Global Automotive circular economy Market Size, Share & Trends Analysis Report, Forecast Period, 2025-2030

Report ID: MS-2558 | Automation and Process Control | Last updated: Apr, 2025 | Formats*:

Automotive circular economy Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

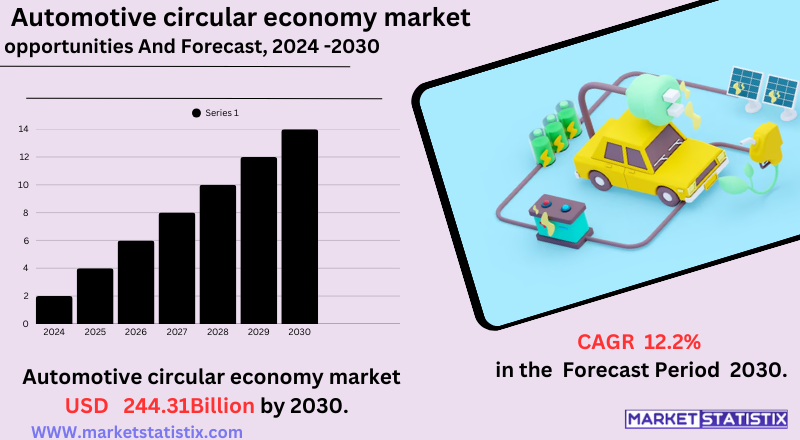

| Growth Rate | CAGR of 12.2% |

| Forecast Value (2030) | USD 244.31 Billion |

| By Product Type | Reuse and Sharing, Product as a Service, Recycling and Recovery, Others |

| Key Market Players |

|

| By Region |

|

Automotive circular economy Market Trends

Several trends currently characterising the automotive circular economy market are having an active role in influencing its growth and development. A key trend is the increasing interest in EV battery recycling and reuse. Considering that EV adoption is now growing at a fast pace, a lot of interest and capital are now being devoted to developing sustainable and efficient routes for battery recycling, remanufacturing, and second-life applications like energy storage. The above trends are now being accompanied by another trend where "design for circularity" becomes more critical. Choosing such designs builds up an end-of-life context for vehicles and parts, with an emphasis on modularity, standardisation, recyclability, and renewables. In addition, shared mobility services and subscription-based models are gaining traction as a means to improve vehicle utilisation and extend their lives. The principles of the circular economy are thereby upheld, in that attention is switched from ownership to access.Automotive circular economy Market Leading Players

The key players profiled in the report are PepsiCo, Inc., Unilever, Inter IKEA Systems B.V., The Coca‑Cola Company, Adidas AG, ADM, Procter & Gamble, BASF SE, H&M Group, HP Development Company, L.P.Growth Accelerators

Forcing several very important pressures on the automotive circular economy market. Increased environmental enforcement and awareness in people to become more environmentally friendly are now forcing the automotive sector into adopting more circular ways to reduce waste, emissions, and susceptibility to finite sources. The code is also orientated toward higher recycling rates, encouraging the consumer to consider vehicles and components produced in more sustainable ways or with recycled materials. Second, the two drivers are economic benefits and resource security. The round economy model creates significant potential for savings through less consumption of virgin material, revenue generation through remanufacturing and recycling, and increased resilience regarding supply chain disruptions through secondary resource consumption. The potential for collecting valuable materials from end-of-life vehicles and components also fortifies the dimension of security regarding resources as primary resources become scarcer.Automotive circular economy Market Segmentation analysis

The Global Automotive circular economy is segmented by Type, and Region. By Type, the market is divided into Distributed Reuse and Sharing, Product as a Service, Recycling and Recovery, Others . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

At this time, the automotive circular economy market shows a competitive landscape, which is still somewhat fragmented. It combines traditional automotive players, specialised recycling and remanufacturing companies, and emerging technology providers. The existing automotive manufacturers are aligned to initiate circular economy principles, for example, designing for recyclability or offering remanufactured parts as well as take-back programmes for such end-of-life vehicles. Besides, several such speciality companies include Sims Limited and Aurubis, with their expertise centred on dismantling, sorting, and recycling automotive materials in the value chain. Competition in accessing end-of-life vehicles and components, developing efficient and low-cost recycling and remanufacturing processes, and value-added services to facilitate circular material flow is getting hotter. Important for businesses wishing to reap the economic and ecologic benefits of more circularity within the automotive system will be collaboration and partnership up and down the automotive value chain, as they will have to learn how to cooperate and compete in this emerging market.Challenges In Automotive circular economy Market

