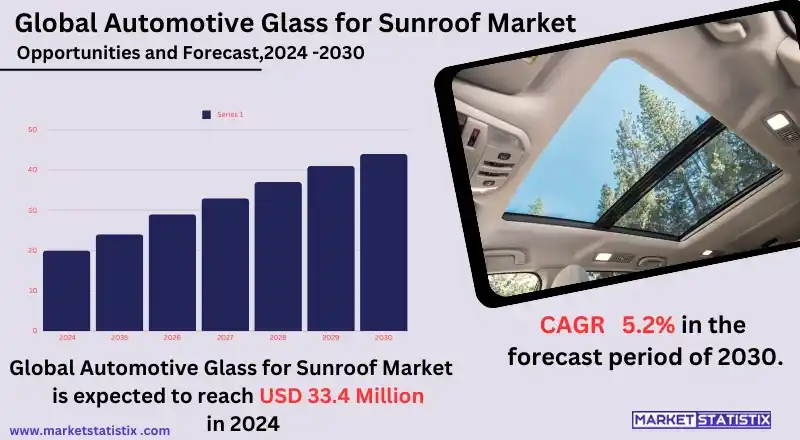

Global Automotive Glass for Sunroof Market – Industry Trends and Forecast to 2030

Report ID: MS-133 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Automotive Glass for Sunroof Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.2% |

| By Product Type | ICE, Electric |

| Key Market Players |

|

| By Region |

Automotive Glass for Sunroof Market Trends

The market for the car sunroof glass is constantly changing and developing, mainly due to the consumer’s inclination towards better materials and in full glass sunroof usage. Glass is considered the best option as compared to plastic due to its transparency and toughness, as well as its extra benefits of UV shielding and noise insulation. These attributes enhance the look of the car and add to the luxury of the cabin, which is why the glass is liked by both producers and clients. Another emerging trend is the growing use of panoramic sunroofs, which are a little more than a third of the vehicle’s roof, allowing that bright, airy feeling of an almost fully opened cabin, which is a premium feature that enhances the interaction with the outside and the vehicle. The slice of the windscreen automotive glass market is also separated on the basis of various distribution channels, and it includes OEMs (Original Equipment Manufacturers) as well. OEM sunroofs being fitted into the vehicles designed for them have to comply with rigorous performance and safety regulations, and they are frequently covered under the vehicle’s warranty, which is a great advantage. This change and the fact that there is still a healthy replacement market for windscreens are likely to propel the growth of the market as more consumers become interested in personalising their cars and improving their travels.Automotive Glass for Sunroof Market Leading Players

The key players profiled in the report are Webasto Group (Germany), CIE Automotive (Spain), Inteva Products LLC (U.S.), Johnan America Inc. (U.S.), Yachiyo Wuhan Manufacturing Co., Ltd. (Japan), Magna International Inc. (Canada), Mitsuba Corporation (Japan), AISIN SEIKI Co. Ltd (Japan), Inalfa Roof Systems Group BV (Netherlands), Valmet Automotive (Spain)Growth Accelerators

The automotive glass sunroof market is mainly driven by the increasing consumer inclination towards cars with sunroofs as they offer better aesthetics, natural light, and fresh air. This is more pronounced in premium and luxury car scenarios where panoramic and solar sunroofs are becoming common. Car manufacturers have started including these features in cars that target consumers whose values influence their choice of cars, such as comfort and aesthetic appeal. Advancement in glass technologies such as UV-resistant, laminated, and tempered glass also acts as another driver of growth. This glass makes the car safer and more insulated than before. These innovations are in line with the societal demands for quality and long-lasting materials that promote safety and energy conservation. Also, with the increase in electric vehicles, there is a corresponding increase in the need for solar sunroof glass, which is used for energy generation, making sunroofs even more functional and attractive to environmentally friendly consumers.Automotive Glass for Sunroof Market Segmentation analysis

The Global Automotive Glass for Sunroof is segmented by Type, and Region. By Type, the market is divided into Distributed ICE, Electric . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The development is propelled by the growing necessity for improved driving experiences along with the growing vehicle customisation demand, especially in luxury and premium categories. The development is marked by advancements in glass technology, which include better glazing for safety and reduced UV exposures, and features like panoramic sunroofs, which add a spacious and clad nature to vehicles. The Asia-Pacific region is expected to help this growth, primarily due to increased disposable incomes and the rising aspiration for high-end vehicles in markets such as China and India. Webasto Group, Inalfa Roof Systems Group, Inteva Products LLC, and AGC Inc. are some of the major companies contributing to the growth of automotive glass for the sunroof market. Such companies are actively innovating new products and entering into strategic collaborations to increase their share of the market. For example, smart glass technologies featuring automatic shading and tinting capabilities have gained more traction among consumers in the recent past. Moreover, in order to satisfy the increasing supply for sunroofs in regions dominated by high car production, the companies are also focusing on enhancing their production facilities.Challenges In Automotive Glass for Sunroof Market

