steps have been taken towards replacing plastics with their biodegradable counterparts to completely eliminate pollution. Apart from this, the medical and agriculture industries are developing a liking for biodegradable polymers in drug delivery systems and sustainable farming, respectively. Challenges remain regarding production costs, which are still higher than conventional plastics, and the enhancement of material properties. A lot of countries are starting to put in place more stringent controls over plastic wastes, and people are becoming environmentally conscious; as such, one would expect to see continued growth in the market. Advancements in polymer technology and development of new biodegradable materials will further drive market expansion.Biodegradable Polymers Market Leading Players

The key players profiled in the report are Hosgör Plastik (Turkey), BEWI (Norway), Mitsubishi Gas Chemical Company Inc (Japan), Smurfit Kappa (Ireland), Avient Corporation (U.S.), Tate & Lyle (U.K.), Cereplast (U.S.), Evonik Industries (Germany), Mondi (U.K.), Toyobo Co. Ltd. (Japan), Green Dot Bioplastic (U.S.), Yield10 Bioscience Inc.(U.S.), Solvay (Belgium), Bio-On.it (Italy), DuPont (U.S.), Trinseo (U.S.), Solutions 4 Plastic (U.K.), TEIJIN limited (U.S.), Georgia-Pacific (U.S.), Westrock company (U.S.), Kaneka Corporation (Japan), Hiusan Biosciences (U.S.), NatureWorks LLC (U.S.)Growth Accelerators

In all, a mix of environmental and consumer attitude concerns is behind the overdrive in the biodegradable polymer market. Plastic pollution has been overwhelming, while the appreciation for sustainability climbs. This pitched a remarkable drive towards eco-friendly alternatives with the growing plastic pollution crisis and raising awareness on sustainability. More so, stringent government regulations around plastic waste management further press on manufacturers to seek biodegradable options. Thus, propelled by the need to give consumers sustainable packaging solutions driven by consumers' needs, the packaging industry became among the very first adopters of biodegradable polymers. On the other hand, with technological advances in this field of biodegradable polymers, their properties in terms of strength, flexibility, barrier properties, and hence applicability have expanded towards other industries like agriculture, medicine, and automotive, further driving its market growth.Biodegradable Polymers Market Segmentation analysis

The Global Biodegradable Polymers is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Starch-based Polymers, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), Polyesters, Others . The Application segment categorizes the market based on its usage such as Rigid Packaging, Flexible Packaging, Liquid Packaging, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The biodegradable polymers arena can be considered dynamic, having numerous large, established chemical companies, specialised biopolymer producers, and some up-and-coming startups in the arena. In fact, leading players are reinvesting substantial revenues derived from R&D into new ideas, innovations, and high-profile performances with biodegradable materials. Accordingly, such ongoing situations have evolved into strategic partnerships, mergers, and acquisitions taking place in the market as companies aim to strengthen their product portfolios and market reach. Success in this market would, therefore, be marked by the acquisition of price competitiveness, product differentiation, and strong supply chain management. Furthermore, it will further be able to outperform others if the firm meets stringent regulatory requirements and consumer demand characterised by a need for products that are sustainable and ecologically friendly.Challenges In Biodegradable Polymers Market

There are many challenges to full-scale industrial applications facing the biodegradable polymer market. One of the most critical of the problems is that the cost of production is still very high compared to traditional plastics produced from petrochemical resources; it is, therefore, of low competitiveness in terms of price for specific applications. Its biodegradability in real environments can be guaranteed only in very few cases, as so many factors like soil composition or temperature influence the degradation rates. Another challenge is to set up appropriate and efficient infrastructures for collecting and processing biodegradable waste, which currently is still in its infancy. Besides, consumer awareness and understanding of biodegradable polymers is still low to effectively create demand. All these issues are being worked on through continued research, technological development, and coordination within the industrial players for the biodegradable polymers to be a viable and affordable alternative to conventional plastics.Risks & Prospects in Biodegradable Polymers Market

Market potential is huge; the drivers for the biodegradable polymers market are growing global interest and reflection towards sustainability and environmental concerns. Rising global concern about plastic pollution and the dire need for an eco-friendly source can be considered a major driver of the market. Important opportunities do exist in the area of packaging, where such polymers can be used to displace otherwise conventional thus non-biodegradable plastics, thus lessening the environmental impact. Growth in material science accomplishment is creating a new level of opportunity in application areas of agriculture, medical devices, and automotive. What is more, the landscape of government policies towards sustainable materials and consumer choice of eco-friendly products are set to further cement the growth of the market. Given that the whole world is now moving towards developing a circular economy, biodegradable polymers are likely to be critical for waste reduction and sustainable development.Key Target Audience

