Global Automotive Seats Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-136 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Automotive Seats Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

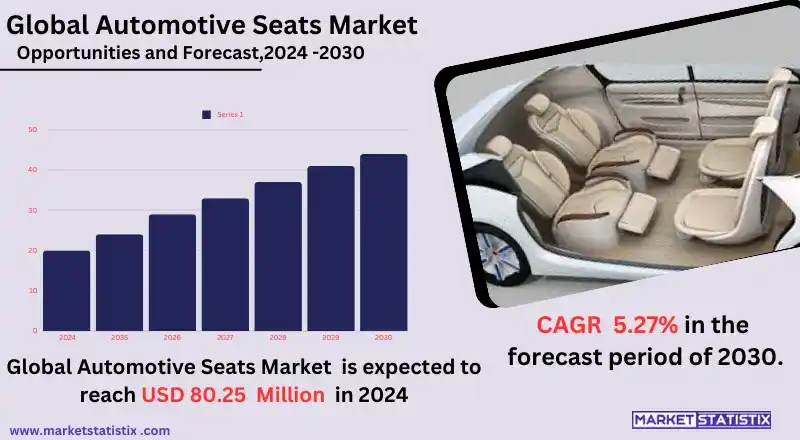

| Growth Rate | CAGR of 5.27% |

| By Product Type | Split Bench/Bench, Bucket |

| Key Market Players |

|

| By Region |

|

Automotive Seats Market Trends

From the perspective of an automotive seats manufacturer, geared for comfort features and ergonomics because of the rising expectations of comfort in vehicles by the consumers. Some of the key trends include seating systems that not only offer heating and cooling but also a massage effect performed on the back of the passenger using the seat. Enhancing passenger comfort is also aided by the inclusion of memory foam pillows and adjustable seats that can be set according to individual preference. This phenomenon is most common in high-priced and high-end automobiles, as consumers are more inclined to technology and India’s seating. Furthermore, the ravaging health enhancement trend in the design of vehicles has led to a need for seats that have posture correction and control and have back pain management and tiredness detection technologies. Sustainability is another major trend in the automotive seats market. The manufacturers are looking for sustainable alternatives such as recycled fabrics, bio foams, and leather substitutes without animal products. Seat design is also affected by electric vehicles (EVs) and autonomous vehicles, where manufacturers look for ways of installing lighter and flexible seat positions to enhance EV range and to accommodate various uppers for self-driving cars. Such trends show how the automotive sector at large is aiming to develop cleaner and more flexible car interiors that meet the modern consumers’ environmental and comfort needs.Automotive Seats Market Leading Players

The key players profiled in the report are Johnson Controls (U.S.), Lear Corporation (U.S.), IFB Automotive (India), Fisher and Company (Austria), Magna International Inc (Canada), Aktis Engineering Solutions (India), Toyota Boshoku Corporation (Japan), TS Tech Corporation Ltd (Japan), DURA Automotive Systems (U.S.)Growth Accelerators

The increasing demand for comfort, safety, and multiple features inside automobiles is an important driver for this market. As consumers seek better driving experiences, manufacturers have focused on ergonomic designs, greater lumbar support, and adjustable configurations in seating, which increase comfort and reduce fatigue on longer drives. Manufacturers are also guided by regulatory mandates to improve their safety standards. Features like side airbags and seatbelt sensors become more available. Advanced materials such as composite lightweight materials and smart fabrics are used for improvements in comfort and safety along with less weight that will make it cost-efficient to run the vehicle. With electric vehicles and autonomous driving technology becoming more prevalent, the main driver of this market is the increased adoption, which now makes more seating solutions flexible. In the case of electric vehicles, where interior space is often not stringent, seats are being designed to swivel or recline to accommodate varied configurations for a better experience among end-users. In return, autonomous driving technology is increasing multi-functional and adjustable seat demand in the car industry due to being pivotal in transforming the vehicle into a relaxation or productivity space. The growth of EVs and self-driving vehicles, therefore, is critical to the progress of innovation in automotive seats.Automotive Seats Market Segmentation analysis

The Global Automotive Seats is segmented by Type, and Region. By Type, the market is divided into Distributed Split Bench/Bench, Bucket . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

This market for automotive seats shall grow at a steady pace with projections at about $94.2 billion in 2024 and crossing over to $152.6 billion by 2037 during the forecast period. It shall rise with the help of increasing production rates and consumer’s demand for comfort and advanced seating solutions with features like heated and ventilated seats, memory foam, or ergonomic designs. The passenger vehicle segment is particularly crucial, wherein the rates of ownership are growing, and users will seek personalization of options for the driving experience. Other than this, continuous technology upgradations and increased market awareness regarding safety features are also some of the main drivers propelling demand in the market globally, mainly in regions such as Asia-Pacific, which will have around 41.2% share with the vigorous expansion of the automotive industries in the region. The competitive landscape is characterized by major players such as Adient, Lear Corporation, Faurecia, Toyota Boshoku, and Magna International. All these companies are continuously investing in R&D and are innovating and enhancing their product offerings with the integration of advanced technologies that bring comfort and safety. Strategic partnerships, mergers, and acquisitions remain some of the common strategies used to expand capabilities and reach markets. For instance, manufacturing and technology companies today often find themselves partnering more frequently to come up with smart seating solutions that best match the changing needs of consumers.Challenges In Automotive Seats Market

