Global Automotive Lighting Market Trends and Forecast to 2030

Report ID: MS-615 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Automotive Lighting Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

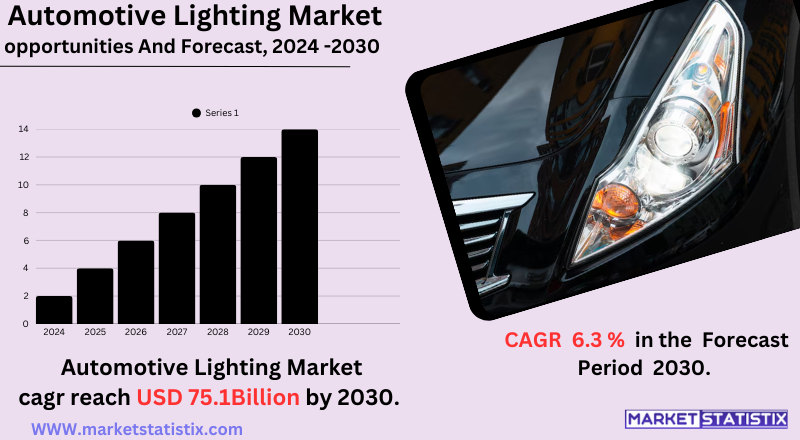

| Growth Rate | CAGR of 6.3% |

| Forecast Value (2030) | USD 75.1 Billion |

| By Product Type | Passenger Vehicles, Commercial Vehicles |

| Key Market Players |

|

| By Region |

Automotive Lighting Market Trends

Interesting things are happening inside the automotive light market, where there is a shift in resolve towards advanced technologies, with LED lamps quickly becoming the standard, mainly because of their energy-saving capability, long lifetime, and flexibility of design. The market trend is getting stronger as more OLED and laser lights are being extended to luxury vehicles, providing high aesthetics and performance. In addition, there is a growing emphasis on intelligent lighting systems, including adaptive driving beam (ADB) and matrix LED headlights that enhance safety by automatically adjusting light distribution according to driving conditions and oncoming traffic. Another important trend is the integration of lights with ADAS, wherein lighting systems are pivotal in communication and signalling for both autonomous and semi-autonomous vehicles.Automotive Lighting Market Leading Players

The key players profiled in the report are Varroc Engineering Limited (India), Valeo (France), Continental AG (Germany), Koito (Japan), Robert Bosch GmbH (Germany), Marelli Corporation (Italy), Koninklijke Philips (Netherlands), Hyundai Mobis (South Korea), Hella KGaA Hueck & Co. (Germany), OSRAM Licht AG (Germany), Stanley Electric Co., Ltd. (Japan)Growth Accelerators

The automotive lighting market is fuelled by several technology advancements, among which the most popular are LED and OLED. The two technologies provide energy efficiency, greatly extended lifetimes, and design flexibility meeting the compulsory modern standards in the automotive world, i.e., regarding sustainability and aesthetic value. The applications of these advanced lighting systems are further predicated on the notion of Advanced Driver Assistance Systems (ADAS), where lighting enables other functions such as adaptive driving beams or improved visibility for independent driving features. According to regulations requiring improvements in visibility and signalling, such as daytime running lights and more severe regulations on headlight performance, the manufacturers will be forced to invest in more advanced systems. Then the consumers—particularly the well-informed ones—would further augment these investments by their demands for safe and sexy cars. The end market would then be lucrative enough for manufacturers to have invested in innovative technologies in automotive lighting.Automotive Lighting Market Segmentation analysis

The Global Automotive Lighting is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Passenger Vehicles, Commercial Vehicles . The Application segment categorizes the market based on its usage such as Rear Lighting, Front/Headlamps, Side, Interior Lighting. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

According to the competitive structure, Koito Manufacturing Co., Ltd., Hella GmbH & Co. KGaA, Valeo S.A., Stanley Electric Co., Ltd., and OSRAM GmbH represent the major global players in the automotive lighting sales market. These companies tend to indulge in technological advances such as adaptive lighting, laser-based headlights, and LED innovations so as to gain a competitive edge in this market. The increasing need for energy-efficient and appealing lighting solutions alongside government regulations on vehicle safety and emissions tends to be the major driver for this industry. Also, with the rising electric and autonomous vehicles, competition is changing with companies investing in smart solutions that will improve communication and safety in vehicles. The integration of artificial intelligence (AI) with the lighting technology to be sensor-based is intensifying competition. Asian manufacturers are, especially from China, increasing their presence by providing affordable options to established players in the market in Europe and North America.Challenges In Automotive Lighting Market

