Global Artificial Intelligence in Energy Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-1062 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The integration of artificial intelligence (AI) into the energy sector involves the application of advanced machine learning and deep and general learning models to improve the way energy is produced, distributed, and consumed. AI systems analyse vast volumes of real-time sensor, climate, and grid data to optimise intelligent grid operations, predictive maintenance, renewable forecasting, and asset management—boosting system efficiency, system resilience, and sustainability. Beyond grid management, AI supports innovation in energy technologies—such as co-designing novel materials and streamlining permitting processes—thereby accelerating clean energy deployment and enhancing decision-making across utilities and industrial users.

Artificial Intelligence in Energy Report Highlights

| Report Metrics | Details |

|---|---|

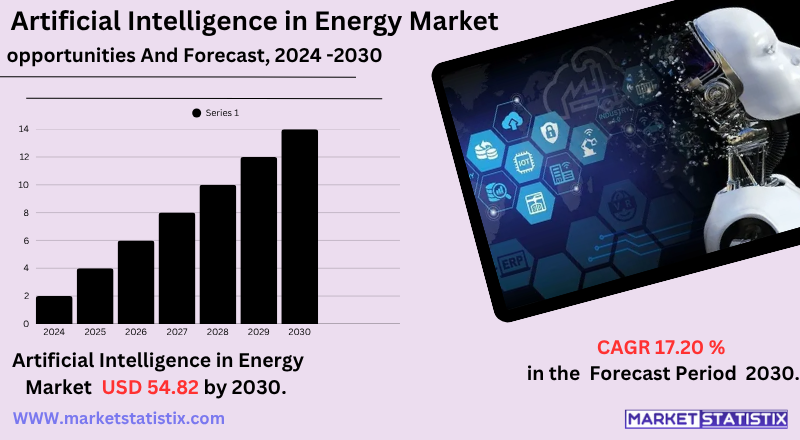

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 17.20% |

| Forecast Value (2030) | USD 54.82 Billion |

| By Product Type | Solutions, Services |

| Key Market Players |

|

| By Region |

|

Artificial Intelligence in Energy Market Trends

- Smart Grid & Real-Time Load Optimisation

AI is increasingly used to manage smart grids—real-time sensor data and IIOT to balance the load, control the appliances autonomously, and integrate distributed energy resources efficiently.

- AI-Powered Predictive Maintenance

Energy providers widely adopt predictive maintenance for assets such as turbines, pipelines, and substations—reducing downtime, optimising repairs, and extending equipment life.

- Renewables & EV Charging Management

AI solutions are being implemented to predict renewable energy production, optimise the placement of the EV charging station, and dynamically respond to grid congestion and demand peaks.

Artificial Intelligence in Energy Market Leading Players

The key players profiled in the report are Hazama Ando Corporation, ATOS SE, Siemens AG, AppOrchid Inc., Zen Robotics Ltd., General Electric, Origami Energy Ltd., SmartCloud Inc., Flex Ltd., Alpiq, ABBGrowth Accelerators

- Surging Electricity Demand from AI Workloads

The rapid expansion of AI and cloud infrastructure—especially data centers—is significantly increasing electricity consumption, forcing existing grids and leading energy providers to invest in intelligent and AI-driven load management systems.

- Energy Market Volatility & Risk Optimisation

Fluctuating commodity prices and geopolitical interruptions are pushing energy companies to use AI forecasting and analysis tools that allow predictive market strategies and risk hedging between energy trading and procurement.

- Integration of Renewable Energy Sources

The growing participation of wind and solar energy requires advanced forecasts of intermittent supplies—AI forecast models optimise network stability and energy balance to support clean energy targets.

Artificial Intelligence in Energy Market Segmentation analysis

The Global Artificial Intelligence in Energy is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Solutions, Services . The Application segment categorizes the market based on its usage such as Robotics, Safety Security & Infrastructure, Demand Forecasting, Renewable Energy Management, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

- High Energy & Resource Consumption

Training and performing powerful AI models significantly increases electricity, cooling, and water demand, putting extra pressure on the already strained power and infrastructure networks.

- Legacy Infrastructure & Compatibility Issues

Energy systems depend on the ageing of OT/SCADA networks that are usually proprietary and siloed, creating complex integration challenges and slowing AI implementation.