The growing need for enhanced seat designs that are lightweight, made of advanced materials while incorporating strict seating regulations, and still affordable presents one of the greatest challenges faced by the automotive seats industry. On one hand, automakers attempt to minimize the weight of the vehicles in order to increase fuel efficiency and comply with emission regulations. On the other hand, seat manufacturers are required to apply weight-saving techniques by the use of materials such as advanced composites, without relaxing on the aspects of comfort, durability, or safety. This quest for efficiency leads to high outgoings in manufacturing strategies coupled with high risks of failed innovation, a situation that is especially unfavourable to smaller players in the industry. Another challenge is the pace at which the automotive sector is changing in terms of technology, namely the coming of smart electric vehicles (EV) systems. Capabilities such as heated and ventilated seats, seat memory, and ergonomics are becoming more and more popular, which in turn complicates the design and manufacturing of the seats. Also, the growing trend of driverless cars comes with a demand for more flexible designs of seating arrangements, which involve entirely different designs from the existing ones. These changes pose a threat to conventional methods of operation because they raise costs, which in turn slows down the rate at which the manufacturers are able to respond to changes in the market without losing their competitive edge in a market that is costly to operate in.Risks & Prospects in Automotive Seats Market

The automotive seats market is exposed to considerable appetite due to the emergence and rise of electric vehicles (EVs) and automated vehicles, which call for different innovative designs of seats that are comfortable. Energy-efficient and enhancing connectivity. EV manufacturers, in a bid to extend the range of the vehicle while aiming for a sleek design, have a high demand for lightweight seat materials and modular designs, hence the lightweight, deluxe seats. Moreover, it is anticipated that in self-driving vehicles, the comfort and flexibility of the user would be more emphasized than the corridors of the car, hence the opportunities to the seat makers to create seating that will convert and recline in various ways to suit the different traveling modes. Another major opportunity is the rising need of consumers for more improved seat functions, which include seat climate control, massage seats, and fitting the seats with complete infotainment systems. High acceptance of premium and luxury cars and the quest for unique passenger experiences have increased the appetite for advanced seating. This trend offers automotive seat producers the opportunity to enhance the competitive edge of their products by designing seating systems that integrate health, safety, and comfort into one seat, whether it’s in an internal combustion engine or electric vehicle.Key Target Audience

Major Market Players Major automobile manufacturers, or original equipment manufacturers (OEMs), and their suppliers are the primary target market for automotive seats. OEMs focus on setting high-quality, ergonomic, and advanced seating options in vehicles to make them comfortable, safe, and beautifully designed, especially luxury, electric, and autonomous vehicles. Distinguishing their models is an important approach for OEMs seeking seating solutions that include advanced materials, lightweight designs, temperature control, power adjustability, and better support for the passengers.,, A further targeted market is aftermarket manufacturers, fleet operators, and interior designers seeking replacement seats, customizations, and upgrades. Fleet operators, mainly for commercial vehicles, have long hauls and appreciate sturdy, ergonomic seating designs as one strategy to reduce driver fatigue and increase comfort. As consumers demand personalization and improved comfort features, aftermarket suppliers and custom car shops are responding with such options for consumers who want seats upgraded, new upholstery, or other types of add-ons, thereby increasing the scope of the automotive seat market.Merger and acquisition

An upsurge of recent mergers and acquisitions in the automotive seats market indicates the strategic importance of enhancing capabilities and broadening product portfolios within the key players of the industry. In March 2022, Toyota Boshoku Corporation announced that it had secured the rights for the vehicle seat frame mechanism parts manufactured and sold by **Shiroki**. This would allow Toyota Boshoku to embrace modern engineering methods to manufacture its range of seats and raise the standards of its seats. This buyout, in turn, is envisioned to augment Toyota Boshoku’s aggressiveness in revolutionizing high-quality seats in accordance with the behaviour of car makers, more so for electric and hybrid vehicles. In the sphere of the automotive seats market, another notable event was Magna International’s purchase of the majority stake in Honglizhixin (HLZX), one of the largest seating suppliers to local automobile manufacturers, in September 2020. This acquisition helps Magna not only to expand successfully in the fast-growing substrate market of Asian cars but also to enhance its advanced seating technology for new energy sources vehicles. All of these developments signify the persistent consolidation of the industry as companies try to outdo their rivals by innovating and increasing their reach in the market.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Seats- Snapshot

- 2.2 Automotive Seats- Segment Snapshot

- 2.3 Automotive Seats- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Seats Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Split Bench/Bench

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Bucket

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Automotive Seats Market by Seat Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bench

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Bucket

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Folding

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Automotive Seats Market by Material

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Genuine Leather

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Synthetic Leather

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Fabric

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Automotive Seats Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Johnson Controls (U.S.)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Lear Corporation (U.S.)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 IFB Automotive (India)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Fisher and Company (Austria)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Magna International Inc (Canada)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Aktis Engineering Solutions (India)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Toyota Boshoku Corporation (Japan)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 TS Tech Corporation Ltd (Japan)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 DURA Automotive Systems (U.S.)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Seat Type |

|

By Material |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Automotive Seats Market?

+

-

What are the latest trends influencing the Automotive Seats Market?

+

-

Who are the key players in the Automotive Seats Market?

+

-

How is the Automotive Seats } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Automotive Seats Market Study?

+

-

What geographic breakdown is available in Global Automotive Seats Market Study?

+

-

Which region holds the second position by market share in the Automotive Seats market?

+

-

How are the key players in the Automotive Seats market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Automotive Seats market?

+

-

What are the major challenges faced by the Automotive Seats Market?

+

-