It targets manufacturers from the packaging, agriculture, textile, and medical sectors for biodegradable polymers. Companies within these industries are actively seeking alternatives to traditional fossil fuel-based plastics. Environmental institutions and government organisations dedicated to increased sustainability and reduced plastic pollution in society are also some of the major target customers. More and more environmentally conscious consumers influence demand in the market by way of forcing companies to utilise biodegradable products., It is also an important part associated with the development of new biodegradable polymer technologies in research institutions and academic bodies, which also helps fuel the market and create innovation.Merger and acquisition

The biodegradable polymers market has been characterised by a number of mergers and acquisitions as the industry players strengthen their position and products offered. Strategic steps were orientated towards enhancing the capabilities of research and development, market reach, and growth rate with which such sustainable solutions are mercialized. The key mergers and acquisitions include partnerships between chemical companies, bio-based material producers, and packaging manufacturers. These are orientated at developing solutions for innovative biodegradable polymers in multiple industries such as packaging, agriculture, and consumer goods. The general trend is the increasing shift towards sustainability and mainstream product development with biodegradable polymers.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Biodegradable Polymers- Snapshot

- 2.2 Biodegradable Polymers- Segment Snapshot

- 2.3 Biodegradable Polymers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Biodegradable Polymers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Starch-based Polymers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Polylactic Acid (PLA)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Polyhydroxy Alkanoates (PHA)

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Polyesters

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Biodegradable Polymers Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Rigid Packaging

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Flexible Packaging

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Liquid Packaging

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Biodegradable Polymers Market by Substrate

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Paper and Paperboard

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Cellulose Films

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Others

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Biodegradable Polymers Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Hosgör Plastik (Turkey)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 BEWI (Norway)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Mitsubishi Gas Chemical Company Inc (Japan)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Smurfit Kappa (Ireland)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Avient Corporation (U.S.)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Tate & Lyle (U.K.)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Cereplast (U.S.)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Evonik Industries (Germany)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Mondi (U.K.)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Toyobo Co. Ltd. (Japan)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Green Dot Bioplastic (U.S.)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Yield10 Bioscience Inc.(U.S.)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Solvay (Belgium)

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Bio-On.it (Italy)

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 DuPont (U.S.)

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Trinseo (U.S.)

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Solutions 4 Plastic (U.K.)

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 TEIJIN limited (U.S.)

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Georgia-Pacific (U.S.)

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Westrock company (U.S.)

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

- 9.21 Kaneka Corporation (Japan)

- 9.21.1 Company Overview

- 9.21.2 Key Executives

- 9.21.3 Company snapshot

- 9.21.4 Active Business Divisions

- 9.21.5 Product portfolio

- 9.21.6 Business performance

- 9.21.7 Major Strategic Initiatives and Developments

- 9.22 Hiusan Biosciences (U.S.)

- 9.22.1 Company Overview

- 9.22.2 Key Executives

- 9.22.3 Company snapshot

- 9.22.4 Active Business Divisions

- 9.22.5 Product portfolio

- 9.22.6 Business performance

- 9.22.7 Major Strategic Initiatives and Developments

- 9.23 NatureWorks LLC (U.S.)

- 9.23.1 Company Overview

- 9.23.2 Key Executives

- 9.23.3 Company snapshot

- 9.23.4 Active Business Divisions

- 9.23.5 Product portfolio

- 9.23.6 Business performance

- 9.23.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Substrate |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Biodegradable Polymers Market?

+

-

What major players in Biodegradable Polymers Market?

+

-

What applications are categorized in the Biodegradable Polymers market study?

+

-

Which product types are examined in the Biodegradable Polymers Market Study?

+

-

Which regions are expected to show the fastest growth in the Biodegradable Polymers market?

+

-

What are the major growth drivers in the Biodegradable Polymers market?

+

-

Is the study period of the Biodegradable Polymers flexible or fixed?

+

-

How do economic factors influence the Biodegradable Polymers market?

+

-

How does the supply chain affect the Biodegradable Polymers Market?

+

-

Which players are included in the research coverage of the Biodegradable Polymers Market Study?

+

-