- Poor Data Quality & Fragmentation

Data from inconsistent sensors, fragmented systems, and access to limited data prevent AI model training, reducing the accuracy of the forecast and reliability of decision-making.

Challenges In Artificial Intelligence in Energy Market

- High Energy & Resource Consumption

Training and performing powerful AI models significantly increases electricity, cooling, and water demand, putting extra pressure on the already strained power and infrastructure networks.

- Legacy Infrastructure & Compatibility Issues

Energy systems depend on the ageing of OT/SCADA networks that are usually proprietary and siloed, creating complex integration challenges and slowing AI implementation.

- Poor Data Quality & Fragmentation

Data from inconsistent sensors, fragmented systems, and access to limited data prevent AI model training, reducing the accuracy of the forecast and reliability of decision-making.

Risks & Prospects in Artificial Intelligence in Energy Market

Artificial intelligence market opportunities in the energy sector are expanding rapidly due to the convergence of digital transformation, clean energy goals, and grid modernisation efforts. AI is allowing predictive maintenance, demand, and real-time energy management, making public services increase efficiency and reduce operating costs. The change towards decentralised energy systems, such as distributed renewable microgrids and assets, requires intelligent orchestration—something AI excels at. These technologies are also unlocking faster solar, wind, and battery storage integration into power systems. As governments and companies prioritize zero net goals and intelligent infrastructure, AI's ability to accelerate decision-making, automate workflows, and improve reliability is positioning it as a dominant force in the generation, transmission, and consumption layers.

Key Target Audience

,

, Data from inconsistent sensors, fragmented systems, and access to limited data prevent AI model training, reducing the accuracy of the forecast and reliability of decision-making.

, Energy systems depend on the ageing of OT/SCADA networks that are usually proprietary and siloed, creating complex integration challenges and slowing AI implementation.

,

- ,

- Legacy Infrastructure & Compatibility Issues

,

Merger and acquisition

- High Energy & Resource Consumption

Training and performing powerful AI models significantly increases electricity, cooling, and water demand, putting extra pressure on the already strained power and infrastructure networks.

- Legacy Infrastructure & Compatibility Issues

Energy systems depend on the ageing of OT/SCADA networks that are usually proprietary and siloed, creating complex integration challenges and slowing AI implementation.

- Poor Data Quality & Fragmentation

Data from inconsistent sensors, fragmented systems, and access to limited data prevent AI model training, reducing the accuracy of the forecast and reliability of decision-making.

Analyst Comment

Global AI in the energy market is growing, with recent estimates valuing it between $9.9 and $11.5 billion by 2024 and projections that predict it will rise to $54 to $99 billion by 2030-2032, driven by double-digit CAGR. AI applications are transforming the sector through smart grids, predictive maintenance, demand forecasting, and renewable integration—reducing optimised system performance, improving resilience, and simplifying operations. As global electricity demand is increasingly fed by the acceleration of AI-driven data from the Utility Data Centre, they are adopting AI-powered control systems to balance the load, reduce interruptions, and meet sustainability mandates.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Artificial Intelligence in Energy- Snapshot

- 2.2 Artificial Intelligence in Energy- Segment Snapshot

- 2.3 Artificial Intelligence in Energy- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Artificial Intelligence in Energy Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Solutions

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Artificial Intelligence in Energy Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Robotics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Renewable Energy Management

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Demand Forecasting

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Safety Security & Infrastructure

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Artificial Intelligence in Energy Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Siemens AG

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 General Electric

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Hazama Ando Corporation

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 ATOS SE

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 AppOrchid Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Zen Robotics Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Origami Energy Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Flex Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Alpiq

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SmartCloud Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 ABB

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Artificial Intelligence in Energy in 2030?

+

-

Which type of Artificial Intelligence in Energy is widely popular?

+

-

What is the growth rate of Artificial Intelligence in Energy Market?

+

-

What are the latest trends influencing the Artificial Intelligence in Energy Market?

+

-

Who are the key players in the Artificial Intelligence in Energy Market?

+

-

How is the Artificial Intelligence in Energy } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Artificial Intelligence in Energy Market Study?

+

-

What geographic breakdown is available in Global Artificial Intelligence in Energy Market Study?

+

-

Which region holds the second position by market share in the Artificial Intelligence in Energy market?

+

-

How are the key players in the Artificial Intelligence in Energy market targeting growth in the future?

+

-

,

,

,

- ,

,

,