The automotive circular economy market is beleaguered with obvious challenges to mass adoption and scaling. Operational complexity arises due to high processing costs of recycled and remanufactured products, fears of product degradation and inconsistent quality, logistical hurdles obtaining and sorting end-of-life vehicles and components, limitations in product warranties, and persistent customer scepticism toward refurbished or recycled automotive parts. The sad reality is that consumers often question the reliability and safety of such products. Besides these operational headaches, the industry must also contend with supply chain complexities, advanced reverse logistics, and ever-changing regulatory requirements. High-purity material recovery, while difficult, is imperative since current dismantling and recycling processes have, more often than not, yielded mixed or contaminated outputs unfit for reuse in high-quality automotive applications. The automotive industry must overcome these hurdles to really reap the merits of circular economy schemes and meet heightened sustainability expectations.Risks & Prospects in Automotive circular economy Market

Key opportunities include advancements in remanufacturing technologies, a growing focus on battery recycling and remanufacturing, and the integration of digital tools such as AI for smart value chain management. Product innovation—such as modular designs for easier reuse and recycling—and collaborative supply chain models are also emerging as pivotal trends. These developments not only reduce emissions and material waste by up to 50% but also align with consumer demand for cost-effective and eco-friendly mobility solutions, ultimately positioning the sector for strong growth. In terms of regional development, North America and Europe remain the forerunners. This is due to stringent enforceable laws on the environment, mature automotive industries, and early acceptance of circular business models. Sensing the opportunity, Asia-Pacific is galloping forward with incredible speed, thanks to growing vehicle markets, the increasing regulatory environment, and investments in sustainable infrastructure, especially in China and India.Key Target Audience

Market for the automotive circular economy targets OEMs, automotive suppliers, and aftermarket service providers. Increasingly, these stakeholders adopt sustainable practices, like remanufacturing, refurbishing, and recycling, to lessen the environmental impact and comply with regulatory requirements. For instance, BMW integrates circular economy principles by substituting secondary materials to promote the recycling of vehicle components – a practice that will cut CO₂ emissions and dependency on virgin resources.,, Another significant interest group encompasses policymakers, environmental organizations, and consumers championing sustainability. The government and regulatory bodies have put in place policies to encourage circularity in the automotive industry with an emphasis on extended product lifecycle and reuse of materials. Increasingly, consumers are becoming environmentally conscious, pressuring manufacturers to switch to circular economy models to meet an ever-increasing demand for sustainable vehicles and components.Merger and acquisition

The market for the automotive circular economy has witnessed significant M&A activity, testifying to an increasing commitment towards sustainability and resource efficiency. In October 2024, the French utility, Suez, acquired a 20% share in Renault's recycling unit, The Future is NEUTRAL. This partnership involves a joint investment of €140 million to enhance closed-loop recycling and decrease reliance on virgin materials in the automotive sector. Stellantis has been proactive in this domain; in 2023, it entered a joint venture with Orano to recycle EV batteries, concentrating on reclaiming vital materials. Widening its portfolio in favour of circular economy principles SUSTAINera was introduced by Stellantis, comprising remanufacturing, repairing, reusing, and recycling functions of auto parts. The purchase of B-parts happened well before this, which is a used auto parts platform that facilitates the prolonged use of automobile components and reduces environmental impact. Thus, these are strategic moves by the major automotive giants that symbolise a broader industry trend towards embedding circular economy practices towards sustainability goals and improvement in carbon footprints. >Analyst Comment

The automotive sector circular economy market is expanding rapidly, as the industry moves toward sustainable practices, resource efficiency, and regulatory compliance. Circular economy activities in the automotive sector aim to remanufacture, recycle, and reuse the components of vehicles to mitigate emissions, material waste, and environmental degradation. By 2030, circular models and regulations could reduce the industry's emissions and material waste by 50% due to trends such as EVs, increased vehicle complexity, and the shift toward autonomous vehicles. Digital technologies, eco-design, and smart value chains track and recycle auto materials and products more efficiently.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive circular economy- Snapshot

- 2.2 Automotive circular economy- Segment Snapshot

- 2.3 Automotive circular economy- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive circular economy Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Recycling and Recovery

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Reuse and Sharing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Product as a Service

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Automotive circular economy Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Adidas AG

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Inter IKEA Systems B.V.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 PepsiCo

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Inc.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Procter & Gamble

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 The Coca‑Cola Company

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Unilever

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 ADM

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 BASF SE

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 H&M Group

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 HP Development Company

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 L.P.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Automotive circular economy in 2030?

+

-

Which type of Automotive circular economy is widely popular?

+

-

What is the growth rate of Automotive circular economy Market?

+

-

What are the latest trends influencing the Automotive circular economy Market?

+

-

Who are the key players in the Automotive circular economy Market?

+

-

How is the Automotive circular economy } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Automotive circular economy Market Study?

+

-

What geographic breakdown is available in Global Automotive circular economy Market Study?

+

-

Which region holds the second position by market share in the Automotive circular economy market?

+

-

How are the key players in the Automotive circular economy market targeting growth in the future?

+

-