The automotive lighting market faces numerous challenges that act as impediments to its growth. One major issue is the high cost of advanced lighting technologies such as LEDs, OLEDs, or adaptive systems. Although these have the best energy efficiency, longevity, and safety performance, they incorporate expensive materials and complex processing technologies in order to come at their high cost. Even the installation of such systems is more difficult than retrofitting halogen or xenon lights, adding to the cost. All these high-technology costs make it difficult for manufacturers to supply high-end lighting systems for budget cars or commercial vehicles, thus restricting them from entering cost-sensitive markets. Another important challenge is the fact that advanced lighting systems have not penetrated the commercial vehicle market. Freight trucks and other long-haul vehicles tend to run on a very tight budget whereby cost efficiency is a priority in place of upgrading the facility with any technology. Also, the widespread shortage of raw materials and production delays have been aggravated by supply chain disruption events such as the COVID-19 pandemic. These emerge as formidable challenges to the total adoption of innovative lighting solutions in the automotive industry.Risks & Prospects in Automotive Lighting Market

The key market opportunities revolve around high demands for adaptive lighting systems and smart headlights and ambient lighting in electric and luxury vehicles. In addition to this, the mandate of regulations for improved safety standards in vehicles and energy-efficient lighting solutions is used in the propulsion of market demand. With autonomy and connectivity being current trends, the manufacturers also find another range of opportunities for innovation with intelligent lighting systems. By region, Asia-Pacific leads the market with a 50 percent share, led by the great production of vehicles in China and India, with urbanization and rising disposable incomes sustaining the market. North America and Europe have also acquired substantial shares in the market due to the stringent safety regulations and technological advancements. The emphasis in North America on energy-efficient LED systems is consistent with and would reinforce environmental sustainability apprehensions; Europe, on the other hand, is taking the lead in the incorporation of high-end lighting technology into electric vehicles. Various emerging markets in Latin America, the Middle East, and Africa are growing due to increasing production of vehicles and demand for durable, energy-efficient lighting solutions.Key Target Audience

Key target audiences for the automotive lighting market include OEMs, aftermarket suppliers, and the consumer market. For OEMs, advanced lighting solutions implemented for safety, energy efficiency, and aesthetics are what they mainly seek. With the rising trend for electric and autonomous vehicles, demand for adaptive lighting, LEDs, and laser solutions is foremost in the minds of OEMs. Aftermarket suppliers answer to vehicle owners who want lighting upgrades or customization or simply replacements and are therefore looking to provide cheap and effective solutions.,, Consumers, especially in the developed world, prefer highly stylish and high-performing lighting, whereas developing markets gain illumination based on price and durability. Fleet and commercial vehicle owners must also be accounted for, as they demand durable and long-lasting illumination so as not to hinder operational efficiency. The emergence of smart lighting and IoT integration greatly widens the cry for the automotive lighting market front, encouraging tech-oriented companies and startups.Merger and acquisition

It has been gathering rather interesting partnerships and acquisitions in favour of the vast technological application and penetration into more markets. Lumax Auto Technologies entered into a strategic agreement in February 2023 to acquire a majority stake in the Indian operation of IAC Group with a valuation of ₹587 crores, following Minda Corporation, which acquired about ₹400 crores to buy a 15.70% stake in rival Pricol. Furthermore, in October 2023, KOITO MANUFACTURING CO., LTD, and DENSO CORPORATION united to realize their aim of developing object recognition solutions using lamps and image sensors to improve driving experience at night and the next generation mobility solution. >Analyst Comment

The sector of automotive lighting is evolving greatly to cater to the increased demand for safety and aesthetic features in vehicles. A notable trend in this evolution is the rapid acceptance of advanced lighting technologies, including LED, OLED, and laser lighting, which are more energy-efficient, with longer life spans and design-inflexible compared to traditional halogen bulbs. This ongoing technological revolution, coupled with the stringent rules imposed by governments on vehicle safety, is greatly aiding the market's growth.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Lighting- Snapshot

- 2.2 Automotive Lighting- Segment Snapshot

- 2.3 Automotive Lighting- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Lighting Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Passenger Vehicles

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Commercial Vehicles

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Automotive Lighting Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Front/Headlamps

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Side

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Rear Lighting

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Interior Lighting

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Robert Bosch GmbH (Germany)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Hella KGaA Hueck & Co. (Germany)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 OSRAM Licht AG (Germany)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Valeo (France)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Koito (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Marelli Corporation (Italy)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Continental AG (Germany)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Hyundai Mobis (South Korea)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Koninklijke Philips (Netherlands)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Varroc Engineering Limited (India)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Stanley Electric Co.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Ltd. (Japan)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Automotive Lighting in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Automotive Lighting market?

+

-

How big is the Global Automotive Lighting market?

+

-

How do regulatory policies impact the Automotive Lighting Market?

+

-

What major players in Automotive Lighting Market?

+

-

What applications are categorized in the Automotive Lighting market study?

+

-

Which product types are examined in the Automotive Lighting Market Study?

+

-

Which regions are expected to show the fastest growth in the Automotive Lighting market?

+

-

Which application holds the second-highest market share in the Automotive Lighting market?

+

-

What are the major growth drivers in the Automotive Lighting market?

+

-