The market for automotive sunroofs is generally faced with several issues, which mostly border on costs and the durability of the products. Commercially viable sunroof glass must also be able to endure UV rays, variations in temperatures, and impact, all of which contribute to a higher cost of production. Moreover, such costs may raise the prices of vehicles fitted with such roofs, deterring rather price-sensitive consumers in developing countries from purchasing them. Another issue concerns safety. Sunroofs, by their nature, add openings to the car’s structure, which in turn increases chances of shattering and injury. It is an especially hard task for manufacturers to ensure that the safety standards concerning solar glass contents are met while still looking good and not being too expensive.Risks & Prospects in Automotive Glass for Sunroof Market

The market for sunroof automotive glass is projected to grow at a substantial rate due to the increasing adoption of sunroofs, especially in premium and mid-range vehicles. Currently, more consumers are looking for comfort, ventilation, and natural light in vehicles, which has resulted in the use of sunroofs, which in turn calls for high-quality and tough sunroofs. This is especially so for areas that are hot and among the young people who tend to appreciate the use of such high-class vehicles. Also, with the improvements in the technology of glass produced for use in sunroofs, such as tempered, laminated, and UV-protected glass, more doors are opened for sunroof glass usage due to improvements in durability, safety, and insulation of the glass. These developments respond to the needs of consumers for safety systems as well as energy management, enhancing the appeal of vehicles with sunroofs fitted. Even though the majority of focus is on electric vehicles (EVs), EDD also enhances the sunroof market, as the EV manufacturers are also inclined towards the provision of panoramic sunroofs to enhance the user experience.Key Target Audience

The automotive glass for windscreen market primarily targets original equipment manufacturers (OEMs), automotive design companies that focus on premium and mid-range vehicles. Due to the increase in consumer demand for vehicles with sunroofs, especially in the luxury and SUV segment, the OEMs remain focused on procuring and suiting materials that are innovative and durable, energy-efficient glass, improving aesthetics, comfort, or revolutionising these products and markets.,, The other key final audience is composed of car modification and repair enthusiasts or aftermarket providers that provide sunroof installations as part of vehicle enhancement features. They tend to be more significant in areas where there is a hot climate, thus the need for tinted or sunroof glass coatings with UV protection.Merger and acquisition

The latest trends in the automotive glass for windscreen market have witnessed substantial mergers and acquisitions to improve the product range and also the market share. For instance, in June 2022, Champion Auto Systems purchased the Hollandia 700 (H700) sunroof product line from Webasto SE. Through this buyout, Champion Auto System’s product range will go a step higher and its services in the sunroofs category enhanced as a clear indication of increasing consumers’ traits towards high-quality vehicles. The acquisition is also indicative of the current trend of companies pooling their resources to undertake core innovations and modernise the existing solutions in the automotive glass business. As is the case with Champion Auto Systems, other companies such as Webasto Group, Inalfa Roof Systems, and Inteva Products are also engaging in mergers and acquisitions in order to do well in the market. These companies seek to put cutting-edge solutions in their product lines geared towards advanced designs of simple-to-use systems incorporating sunroofs, sash, multipurpose, and energy-saving smart designs. The competition in this sector is intense and partly characterised by advanced levels of product differentiation where companies strive to have better products and service delivery to customers.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Glass for Sunroof- Snapshot

- 2.2 Automotive Glass for Sunroof- Segment Snapshot

- 2.3 Automotive Glass for Sunroof- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Glass for Sunroof Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 ICE

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Electric

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Automotive Glass for Sunroof Market by Material Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Glass

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Fabric

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Automotive Glass for Sunroof Market by Operation Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Electric

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Manual

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Webasto Group (Germany)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CIE Automotive (Spain)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inteva Products LLC (U.S.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Johnan America Inc. (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Yachiyo Wuhan Manufacturing Co.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ltd. (Japan)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Magna International Inc. (Canada)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Mitsuba Corporation (Japan)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 AISIN SEIKI Co. Ltd (Japan)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inalfa Roof Systems Group BV (Netherlands)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Valmet Automotive (Spain)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Material Type |

|

By Operation Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Automotive Glass for Sunroof Market?

+

-

What major players in Automotive Glass for Sunroof Market?

+

-

What applications are categorized in the Automotive Glass for Sunroof market study?

+

-

Which product types are examined in the Automotive Glass for Sunroof Market Study?

+

-

Which regions are expected to show the fastest growth in the Automotive Glass for Sunroof market?

+

-

What are the major growth drivers in the Automotive Glass for Sunroof market?

+

-

Is the study period of the Automotive Glass for Sunroof flexible or fixed?

+

-

How do economic factors influence the Automotive Glass for Sunroof market?

+

-

How does the supply chain affect the Automotive Glass for Sunroof Market?

+

-

Which players are included in the research coverage of the Automotive Glass for Sunroof Market Study?

+

-